|

Technology

Real time quoting is "EZ"

EZLynx provides real time premium comparisons to agents and their customers

By Nancy Doucette

Can your agency access multiple carrier Web sites to obtain a personal lines quote for a client or prospect in under five minutes?

For many agencies, the answer is “no,” followed by a laundry list of pain points—time-consuming duplicate entry that is compounded by the need to navigate different carrier Web sites; credit scores; tiered rates; and then spending yet more time to complete carrier-unique underwriting questions at each site.

“Too often, agents aren’t going to three or four carriers for their customers; they’re going to one company that they think will offer the best price for the coverage, and they’re keeping their fingers crossed,” asserts Pete Holcomb, vice president of special projects for Webcetera, L.P.

“In other words, the value of representing multiple carriers frequently is sacrificed due to time constraints,” he notes.

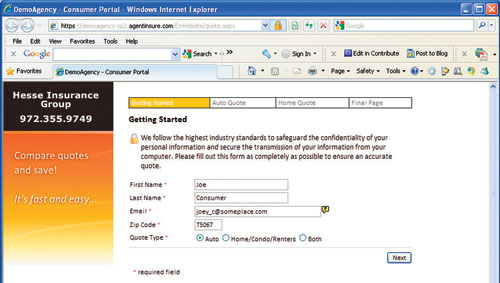

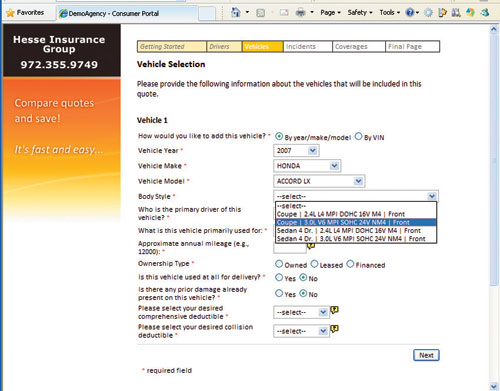

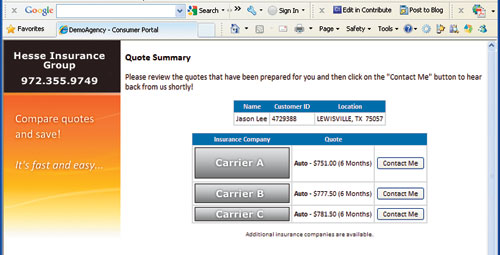

| CPLive!! enables agencies using EZLynx to offer consumers online real time quotes from the agency Web site. These views illustrate the interview screens where consumers input their information and the results screen that summarizes the premiums from the carriers that the agency represents. |

| |

|

| |

|

| |

|

|

Pain reliever

A number of agents told us that Webcetera’s premier product, EZLynx, eliminates many of the pain points.

Marla Folsom was in on the ground floor with EZLynx. Phoenix-based Horizon Insurance Group, Inc., where Folsom is vice president, was one of the beta test agencies back in 2003. Frustrated by the “thousand different tiers” and credit scores that carriers were using to fine-tune their quotes, she says Horizon subscribed to EZLynx as soon as it hit the market in 2004.

She explains that EZLynx compresses the personal lines quote process from a task that took upwards of 40 minutes to one that can be completed in less than 10 minutes because she needs to input the data only one time into the agency’s management system, The Agency Manager from Applied Systems.

From there the risk information automatically flows into EZLynx, where it is communicated to multiple carriers’ proprietary rating Web sites where the unique underwriting concerns of each carrier are addressed. Each carrier’s system then generates the quote and returns it—in real time—to Folsom via the EZLynx results screen.

“Webcetera’s standards for accuracy are exceptional,” notes Pete Holcomb. “The guiding principle of the connectivity that we establish with each of the 110-plus carriers that we work with is that what we provide an agent is no different from what that agent would receive if he went to the carrier Web site himself.”

Holcomb explains that EZLynx is a separate application that can sit beside an agency’s management system. “We have the ability to extract risk information from just about every management system,” he says. EZLynx works equally well in agencies that don’t use a management system.

Because EZLynx is a Web-based solution, subscribers have access to their account from any workstation that has Web connectivity. As such, there’s nothing to install locally.

Folsom emphasizes that having a singular workflow is critical, and she’s not shy about sharing that viewpoint with carriers that wish to appoint Horizon. “When I’m getting ready to add a carrier, the first place I go is to the EZLynx carrier library. EZLynx works with 110 carriers. If the carrier isn’t in the library, that impacts the deal. It’s an ease of doing business issue,” she says.

Webcetera’s Holcomb interjects: “EZLynx has perfected the process in terms of carrier availability. Being able to say you offer real time is one thing. But having broad carrier availability on your real time platform is another. The 110-plus carriers that EZLynx is working with include national and regional carriers. Agents provide us guidance on which carriers to add. Forward-thinking carriers also want to adopt whatever technology tools their agents make use of.”

Horizon extends that ease of doing business to its clients, Folsom continues, by giving them PURLs—personal URLs. Put simply, PURLs are hyperlinks. Folsom says being able to create PURLs using EZLynx is especially helpful during the remarketing process. She says once she has completed the new application, she sends an e-mail to the client that includes the hyperlink. When the client clicks on the hyperlink, he is directed to a secure EZLynx portal where the application is posted.

This process allows the client to review the application for accuracy when it’s convenient. Once the client has checked the application and made any necessary changes, he e-mails it back to Folsom so the next time she logs in to the EZLynx account, the approved application is there.

Holcomb explains that PURLs are also useful when an agency has only partial information on an application. In this scenario, the CSR might be on the phone with the client or prospect, gathering information. But suppose the individual has another appointment and cannot complete the information-gathering session. The CSR can follow the same process as above, including the PURL in an e-mail, enabling the client or prospect to complete the application in his own time.

Folsom says EZLynx is more than a rating tool. “It’s a customer acquisition and retention tool,” she says.

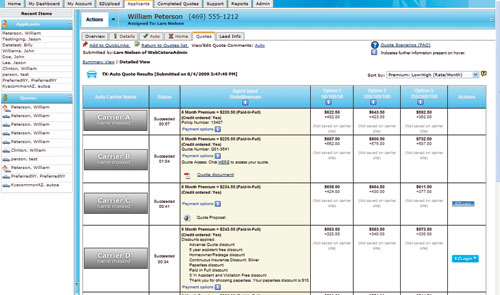

| Agency users of EZLynx see this results screen when they request multiple quote scenarios for a risk. The “scenarios” feature allows staff to have the agency’s carriers return premiums for various combinations of coverages and deductibles in real time. |

| |

|

Real time, really

Nolan Jackson has had an online presence for 10 of the 11 years he’s owned Jackson Insurance, headquartered in the Atlanta suburb of Stone Mountain (www.insurance-of-georgia.com). All along, he had the idea of having an online rater on his home page. He knew it would set him apart from other agencies that also had an online presence.

In 2007, he was in the process of building his own online rater when Christmas came early. He heard about CPLive!! during an EZLynx presentation. Consumer Portal Live (CPLive!!) is a secure, consumer-facing, real time comparative quoting tool for auto and homeowners insurance that agents can seamlessly link to from their agency Web site.

Jackson says EZLynx forwarded the CPLive!! link and his Web designer had it up and running in a matter of minutes. “I was like a kid on Christmas morning when I discovered how fast and easy CPLive!! is for everyone involved,” he recalls.

Consumers who come to Jackson’s site can get a homeowners or auto quote from four or five different carriers in about two minutes, he reports. “This speeds the process of getting the consumer what they want, when they want it,” Jackson notes.

When a consumer uses CPLive!!, EZLynx immediately alerts Jackson’s office. “The secret to capturing Internet business is speed,” he explains. “So we have about a five-minute window in which to contact the consumer to close the deal.” Jackson has allocated one of his CSRs to do just that—her sole responsibility is to sell to and service Internet customers.

It’s proved to be worthwhile. By tracking the agency’s Internet business, Jackson has learned that these customers seem to be better risks. “Typically they’re 650 - 700 credit score people; they own a home and a couple of cars. Over time, they have fewer claims and in general are low-maintenance clients who tend to pay their entire premium up front.”

Webcetera’s Holcomb adds, “At its soul, CPLive!! is a Web-based lead generation tool that provides consumers with accurate, real time premiums from the carriers that the agency represents. The risk information that the consumer has input floods the EZLynx tool so the agent can complete the sale.”

Of course, the “secret sauce” is driving consumers to the agency Web site in the first place. Jackson confides that’s a significantly bigger expense than his subscription to EZLynx and CPLive!!

Every nickel counts

Florida agent Rodney Taylor, CIC, CRM, acknowledges that it’s a tough personal lines market in his state these days, especially for homeowners insurance. “You can’t find a large standard carrier in Florida,” Taylor says. “They’ve non-renewed all their policyholders in our state. This agency was founded in 1901, and we were growing until 2004. We took a direct hit from Hurricane Charley that year. We processed over 7,000 individual claims. To date, the carriers that we represented paid claims of over $800 million out of this agency alone.”

Add to that Taylor’s observation that the economic downturn that the country is now slogging through hit southwest Florida about a year before it affected the rest of us, and you can appreciate why he was on the lookout for tools that could increase productivity and boost efficiency for Charlotte Insurance Agency, Inc.

In asking other agents and CSRs about the solutions they use, he heard about EZLynx. “You tend to listen to what the CSRs have to say about tools like this,” Taylor says with a smile. “They generally use it more than the producers do and therefore have better insight.” Another rater he was considering offered a 90-day trial. In the end, the CSRs at Charlotte Insurance preferred EZLynx.

“Every nickel counts in Charlotte County, Florida,” Taylor declares. This is why he decided to remarket the agency’s personal auto book—to make sure his customers weren’t paying any more for their auto insurance than they should. Using EZLynx and the agency’s management system, AMS 360, Taylor is able to have one CSR dedicate about two hours each day to that effort. EZLynx pulls the data from AMS 360, which simplifies the CSR’s job and ensures the accuracy of the information going to the carriers.

“Management system integration is important,” Webcetera’s Holcomb says. “Depending on the management system, our integration is either one-way or bi-directional.”

As of press time, EZLynx does not offer homeowners rates in Florida. Taylor notes that having real time rating for homeowners insurance would certainly help, particularly in light of State Farm’s recent announcement that it would be non-renewing its Florida property policies. “A lot of people are shopping their insurance right now,” he says. Some decide to wait it out until State Farm actually non-renews them. Others, he says, are so angry with State Farm that they’re switching mid-term.

“Charlotte Insurance is extremely competitive against State Farm’s auto,” Taylor says. “Using EZLynx, we can provide auto quotes from four carriers while the caller is on the phone. It takes about five minutes. The consumers are pleased with the quick response.”

For more information:

Webcetera, L.P.

Phone: (877) 932-2382

Web site: corp.ezlynx.com |