|

Benefits Products & Services

Health care costs and wellness incentives

Brokers have an opportunity to bring options to the table

By Thomas A. McCoy, CLU

A dominant concern for benefits brokers in 2011, as it has been for the past several years, is the inexorable rise in health insurance premiums. What may be a particular challenge this year will be decisions about how much more of the health care price tag can be passed along to employees.

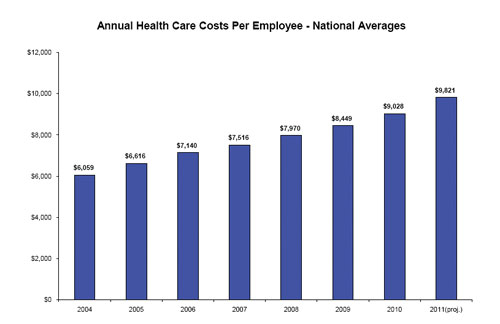

Hewitt Associates projects that overall health insurance rates will go up this year at their fastest rate in five years—an average hike of 8.8% for employers in 2011, compared to 6.9% in 2010 and 6.0% in 2009.

Never mind the uncertainties that accompany the new health care law. The sobering message that brokers must deliver to their client companies now is that the cost of the program they have been providing is rising at roughly four times the annual rate of inflation.

When there is greater general inflation in the economy, businesses can respond to cost increases by raising the prices of their own products. That is not an option in today's economy. So brokers will be proposing cost-saving measures for their clients' health plans. The difficulty they face is that the primary cost saver—increased employee contributions—has been utilized so heavily in the past few years that employers who go to this well again run the risk of becoming uncompetitive in the labor market, as that market begins to strengthen.

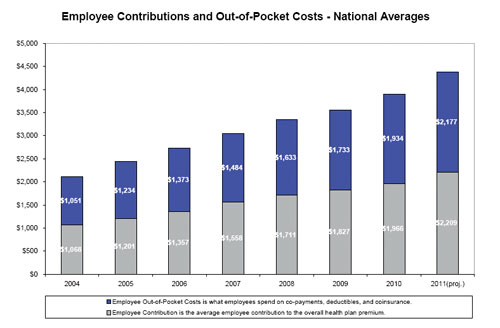

Hewitt's analysis indicates that employees of large companies will be asked to contribute an average of 22.5% of their total health care premium this year, or $2,209, which is 12.4% more than they contributed in 2010. The impact of rising health costs on employees is far more dramatic when total out-of-pocket medical costs are added to employee premium contributions.

Hewitt's figures show that those combined medical costs for employees will have more than tripled—to $4,386—over the past 10 years. During that same time, the overall increase in health care premiums doubled—to $9,821.

This leaning on employees to absorb these costs is starting to take its toll. According to a study of more than 9,000 U.S. employees conducted in mid-2010 by Towers Watson, satisfaction with their group health plans dropped from 69% to 64% over the past two years. Those who said they are satisfied with the cost of their health plan declined from 53% to 45%, and 26% said they believe health care spending has increased their stress levels.

"The growing health care affordability gap is a very real problem that employers must consider as they rethink their total rewards program and approach to health care subsidies," said Ron Fontanetta, a senior health care consultant with Towers Watson.

The study went further, probing the source of employee dissatisfaction and asking what they would be willing to contribute to improve their health care programs. It found that it isn't strictly the higher costs of health care that weigh on employees, but the unpredictability of those costs. The number of employees who said they would pay more for predictable health care costs has doubled over the past year to 42%. And 30% of employees said they would be willing to get smaller compensation increases today if they could ensure lower, more predictable health care cost increases tomorrow.

Possible solution

It may well be "the best of times and the worst of times" for benefits brokers. On the downside, their clients are facing the aforementioned cost pressures, as well as concerns about health care reform, while still recovering from the recession. On the positive side for brokers, their business owner clients realize that as the labor market improves, they will have less latitude to combat health insurance price increases by boosting employee contributions and raising deductibles and co-pays. They will be looking to their brokers for fresh ideas.

"The key to future success is a well-designed plan with creative and meaningful consumer and wellness incentives to slow cost inflation and improve employee health and productivity," says Fontanetta of Towers Watson.

Even employers that are favorably disposed to the idea of a wellness program may balk at implementing one if they view the rewards of wellness as long-term and the expenses as short-term. Coaxing employees to participate in wellness programs can take time, and employers want to use their benefits dollars in ways that motivate their current employees and potential new hires immediately.

The process of getting employees to participate can be speeded up, and the employees' general excitement level about the programs boosted, through the use of incentive programs. And the cost of the specific incentives are not incurred until there is already employee buy-in. "You don't give away the incentive until the employee takes action," says Michael Dermer, CEO of IncentOne, a health care incentive programs company.

Dermer points out, "Some brokers will get their wellness programs from their health plans—using Aetna, Cigna, a Blue or whatever—but the client will look to the broker for the smarts and say, 'How can I get my employees to use these solutions?' Of all the tools that brokers are likely to be asked to bring to the table, incentive programs may be the most important."

In the earlier days of incentive-based wellness programs, Dermer says, rewards were generally based on employee participation—such as taking a health risk assessment or participating in a smoking cessation program. "Now the trend is toward more outcomes-based programs, such as reducing cholesterol or reducing BMI (body mass index)."

When the health care reform law was passed last year, it increased the amount of the incentives that employers can offer for wellness program participation, but not until 2014. Currently, employers can offer premium discounts or other rebates up to 20% of the premium for employees who participate. That amount goes to 30% in 2014, but the Secretary of Health and Human Services has the authority to raise it to 50%. Also, some small employers are eligible for grants to start wellness programs beginning this year.

Risk management on the property/casualty side of the business includes loss avoidance. It can on the health side as well. Wellness programs linked to rewards and penalties have been proven to cut claims. Benefits brokers who successfully tailor wellness incentive products to a client's workforce will be helping them through this difficult era of rising health care costs.

|

Graphs from Hewitt Associates |

| |

|

| |

|