Coverholders and Risk Takers

By Frank Huver

IT’S NO LONGER “BUSINESS AS USUAL”

Suggestions to make a new program submission more appealing

Benjamin Franklin has a number of historical achievements to his credit. He was an inventor, statesman, and publisher. One of the most significant periodicals attributed to him was the Poor Richard’s Almanack. The pamphlet contained the calendar, weather, astronomical and astrological information—data that a typical almanac of that period would contain. It is chiefly remembered for being a repository of Franklin’s aphorisms and proverbs, many of which are still a part of the American lexicon. These maxims typically counsel thrift and courtesy, which are delivered with a hint of cynicism.

We bring up this little piece of history because one of the adages found in the Almanack—“God helps those who help themselves.”—is very relevant to the topic of this particular article. We’ll circle back to this quote in a bit.

Domestic agency specialists will need to up their game in order to secure delegated underwriting authorities from Lloyd’s.

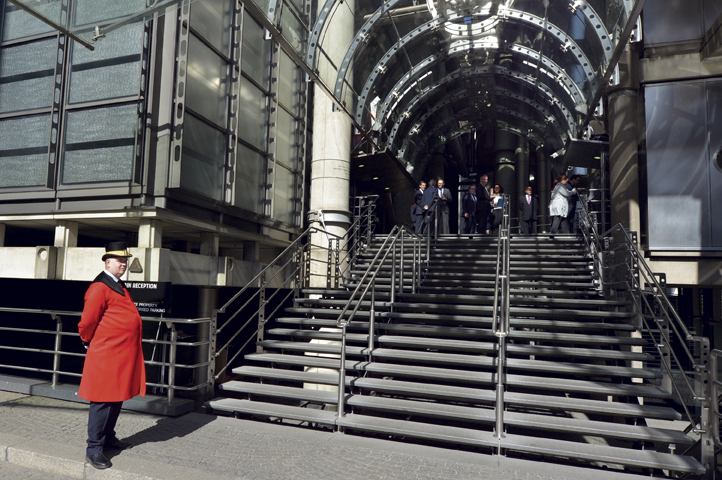

The CHART Exchange (now known as CHART 2.0) was established in 2015 to organically grow the U.S./London marketplace. During our tenure, we submitted over $111 million in potential program business to Lloyd’s for their review. Delegated underwriting authorities were granted to fifteen different domestic agencies as a result of our efforts.

Recent events have caused us to recalibrate our approach. Over the past several years, Lloyd’s was forced to critically evaluate the performance of its Syndicates due to the losses posted in 2017 and 2018. Books of business were re-underwritten, and markets pulled out of unprofitable lines. The rehabilitation strategy paid off, as Lloyd’s returned to profitability in 2019.

In recent remarks, John Neal, Lloyd’s chief executive officer, has made it quite clear that the market has no intention of backsliding into previous bad habits: “[I]t is important that we get the [business] plans right for 2021, so we don’t undo all of the good work that we’ve done through 2018, 2019, and 2020. Yes, growth can be supported but it has to be the right risk at the right price,” he said.

There is no doubt that this more conservative mindset is having an impact on the number of new programs being accepted in London. Alex Lloyd-Baker, director of the Corporate Risks Division at CBC UK Ltd, made the following observation: “Delegated authority business is important in Lloyd’s but has not been receiving the same premium increases as open-market business. Currently, capacity is in short supply and Syndicates have to deploy it as effectively as possible.

“We have seen first-hand how these constraints have affected the market’s views on new program submissions,” he continued. “Proposals that would have been readily accepted five years ago are now being declined. The undersupply of capacity means only the best prospective business plans are now being considered.”

The take-away from all of this is pretty clear. While the London market is open for business, it is no longer “business as usual.” Domestic agency specialists will need to up their game in order to secure delegated underwriting authorities from Lloyd’s. CHART 2.0 articulates this new reality to any prospective client coming to us for assistance in establishing a relationship with the London market. We admittedly had to walk away from several different ventures because of the agency’s reluctance to put in the work.

Remember how we referenced the Poor Richard’s Almanack quote earlier about God helping those who help themselves? Here’s where it comes into play. We’ve come up with some suggestions on how to make a new program submission more appealing to potential Syndicate partners:

- Don’t be afraid to toot your own horn. Incorporate your in-depth knowledge and experience regarding the prospective program into the write-up. Remember to touch on the following topics in your proposal:

- Overview of the prospect universe. Talk about the preferred risk characteristics of this target audience. How many of them are there? Are there any points of aggregation (associations, organizations, regulatory/oversight agencies, etc.) that you can access to improve your reach? What is the level of competition in the marketplace?

- Marketing strategies. Demonstrate your expertise by articulating how you intend to solicit business. Provide mock-ups of promotional materials if possible.

- Model policy wording and underwriting guidelines. No one knows the potential exposures and coverage “hot buttons” of this niche market better than you. Outline the product features and pricing structure need-ed to make the program successful.

- Prior team experience. Include résumés of key office personnel with the submission. Highlight the diversity in areas of specialty (operations, accounting, marketing, underwriting, etc.) within the group.

- Projections. Estimate production growth over an extended period of time (three to five years). Don’t forget to provide estimates of loss trending … as well as an explanation into the assumption set used to generate the results.

- Show yourself to be “cutting edge.” The markets will gravitate to fresh approaches for identifying, underwriting, and pricing risks. It is imperative to differentiate your operations from the competition. Among the ways to accomplish this objective:

- Administrative strategies. Explain how you envision handling incoming submissions. Tout the internal controls and workflows that have been implemented within the agency.

- Utilization of technology. Automation helps guarantee uniformity in risk evaluation, reduces the potential for error, and helps make processing more efficient. Detail the systems that are either in place or will be utilized for program administration.

- Underwriting approaches. Be sure to articulate the evaluation process that will be undertaken when reviewing an incoming application. Which risk demographics are scrutinized? Are there any “red flag” characteristics which lead to declination? How will the portfolio be managed—i.e., the monitoring of global shifts in areas like geographic concentrations, retention/limit options selected, etc.

- Utilize all the tools of the trade. Show a willingness to incorporate innovative risk evaluation techniques into your process. The use of insurance scoring is a great example. Studies by regulators, insurance companies, universities and independent auditors show that credit history is an indisputable and strong indicator of how likely someone is to file a future claim. Utilizing these new strategies helps differentiate your proposal from others.

- Know your audience. Each Syndicate possesses a unique set of underwriting philosophies and risk appetites. Make sure that the potential insurer partners you are targeting are compatible with the program attributes you are proposing.

Poor Richard’s Almanack was originally published nearly 290 years ago … but provides advice that is still applicable in today’s business environment. Investing the extra effort in a program proposal developed for London’s consideration will help distinguish it from others and improve the chances for acceptance.

The author

Coverholders and Risk Takers is a periodic column written by principals or “early adopters” of the CHART Exchange (chart-exchange.com). The group’s core mission is to facilitate more U.S./London commerce via personal interaction, education, and technology. Francis J. “Frank” Huver is senior vice president and chief financial officer at Claymont, Delaware-based Rockwood Programs, a Lloyd’s Coverholder for more than 15 years and a CHART Exchange early adopter. For more information, submit questions to info@chart-exchange.com.