Employers and employees have a mutual interest in a smooth transition

Those who are debating whether or when to retire from their life-long work are sometimes offered this philosophical advice: “It is better to retire ‘to’ something than ‘from’ something.” Baby Boomers seem to be heeding that advice, and what a significant number of retiring Baby Boomers are retiring “to” is other paying work, according to research by Strategic Business Insights (SBI).

“It’s definitely not your father’s retirement,” says Larry Cohen, vice president and director of the consumer financial decisions practice services for SBI, an employee-owned spin-off of SRI International.

Cohen has been researching Baby Boomers’ relationship to their work for decades. He believes this trend of “retirees” continuing to work after leaving their traditional workplace will have implications not only for the 71 million retiring Boomers themselves, but also for benefit planners who will witness this huge exodus of long-time employees over the next several years.

He shared his observations in a recent Webinar sponsored by the Retirement Income Industry Association and in a follow-up interview.

Cohen coined the term “revolving retirement” to describe the work an employee does after leaving his or her traditional career-long workplace and before retiring from all work. It can include people in three categories: those who are, he says, “retired, but plan to return to work; partially retired—having gone from full-time to part-time; or retired, but now working.”

Some become revolving retirees for financial reasons, others for different sources of fulfillment, he notes. SBI figures from 2016 indicate that the revolving retired were about evenly divided between those doing the same kind of work they did for their career jobs and those doing different work.

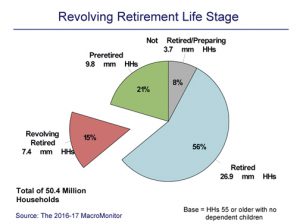

To measure the scope of the revolving-retired population, Strategic Business Insights analyzed 2016 figures from more than 50 million households of people aged 55 and above with no dependent children at home, asking about their work status. (See chart 1.) The majority (56%) fit the description of traditional retirees; 21% were still working and preparing for retirement; 15% fit the category of “revolving retired.”

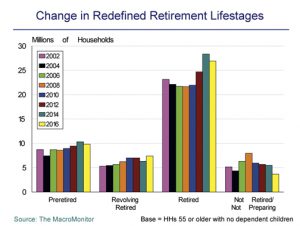

Chart #2 demonstrates the growth of the revolving-retired population. Between 2014 and 2016 the number of “revolving retired” increased by about the same number as the number of “retired” declined.

The large number of pre-retirees still in the regular workforce could add dramatically to the number of revolving retired in the years ahead.

Citing further research from SBI, Cohen notes the financial challenges that Baby Boomer retirees face. They have higher debt than previous generations did at this stage of life. A large and growing number will have the responsibility of caring for their own parents. And, most important, the Boomers, on average, are expected to live longer than prior generations.

Cohen says this added longevity “has turned the traditional definition of retirement into a 20th century anachronism.” In the prior century, he says, “you worried about living long enough to afford to retire. Today you worry about retiring with enough to afford to live long.”

While Baby Boomers are still in their career jobs, they might look at the financial challenges ahead of them and wonder if staying in their careers a while longer might be a good idea. Their employers, however, might not buy into this idea. In fact, says Cohen, some employers have moved toward encouraging a younger workforce at the expense of older workers.

While Baby Boomers are still in their career jobs, they might look at the financial challenges ahead of them and wonder if staying in their careers a while longer might be a good idea. Their employers, however, might not buy into this idea. In fact, says Cohen, some employers have moved toward encouraging a younger workforce at the expense of older workers.

“It used to be that a person’s peak earnings were in their late 50s and early 60s, just before they retired,” he says. Over time, “The peak earning years have shifted to the late 40s and early 50s, as companies have replaced older employees with younger ones, thereby reducing costs. While there may have been fiscal benefits, employers have lost the expertise of some older employees.”

One solution, Cohen suggests, that can benefit both the employer and its older employees is for retiring Baby Boomers to re-enter their prior workplace on a part-time or project-type basis. “We are seeing some employers starting to create independent consultants out of their ‘retirees.’ They have been able to recall them to take advantage of their expertise, using them to mentor and help younger employees. It’s like having a variable workforce available that they can call on when the need arises.

“The next step is that we’ve seen a group of companies sharing the resource of retired employees. It benefits everyone to be able to pull the best people available for a particular need. Ultimately, you can imagine some sort of a clearinghouse, where revolving retired employees could be available on their own schedule to take on additional project work.

“It works better for people who have a particular skill set—for example, in science, research, or consulting. It doesn’t work for manufacturing, assembly line-type positions.”

Whether former employees seek out gigs—either volunteer or paid—that utilize their previous job skills, or work that is completely different, Cohen says workers who leave their traditional careers should seek out an agenda that fits what they enjoy doing. (“Do what you’ve always wanted to do when you grow up.”) If that activity enables the revolving retired person to earn income, so much the better. “It helps them delay using retirement assets for everyday expenses for as long as possible.

“We are seeing some employers starting to create independent consultants out of their ‘retirees.’”

—Larry Cohen

Director, Consumer Financial Decisions Practice

Strategic Business Insights

“Once someone has made a second career decision, the financial counselor should do everything in their power to craft a method by which the person can accomplish it,” Cohen urges. “The counselor has to take care not to let his or her personal objective of maximizing income get in the way of helping customers. It’s a fiduciary responsibility that needs to be taken seriously.”

He reminds financial providers that Baby Boomers still represent the demographic that controls the largest share of assets, whether they are pre-retirees, revolving retirees, or retirees. Yet to manage those assets, Boomers will need help with more than just financial investments.

He reminds financial providers that Baby Boomers still represent the demographic that controls the largest share of assets, whether they are pre-retirees, revolving retirees, or retirees. Yet to manage those assets, Boomers will need help with more than just financial investments.

“They may need help with Social Security, Medicare, retrofitting their home, home maintenance, estate appraisals, in-home care, assisted living, hospice, funeral arrangements and many other potential needs. They value their time more than anything else. The counselor who can provide information to simplify some of these decisions will be rewarded.

“The retirement industry should try to integrate financial products, services, advice, and ancillary services into simple solutions to create greater efficiencies for the client.”

This is the first year that those who are categorized as Boomers will start taking required minimum distributions (RMDs) from their tax-advantaged retirement plans. Most of those taking RMDs will have already left their career jobs. The largest number of Boomers are still in the regular workforce, so employee benefits planners have an opportunity to help prepare them for what’s ahead.

When employees can look forward to retiring to something that is productive and fulfilling, it’s a “win” for the employer, too.

The author

Thomas A. McCoy, CLU, retired in 2013 as editor-in-chief of Rough Notes magazine.