|

A "deteriorating" workers comp market

100th anniversary year is not the system's best

By Dennis H. Pillsbury

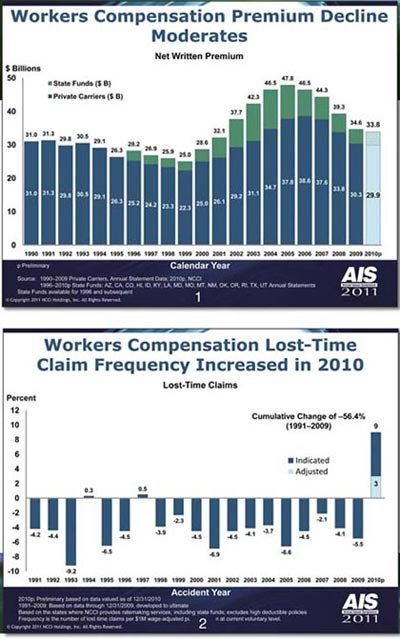

"The appropriate status statement for the market today is 'deteriorating,'" Stephen J. Klingel, CPCU, president and CEO, NCCI Holdings, Inc., Boca Raton, Florida, said in his opening remarks at the NCCI's 2011 Annual Issues Symposium (AIS). This represents a change from "guarded" in 2009 to "precarious" in 2010. "Many of the concerns that led to the 'precarious' status have been resolved," Steve continued, "but not all of them were resolved in a favorable manner." He also pointed out that the status change is hardly surprising considering that "the collapse in private sector wages and salaries resulted in workers compensation premiums falling nearly 24% over the last three years." (See chart 1.)

He pointed to several areas that continued to cause concern: the difficult economic conditions, a turn in claim frequency, the rise in combined ratios, and weakening in the loss reserve position.

At the same time, he indicated that there were some positive market indicators that could presage a real turnaround: Employment appears to be stabilizing and the rate of premium decline is slowing and may have bottomed out.

He also noted some areas that had a uniquely negative impact on workers compensation, including the fact that the recession hit construction and manufacturing sectors hardest and both of those segments had higher than average workers compensation premium rates. Another problem area was the lag in small business hiring. This had a strong impact on workers compensation premiums because small businesses tend to buy full coverage while larger employers may self-insure or use large deductible plans.

The turn in lost-time claim frequency was also troubling. "This represents the first significant upward development in 13 years," Steve said, noting that NCCI was watching this closely to see if it turned out to be a continuing trend or a "new normal." However, he pointed out that a similar uptick occurred at the end of the 1982 recession and then started down again. "All system costs come under pressure with rising frequency," he noted. (See Chart 2.)

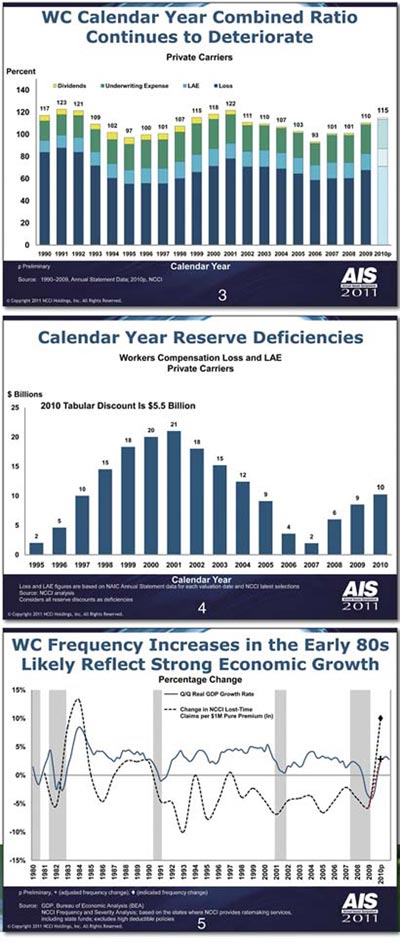

Another problem is the combination of a worsening combined ratio (both the accident year and calendar year combined ratios deteriorated by five points) and weakening loss reserve position.

The system has survived

He went on to temper the concerns by noting that the industry was celebrating its 100th anniversary and had "seen and survived worse markets before." He concluded that the industry needed to focus on those fundamental principles that saw the creation of the system—to protect workers, to protect employers and to incentivize good behavior. The system represents a "fragile balance of social responsibility and economic realities and it can be all too easy to disrupt," he cautioned, adding that NCCI would be working to educate all stakeholders about the importance of the system and the need for rates that are sufficiently strong without being excessive.

As in years past, the AIS managed to present an impressive amount of important information in a short period of time, making it one of the best conferences in the industry and explaining why attendance continues to grow.

And, once again, it was the report of the NCCI's chief actuary, Dennis Mealy, FCAS, MAAA, that captured the attention of a standing-room-only audience. Dennis expanded on the macro issues that Steve presented in his opening remarks by displaying and explaining the data that led to the "deteriorating" appellation.

Among key findings: The calendar year combined ratio for private carriers was 115 in 2010, up five points from 2009; and the accident year combined for 2010 was 114, up from 109 in 2009. "The pattern of combined ratio increases in this cycle is still quite similar to the last underwriting cycle and a significant worsening from 2009," Dennis commented. (See Chart 3.)

At the same time, "NCCI estimates that the reserve position of private carriers has continued its recent pattern of modest deterioration in 2010," Dennis said. (See Chart 4.)

Frequency rises

Perhaps of greatest concern is the fact that "the decline in lost-time claim frequency stopped in 2010," Dennis commented. He went on to explain that the "significant increase of 9%" is not as bad as it looks because there were "several distortions in the data due to the recession and subsequent recovery....Once these distortions are accounted for, frequency is up 3%."

Dennis went on to note: "The 1982 recession was the last one that approached the severity and length of the most recent one. However, the United States experienced a sharp recovery in economic growth and employment coming out of that recession. That growth in employment from 1982 to 1984 was a time when many newer/inexperienced workers entered the workforce and caused two successive years of sharply increased frequencies of workers compensation claims. (See Chart 5.)

"In the most recent recession, the United States lost over eight million private sector jobs. Since this trough, the economy has added only about 1.5 million new jobs in the last 18 months….With this recession's more modest recovery we would expect less upward pressure on frequency than was experienced coming out of the 1982 recession. The adjusted 3% frequency increase fits within the reasonable range of expected frequency changes given the slower growth in employment in the recovery in the most recent recession.

"However, any upward movement in lost-time claim frequency in workers compensation is a serious cause for concern," Dennis warned, "and we need to watch closely to see if this is going to be a temporary phenomenon for a year or two, or be the 'new normal.' The latter would be a very disturbing trend indeed."

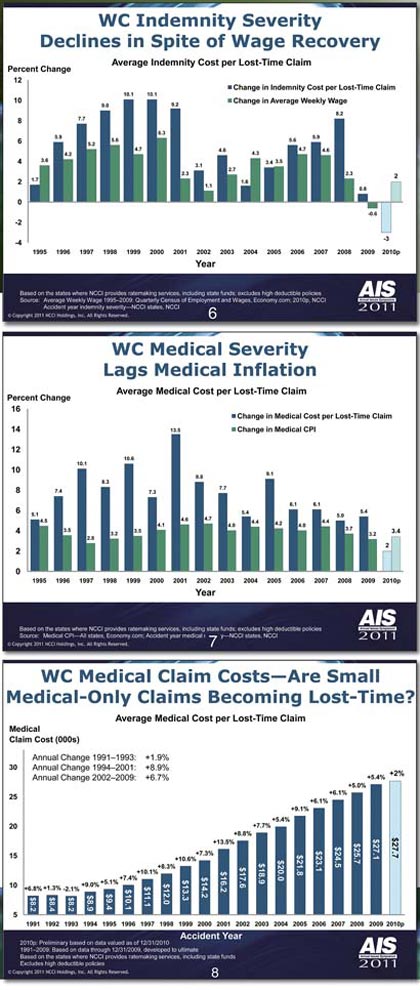

Fortunately, there was some offsetting good news in the area of medical and indemnity claim cost changes. NCCI estimates show a drop of 3% in the cost of the indemnity portion of lost-time claims in 2010, the first drop since 1993. (See Chart 6.) At the same time, the average medical cost per lost-time claim increased only 2%, the smallest increase since 1993. (See Chart 7.)

Dennis went on to note that these improvements in 2010 appear to be "due to an influx of small lost-time claims into the system that in previous years were likely medical-only claims." (See Chart 8.)

Conclusion

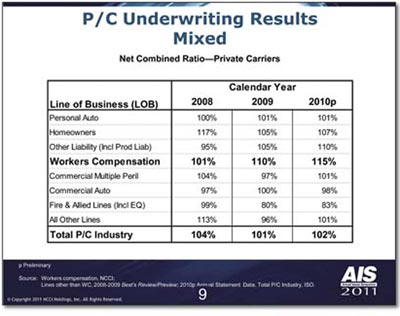

"Although the total property/casualty insurance industry had a reasonable year in 2010 (Chart 9), workers compensation results continued to deteriorate. Not only did the combined ratio increase another five points, but workers compensation experienced its first claim frequency increase in 13 years. Although the increase in frequency was partially offset by no increase in the average lost-time severity, any increase in frequency is something NCCI and the industry will be watching closely," Dennis said. "If it persists, it could mean significant long-term deterioration in system performance. Even if the pressure on lost time costs from the frequency increase is small and temporary, the current combined ratios are unsustainable. In addition, reserve adequacy continues to slip.

"The small change in average severity of lost-time claims in 2010 should be viewed as an aberration. It is likely caused by a temporary influx of medical-only claims becoming smaller lost-time claims as the recovery firms and does not reflect an underlying reduction in medical and indemnity cost drivers.

"On the more positive side," Dennis concluded, "it appears that the worst of the recession and accompanying drastic declines in premium are behind the industry for now."

This could certainly be good news for agents as their commission income from workers compensation business has been declining along with premium levels.

|