AGENCY PARTNERS

Agents have high praise for Zenith in this demanding line of business

Somehow, a prolonged soft market in a challenging line of business doesn’t make much sense—but that’s the way it is for workers compensation, which is generally acknowledged to be one of the toughest coverages to underwrite, price, and earn a profit on. To compete successfully today, insurers need to be selective about the risks they write, while remaining mindful that they’re operating in a price-shopping environment. Rates must be adequate, and carriers must have the expertise to write this volatile, long-tail line of business.

A carrier that’s nimbly walking this fine line is Zenith Insurance Company, a California-based workers compensation specialist that’s earning plaudits from agents who point to its product quality, underwriting know-how, and high-touch service model. In a 2016 Best’s Statistical Study of U.S. workers compensation premiums written for 2015, Zenith ranked 26th among the top 100 insurers.

In 2010, Zenith’s holding company, Zenith National Insurance Corporation, was acquired by Fairfax Financial Holdings Ltd., which also owns other insurers, including Crum & Forster. As a wholly owned subsidiary of Fairfax, Zenith operates with a high degree of autonomy, says Jon Lindsay, chief sales and marketing officer.

“Fairfax gives us the responsibility to run our company,” Lindsay says. “We have the best of both worlds: a financially strong parent company and the ability to manage our operation for long-term success.”

Zenith operates in a similar manner through its decentralized regional operations, says Bill Granato, senior vice president and regional executive for the Midwest.

“We’re a regionally focused company, and the regions have significant autonomy to run their day-to-day operations,” he explains. “Some companies have a regional structure, but those locations are essentially run by the home office, which tells them what to do. At Zenith, while we have corporate expertise and support, each of our regions essentially functions as its own company, consistent with the values and strategies of the overall organization.”

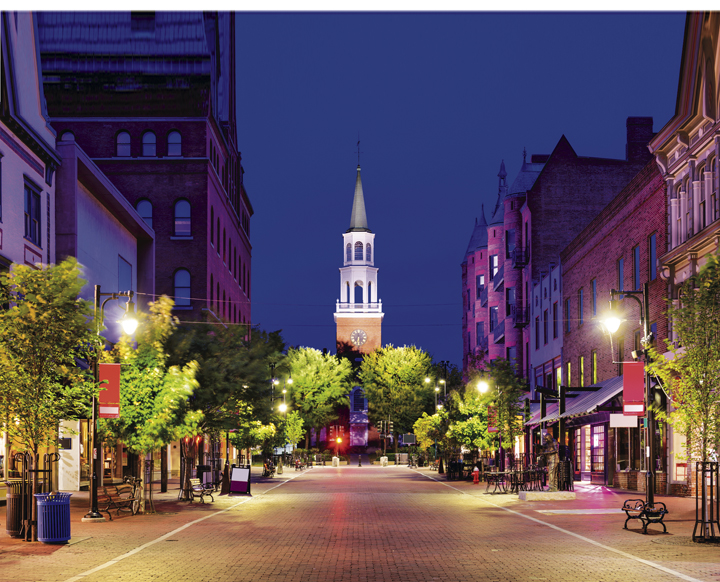

Zenith is licensed in all 46 of the non-monopolistic states and has nine regions, each with its own executive. “We focus on 20 core states that fall within the regional structure,” Lindsay says. “This strategy has created relevant and vibrant markets for us, and now that Bill has joined us, we are optimistic about our opportunities in the Midwest. Already, we are seeing strong evidence of this.”

Says Granato: “We have three core states in our Midwest region: Illinois, Indiana, and Missouri. Claims laws are very state specific, and our detailed knowledge of each jurisdiction lets us focus on securing the best possible outcomes for our injured workers and for our insureds overall. Each region maintains a staff of safety and health specialists, and they make immediate contact with an employer that has an injured worker. We’re a very high-touch company, from the safety and health side to the claims side, and our core strategy enables us to be close to our customers.”

—Jon Lindsay

Chief Sales and Marketing Officer

Employees first

“Our motto is: ‘Invest in the best; nothing else is good enough,’” says Granato. “We strongly believe that workers compensation is one of the most important long-term investments our insureds make. It’s an investment not only in their business, but also in their people, because their people drive their success.

“We take an employee-first approach, ensuring that injured workers get care to achieve optimal outcomes. This approach starts with our safety and health teams. We believe that the best claim is the one that never happens. Our teams use a system called evidence-based consulting to identify and mitigate exposures. They spend a substantial amount of time analyzing claim trends to identify the main sources of losses, and they work with the insured to put solutions in place to mitigate those exposures.

“From my experience, our safety and health approach is different from that at some other companies,” Granato continues. “While it varies by region, typically our minimum premium for an insured to receive full safety and health services is under $70,000, which I believe is very low by industry standards. In our Midwest region the minimum is $40,000.

“Our full suite of safety and health services represents a great value that our agents can use to attract new business, because it’s an added benefit, at no additional fee, that insureds may not be receiving from their current carriers.”

Adds Lindsay: “Our safety and health approach with employers is not about providing, say, 100 hours of service; to us that’s counterintuitive. Our approach is: ‘What do we need to focus on to make you a better risk, get your loss drivers down to a manageable level, and continually improve on that?’ Our goal is to work proactively with each employer to do whatever it takes to help the employer achieve those results.”

Even with high-quality safety and risk control measures, losses are bound to occur. “We believe that to succeed, we’d better have our claims operation nailed down,” Granato declares. “We use a multidisciplinary approach with teams that include physicians, nurses, pharmacists, claims adjusters, lawyers, and others. These are all our own people; we don’t contract these responsibilities out. We focus on achieving the best possible outcome for injured workers, and our proactive approach has proved successful in attaining that objective.

“We think of our claims management costs as an investment in positive outcomes,” Granato continues. “This philosophy is apparent when you look at the markedly lower caseloads our claims professionals carry, compared with industry norms. The lower caseload per adjuster makes for better communication with the injured worker and the insured, collaboration with the right resources, and fewer friction points, which then leads to less litigation and ultimately to consistently lower overall claim costs. This requires a greater investment by Zenith in claims expertise and resources than is typical for our industry, but our insureds and their injured workers are rewarded with improved claim outcomes.”

A look at the market

As noted earlier, the workers comp market continues to be soft in most segments, with substantial capacity that gives rise to what can become intense competition for business. Even in a soft market, Granato asserts, “We still see opportunities to write business at an appropriate price. We’re seeing some craziness, but we’re seeing enough stable business with decent pricing.”

Adds Lindsay: “We respect the market; we learn from the market, but we don’t follow the market. We do what we believe makes sense for us, our insureds, our agents, and our owner. This aligns exactly with how Fairfax thinks. We’ve always hoed our own row. We are totally focused on loss outcomes. Our objective is to produce a loss ratio that allows us to earn an underwriting profit, which means that we have achieved positive outcomes for our insureds and their injured workers.

“As Bill explained, we think of our expenses as an investment in managing the loss outcome, and that is critical to our long-term success in this market. I can’t recall an expense ratio killing a company, but we’ve seen loss problems kill a lot of companies—and, more important, adversely affect their customers. For over 30 years, we’ve produced a loss ratio that’s 20% to 30% better than the industry.”

TheZenith Difference

When it comes to gaining an edge in the marketplace, Lindsay explains, “We refer to our approach as TheZenith Difference, and it all comes down to execution of our hands-on service approach. We invest in developing expertise and resources, as well as in fostering a culture of collaboration that focuses on improving loss outcomes. That may sound obvious, but if you dig into the industry, you’ll find that isn’t always the case. As Bill mentioned, we invest in unallocated loss adjustment expense—our claims resources—rather than running our claims operation as a profit center. We don’t want our adjusters to think about what to bill to a claim; we want them to think about doing the right thing for the injured worker.”

—Bill Granato

Senior Vice President and Regional Executive-Midwest

Working with agents

Zenith is represented by over 1,600 agents and brokers across the country, and the carrier places a solid focus on building and enhancing agent relationships. “We’re strongly committed to the independent agency system, and it is the sole source of our business,” Lindsay asserts. “We believe that our relationships with independent agents are invaluable not only to their customers but also to us.”

“In the Midwest we have a modest number of active appointments,” Granato says. “In fact, I consider Zenith to be the best kept secret in the Midwest. As we move forward, a big part of our growth strategy is focused on expanding our distribution system. We look to foster partnerships with agents who are willing to take the time to fully understand the Zenith value proposition and develop the ability to fully articulate that value proposition to prospective insureds. The agents who are willing to invest that time and energy are very successful writing business with us.”

“This industry has become increasingly complex,” Lindsay adds. “It has become critical for agents to get more deeply educated and, in turn, educate their clients. Buying and managing an effective workers compensation program often lends to a commoditization of the line, which runs counter to the need for greater investment in the resources needed to shape an impactful program. The agent who takes the time and energy to fully educate the client is an important component of our success, and we devote the time and resources to do so.”

Comments from agents who represent Zenith confirm that the positive feeling is mutual.

“I have had the sincere pleasure of working with Zenith for four years,” says Greg Chaples, vice president of Brown & Brown in Conshohocken, Pennsylvania, calling the relationship one of the agency’s most valuable. “As an agency, it is important for us to partner with carriers that share in our commitment to helping our clients be safer, more protected, and more profitable. We align our clients with Zenith because we know and trust that our clients are in good hands.” He describes the insurer as an underwriting company that doesn’t just look at the numbers, but is equally interested in getting to know the agency’s clients, their business, and their culture.

Tom Connor, principal of Connor & Gallagher OneSource in Lisle, Illinois, says his agency has represented Zenith for about 10 years. “The greatest strength of Zenith is how they face out to the client,” Connor says. “There is a genuine desire to deliver on their promises, and they do! I have clients with them that don’t even want to consider an alternative quote.” With respect to key criteria like underwriting, pricing, safety, loss prevention and control, and claims handling, Connor says, “Zenith is at the top of our list. The tenure and talent in all these areas is as robust as that at any of the carriers we represent”

Dan Klaras, president of Assurance Agency in Schaumburg, Illinois, shares a story that illustrates how he feels about Zenith. “While undergoing a relatively minor surgical procedure, an injured worker of a client of ours had an adverse reaction to the anesthesia, which led to a brain injury. Within hours of the event, the Zenith team was all over the claim. The team, which included a medical director, a nurse case manager, a pharmacist, and other technical claim gurus, quickly mapped out a plan for an optimum recovery. Each step of the way, the focus has been on getting the injured worker the best medical and rehab care available.”

Brett Studner, vice chairman of Odell Studner in King of Prussia, Pennsylvania, says Zenith, the agency’s primary go-to workers compensation market, is “an extremely understanding, proactive, communicative, dependable, consistent, focused, client-committed company that looks to form long-term, mutually beneficial relationships with clients, as well as brokers. I’m a true fan.” He values Zenith’s underwriting (“they know their appetite and stick to it”), pricing (“rarely the lowest, but often the best value”), safety and loss prevention (“top notch and an industry leader”), and claims handling (“outstanding communication and extremely fair”).

New to Zenith and enthusiastic about what it brings to the table is Don Zimelis, managing director of NFP in Chicago. Asked what he views as Zenith’s greatest strengths, Zimelis recalls a situation in which the company came through for a client. “I like the fact that they are very open to having a dialogue about an account. We recently had trouble marketing an account due to some historical loss issues. We received quick declinations from most of our markets. Zenith was willing to meet with the insured to listen to their story. They worked with the insured to develop a safety service plan and quoted the account.”

By Elisabeth Boone, CPCU

For more information:

Zenith Insurance Company

www.thezenith.com