Coverholders and Risk Takers

By Glenn W. Clark, CPCU

THE SIGNIFICANCE OF TIMING IN THE PROGRAM SPACE

From TMPAA to CHART 2.0 and Patrol Protect

“I have not failed 10,000 times. I have not failed once. I have succeeded in proving that those 10,000 ways will not work. When I have eliminated the ways that will not work, I will find the way that will work.”

—Thomas Edison

Rockwood Programs has been tribunalized in London for almost twenty years. When we were a start-up in 1996, it was very difficult to obtain the attention of U.S.-based programs specialists. The standard requirement was $10 million in aggregated accounts along with five years of loss triangles. Our (unexpressed verbally) first thought was, “If we had built such a large portfolio of business—with excellent claims experience—why would we need a new partner?”

Someone once observed that “adversity is the mother of invention.” While the source of that quote may be lost to history, we do know that whoever said it must have been an entrepreneur. Our adversity spawned two simultaneous strategies:

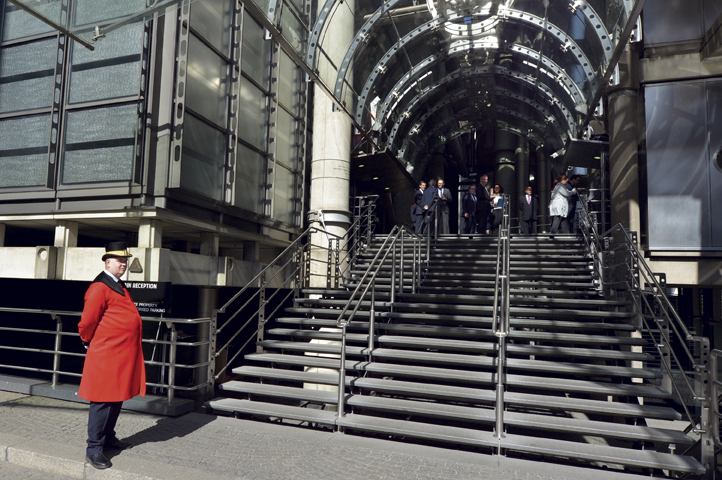

- Approaching London through a creative broker who helped us speak “proper English” to various syndicates in Lloyd’s

- Building a campaign to find like-minded program managers to form an affinity group, which ultimately became the Target Markets Program Administrators Association (TMPAA) in 2001.

Our first success was in London where—as Employment Practices Liability Insurance (EPLI) specialists—we invented a concept called “Write Your Own (WYO) EPLI.” WYO helped our parent company E.W. Blanch bring a significant new General Liability (GL) and Business Owners Policy (BOP) enhancement by embedding a small limit of EPLI into an entire portfolio of commercial accounts. Mutual companies and regional carriers like Frankenmuth, West Bend, Florists’ Mutual (now Hortica), and American Resources were our first clients.

Earning “respect” with a profitable new idea and good results opened new doors for us and enabled our team to warrant new authorities for Insurance Agents Errors and Admissions (E&O) and Miscellaneous E&O.

Target Markets prospered beyond our most aggressive expectations. As organic growth program specialists we obviously “scratched an itch” in the marketplace. Program administrators, carriers with distinct program strategies, and vendor partners all prospered and became stronger together. Excellent timing.

While serendipity can accelerate a good idea, sometimes the opposite can occur. There is such a thing as being ahead of the curve, an excellent concept that is under-appreciated when it is first presented to the market.

Rockwood built a series of professional liability products to serve the law enforcement community. Our experience in the federal government space, resulting from our joint partnership with Ironshore, clearly illustrated the need for career protection insurance in the niche. Individuals working in the public sector are not immune to accusations of committing a wrongful employment act.

We were so sure that we were right that we built an entire agency—the Public Servants Defense Agency (PSDA)—and product suite (legal defense, indemnity, loss prevention hotline, personal gun liability, etc.) as an industry brand.

You will not read many stories in Rough Notes that highlight failures; yet, as program specialists constantly seeking to help underserved markets, mistakes are a necessary part of the learning process. We discovered that we were a bit ahead of our time with the launch of PSDA. It was a humbling experience to dedicate so much time, effort, and treasure on a business concept …only to see it not deliver the numbers that were expected.

We have embraced another entrepreneur’s philosophy on failure, as Thomas Edison said: “I have not failed 10,000 times. I have not failed once. I have succeeded in proving that those 10,000 ways will not work. When I have eliminated the ways that will not work, I will find the way that will work.”

Our team built another initiative in 2015 known as “The CHART Exchange.” We used many of the same strategies that made TMPAA such a phenomenon. Three years of trying to build a CHART community did not yield a profitable model for us. A relaunch of CHART 2.0 in January 2020 changed the collegial model into a more focused entity that helps U.S. program specialists access London in a more efficient manner.

CHART 2.0 relies on 20 years of experience in London, partnerships with expertise in brokerage, legal, marketing, systems, and even U.S. paper. There are proprietary questionnaires, incubation partners, fast-track processes, etc., that help us to cut through red tape.

In the age of COVID-19 we believe the timing is particularly right for the CHART 2.0 approach. We help to validate, package and expedite Lloyd’s submissions at a time when face-to-face interaction has become more infrequent and increasingly less cost effective.

We are taking what we learned in our PSDA launch in previous years and partnering with CHART 2.0 colleague Fortegra (U.S. paper with London support) to market a new product in the law enforcement space.

There are 17,985 police agencies in the United States, which include city/municipal police departments, county sheriff’s offices, state police/highway patrol, and federal law enforcement agencies. In 2018, there were 686,665 active law enforcement officers in the country.

A recent study suggests that hundreds of thousands of officers put in millions of hours every year moonlighting. “As many as 300,000 may be putting in more than 43 million hours working for private employers every year,” said Seth Stoughton, a University of South Carolina legal scholar, who wrote a white paper on off-duty police work. “From directing traffic at a busy church parking lot to making arrests at a packed nightclub …, uniformed off-duty personnel exercise the full panoply of police powers while working for private employers.”

Our team developed an entirely new product to address this unique liability exposure. The purpose of this new offering is to safeguard police officers from the potential personal financial risk they assume by taking on additional work to augment their income.

The insurance provides defense and indemnity protections against allegations of negligence, misrepresentation, violation of good faith, property damage, and false arrest/detainment. Coverage for claims of assault and battery is also provided. The plan is offered through the Patrol Protect brand.

Patrol Protect was made possible through the various connections available through CHART 2.0.

We are hoping to develop other new products to serve the law enforcement community. Our team invites inquiries from law enforcement groups, insurance agencies, and other potential sponsors or partners. It’s all about the timing.

The CHART Exchange can serve as a resource for helping specialist insurance agencies launch new programs or products within the U.S./London marketplace. CHART’s client-centric approach puts us in the position to advocate for the business submissions seeking placement through Lloyd’s. We have a number of tools at our disposal, including brokerage capabilities, and an extensive vendor network representing various disciplines.

For more information, view the CHARTwebsite (www.chart-exchange.com).

The author

Coverholders and Risk Takers is a periodic column written by principals or “Early Adopters” of the CHART Exchange. The group’s core mission is to facilitate more U.S./London commerce via personal interaction, education, and technology. Glenn W. Clark, CPCU, is owner and president of Rockwood Programs and the “Earliest Adopter” of the CHART Exchange. Email him at Glenn.Clark@rockwoodinsurance.com.