ARTful Measures

Get up to speed on one of the most promising growth opportunities for brokers and agents

For many people in the financial sector, the debate is over. Analytics has become the differentiating factor that determines if a firm will thrive or fade in the years ahead. To drive home the message, Tim Coomer, Ph.D., CEO of SIGMA Actuarial Consulting Group, Inc., points to a bold statement Harvard Business Review published in in 2013: “Companies that want to prosper in the new data economy must once again fundamentally rethink how the analysis of data can create value for themselves and their customers.”

[I]t is imperative that brokerage firms that want to thrive in the years ahead focus on the internal skills and external relationships that will dramatically increase their analytical ability.

Today, CFOs are leading the charge by declaring that their departments should be among the early adopters of the analytic revolution among C-suite contenders. As a result, CFOs are pushing internal and external resources to deliver analytically-based, data-driven decisions.

Insurance agents and brokers need to be aware of this fact and plan accordingly.

Because of the CFOs’ demands, the analytical prowess of an organization will continue to be crucial. While the increased visibility will be top of mind for most corporations, the situation offers an unparalleled opportunity for mid-sized agents and brokers. Based on a recent survey of brokerage firms, it appears that insurance buyers have determined that successful agents/brokers must be appropriately analytical. Coomer points out that based on the survey “analytically successful insurance brokerage firms have the following characteristics”:

Information Management Skills. This is the ability to accumulate, manipulate, and use data. It includes a comprehensive understanding of existing computer systems utilized by the agency and its clients, as well as the ability to import and manipulate data from a variety of sources, including loss runs, accounting systems, and claims management databases.

Analytics-Based, Data-Driven Skills. This is characterized as the ability to process data by using appropriate analytical techniques in order to improve decision making. Analytically-based, data-driven skills are divided into three levels. The first level of skill is the ability to effectively utilize spreadsheet and database programs in-house.

The second level, Coomer says, “quickly differentiates the organization and includes a basic understanding of third-party software tools for statistical analyses, loss projections, and reserve analyses.”

Last, the third level of skill is building relationships with outside resources that, in effect, become part of the resources offered by the brokerage firms. In practice “this is typically a relationship with an independent actuarial consulting firm.”

Data-Oriented Culture. This creates a universal posture throughout the organization on how to approach decision making. The first-level skill is to cultivate leaders that ask the right questions and set the expectations for how decision making will occur.

The second is created to support data-driven marketing plans. As busnesses begin to utilize data-driven marketing, they will become more concerned about actionable insights, which are available from the first-level skills to the second and also to the third.“

The third level is to create a pervasive culture where analytics drive the organization in all aspects including sales, customer service, decision making, client services, stewardship reports, and more,” Coomer notes.

The Applied Marketing Analytics journal surveyed hundreds of organizations and recently reported that the combination of skills outlined above generates “supra-normal profit,” or profits that far exceed expectations. Coomer notes that “this type of finding becomes an almost everyday occurrence when the competitive advantage of analytics is studied from different angles. The documented success of analytics will continue to reinforce the rapid changes that insurance agents and brokers face.”

In time, the extinction of the non-analytical agent/broker will become obvious. Thus, it’s important that agents and brokers recognize the competitive advantages that analytics can provide to their clients. Agents and brokers need to become trusted resources with regard to assisting their clients in taking maximum advantage of analytics.

Several case studies illustrate how analytics significantly improved decision making and lowered costs. The details are factual; however, these cases are based on real-life examples with names omitted and some data modified for confidentiality purposes.

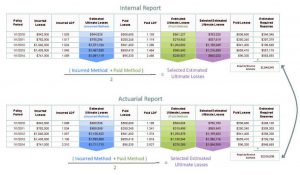

In our first case, the broker is advising a client during an acquisition. During a merger or acquisition is one situation that calls for the use of analytics. There’s a concern that balance sheet entries for property and casualty liabilities may be understated. As shown below, an internal report is being used for the purposes of liability calculations. Due to underestimation in the later years of the company’s experience (also known as the tail loss development factor), Coomer says, “The report used loss development factors that did not accurately reflect actual loss experience.”

Over the course of negotiations, the broker engaged an actuary to complete an actuarial analysis. In doing so, loss development factors were adjusted to truly reflect the organization’s experience, which ultimately resulted in a higher estimate of liabilities. “Naturally, this had a significant impact on negotiations,” as the funding amounts in question could now be considered in a more accurate light.

Graph 1: The independent external evaluation of liabilities resulted in a significantly higher estimate which the acquiring company was better able to account for during negotiations.

The difference in the two estimates is $651,793—a significant amount that needed to be accounted for during the negotiations, Coomer points out. The broker was thus able to provide a value-added service that heretofore was ignored in previous acquisitions.

More and more brokers are consistently using an actuarial resource to enhance negotiations during acquisitions and divestitures. Agents and brokers are expanding their base of available analytic-related services. In this way, Coomer states, they are differentiating themselves by utilizing a comprehensive set of analytical resources and techniques to help their clients and prospects appropriately quantify liabilities during negotiations. Mid-sized agents and brokers are increasingly finding that CFOs with whom they work “expect to receive the analytical support they require for these high-level strategic decisions.”

The second case study involves a broker that is attempting to supplement knowledge about its client’s improved safety programs and claims management with actual quantitative information. “Since the ultimate loss estimates shown on the client’s actuarial report were trending upward, they needed to be able to see how this trend looked from a broader perspective.”

In order to do so, Coomer points out, they turned to the use of pure loss rates. “A pure loss rate better represents loss trends by comparing fully trended and developed losses to trended exposures.” The result allows a valid comparison between policy periods, despite the ever-changing level of exposure and changes in operations.

“While ultimate loss estimates can serve as capable trend indicators, they are void of any context in relation to the company’s performance as a whole. Thus, pure loss rates are meant to provide this context by comparing a company’s loss experience to their ‘exposure to risk.’” By examining their client’s pure loss rates, the broker or agent can more easily frame improvement through a contextual lens and strengthen their client’s stance that their initiatives were having the intended effect.

While the pure loss rate can provide significant insight, it is often just the initial indicator of the analytics needing to occur at a deeper level. Certainly, a negative trend may be observed and perhaps identify where additional analyses involving injury analysis, geographical analysis, or class code analysis may be appropriate.

To survive in an analytics-oriented environment, corporations must first improve their analytical prowess—realizing “an effective integration of information management and analytical skills into organizational culture.” Once this is accomplished, according to Coomer, brokers will be equipped with the abilities and processes to approach larger clients with a powerful value proposition to deliver better decisions using data and analytics.

CFOs not only expect this, “they now require it,” Coomer explains. The role of the corporate CFO has expanded to be what Strategic Finance magazine calls a “strategic advisor,” which, among other things, requires an increase in the effective use of analytics.

If you want to grab the attention of the next large account prospect, Coomer says simply tell the CFO, “I would like to meet with you to discuss our analytically-based, data-driven process for improving loss financing and risk management decisions. Ultimately, the implementation of this process results in a lower total cost of risk.”

In conclusion, most insurance professionals realize that the tipping point for analytics has passed. As a result, it is imperative that brokerage firms that want to thrive in the years ahead focus on the internal skills and external relationships that will dramatically increase their analytical ability. Without a plan to deliver analytics, the average account size for middle market agents/brokers will continue to decline.

The good news, according to Coomer, is that through a concerted effort, mid-sized agents and brokers can improve their information management skills, analytically-based and data-driven skills, and data-oriented culture.

Analytics is one of the most promising growth opportunities for the brokerage community.

The author

Michael J. Moody, MBA, ARM, is the retired managing director of Strategic Risk Financing, Inc. (SuRF), a firm that was established to provide consulting services to captive and other alternative risk transfer mechanisms. As a regular columnist, he continues to actively promote the benefits of the ART market by providing current, objective information about the market, the structures being used, and the players involved.