|

SPECIALTY LINES MARKETS

The construction beatdown

Premiums fell below $10 billion during the economic downturn

It hardly comes as a surprise to anyone that the construction industry was hurt severely during the recent economic downturn. Hit with a double whammy of housing foreclosures and general economic ennui, the construction industry suffered an almost unparalleled drop in all sectors as housing starts ground to a halt and commercial enterprises and state governments curtailed spending.

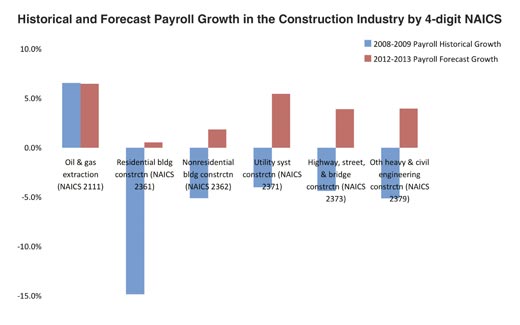

Overall, the construction sector saw a decline in payroll of 8.4% from 2008 to 2009, according to data compiled by MarketStance, Middletown, Connecticut, dragging written premiums down to $9.93 billion. Hardest hit was residential building construction, where payrolls fell 14.8%. Nonresidential building construction saw a drop in payrolls of 5.1%, as did other heavy and civil engineering construction. They were followed by a 4.4% drop in payroll for highway, street and bridge construction, and a 4% drop for utility system construction.

By way of comparison, MarketStance found that firms engaged in oil and gas extraction enjoyed a 6.6% increase in payrolls during the same period.

Looking into its crystal ball, MarketStance anticipates a turnaround in 2012 for the construction sector, with payrolls rising 2.6%, as all sectors are expected to show increases thanks to an improving economy and, in some areas, the added impetus of federal funds flowing into "shovel-ready" projects.

Utility system construction is predicted to show the strongest growth in payroll at 5.5%, followed by heavy and civil engineering construction (4.0%) and highway, street and bridge construction (3.9%). Unfortunately, the two largest construction sectors are forecasted to have the most anemic growth, with nonresidential construction showing payroll growth of 1.9% and residential construction rising only 0.6%. Meanwhile, oil and gas extraction is expected to continue to enjoy strong growth of 6.5%.

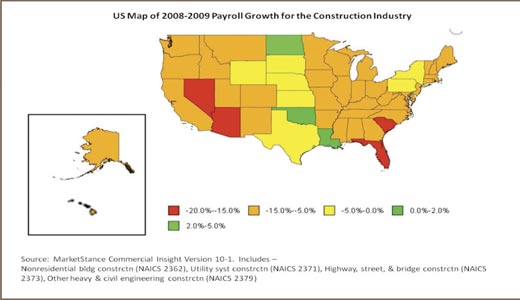

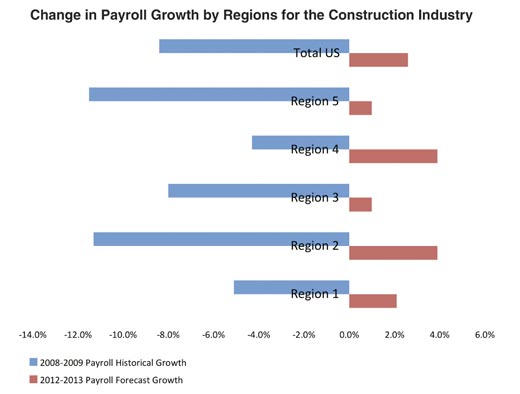

The hardest hit regions were the Rough Notes Western region, where payrolls fell 11.5% and the Southeast region, where payrolls were down 11.3%. In the West, six states showed double-digit declines in payroll, with Nevada (-19.8%) showing the steepest drop, followed by Arizona (-18.5%), Idaho (-11.6%), Oregon (-11.3%), California (-11.2%), and Utah (-10.3%). There also were six states in the Southeast showing double-digit declines, led by South Carolina (-16.9%), Florida (-15.7%), Delaware (-13.3%), North Carolina (-11.8%), Georgia (-11.3%), and Virginia (-10.7%).

The Rough Notes Southwest region had the best performance, with a drop of only 4.3% in payroll. Two states in the region—Louisiana (+1.9%) and Oklahoma (+0.1%)—had modest gains. The Northeast region showed a decline of 5.1%, and the Midwest region was down 8.0%. The state showing the best performance was North Dakota with a 2.8% increase in construction payrolls.

MarketStance forecasts that the strongest growth will occur in the Southeast and Southwest regions, where construction payrolls are expected to rise 3.9% in the 2012 to 2013 period. The Northeast region is expected to have a 2.1% rise, while the Midwest and Western regions are expected to see payrolls rise by only 1.0%. New Mexico is predicted to have the strongest growth, with payrolls expected to rise 10.5% in 2012, the only state to show a double-digit increase.

Although construction still has a long way to go, there is reason for optimism as nearly all states will see payrolls begin a slow rise starting in 2012. This should be a welcome respite for agents who have watched their commission revenue from construction accounts dip or even disappear as the economic downturn pummeled a number of construction firms into oblivion.

For additional information go to www.marketstance.com.

Questions can be e-mailed to ms@marketstance.com

or call (888) 777-2587.

|