RISK MANAGERS’ FORUM

Working together to enhance solutions, boost satisfaction, and increase retention

When we purchase gasoline, how many of us ask about “particulars,” such as the presence of MTBE? Do we ask about the sulfur content of home heating oil before we arrange for a delivery? What about the fat content of that fast-food double cheeseburger? Do you consider that before you place an order?

More important, you may ask, does any of this have anything to do with insurance? It does. We buy items such as gasoline and heating oil because we need them (more on the cheeseburger in a minute), and buyers of insurance are in much the same position. Too often, the purchase is like buying a gallon of gasoline—just shop around for the best price. In many cases, this reduces the act of purchasing insurance into a transaction that ignores particulars that may not be deemed to be important until there is a claim.

Much like the impulse purchase of a double cheeseburger, the danger of this kind of insurance transaction is not immediately apparent.

From a buyer’s perspective, this blind-side rationale is based on the perception that insurance is an expense. On the agency side, the problem is that, while staff may know the particulars, it is often difficult to engage clients in a meaningful discussion regarding the complexities that make the agency’s services valuable to buyers in the first place.

Working together

A third perspective is created where agents and client risk managers intersect. By working synergistically, the agent/risk manager team can offer an analysis that draws on a larger knowledge base of the particulars that are important in a specific client situation. The result is better solutions, which ultimately leads to enhanced client satisfaction and retention.

To understand this point, it is important to note that risk management is based on a systematic five-step process of identifying exposures to loss, analyzing the exposures, selecting the best process to manage/minimize those financial impacts, implementing the best practice(s), and continually monitoring and fine tuning.

Historically, insurance has been a cost-effective way of obtaining an acceptable amount of risk transfer, and it comes with enough ancillary services (loss prevention, claims handling, claims payment, etc.) to suit the needs of many risk managers. With these facts in mind, let’s examine some specific examples related to the intersection of agents and risk managers.

Workers comp

To illustrate the problem/solution scenario, consider a basic workers compensation program with a minimum deductible. Many business owners are sensitive about this expense, and agents don’t like the low commission percentage. On smaller accounts, there are incentives to just process the business as usual, but even for these accounts, there are benefits to approaching the problem from a risk management perspective.

By offering an illustration comparing a workers compensation program without a deductible to one with a deductible, a good insurance/risk management team can illustrate that, over time, the client could be better served by one or the other. More important, it provides an opportunity to illustrate that, by managing its exposure to loss over time, the client will be paying less and getting more protection for their premium dollar.

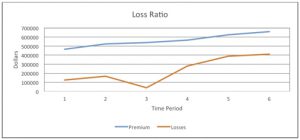

This comparison can be best illustrated by using a graph. By adding incurred losses and the degree of accuracy (standard deviation) regarding the prediction of future losses, the risk manager and agent will have a highly effective tool suitable for guiding short-term decision making and long-term predictive modeling.

Although this may not be the most effective way to maximize commission earned, it will give agents a better opportunity to demonstrate their understanding of the language and thought process that risk managers regularly use internally. Many agents, especially those who are well versed in workers comp, offer these comparisons as matter of course. Other agents would be wise to do likewise.

Flood solution

No matter how basic or complex the insurance or financial product, a good cost/benefit illustration will go a long way toward helping the client justify their decision.

For example, the National Flood Insurance Program (NFIP) has been around since 1968. We all know about the applications, certified checks, elevation surveys, and so on that are part of this program. How many of us understand the importance of flood coverage for employers using their property as collateral for a line of credit? Lenders have targeted this exposure as one of many compliance-related items, and it can jeopardize the approval or amount of a company’s line of credit.

One approach to the problem might be to provide a deductible buy-down with a multi-year finite risk program, which would enable the employer to meet the requirements of its credit facility, while accelerating the expense item. Finite risk insurance is a contract that shifts the risk of loss from an insured to an insurer during a stated number of years. Typically the insurance component is a minimum of 10% of the expected loss; it is excess over the loss projection and results in the payment of a fee (plus the expected loss amount) to the insurer, along with premium payment for the insurance component.

This is a perfect example of the value that can be added by combining solid insurance knowledge and products with elements that are specific to effective risk management techniques.

Property risks

Another example is the use of a stock throughput policy in place of standard contents or personal property coverage when insuring contents or inventory. A stock throughput policy is a marine form that provides first-party coverage for material in transit and in storage, inclusive of the increasing value of work in process.

A constructive conversation on this topic will include a loss history and a premium comparison between the two policies, and an assurance that the insured will qualify for a stock throughput policy. This allows the agent to communicate clearly the pros and cons of each policy.

A picture is worth a thousand words, and a simple graph can illustrate the financial impact from previous years and extrapolate for the upcoming year based on experience. The past is one of the best indicators for predicting the future. Using historic loss data is an easy and effective way to distinguish an agency that offers a solution from one that merely sells a policy.

The graph offers several discussion points. Premium increases appear to be in line with the increasing losses. Is this trend indicative of market conditions? How are these figures affected by changes in exposure? Consider including a third data set for exposure. Such a graph can pinpoint the need for an additional level of analysis, lead to the sale of additional coverage, and add value to the risk transfer process.

Engineering services

The use of engineering services can influence loss outcomes, and agents should include these possible effects in their recommendations. The least expensive claim is the one that never happens. Every risk manager knows the economies that can be gained when applying safety engineering resources to a known or historic exposure. An effective agent will review loss information, determine the cause of loss, identify similarities or common root causes, and make a strategic recommendation about the use of safety engineering allocations.

The common theme present at the intersection of agents/brokers and risk managers is, or should be, the recognition of the importance of managing risk exposures. Working together, the agent/broker and risk manager team can provide solutions that will ultimately facilitate commerce that delivers greater value to the buyer, and isn’t that what is really most important?

The author

David Hershey is corporate risk manager for Sprague Operating Resources, LLC, and Lexa International, collectively a $5 billion-plus (USA) and $15 billion-plus European global

organization. His experience includes serving as risk manager for Sotheby Holdings, NYC, and Day & Zimmermann. He is a faculty member in The National Alliance’s Certified Risk Manager (CRM) program.