It’s time to step up your game and focus on risk

Beyond Insurance

By F. Scott Addis, CPCU, CRA

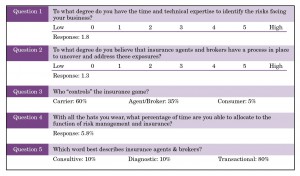

A few years ago I had the opportunity to speak in a conference setting to 100 or so CFOs in the Philadelphia area. While I was asked to present on the state of the property and casualty industry, I took the liberty of asking each participant to complete the following five-question survey. The responses to the survey took me by surprise and made me rethink who I am and what I must accomplish in the industry. What do the results tell you? Are the results good news or bad news? And, most important, do you see an opportunity?

Through the eyes of the customer

As you continue your journey in the business of insurance and risk management, it is vital that you see through the eyes of the customer. This includes business leaders and heads of household. As you know, these individuals are juggling responsibilities as never before. And there’s one responsibility that needs extra focus: risk.

… the CFO is searching for a new brand of insurance agent or broker—one who is consultative, diagnostic, results-oriented, and focused on managing and mitigating risks, rather than selling insurance.

What is risk, and why is it so important that you reevaluate your priorities to help the consumer identify, prioritize, measure, and manage it? Risk is defined as “situations that involve exposure to danger.” Synonyms include “endanger,” “imperil,” and “jeopardize.” As the survey indicates, a typical CFO (the insurance and risk management consumer) does not necessarily have the time or technical expertise to accurately identify exposures to loss. While the CFO is well equipped to manage finance and related areas, research indicates that he or she is not equipped to effectively manage risk. A 2006 Los Angeles Times article stated that fewer than 20% of CEOs believed that their CFO was doing a good job in managing risk. And the survey substantiates the fact that the well-intentioned CFO admits that he or she does not exude confidence, expertise, or comfort in this role.

The challenges and time constraints of the CFO create a wealth of opportunities for you. Today’s multi-tasked CFO is starving for an insurance agent or broker who has the desire to go beyond insurance to become the organization’s outsourced risk manager. The CFO:

Wants you to take the time to understand his or her business and industry

Desperately needs help in identifying, prioritizing, measuring, and mitigating risks

Covets a professional advisor who delivers a systematic process, including risk mitigation strategies that affect the bottom line of the organization

Detests the traditional insurance bidding process. The CFO is looking for a more strategic and disciplined approach to insurance and risk management. Simply put, the CFO does not want to be sold insurance.

Today’s decision maker is eager for you to “think outside the box”—to demonstrate a curiosity and desire to understand the inner workings of his or her business. In other words, the CFO is searching for a new brand of agent or broker—one who is consultative, diagnostic, results oriented, and focused on managing and mitigating risks rather than selling insurance.

Enterprise risk management

Because risk encompasses the possibility that something bad or unpleasant will happen, it is essential that you deliver a systematic means to manage it. Every business or organization, whether for-profit or not, has one main purpose: to create value for its stakeholders. These stakeholders include shareholders, customers, employees, suppliers, and vendors. The creation of stakeholder value is accomplished in many ways, including product innovations, acquisitions, business expansion, and customer experience journeys. The concept known as enterprise risk management (ERM) aims to ensure that management is able to fulfill its obligation to its stakeholders through goal achievement, such as hitting revenue targets, profit margins, and business valuations.

In the Risk and Insurance Management Society’s (RIMS) book Enterprise Risk Management for Dummies, Beaumont Vance and Joanna Makomaski teach us that risk management is an art as much as it is a science. The science involves a structured, systematic approach to risk management, while the art involves your creative flair in delivering this promise. It is interesting to note that the five-step risk management process was introduced by an innovator named George Head in 1972:

1. Identify. During this crucial phase, you investigate every aspect of the organization to help the customer identify the risks that face the business. This is the process of figuring out what kinds of future events might prevent or slow the achievement of objectives. Step 1 involves attempting to figure out where, when, why, and how an event may occur.

2. Assess. This involves judging, gauging, analyzing, and appraising the risks that you uncover. It also involves determining how individual risks are related to one another.

3. Evaluate. Here is where you ponder the balance between good and bad outcomes, and decide which risks need to be addressed to protect the organization.

4. Mitigate Risks and/or Exploit Opportunities. It is here that the risk management process really shines. Because you have identified, assessed, and evaluated risks, you are now able to explore a spectrum of strategies to minimize risk. Of interest, insurance fits in Step 4 as a “risk transfer” strategy.

5. Monitor. Organizations are dynamic. What works today might not work as well tomorrow. For this reason it is essential that you monitor and adjust the risk management program to ensure success as the business evolves and changes.

The problem with traditional agents

Today’s consumers have come to believe that the primary role of the agent and broker is to deliver products and services dominated by the insurance transaction. They do not see the evaluation of risk as agents’ and brokers’ top priority. They see them selling insurance. For this reason, commoditization occurs. Commoditization is devastating, as the consumer perceives little or no difference among products, services, and resources. When this happens, price becomes the primary point of differentiation. Picture commoditization as a disease that eats away at your knowledge, wisdom, and professionalism. It strips away the value proposition of even the most seasoned insurance professional—his or her reason for existence—and reduces it to a number.

The solution: the outsourced risk manager

The evidence is overwhelming. Today’s consumers are demanding that you step up your game and serve them in the same way a chief risk officer serves his or her multifaceted organization. They are demanding a disciplined approach, a planning process, and service standards that differ significantly from those of the traditional agent or broker. Most important, they expect you to begin each engagement with a blueprint focused on the identification, evaluation, and measurement of risk—an enterprise-wide diagnostic risk management evaluation.

I suggest the following 10 steps toward becoming an outsourced risk manager:

Understand your natural approach to creative problem-solving.

Expand your understanding of HR, safety, and risk management issues.

Live the risk management process.

Demonstrate proficiency in researching a business in this industry.

Master the art of exposure identification and risk mitigation.

Understand the importance of strategic planning.

Reassess the tools you have in your agency’s toolbox to support enterprise risk management.

Institute methodologies to monitor the results of your interventions.

Realize that the insurance bid is encompassed in Step 4 of the risk management process.

Appreciate the fact that insurance (risk transfer) is only one of many risk management strategies.

The opportunity of a lifetime

You have a unique opportunity sitting in front of you through the adoption and execution of the risk management process. As you commit to becoming an outsourced risk manager, you will gain purpose and passion as never before. Goodbye agent and broker. Hello outsourced risk manager.

The author

Scott Addis is the CEO of Beyond Insurance and is recognized as an industry leader, having been named a Philadelphia finalist for Inc. Magazine’s “Entrepreneur of the Year” award as well as one of the “25 Most Innovative Agents in America.”

Beyond Insurance is a consulting firm that offers leadership training, cultural transformation, and talent and tactical development for enlightened professionals who are looking to take their organization to the next level. To learn more about Beyond Insurance, contact Scott Addis at saddis@beyondinsurance.com.