|

Insurers' appetite for acquiring MGAs

Some strong P-C insurers will be in an acquisition mode

By Charles Norton-Smith

From 2006 through 2008 property/casualty insurance companies were enjoying rising income and strong balance sheets in the commercial and specialty sectors. As excellent financial results increased the valuation of publicly traded insurers, these companies looked for additional growth opportunities and sought to acquire high-quality distribution and underwriting businesses, specifically program administrators and managing general agencies (collectively MGAs).

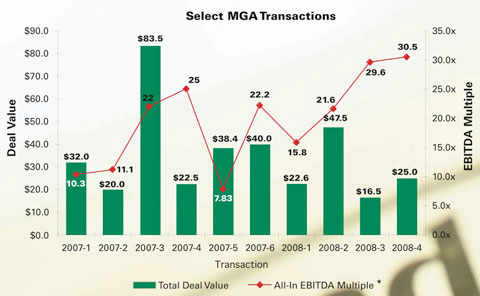

While MGAs historically had been valued based on their net income, insurers became increasingly willing to pay for the underwriting profit they believed they would capture by acquiring an MGA. This provided a unique opportunity for MGA owners to monetize an income stream that historically had been available only through profit-sharing arrangements.

Recent events have created a very different picture. Insurers are now generally divided into two camps: those that have suffered material damage to their balance sheets due to the recent financial turmoil and those that appear to have avoided the storm. Insurers that fall into the latter group are well positioned to capitalize on market upheaval and disruption.

In 2008, the property/casualty industry lost approximately 15% of its book value due to significant catastrophe losses and unprecedented asset deterioration, but results for individual insurers varied greatly. As a result, overall insurance supply is significantly reduced. The question of what insurance demand will look like as the year progresses is unclear; some suggest that a reinsurance-led market hardening is under way, although the current economic turmoil may prove that notion to be wishful thinking.

Merger and acquisition activity involving MGAs has declined while the market digests the effect of recent financial results, reinsurance renewal pricing and the unprecedented events at some of the most recognizable insurance names in the world. However, we predict that toward the middle of this year the healthy carriers will aggressively seek to build their premium base. With continuing scrutiny of insurers’ balance sheets, we believe that the appetite for reserve-risk-free transactions (and therefore MGAs) will be strong. These transactions will better position these insurers to take advantage of their weakened competition and the next hard market cycle.

|

| |

* EBITDA (earnings before interest, taxes, depreciation and amortization) “All-in” means that the price includes the up-front cash as well as the earn-out consideration.

Source: Fox-Pitt Kelton Cochran Caronia Waller |

| |

What factors will distinguish those MGAs that choose to take advantage of this dynamic and drive outsize valuations? We believe the following five factors, in order of importance, will be pivotal in this stage of the cycle:

1. Agency profitability. Buyers pay premium multiples for businesses with a clear path toward continued growth and expanding margins. It is important to note that not all earnings are valued the same in a transaction and buyers are sensitive to the identification of core operating profits as against “contingent” earnings resulting from revenue streams such as profit sharing. The contingent element of profitability will ultimately give rise to a discussion regarding an adjustable earnout structure.

2. Underwriting profitability. Historically, MGAs have been valued on the basis of their fee-based income. When conditions permit, as was the case between 2006 and the first half of 2008 and, we believe, will be the case again in mid-2009, insurers also have demonstrated a willingness to pay for a portion of the underwriting profit they believe they can capture by acquiring MGAs. As a result, MGAs may again see valuations markedly higher than the norms. MGAs that can produce a consistently profitable book of business are best positioned to capture a portion of their underwriting profit through the price they receive in a transaction.

3. Specialization. MGAs with a well-defined portfolio of specialty business are more appealing to strategic acquirers. Strategic acquirers often look to add specific new products, service offerings and expertise through acquisitions. By buying these elements, they avoid the uncertainty of building these skills and facilities and thereby reduce their time to market.

4. Sustainability. Strategic acquirers are more likely to pay premium multiples for developed results that can be continued. This, in turn, puts the spotlight on the continuation of the team that has delivered these results. Sellers with an experienced team that is still motivated to generate quality results after the transaction are positioned to achieve outsized valuations.

5. Barriers to entry. Buyers must convince themselves that “building it on their own” is a less attractive solution than making an acquisition. Without giving away the ingredients to their “secret sauce,” sellers must articulate the barriers to entry that protect their business. Data, technology, distribution relationships, unique service offerings, and a known and respected brand often provide key competitive advantages.

While we continue to await the outcome of the current economic turmoil, certain truths remain evident:

• Capital will always seek out the highest return.

• High-quality MGAs represent significant profit potential for insurers, with limited or no balance sheet risk

As a result, opportunities to produce attractive returns for both buyers and sellers exist, even in this challenging environment.

The author

Charles Norton-Smith is managing director of Fox-Pitt Kelton Cochran Caronia Waller, a New York-based investment bank that specializes in banking, insurance and related industries.

|