|

Social services—recession-proof?

With more than $2 billion in premium and a positive growth forecast, social services can be an attractive niche for agents

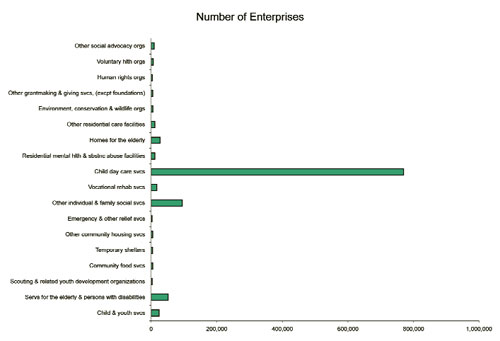

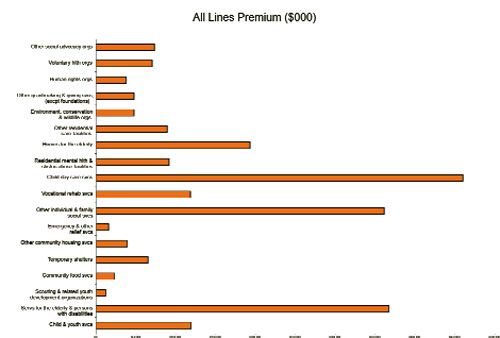

There are more than one million social service businesses in the United States, providing some $2.2 billion in premium, according to data compiled by MarketStance, Middletown, Connecticut. With the vast majority of these enterprises being non-employer (894,000), small accounts (143,000), or middle market accounts (11,000), they are perfect targets for independent agents. The non-employer accounts provide some $146 million in premium; $851 million is generated from the small accounts; and the middle market accounts for just over $1 billion in premium. The 226 national accounts provide $186 million in premium.

Adding to the attraction of significant premium potential, the social services market also appears to be relatively recession proof when compared to all industries. In the period from 2006-2008, the social services market enjoyed a 2.3% growth in the number of enterprises and employment growth of 3.6%, compared with anemic growth of 0.7% and 0.6%, respectively, for all business classes during the same period. MarketStance forecasts that growth for 2009 through 2010 will be 0.4% and 1.7% for social services, while all business classes are expected to show declines of 2.3% and 2.5%, respectively.

Child day care services represent the largest sector with 769,000 enterprises spread across the country, generating $460 million in premium. Other individual and family social service businesses represent the second largest category with 94,000, followed by services for the elderly and persons with disabilities, where there are 51,000 businesses. However, services for the elderly is the second largest category in terms of premium, generating some $367 million, as compared with $361 million for other individual and family social services. Not surprisingly, services for the elderly is anticipated to have the strongest future growth in terms of number of enterprises (4.1% for 2009-2010) and employment (4.7%). During the same period, child day care services are expected to show a small decline of 0.5% and 0.3%, respectively.

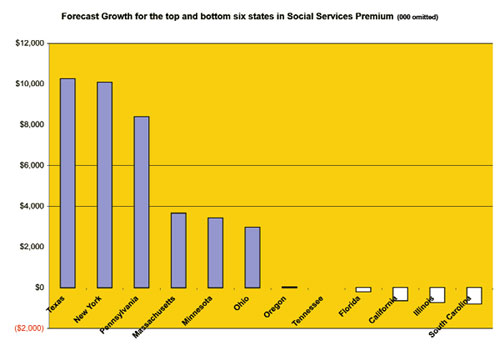

Social service businesses are concentrated in the large population states, with about 40% of the enterprises and premium in only six states—California, Illinois, Michigan, New York, Pennsylvania and Texas. Texas and New York also are expected to show the strongest premium growth in 2009-2010, with both enjoying premium growth of more than $10 million. Pennsylvania is expected to have premium growth of $8.4 million. Four states—Florida, California, Illinois and South Carolina—are the only states expected to show decreases in social services premium.

|

|

|