|

Building Equity Value

Agency consolidation: A different look

The number of firms for sale will not change much, but the sellers will be smaller

By John M. Wepler and Patrick T. Linnert

Many agencies and brokerages continue to seek transactions with strategic partners in the hope of realizing long-term growth, profitability and, frankly, survival. Merger and acquisition activity is alive and well, but the goals, dynamics and rationale for that activity are quickly changing.

A look back at 2008

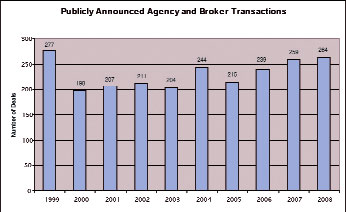

In keeping with the decline in housing valuations, the number of new business startups, consumer spending, and investment portfolios, the value of the average insurance agency fell drastically during the second half of 2008. Conventional wisdom was that buyers were going to scale back on deals due to limited access to capital and depressed internal stock prices. Many also predicted that 2008 would result in a decline in the number of sellers in the market, given depressed valuations. However, 2008 saw the second highest number of publicly announced transactions since banks swarmed into the insurance distribution business in 1999.

The SNL deal statistics, shown in the graph below, represent publicly announced transactions. MarshBerry estimates that less than 30% of all insurance brokerage deals were publicly announced. We believe the average annual number of insurance brokerage transactions actually exceeded 750 each year over the past decade and that the actual number during 2008 exceeded 880.

Since 2005, 18 of the top 100 insurance brokers have sold all or a portion of their stock to a third party. These 18 transactions alone represent a change in ownership of more than $2.8 billion in aggregate insurance revenue. Six of these deals were done in 2008 with the sellers spread across each segment (public brokers, banks and independent agencies). At least another 17 firms in the top 100 explored selling during 2008 but did not consummate a transaction. In short, closing a transaction with an outside strategic partner was a prominent strategy for many during 2008. Potential sellers or those in search of an equity investment were motivated by many factors, including the potential increase in capital gains taxes that still looms large, a threat of nationalized health care, an inability to maintain requirements dictated by insurance companies, perpetuation challenges and, most important, a general inability to navigate growth and profitability in an era of contraction vs. expansion.

While deal count was at a nine-year high, many of the traditional buyers of brokers were either no longer in the acquisition game or were unable to close on pending deals. Many of the traditional buyers found it increasingly difficult to push transactions through their boards of directors. All have become hyper-selective. Most banks either took their acquisition hat out of the ring or divested their insurance platform because of capital problems or challenges with their core business. Bank buyers closed the lowest number of deals over the past decade during 2008, accounting for only 15.5% of the total publicly announced transactions. This is a marked decrease from a high of 39.4% of all insurance transactions during 2000. However, two public brokers, Brown & Brown and Arthur J. Gallagher, continued to close deals at a record pace. These two firms collectively closed 59 deals in 2008, and both individually hit a 10-year, high-water mark in closings.

The credit crunch has crippled the masses of private equity firms looking to buy insurance agencies, and many of those with gunpowder are having a challenge closing deals at negotiated valuations because of growing pressure from their capital partners to retrade the deal or only pursue those that provide an abusive return. While a handful of private equity funded buyers remains viable and committed to insurance, overall private equity pulled back significantly in 2008.

With several buyers scaling back, the supply and demand shift accelerated a reduction in deal pricing. From 1999 through early 2008, deal values increased to 7X to 9X EBITDA including the earn-out as buyer demand outpaced seller supply. Additionally, over 80% of the purchase price was guaranteed in many deals. Today, post-closing growth has virtually vanished, and the remaining buyers are transferring more risk to the seller via reduced guaranteed payments and higher earn-outs. Buyers today are throwing out down payments as low as 60% with additional upside based on growth requirements that few can hit. There are not a lot of catchers at that type of structure, but buyers are trying to preemptively push down guarantees to ferret out opportunistic deals. Today’s EBITDA deal multiples reside more in the 5.5X to 7.5X range.

Transactions in the pipeline were overflowing during 2008, and early momentum suggested that 2008 was to be the biggest deal year in history. The number of closed deals quickly declined as challenges in the financial world and shifting supply and demand reduced buyer pricing to the point where seller expectations could not be met. Many brides were literally left at the altar.

The most telling trend of 2008 was in the number of announced deals by independent agency and privately held broker buyers. Independent agencies closed 26.9% of all publicly announced deals, a level not witnessed since independents captured 29.6% of all deals in 1999. The increase in both the number of deals closed, as well as the percentage of total transactions by independents is indicative of an emerging strategy for independents—grow via acquisitions. Valuations are now in a zone where independents can compete on acquisition pricing. For many sellers, yesterday’s plan of landing a short-term premium valuation has been replaced by securing a sale to an independent broker that can enhance long-term return. Life after the deal has quickly become a strategic objective, and most in the market today are more impressed with Main Street than Wall Street.

A look ahead at 2009

The supply of independent agency sellers in the $3 million to $20 million revenue range will subside during 2009. Most agencies in this revenue range have decided to at least temporarily weather the economic storm and reassess where taxes, legislation, the economy, the insurance market and valuations stand in a couple of years. The majority have the leadership and relationships in place to survive—at least in the short term.

However, many agencies under the $3 million threshold are losing their grip on sustaining independence. Stock remains too narrowly held, the average age of principals continues to increase, insurance company pressure for growth and profit continues to rise, premium rate increases are being more than offset by a reduction in insurable payroll and risk, and competitors are becoming stronger by partnering. Agency financial performance is weakening, and already depressed valuations will hold stagnant at best. For the first time in the employment history of many owners, 2009 brings with it staff reductions, payroll freezes, and other dramatic expense control policies. Adding to the pain is the fact that many economists predict that the economy will feel the current pain for several years to come. Many of these agencies will have to sell as the landscape becomes increasingly difficult to navigate. Sell side supply will remain intact, but the supply will be driven by smaller agencies than we have seen over the past several years.

For buyers, large, stand-alone P-C shops have fallen largely out of favor. Post-closing growth and profitability simply cannot support the sellers’ inflated price expectations. Buyers are now more acutely focused on smaller P-C roll-in opportunities that provide tangible expense savings. An attractive target for 2009 has been redefined as an agency with either growth potential or one that can help a buyer diversify beyond P-C, such as a firm with significant benefits or specialty business.

Brown & Brown and Arthur J. Gallagher will remain on the warpath. Marsh & McLennan and Aon also will attempt to enter the acquisition space as they seek to expand their market share with smaller insureds. Most banks will either stay on the sideline or divest themselves of insurance altogether. Wells Fargo, BB&T and BancorpSouth are just a few of the exceptions that will continue to build out and acquire insurance brokerage.

Over the last 18 months, as the number of buyers dwindled along with organic growth rates and agency valuations, a renewed buyer has appeared and is ready to rumble. Large regional independents see 2009 as an opportunity to grow via strategic acquisition or merger, offering sellers an alternative to the public brokerage houses and private equity funded buyers. For sellers, the large independents offer more consistency regarding life after the deal and exhibit a more appealing bedside manner. The attraction of affiliating with a “financial engineer” has been replaced by a general movement to deal with insurance people. Private firms such as Bollinger and Leavitt have already built successful acquisition platforms, and many more will emerge and aggressively seek to acquire. Some large regional brokers will deploy internal cash, others will secure debt financing and a truckload will push for seller financing.

The composition of insurance buyers and sellers will look different in 2009. New deal structure and terms will take root. And the search for financial partnerships will be outpaced by the search for strategic partnerships. Agency consolidation is alive and well. It just looks different.

The authors:

John M. Wepler is president and Patrick T. Linnert is executive vice president, of Marsh, Berry & Co., Inc., a management consulting and deal advisory firm working exclusively in the insurance distribution space. For additional research, please review subscriber.MarshBerry.com/Spring2008StateofIndustry. They can be reached at (800) 426-2774 or at John@MarshBerry.com or Patrick@MarshBerry.com. |