|

MARKETING AGENCY OF THE MONTH

Bringing new blood into the industry

A diverse producer corps helps this Illinois agency reach many different clients

By Dennis H. Pillsbury

When Thomas E. Crosby, Sr. left his home in Blytheville, Arkansas, to attend Chicago State University, insurance was not even on his radar screen. "I had hosted a sports radio show in high school and planned on becoming either a school teacher or a radio disc jockey." However, his sales abilities quickly became evident when he was working at Syblock Furniture and sold a Zenith stereo to Gwendolyn Sea, who worked at Prudential. She was so impressed by his ability to sell her and her father something that they weren't planning on buying that she suggested he go into insurance sales. After he made the predictable response, she continued over a two-year period to suggest with increasing fervor such a career, until finally she won him over and he became an agent for Prudential in 1974 and later became a sales manager.

When he left Prudential nine years later to join Country Companies, he was one of the top selling African-American agents in the nation.

He soon realized, however, that what he really wanted was his own firm where he could help make up for the dearth of minority involvement in the insurance industry. "Back then, there were very few minority insurance agencies and the numbers of minority insurance agents were dwindling. So I decided to increase the number of agencies by one, as well as develop a platform for minorities to become producers." In 1986, Thomas formed The Insurance Exchange Ltd. in Oak Forest, Illinois, and managed to win an appointment with American National. In addition to building the agency, he also served as general manager for American National.

By 2004, Thomas, Sr., LUTCF, CPIA, was able to actively pursue his dream when his son, Thomas, Jr., joined the firm to help boost commercial lines production and to take over the accounting functions. This gave Thomas, Sr. some breathing room to work on recruiting and training, as well as developing books of business with other insurance companies. He broke ties with American National, and The Insurance Exchange, Ltd., became a totally independent agency.

In that same year, two of his daughters also joined the agency. Neidra C. Echols is vice president-personal lines and also handles IT. Kelly Crosby is the agency manager.

The philosophy

From the beginning, Thomas, Sr. placed a strong emphasis on integrity and creating an agency that provided "a place for all your insurance needs. I firmly believe that if we all offer our best to our customers and to each other, the rewards will come back to us," he maintains, speaking with a zeal that translates beautifully to radio where he once had a show on a Christian station called "Let's talk insurance, why not?" He brought in guests to provide information on coverages, safety, mitigating risk and other important topics. "The more informed people are, the better insurance consumers they will be," Thomas, Sr. says. "And that's what we want. We want them to look at us as professionals who provide them with the best ways for them to transfer risk."

Clearly this philosophy has been passed on to the next generation. Thomas, Jr., CPIA, vice president-commercial lines, says, "We treat everybody with fairness and respect. If the insurance offering is right for the insurance company and for the client, then, and only then, it's right for us."

Supporting producers

This philosophy is passed on to the producers who work as independent contractors. They earn two-thirds of the commission, with one-third going to the agency. "I'm the most popular person in the agency on the 20th of each month," quips Thomas, Jr. "That's the day we write 23 or 24 checks to our employees and producers. Occasionally, there are additional checks to be written to some other producers who may send in a piece of business. We have a network of agencies that we partner with and refer business back and forth to each other, depending on who has the best market for the client."

This partnership with other agencies extends beyond the Illinois marketplace. "We are partnering with agencies in Indiana, Arizona, and Georgia and have plans for further expansion," Thomas, Sr. points out.

He uses the skills he learned as a sales manager to recruit and train new producers. The agency has a conference room that holds 25 people where producers are brought together to learn about product offerings. There are monthly training classes for new producers or for those who feel that they need a refresher. There are nine people working in the Oak Forest office and another 15 who primarily work from their home office.

"I also meet with them individually to learn their strengths and weaknesses," Thomas, Sr. says. "I help them set goals and let them know that I and my team are always available to them if they have any questions or concerns. We also have an intranet where producers can talk to us and also can log on to each of our carriers. Neidra worked on developing the intranet. We also encourage cross–selling. Some of our producers are strong in life insurance selling, so a producer who has a business owner that needs key man life or some other form of life/health coverage will bring in one of his peers to help with that. That helps us live up to our motto of being a place for all your insurance needs."

He continues: "We also have meetings with our carrier representatives so our producers can get to know them better and develop their own relationships with the insurance companies. We recently had the marketing reps from each of our companies meet with us at the Doubletree and each did a presentation on why we should do business with their company. We encourage each of our producers to tie themselves to three companies and really get to know them."

Thomas, Jr. adds, "If producers have an appointment with a potential commercial account, they know they can call me and I'll provide them with the questions they need to ask, as well as the types of coverages that business probably will need. I'll also go with them on some calls if they need additional backup. Once they have converted a prospect, we do the marketing to the companies."

In addition to developing the agency's IT capabilities and heading up the personal lines department, Neidra also helps support the producers with marketing tools. "I developed a service to help our client companies grow, while thanking new clients and prospects for giving us an opportunity to quote their business. The service provides a package of discounts from some of our commercial clients that is e-mailed to clients and prospects. The commercial clients loved the free advertising and the new business it produced for them. It really helped to cement our relationship with those clients as well as keeping our name in front of our clients in a positive, helpful way," she says.

Not so cold-calling

Although producers are responsible for developing their own leads, "we help them develop a system of referrals that will quickly move them from cold-calling to relationship selling," Thomas, Sr. notes. "We insist on getting three referrals from every client. If we've done a good job for them, they are only too happy to provide us with those referrals. And those are warm leads for our producers."

"It also helps that we have a diversity of producers," Kelly adds. "We have producers of all ethnic backgrounds, many of whom speak several different languages. Because of that, we're able to reach a large demographic of people. It also means that a cold call is not so cold when the prospect is actually approached by someone who speaks his or her native tongue.

"Many of these communities are underserved by the insurance industry because of the language barrier," Kelly points out. "We're working to change that. It's great to work in a family business where you're working toward something special."

Neidra echoes that sentiment, adding that she is "definitely behind the expansion program. I am hoping to go to Georgia and build our business there. I have a lot of college friends in the area."

Blazing the trail

While Thomas, Sr. is not the only person who has opened the doors to minority participation in the insurance industry, he certainly is one of the trailblazers. The agency's outreach to diverse ethnic backgrounds is a model for others. By providing needed insurance coverage to people and businesses that were often overlooked, The Insurance Exchange has enjoyed profitable growth year after year. "Each year has been our best year since we opened our doors," Thomas, Sr. concludes. "And we have created opportunities for individuals to succeed in a lucrative and growing business that is vital to all aspects of our economy."

Rough Notes is proud to recognize The Insurance Exchange Ltd. as our Marketing Agency of the Month.

|

|

| |

|

| |

Members of The Insurance Exchange team. |

| |

|

| |

"We help our producers develop a system of referrals that will quickly move them from cold-calling to relationship selling."

—Thomas E. Crosby, LUTCF, CPIA |

| |

|

| |

Kelly D. Crosby, Agency Manager, (left) with members of her team. |

| |

|

| |

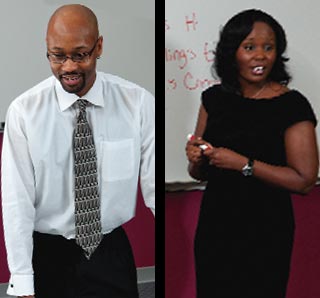

Both Thomas E. Crosby, Jr., CPIA, Vice President, and Neidra C. Echols, Vice President, facilitate monthly training sessions in the agency conference room for new and veteran producers. |

| |

|

| |

Thomas, Sr. visits with Kimberly Alsup, President and Chief Technical Officer (left), and Nadia Meza, Web Site Designer, Computers at Your Fingertips,

a client of The Insurance Exchange. |

|