Coverholders and Risk Takers

By Francis J. “Frank” Huver

FOLLOWING THE BLUEPRINT

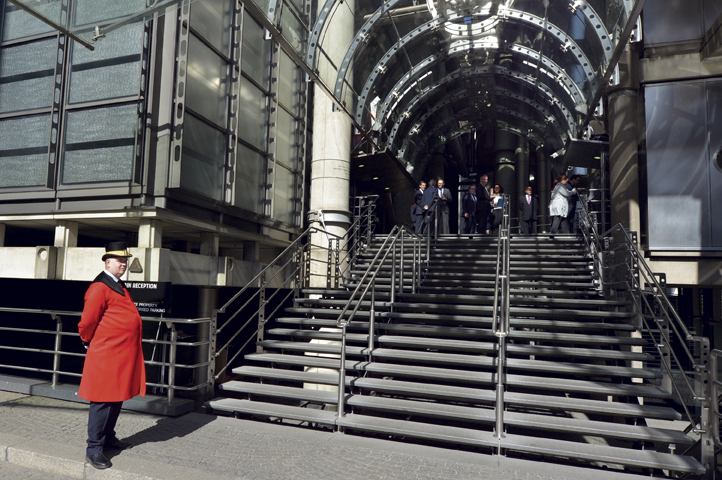

Lloyd’s of London initiative aims to build most advanced marketplace in the world

Lloyd’s of London is the world’s oldest and most recognized insurance brand. The market began sometime around 1686 at Lloyd’s coffee house—a place popular with sailors, merchants, and ship owners. The location soon became recognized as a center for securing marine insurance.

In the intervening 335 years, the market has developed a reputation as being an innovative pioneer within our industry. Many of the “commodity” products widely available today—directors and officers, cyber liability, and more—can trace their lineage to this venerable institution.

The insurance market is constantly evolving … . Those who do not recognize the dynamic nature of our business are in danger of being left behind.

Unfortunately, past accomplishments are no guarantee of future success. The insurance market is constantly evolving in response to emerging risk exposures, operating efficiencies, and technological advances. Those who do not recognize the dynamic nature of our business are in danger of being left behind. One of our most famous founding fathers, Benjamin Franklin, articulated it most succinctly: “By failing to prepare, you are preparing to fail.”

Franklin’s advice did not fall on deaf ears. Two years ago, the “Future at Lloyd’s” project was announced. The initiative’s stated aim was simple: “to build the most advanced insurance marketplace in the world.”

The first phase (called Blueprint One) was launched in September 2019 and outlined six integrated solutions to improve the customer experience while also improving operating efficiencies. They were:

- Complex Risk Platform—an automated mechanism for dealing with more sophisticated submissions. The platform will complement/augment the traditional face-to-face interactions that take place during the quoting, binding, issuance, and renewal of insurance/reinsurance business.

- Lloyd’s Risk Exchange—a system for processing less complex risks more quickly and efficiently.

- Claims Solution—a platform for expediting the claims process.

- Capital Solution—a feature that will bring more capital into the marketplace by allowing investors who are not part of a licensed insurance entity to participate.

- Syndicate-In-A-Box—an initiative described in Blueprint One as a new way to “bring innovative, accretive, and profitable business into the market for a set period without the need for a physical presence at Lloyd’s.”

- Services Hub—a set of high-value services offered to support the market’s business. This includes data sharing and access to Lloyd’s inventory of insights and analytics. The information will be available via an online platform.

Of course, 2020 provided proof of the validity of the old saw, “the best laid plans of mice and men often go awry.” All of the intricate strategies proposed in Blueprint One did not foresee the impact that COVID-19would have on a global scale. The pandemic resulted in a reprioritization and scaling-back of expected deliverables. Much of the work was focused on building a next-generation electronic placing platform, delivering a digital solution for agents with delegated underwriting authorities (“Coverholders”), and expediting claims-processing improvements.

The next phase of re-tooling efforts (Blueprint Two)was announced in November 2020. The approach for the second stage targets improvements to two of Lloyd’s customers’ most frequent interactions: open markets and delegated underwriting authorities. These two sources account for 80% of all premiums written and 90% of all contracts placed.

Blueprint Two further splits each of these two customer touch points into two transactional stages:

Getting covered—digital placement for new business, endorsements, and renewals.

Recovering from loss—digital claims notification and loss adjusting. This latest phase is expected to run for two years. The resulting improvements are projected to result in targeted savings of about £800 million (over $1.1 $1.1 billion) for market participants. Many in the industry welcome the changes being brought about in London. Alex Lloyd-Baker, director of the Corporate Risk Division of CBC UK Ltd, had the following observation: “Lloyd’s is far from being complacent about its position as the leading innovator in the insurance industry. The initiatives being launched will ensure that the expertise in complex product development, which Lloyd’s has in abundance, is maintained for many years to come and will differentiate it from others in the insurance market.”

CHART has been an advocate for the U.S./London marketplace since 2015. During our six-year tenure, we have helped present over $111 million in potential program business from domestic agency specialists to various Lloyd’s risk takers. Our experiences have taught us a great deal.

Anyone thinking about establishing a new business relationship with the London marketplace should consider these common-sense approaches:

- Develop a comprehensive business plan. The various Syndicates have finite levels of capacity to dedicate to new programs/products; they are looking to allocate this precious resource to initiatives that will generate the highest levels of underwriting profits. Agencies should be cognizant of this fact when developing their submissions. Remember to touch on the following topics in your proposal:

- Overview of the prospect universe. Talk about the preferred risk characteristics of this target audience. How many of them are there? Are there any points of aggregation (associations, organizations, regulatory/oversight agencies, etc.) that you can access to improve your reach? What is the level of competition in the marketplace?

- Marketing strategies. Demonstrate your expertise by articulating how you intend to solicit business. Provide mock-ups of promotional materials if possible.

- Model policy wording and underwriting guidelines. No one knows the potential exposures and coverage “hot buttons” of this niche market better than you. Outline the product features and pricing structure needed to make the program successful.

- Administrative strategies. Explain how you envision handling incoming submissions. Tout the internal controls and workflows that have been implemented within the agency. Now would also be a good time to talk about any systems enhancements you plan on incorporating to make processing more efficient.

- Estimate production growth over an extended period of time (three to five years). Don’t forget to provide estimates of loss trending, as well as an explanation of the assumption set used to generate the results.

- Be realistic when it comes to commission requirements. As noted earlier, the London market is focusing on the acquisition costs of the business it writes. One strategy to consider is a willingness to “put your money where your mouth is.” Reduce some of the upfront compensation requirements in exchange for the opportunity to share in back-end underwriting profit. Adopting this approach both demonstrates a confidence in the success of your business plan and depicts you as a true “partner” in the venture.

- Don’t be afraid to ask for help. Everyone’s heard the expression that “too many cooks spoil the broth.” But when it comes to writing your program proposal, take all the help you can get. If there are deficiencies in your submission, seek out assistance from industry experts to get them resolved.

CHART has a network of specialists from a diverse array of disciplines to help agencies develop a compelling proposal for London’s consideration. Services offered through our vendor partners include actuarial, claims administration, marketing, systems, legal, and more. The addition of placement capabilities means we now have the resources needed to support clients through all phases of the program business life cycle. Feel free to reach out to us if you have any new program or product ideas you’d like to discuss.

The author

Coverholders and Risk Takers is a periodic column written by principals or “early adopters” of the CHART Exchange(chart-exchange.com). The group’s core mission is to facilitate more U.S./London commerce via personal interaction, education, and technology. Francis J. “Frank” Huver is senior vice president and chief financial officer at Claymont, Delaware-based Rockwood Programs, a Lloyd’s Coverholder for more than 15 years and a CHART Exchange early adopter. For more information, submit questions to info@chart-exchange.com.