Coverholders and Risk Takers

By Frank Huver

OUTSIDE THE BOX

London market carries solid history of fresh approaches

The insurance industry has a bit of a perception problem. The typical stereotype is that we are a sorry lot—conservative, stodgy, technologically challenged, and just plain boring. Remember attending a party (in the pre-social distancing era) and watching someone’s eyes glaze over when you told them what you do for a living?

The general public fails to recognize the important role insurance plays in their everyday lives. Many companies would be hard-pressed to remain viable without a mechanism for mitigating risk. And how many individuals would take the chance of even owning a car if they were going to be financially responsible for any accident or mishap?

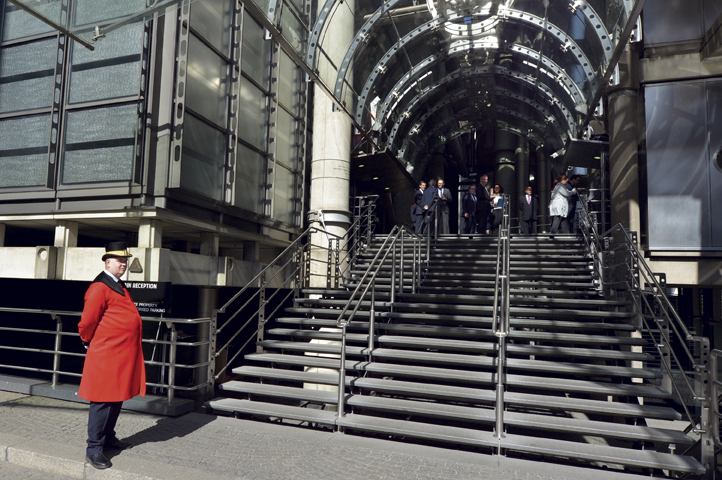

Lloyd’s of London has been an insurance leader for over three centuries. … The market’s innovative approach to risk evaluation has had a real impact on the course of our entire industry.

Contrary to popular opinion, we are a part of an innovative, dynamic industry. Insurance companies must be able to assess new exposures in the marketplace and quickly respond to them—often without the benefit of historical results, actuarial tables, or other reference materials.

In no place is this spirit of “outside-the-box” thinking better exemplified than at Lloyd’s of London. Throughout its 334-year tenure, the market has repeatedly demonstrated fresh approaches for dealing with emerging risk trends. Many of the products Lloyd’s pioneered are commonplace today. It is a worthwhile exercise to revisit some of these coverages in a historical context to fully appreciate just how innovative they were at the time.

Personal lines insurance. The first gas-powered automobile was introduced to the world in 1886. The concept of a “horseless carriage” was slow to catch on; by the dawn of the 20th century, there were only 4,192 vehicles produced in the United States (with 40% propelled by steam). In 1904, Lloyd’s was asked to insure a motorcar. Risk evaluation was handled by the market’s marine underwriters; it is hardly surprising that the insurance documents described the car as a “ship navigating on land.”

Today more than 203 million cars are insured in the United State alone.

Lloyd’s proved to be equally flexible in adapting its homeowners insurance offering to address unique exposures. Case in point: In 1914, a Householder’s Comprehensive Policy covered damage caused by “aeroplanes, airships, riots, strikes, and suffragists.” The inclusion of that last exposure wasn’t due to any latent sexism; it was inserted to address a real threat. The struggle for women’s voting rights in early 20th century Britain had taken a violent turn; activists were jailed for acts of arson, window-smashing, and other related crimes.

Directors and officers insurance. The 1930s was a time of significant economic upheaval in the United States. The Securities and Exchange Commission put in place a number of regulations to protect investors who were willing to buy public securities after the stock market crash. For the first time, directors and officers of companies could be held personally liable for the decisions they were making.

Lloyd’s introduced an insurance policy to address this new exposure. It is widely believed that Federated Department Stores, Inc. (known now as Macy’s), was the first buyer of the coverage.

Over the course of the last 85 years, directors and officers liability has grown from a specialty offering to a commodity product purchased by practically every publicly traded company. It is estimated that about $15 billion of premiums are collected annually for the coverage. The pattern of innovation continues for this line, as policy wordings are modified to address new exposures arising from event-driven litigation, collective redress developments, and changes in the regulatory environment.

Aerospace insurance. As any Trekkie can tell you, space is the final frontier. Yet it was up to Lloyd’s to boldly go where no man (or insurance carrier) had gone before. The first policy was written through the London market in 1965. It was written to cover physical damage during the pre-launch of Intelsat 1—the first commercial communications satellite to be placed in orbit. This was a milestone event in itself, as space vehicles enabled direct and nearly instantaneous contact between the United States and Europe via television, telephone, and fax transmissions.

Over time, space has become increasingly commercialized. Insurance providers have kept pace by expanding coverage to include launch and in-orbit exposures. Lloyd’s continues to be a player in the aerospace-related marketplace.

Drone insurance. While one would expect that the use of unmanned aerial vehicles is a relatively recent phenomenon, the concept itself is over 170 years old. The first recorded military application dates back to 1849 when Austrian forces used unmanned balloons to bomb the besieged city of Venice. Many advances have taken place since then. Most Americans were introduced to the drone in the early 1990s during the first Gulf War.

The use of drones for commercial/civilian applications began to really take off (pardon the pun) in the early 2010s. This new technology opened up the user to a vast array of ancillary exposures. Costero Brokers Limited has been providing solutions to commercial drone operators worldwide since 2015. We asked James Gadbury, divisional director at the firm, for his insights:

“We [Costero] did some research into the myriad of ways drones could be used to drive efficiencies and safety in a number of different sectors. At the time, many of the traditional aviation brokers were not doing much to provide insurance solutions to the sector, so we set about getting a worldwide facility in place and working with markets to develop policy wordings that are adequate for the exposure drone operators face.

“The primary exposures for commercial operators are third-party liability and hull coverage for their UAVs,” he continues, “but there are a number of ancillary exposures such as cyberattacks, privacy liability, and errors and omissions that operators need to be aware of, and as the market develops the risk landscape will become more complex.”

A paper issued by Lloyd’s in April 2017 provided insights into the emerging drone insurance market. At the time, it was difficult to quantify the amount of business underwritten within London. With that said, the write-up goes on to state that “there is evidence that coverholders, binding authorities and direct business are all used as conduits for writing drone-related risk insurance in the Lloyd’s market.”

Cyber liability insurance. Cyber liability covers financial losses that result from data breaches and other IT-related events. Most policies available today include coverage for both first-party and third-party exposures.

If you’ve gotten to this point, you’ve probably noticed a recurring theme in the article: that Lloyd’s has historic-ally been at the forefront of providing insurance coverage for emerging risks. Cyber coverage is no different. One of the first policies to cover this exposure was issued through Lloyd’s in 2000.

Recent reports issued by the NAIC indicate that the cybersecurity insurance market is generating upwards of $2.03 billion in direct written premiums.

Lloyd’s of London has been an insurance leader for over three centuries. We’ve demonstrated how the market’s innovative approach to risk evaluation has had a real impact on the course of our entire industry.

The CHART Exchange can serve as a resource for helping specialist insurance agencies launch new programs or products within the U.S./London marketplace. CHART’s client-centric approach puts us in the position to advocate for the business submissions seeking placement through Lloyd’s. We have a number of tools at our disposal, including brokerage capabilities and an extensive vendor network representing a variety of disciplines.

For more information:

View the CHART website (www.chart-exchange.com) or submit any questions to info@chart-exchange.com.

The author

Coverholders and Risk Takers is a periodic column written by principals or “early adopters” of the CHART Exchange. The group’s core mission is to facilitate more U.S./London commerce via personal interaction, education, and technology. Francis J. “Frank” Huver is senior vice president and chief financial officer at Claymont, Delaware-based Rockwood Programs, a Lloyd’s Coverholder for more than 15 years and a CHART Exchange early adopter.