Cole Cooper, while riding his motorcycle, struck a trailer that had been left on the side of the road. Cole sued the trailer owner, Rick’s Blacktop & Paving Company, who turned the case over to Grinnell Mutual Reinsurance Company who provided both commercial general liability coverage and business auto coverage for Rick’s. Grinnell refused to provide coverage under either policy.

Rick’s challenged the decision and when he didn’t like the first ruling appealed it to a higher court.

Read below to see how the courts ruled.

Cole Cooper, a motorcyclist, was injured when he struck a trailer that was parked alongside a road. He sued the trailer’s owner, Rick’s Blacktop & Paving Company (Rick’s). Rick’s, at the time of loss, was insured by a Commercial General Liability Policy and a Business Automobile Policy, both issued by Grinnell Mutual Reinsurance Company (Grinnell). The court granted Grinnell’s summary judgment, ruling that neither the CGL nor the BAP provided coverage for Cooper’s loss and Cooper appealed.

The higher court focused on the arguments regarding the BAP as it concurred that the CGL’s auto exclusion applied, so no coverage existed under that policy. With regard to the BAP, Cooper re-asserted that the BAP did provide coverage. While the parties presented several arguments and counter-arguments, the court believed that the trailer that was parked on the roadside was at the heart of the matter. Cooper argued that coverage applied while Grinnell countered that, as the trailer was not listed on the BAP’s vehicle schedule, it was ineligible for coverage. Important, both parties agreed that, while the trailer was not attached to a vehicle at the time of loss, a Rick’s employee did use a company dump truck to park the trailer and that truck was scheduled on the BAP.

The higher court balanced the issue of whether the loss was the result of the use of a covered vehicle versus the requirement of a vehicle, in this case a trailer, had to appear on the BAP policy schedule. The court held that enforcing the requirement that the trailer be listed would act as an unreasonable exclusion since it was at the loss site due directly to the use of a covered vehicle,

The lower court decision was affirmed with regard to the exclusion under the CGL, but reversed with regard to the applicability of the BAP. The matter was remanded in light of the court’s decision.

Cole J. Cooper., Plaintiff-Appellee v.Rick’s Blacktop & Paving Co. and James Lee Cherry, Defendants, Grinnell Mutual Reinsurance Company, Defendant-Respondent. CtAppWisc. No. 2014AP966 Filed March 19, 2015. Affirmed in Part, Reversed in Part and Remanded. Westlaw 864 N.W 2d.

What is a covered auto?

The ISO commercial auto policy is unique in how coverage is scheduled. Symbols on the declaration are used to indicate if coverage is scheduled or blanketed. When only scheduled autos are covered, a symbol 7 is shown and only those vehicles listed on the schedule are covered. However, there are exceptions.

Read the PF&M analysis of the ISO Business Auto Policy Section I – Covered Autos. Pay particular attention to item C.

CA 00 01–BUSINESS AUTO COVERAGE FORM ANALYSIS

(October 2016)

SECTION I–COVERED AUTOS

Numerical symbols are used to describe which autos are covered and for what coverages. These symbols are defined in the Description of Covered Auto Designation Symbols.

The Business Auto Declarations contains spaces next to each of the business auto coverages in which symbols can be entered. The entry of a symbol means that the coverage applies. The entered symbol explains what types of vehicle have that coverage.

- Description of Covered Auto Designation Symbols

1–Any Auto

This is the broadest symbol designation and it has no limitations or restrictions. If the vehicle is an auto as defined by this coverage form, it is covered, subject to certain exclusions and conditions. Because of the broad scope of the coverage provided, many insurance companies use this symbol very cautiously. Even if a given company uses it for liability, it may not allow its use for physical damage. When Symbol 1 is used, no other symbol should appear in the same box.

Note: See Section V–Definitions for the definition of auto.

Example: Acme Limited files a claim after one of its salespeople’s car is involved in an intersection collision and other parties are injured. The claims handling is delayed because Acme’s policy shows Symbol 1, 8 and 9 next to that vehicle. Everyone is confused.

2–Owned Autos Only

This symbol means that any auto the named insured owns is covered, including those acquired after the inception date. In addition, when this symbol is used with covered autos liability coverage, any owned or non-owned trailer pulled by an owned vehicle is also covered but only for covered auto liability.

Related Court Case: Only “Owned” Autos of the Insured Covered Under Business Auto Policy

Note: See Section V–Definitions for the definition of trailer.

3–Owned Private Passenger Autos Only

This symbol means that all private passenger type autos that the named insured owns are covered. This includes any private passenger type vehicle acquired after the inception date.

Note: The term private passenger type is not defined. Pickup trucks and vans that might be considered private passenger on a personal lines policy would be considered commercial on this policy.

4–Owned Autos Other Than Private Passenger Autos Only

This symbol means that all autos that are not considered to be private passenger types are covered if they are owned by the named insured. Those that are acquired after the inception date are also covered. Similar to Symbol 2 above, the covered autos liability coverage provided is extended to non-owned trailers pulled by this type of owned vehicle.

5–Owned Autos Subject To No-Fault

An owned auto that is licensed or garaged in a state where no fault coverage is available is covered for no-fault coverages but only if the particular auto is required to have such coverage. Coverage also extends to such autos acquired after the inception date.

6–Owned Autos Subject To A Compulsory Uninsured Motorists Law

This symbol means that any auto the named insured owns that is garaged or licensed in a state that mandates uninsured motorists coverage is covered. It also applies to any auto acquired after the inception date.

This symbol does not apply to vehicles licensed or operated in states that allow the named insured to formally reject Uninsured Motorists coverage.

7–Specifically Described Autos

Only autos specifically scheduled and for which a premium charge is made are covered. Similar to Symbol 2 above, the covered autos liability coverage provided is extended to any non-owned trailer pulled by this type of owned vehicle.

8–Hired Autos Only

This symbol means that autos the named insured leases, hires, rents or borrows are covered. This symbol has a significant limitation. It does not include leased, hired, rented, or borrowed vehicles that are owned by an employee, partner, LLC member, or members of any of the preceding groups’ households.

Example: Perry drives a vehicle owned by his company, First-Up, Inc. and Symbol 8 applies to it. One snowy morning, Perry’s wife’s car is behind his in the driveway and, being late for work, he takes her vehicle. In his rush, he slides off the roadway. First-Up’s insurance company does not respond to this loss because Perry borrowed his wife’s car.

9–Non-Owned Autos Only

This symbol means that autos the named insured uses in its business but that it does not own, lease, hire, rent, or borrow are covered. These autos may be owned by employees, partners in the case of a partnership, members in the case of limited liability companies or members of the preceding group’s households. However, they are covered only while they are being used in either the named insured’s business or personal affairs.

Example: In the example above, First Up’s insurance company would have responded if Symbol 9 applied on the policy and Perry used his wife’s car to drive to his first appointment instead of just to work.

19–Mobile Equipment Subject To Compulsory or Financial Responsibility or Other Motor Vehicle Insurance Law Only

This symbol means that land vehicles that meet the definition of mobile equipment except that they are subject to state-mandated registration and/or licensing are covered. This symbol is needed because of recent state laws that are mandating that certain types of mobile equipment be registered and/or licensed. The symbol applies only in those states where the mobile equipment must comply with motor vehicle laws.

Example: Best Kept Secrets, Inc. provides security services to an exclusive gated beachfront property. It uses an ATV to patrol the beachfront areas and to keep unauthorized boats from landing. Because ATVs must be registered in the state, using Symbol 19 on its auto policy provides coverage on the ATV.

Note: In some cases, more than one symbol may be used.

Example: Mega Lumber Supply insures its vehicles using the Business Auto Coverage Form. Mega wants to have liability insurance for all of its private passenger vehicles, as well as for any hired or non-owned vehicles. For this reason, Symbols 3, 8 and 9 appear in the space next to covered autos liability coverage on Mega’s declarations.

Manuscript Symbol

An additional manuscript symbol not mentioned in the Business Auto Coverage Form is available by adding endorsement CA 99 54–Covered Auto Designation Symbol. Symbol 10 is available for the Business Auto Coverage Form and applies based on what is listed and described on the endorsement.

Example: The insured wants covered autos liability coverage for all owned vehicles and physical damage coverage on all owned vehicles except one. It also owns a high-value antique automobile. Physical damage coverage on the antique automobile is written on a separate policy in a specialty market. Symbol 2 designates the covered autos for covered autos liability coverage. Symbol 10 designates the covered autos for comprehensive and collision coverages. The definition for symbol 10 is: All Owned Autos except the 1959 Classic Rolls Royce.

Note: There is no reference to symbol 72 in this item. This means that newly acquired autos are not covered unless mentioned in CA 99 54 when the symbol is added.

Insurers and brokers that are looking for a market to provide coverage on difficult business auto or trucking situations, such as racing activities, should refer to the Automobiles, Trucks, or Recreational Vehicles section in The Insurance Marketplace, a publication of The Rough Notes Company, Inc.

- Owned Autos You Acquire After the Policy Begins

- If Symbols 1–Any Auto, 2–Owned Autos Only, 3–Owned Private Passenger Autos Only, 4–Owned Autos Other Than Private Passenger Autos Only, 5–Owned Autos Subject to No-Fault, 6–Owned Autos Subject to a Compulsory Uninsured Motorists Law or 19–Mobile Equipment Subject to Compulsory or Financial Responsibility or Other Motor Vehicle Insurance Law Only are entered on the declarations, autos of the type described by such symbols that the named insured acquires during the policy period are also covered.

Example: If Symbol 3–Owned Private Passenger Autos Only is used, coverage automatically applies to a new private passenger vehicle the named insured acquires to use to make sales calls during the policy period. However, there is no automatic coverage if symbol 4–Owned Autos Other Than Private Passenger Autos Only is used and the insured purchases the same private passenger vehicle for sales purposes. The insured must specifically request that coverage for this vehicle be added and change the symbol.

When symbol 7–Specifically Described Autos is used, new autos acquired during the policy period are covered either if the insurance company covers all vehicles the named insured already owns or if the new vehicle replaces a vehicle already scheduled. In either case, the named insured must inform the insurance company of the acquisition within 30 days of the date it was acquired.

- Certain Trailers, Mobile Equipment and Temporary Substitute Autos

When covered autos liability coverage is selected based upon entries on the declarations, several additional categories of vehicles are added as covered vehicles.

- Utility trailers having a load capacity of 2,000 pounds or less and designed for travel on public roads are covered but only while being pulled by a covered auto.

Example: A marketing rep for Gr8teHealth Supplements Inc. is traveling to a convention, towing a small trailer that is used to store and transport the company’s convention booth. Symbols 3, 8 and 9 are entered for liability. The rep switches lanes too aggressively and the trailer slams into the front of a car that the rep attempted to pass.

Scenario 1: The marketing rep is using her personal pickup truck to pull the trailer because her company vehicle is too small. The loss is covered by Gr8teHealth’s BAP because the towing vehicle in a nonowned vehicle (9) which is a covered auto.

Scenario 2: The marketing rep is using her personal pickup truck to pull the trailer in order to use the company’s convention booth to assist her son on his science fair project. The loss is not covered by Gr8teHealth’s BAP. Because the towing vehicle was not being used on company business at the time of the loss, it would not qualify as covered under symbol 9.

Note: A semi-trailer is not covered.

- Mobile Equipment is covered while being carried or pulled by a covered auto.

Example: A bulldozer Real Landscaping owns is transported on a flatbed towed by a pickup Real Landscaping owns. The driver turns suddenly and the bulldozer overturns onto another vehicle. Real Landscaping’s Business Auto Coverage Form responds to the damage caused by the bulldozer.

- If the named insured’s covered, owned auto is temporarily out of service for repair or service or due to breakdown, loss or destruction, a non-owned, temporary substitute for it is covered but only if the named insured uses it with the owner’s permission.

Example: Refer to the Symbol 8 example above. Instead of Perry using his wife’s car out of convenience, he uses it because his car would not start and he needed to get to work. In that case, First-Up’s Business Auto Coverage Form responds to the accident because the vehicle was used as a temporary substitute vehicle.

A paving contractor

A paving contractor

Rick’s was a paving contractor. The exposure of a paving contractor is very unique and can be difficult to place due to the need to transport hot asphalt from a portable asphalt plant. There are also numerous concerns because of workers exposure to public drivers and the public being exposed to the activities of the contractor. While this is not an easy risk to write, the premiums available can make it worth the effort. First, it is important to understand the exposure and to ask the right questions

See below to review the Paving Contractors Narrative in the Producers Commercial Lines Risk Evaluation System.

Category: Contractors – Construction

SIC CODE: 1611 Highway and Street Construction, except Elevated Highways

1771 Concrete Work

NAICS CODE: 237310 Highway, Street, and Bridge Construction

238110 Poured Concrete Foundation and Structure Contractors

Suggested ISO General Liability Code: 91125, 99321, 92215

Suggested Workers Compensation Codes: 5221, 5506

Description of operations: Paving contractors clear and level job sites and pave streets, roads or highways, driveways, parking lots, tennis or other athletic courts. Paving is the process of laying down the uppermost surface (“wearing surface”) which must withstand the wear-and-tear from tire friction and from the elements. A cold or hot mixture may be used for paving. Cold mixtures can be used at lower temperatures but are not as strong or durable; these are often used for temporary repairs and patching. Hot mix is a durable combination of asphalt and concrete.

Larger operations will have their own portable hot mix plants (“batch plants”) that are transported to jobsites. Smaller operations will purchase the hot mix and have it delivered to their jobsite.

Property exposures at the paving contractor’s own location are usually limited to an office and storage of material, equipment, and vehicles.

The hazards to fire and wind depend on the processes being conducted in the building. Large drum mix plants or batch plants involve heat and flammable bitumen or tar, and thus pose a serious fire hazard. If repair work on vehicles and equipment is done in the building, fire hazards may be high. If equipment and supplies are stored in the yard, they may be damaged due to wind, vandalism, and theft.

Inland marine exposure is from accounts receivable, construction equipment, especially the hot mix plants, construction materials in transit, installation floater, and valuable papers and records. Construction equipment is heavy and difficult to transport. The training of drivers and haulers, especially with respect to the loading, tie-down, and unloading, is important to avoid damage to bulky equipment due to overturn or collision.

At the job site, tools and equipment may be damaged due to dropping and falls from heights, or being struck by other vehicles. Materials and equipment left at job sites may be stolen or vandalized unless proper controls are in place.

The accounts receivable exposure could be significant if payments are made via installments throughout the course of the project. Valuable papers and records usually consist of custom project plans. Copies should be kept at an offsite location for easier restoration.

Premises liability exposure is low at the contractor’s premises since visitor access is limited, but equipment stored in the open may present an attractive nuisance to children. If a hot tar process is used at the contractor’s premises, it poses a fire hazard. High winds may carry smoke and heat to adjacent properties, posing a risk to neighbors. Contact with the tar or bitumen is a minor injury and property damage hazard. At job sites, the operation of heavy machinery and asphalt plants presents numerous hazards to the public and to employees of other contractors. While a new parking lot may be paved with little exposure to the public, most paving contractors must contend with vehicular, bicycle, and foot traffic. The smoke, dust and noise generated by paving operations are often nuisance hazards. The uneven ground, hot tar, and heavy machinery may result in serious injuries to passersby and motorists, as well as property damage to adjacent vehicles, buildings and residences. Serious traffic accidents may occur in the absence of an appropriate barricading system and clear marking of streets and roads that are closed. The party responsible for warning signs, barricades and other precautions for drivers must be spelled out in any contract.

Completed operations hazards vary with the type of operations. Private driveways are generally low hazard work, while trip and fall hazards in a retail parking project may result in a serious bodily injury loss. Most hazardous of all are airport tarmac and runway projects due to the catastrophic potential of an accident involving a plane full of passengers. Quality control and full compliance with all construction, material, and design specifications is necessary, as is documentation of customer specifications, work orders, change orders, and inspection and written acceptance by the customer.

Environmental impairment liability exposures may arise from the waste generated in the fueling and cleaning of heavy equipment but especially from the asphalt plant.

Automobile exposures become more heightened with the transport of hot tar. The bodily injury and property damage severity increases considerably so only very experienced drivers should be involved in the transport. Equipment unloading and setup may take place on uneven ground, or in undeveloped areas, posing an upset or overturn hazard. Age, training, experience, and drivers’ records, as well as the age, condition, and maintenance of the vehicles, are all important items to consider.

Workers compensation exposures can be very high especially around the asphalt plants and while working with the hot mix. This type of operation has exposure to burns, chemical applications, smoke and fumes, back injury, hernia, sprain and strain and other lifting injuries. Cumulative exposure to the high-decibel operations may result in permanent hearing impairment. The use, misuse, maintenance, and transport of large, heavy machinery present unique hazards that need review. An additional exposure exists if the construction site is on or near existing roadways as workers may be struck by vehicles on the existing road or street, even when warnings and barricades are in place.

Minimum recommended coverage:

Business Personal Property, Employee Dishonesty, Contractors’ Equipment, General Liability, Employee Benefits Liability, Umbrella Liability, Automobile Liability and Physical Damage, Hired and Nonownership Auto Liability, Workers Compensation

Other coverages to consider:

Building, Business Income with Extra Expense, Accounts Receivable, Computers, Goods in Transit, Valuable Papers and Records, Employment Related Practices Liability, Environmental Impairment Liability, Stop Gap Liability

Explaining the auto symbols

Explaining the auto symbols

The basis of all coverage on a business auto policy is the declarations and the symbols being used. Providing a digestible snippet of information to your clients may help them understand their coverage more and may generate some positive discussions regarding the coverage they have or thought they had but don’t.

Below are two e-marketing articles that you could include in a newsletter, put in a blog or add to your webpage that provide a simple explanation of the auto symbols.

Commercial Auto Symbols – Part 1

Have you ever, during a particularly wild moment, closely examined the insurance policy that covers your business vehicles? If so, you may have noticed the little numbers that appear next to each listed coverage. Hopefully you’re familiar with these numbers and their meaning. If not, please see below.

Covered Auto Designation Symbols

Those little numbers are called covered auto designation symbols and they represent the type of vehicle that is protected by the applicable liability or physical damage insurance limit. As you review the symbol definitions, it is important to remember several points. One is that the symbol may apply to either a particular kind of vehicle OR the vehicle’s ownership status. The second point is that “auto” is a defined term, so you must be familiar with your particular policy’s definitions (they can vary among different insurance companies). A third point is that the symbols differ depending on whether the coverage is for liability or physical damage.

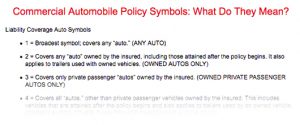

Liability Coverage Auto Symbols

1 = Any “Auto”

This is the broadest symbol designation and covers any “auto.”

2 = Owned “Autos” Only

This symbol covers any “auto” owned by an insured, including any “auto” that is acquired after the policy begins. The symbol also applies to any “trailer” while it is towed by an owned vehicle.

3 = Owned Private Passenger “Autos” Only

This symbol covers only private passenger type “autos” owned by the insured, including any private passenger type that may be acquired after the policy begins.

4 = Owned “Autos” Other Than Private Passenger “Autos” Only

This symbol covers all “autos” other than private passenger type “autos” (vans, trucks, motorized equipment) owned by an insured, including such vehicles that may be acquired after the policy begins. The symbol also applies to any “trailer” while it is towed by an owned vehicle.

5 = Owned “Autos” Subject To No-Fault

Any “auto” owned by an insured that is garaged or licensed in a state where no-fault benefit laws exist. This symbol also applies to any “auto” acquired after the policy begins.

6 = Owned “Autos” Subject To A Compulsory Uninsured Motorist Law

Any “auto” owned by an insured that is garaged or licensed in a state where drivers are required to carry uninsured motorist coverage. This symbol also applies to any “auto” acquired after the policy begins.

7 = Specifically Described “Autos”

Only those “autos” that are specifically listed on the policy are covered. The symbol also applies to any “trailer” while it is towed by a listed vehicle.

8 = Hired “Autos” Only.

This symbol covers only those “autos” that an insured leases, hires, rents, or borrows. HOWEVER, it does NOT include “autos” leased, hired, rented, or borrowed from an employee, partner, or member of an insured’s household.

9 = Nonowned “Autos” Only

This symbol covers only those “autos” an insured does not own, lease, hire, rent, or borrow that are used in the insured’s business, including “autos” owned by employees, partners, or members of an insured’s household, but only while those non-owned “autos” are used either in the insured’s business or personal affairs.

19 = Mobile Equipment Subject To Compulsory Or Financial Responsibility Or Other Motor Vehicle Insurance Law Only

This symbol only applies to land vehicles that are considered mobile equipment under the policy’s mobile equipment definition. It allows extension of coverage for vehicles in states that confer vehicle status by making certain types of self-powered equipment subject to registration/licensing law.

See part 2 for discussion of physical damage and manuscript auto symbols

Commercial Auto Symbols – Part 2

See part 1 for opening discussion on purpose and on Liability Auto Symbols.

Physical Damage Coverage Auto Symbols

1 = Owned “Autos” Only

This symbol covers any “auto” owned by an insured, including any “auto” that is acquired after the policy begins.

2 = Owned Private Passenger “Autos” Only

This symbol covers only private passenger type “autos” owned by the insured, including any private passenger type that may be acquired after the policy begins.

3 = Owned “Autos” Other Than Private Passenger “Autos” Only

This symbol covers all “autos” other than private passenger type “autos” owned by the insured, including any “autos” other than any private passenger type that may be acquired after the policy begins.

4 = Specifically Described “Autos”

Only those “autos” that are specifically listed on the policy are covered. The symbol also applies to any “trailer” while it is towed by a listed vehicle.

5 = Hired “Autos” Only

This symbol covers only those “autos” that an insured leases, hires, rents, or borrows, unless the “auto” is leased, hired, rented, or borrowed from an employee, partner, or member of the insured’s household.

Manuscript Symbols

In some instances, a particular insurance company may agree to provide coverage for a vehicle or ownership situation that is not described in the above symbols. When this occurs, a special symbol, such as 10 for liability or 7 for physical damage coverage, is used and added to the policy by an endorsement. The endorsement must contain a complete explanation/description of what the symbol means. Then, that number must appear next to the applicable coverage(s).

If you have a question about any of these symbols or how coverage applies under your policy, the answers lie with the nearest insurance professional. Call them; they’re eager to help you understand your protection.