|

Marketing Agency of the Month

An organic growth culture

New business emphasis results in best year ever in this soft market

By Dennis H. Pillsbury

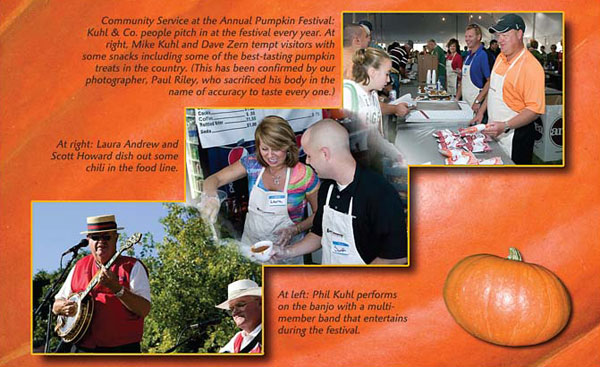

Morton, Illinois, is the home of the Nestlé/Libby’s pumpkin packing plant where more than 80% of the world’s canned pumpkin is processed. It is also home to Kuhl & Co., one of the largest independent agencies in central Illinois.

For those of you who have read this far hoping for an article on organic pumpkins, you can stop reading. This is about Kuhl & Co., an agency that saw commission income grow by 10% through July of this year. If you want to know how they did it, read on.

But first, we need to heed the advice of Glinda the Good Witch when Dorothy started out on the Yellow Brick Road: “It’s always best to start at the beginning.” In this case, that was 1979, when Phil Kuhl started Kuhl & Co. and adopted a mission statement and philosophy that laid the groundwork for success.

A foundation of ideals

“The statement talked about being here to serve first our customers honestly and with integrity,” Phil, who continues to work at the agency and serves as CEO, remembers. “It continued that the agency also existed to serve employees and respect them as unique, and to support and serve our insurance carriers and to live up to our contractual obligations. We also should have put in something about serving the community, because we do a lot of that and it has been a very important ingredient in our success.

“We’ve stuck pretty close to those ideals,” Phil adds. “When I look at the agency and the teamwork we’ve developed today, I’m very proud of what we’ve accomplished. Our customers have responded to us with tremendous loyalty; our retention rate is very high. That’s because we always help our customer buy the right insurance. We don’t sell. We ask the customers what they want and help them achieve that.

“When we write a client’s business, we try to set up a service plan that delineates what we will do to help them mitigate or eliminate risk. We talk to them about their mod and what impacts that and what they can do to improve their mod and lower their premium. I actually created software that projected a client’s mod using a spreadsheet during a mid-term review. That was before ModMaster came out, which is what we use today. Those clients are still with us today, and they think we’re the best thing since sliced bread. The service plan also talks about renewals. It spells out when the client wants to discuss the renewal and how they want it to go.”

Building on that foundation

As the agency grew, Phil realized that he needed to find out how other agencies dealt with the challenges that came with that growth, as well as the challenge of passing the agency on to the next generation. Perpetuation, he realized, is a key part of serving customers first. “Quite simply, we can’t be here to serve them if we don’t have a plan to assure that we’ll be here in the future,” Phil says.

In 1995, Phil made a giant leap of faith by hiring MarshBerry and joining their APPEX group. “I couldn’t talk freely with local competitors about my concerns. Nor would they be willing to share information that might help me compete against them. By hiring MarshBerry, I was able to benchmark my agency against agencies twice our size. But more important, I was able to hang around with those people and talk with them about their solutions to some of the problems I was facing. At that point in time, I also had my son, Mike, and son-in-law, Dave Zern, working with me at the agency and they went to the APPEX meetings as well.”

“I really have to commend my dad for making that investment,” Secretary and Principal Mike Kuhl says. “It was such a good training ground. It put us around really good people, both consultants and agents. We were able to discuss perpetuation, which was a critical concern for Dad, Dave and myself. We also were able to pick their brains about commission schedules and buy/sell agreements. It was amazing how forthcoming all these successful business people were. They were willing to share everything.”

Perpetuation planning forces growth

“We learned very quickly that most perpetuation plans fail,” Mike continues. “It wasn’t welcome news. But we also found out why and determined that we were not going to be one of the failures. Put simply, most perpetuation plans fail because of a lack of discipline in five areas:

• A continuous, relentless drive for organic growth

• Recruiting, replacing and retaining talent

• Reinvesting in the balance sheet

• Relinquishing stock gradually

• Rewarding performance through ownership

“So, all we had to do was become disciplined in each of these areas,” Mike quips with tongue in cheek.

“Fortunately, we had a pretty good handle on points three and four. Dad was planning on staying around for a while, so Dave and I had time to purchase the stock. We also agreed that in the future, we would expand ownership as a way to perpetuate to the next generation. In fact, I already have identified several people who will soon be offered ownership. But points one and two were not going to be easy.”

A tough choice

In March 2004, Kuhl & Co. made the decision to tackle organic growth. “We hired MarshBerry to help us create a total agency growth culture,” Mike says. “We implemented a new commission structure that emphasized new business, and it’s a good thing we did. We were okay living on renewals and some new business that came in over the transom when the market was hard, but during a soft market, it would virtually guarantee no growth or negative growth.

“Under the plan we put in place, producers had to write at least $50,000 in new commissions or their renewal commissions would go down,” Mike explains. “We also moved all the small commercial and personal lines business into a new department so our producers would be concentrating on mid-sized and large accounts.

“Needless to say, not everybody was pleased with the new structure,” Mike remembers quite vividly. “We had 22 people at the time and six of those people quit, including two producers who represented about $800,000 in commissions. It was absolute hell during the transition.

“This also affected Dave and me personally, since we were both producers and needed to make money to help pay off the loans we had made to purchase Dad’s stock. Since this was really one of my first big decisions as an owner, Dad let me run with it. But that also meant that I was very busy managing the business, finding replacements for the people who left, training new producers, and so on. I had lots of help from the 15 people who stayed with us through these tough changes, but it still took a lot of time away from producing. And that first year I failed to hit the new business goal and had my renewal commissions cut.”

The transition took almost five years. The agency has hired 18 people, including seven producers, since 2004. Eleven of those people are still there, including three of the producers. But the final results speak for themselves. “This year has been our best ever in new business with $5.7 million in premium, up from $1.7 million last year,” Mike reports.

Hiring quality

“Fortunately, Phil had reinvested in the agency so we had the wherewithal to hire quality people,” says Dave Zern, treasurer and principal. “Just recently, we had an opportunity to bring in an experienced producer who had been with a direct writer. We made the investment, and this year he is on target to be our top producer. We have top notch people at every level, allowing us to provide excellent service to our customers.”

Dave joined the agency in 1996 from The Principal in Des Moines, Iowa. He started out in the sales center, doing telemarketing and setting appointments for producers. Then someone came along and asked him why he was doing the hard part and not going out and producing business. “So I crossed over into the sales side, with an emphasis on employee benefits. It’s worked out pretty well. Last year, I was the leading salesperson in the agency. Sixty percent of my book is employee benefits.”

All told, the agency has $4 million in revenue, with 58% coming from commercial property/casualty, 32% from employee benefits, and the balance from small commercial and personal lines. There are 26 employees. Phil, Mike and Dave currently are equal shareholders.

“Each account belongs to one producer, so there is no worry about splitting commissions,” Dave points out. “The producers, however, are backed up by a service team for each account and can call on one or more of those people to join him on a client visit if needed. Since we work hard to cross-sell in both directions, adding employee benefits to our property/casualty clients and vice versa, we need to have depth in our service teams. Quite often, I will take an individual from commercial lines with me as a technical person when I’m trying to cross-sell one of my employee benefits clients or when I want to present a total package to a potential client.

“All of our employees are licensed and many of them have earned the CIC designation. We encourage our employees to achieve industry designations by paying any expenses involved.”

Dave concludes: “It’s been quite a ride. And even now, there’s never a dull moment. You can come in thinking you’ve got a clean slate, and one phone call can change that. I also really like the fact that I get to work with some very interesting people, both inside the agency and as clients. We get to meet entrepreneurs from other fields and learn about their businesses and become risk managers for their firms. We truly are viewed as business partners, and what could be better than that?”

Mike very proudly points out that Kuhl & Co. has won the PIN-Up award and the Leverage Award from MarshBerry. “It’s great to be recognized as one of the best in a group that consists of some of the best agencies in the country. We’ve had a lot of positives that resulted in these awards.

“However, what I’m proudest of is the fact that our leakage was only 3.9% against an industry average of 15%. That’s the amount of revenue that is lost from current business due to loss of business or a drop in premium from a soft market,” Mike explains. “At the same time, our average organic growth is 11.9%, against an industry average of 1.3%. You can see that our sales culture is easily covering our leakage. But it also means that our emphasis on service has resulted in tremendous client loyalty.”

Phil, who is 69 years old and originally planned to sell all his stock, says: “Winning is fun. The last 10 or 12 years, I’ve been focused on perpetuation. I’ve been able to watch the next generation implement a plan that has created a strong team. And most important, everybody likes working here, including me. That’s why I’ve hung on to my piece of the agency. It’s a great investment, but it’s also a source of pride.”

We agree with Phil that he has something of which to be proud. And we are proud to recognize Kuhl & Co. as the Rough Notes Marketing Agency of the Month.

|

|

| |

|

| |

Kuhl & Co. Management Team: Seated from left are Dave Zern, CIC, Treasurer/Owner; Phil Kuhl, CIC, Chief Executive Officer/Owner; and Mike Kuhl, CIC, Secretary/Owner. Standing from left are: Phil Witzig, Systems Administrator; Valerie Thibodeaux, Accounting Department; Beth Hattan, Manager-Select Business Unit; Nancy Rule, CIC, Commercial Insurance Manager; Mindy Riden, Group Department Manager; and Scott Howard, Assistant Commercial Lines Manager. |

| |

|

| |

"We don't sell. We ask the customers what they want and help them achieve that."

—Phil Kuhl |

| |

|

| |

Commercial Lines Department: Seated from left are Nancy Luchtefeld, Customer Service Representative; Nancy Rule, CIC; Sue Carruthers, Customer Service Representative; and Miranda Leininger, AIC, AIS, CISR, Customer Service Representative. Standing from left are Laura Andrews, CISR, Customer Service Representative; Scott Howard; and Amy Boll, Customer Service Representative. |

| |

|

| |

Group Benefits Department (from left): Sharon Halstead, ALHC, Account Specialist; Heike Goodin, Account Specialist; Mindy Riden (seated); and Sandy Streeter, Customer Service Representative. |

| |

|

| |

Select Customer Unit (from left): Sharon Grawe, Agent; Elizabeth Pisano (seated), Customer Service Representative; Beth Hattan; and Constance M. Pompa, Account Executive. |

| |

|

| |

The Sales Team: Seated from left are Mike Kuhl, CIC; Phil Kuhl, CIC; and Dave Zern, CIC. Standing from left are Jonathan D. Weber, Producer; Mark Whitlock, ARM-P, AIS, CLCS, Producer; Denise Jacobus, CIC, Producer; and Jack Lynch, Agent. |

| |

|

| |

Administration Department (from left): Alicia Endress (seated), Receptionist; Valerie Thibodeaux; Phil Witzig; and Becky Smith (seated), Accounts Payable. |

| |

|

| |

"There's never a dull moment. You can come in thinking you've got a clean slate, and one phone call can change that."

—Dave Zern |

| |

|

| |

"This year has been our best ever in new business with $5.7 million in premium, up from $1.7 million last year."

—Mike Kuhl |

|