Thirty-Third Annual Rough Notes Agency of the Year

Who will be the 2021 Agency of the year?

One of the agencies featured in a Rough Notes cover story during 2021 will be named Agency of the Year. The winner will be selected from votes by the previous 32 years of Rough Notes cover agents (from the years I989-2020). The principals of the winning firm will be presented with the award at a dinner held in their honor this spring (COVID-I9 pending). The nominees for this year’s award are described on the following pages. The winning agency will be announced in the February 2022 issue of Rough Notes, and a full story on the winner will appear in a future issue.

February

Stewardship

Founder Grant Botma had a vision to provide completely open communications about the services being offered at his firm, as well as educating people about finances. The result was Stewardship, four separate entities—mortgage, insurance, planning and financial—operating under one roof.

Founder Grant Botma had a vision to provide completely open communications about the services being offered at his firm, as well as educating people about finances. The result was Stewardship, four separate entities—mortgage, insurance, planning and financial—operating under one roof.

“The fact that we have a unified purpose allows each of the four companies to stay focused on the needs of the clients, rather than the financial needs of the corporations,” says Brandon Ream, co-founder of Stewardship Insurance. “We let our clients know that we’ve got their back, and we maintain regular communication to make certain that the coverage they have remains relevant with any changes in their circumstances.”

“We never force clients to use our other products or services,” Botma adds. “We just have a mission to give advice with wisdom and love, and that’s regardless of which company is involved in the transaction.”

On top of serving their community, whether by helping at the local food bank or by providing free financial education through its blog and podcast, the firm also takes care of its staff members and clients by providing meals, rides, or whatever else is needed when hard times arise. “Stewardship was started because I saw a need in our community,” Botma explains. “People need their finances to be handled correctly. … [T]he way we love people through their finances is very specific. Love is our niche.”

Botma’s vision has earned the firm back-to-back honors as an Inc. 5000 fastest growing privately held company, with three-year growth topping 200% each year.

March

ChurchWest Insurance Services

When Tom Cutler sold his 20-year-old agency to MetLife, one entity remained in his possession: the church business. From that he parlayed what eventually became ChurchWest Insurance Services into a successful niche, increasing from 20 houses of worship to 3,500 ministries in California, Arizona, and Nevada with $55 million in premium and organic growth of 10% or better.

When Tom Cutler sold his 20-year-old agency to MetLife, one entity remained in his possession: the church business. From that he parlayed what eventually became ChurchWest Insurance Services into a successful niche, increasing from 20 houses of worship to 3,500 ministries in California, Arizona, and Nevada with $55 million in premium and organic growth of 10% or better.

That choice allowed ChurchWest to become a mission in itself, reflecting the spiritual bents of its founder and staff. Son Charlie, who joined the firm in 1998 and now is president, points out: “We are aware that insurance premiums are sacrificial gifts paid out of tithes and offerings, and that we are stewards of that.”

Ryan Lucht, vested partner, benefits consultant, echoes that thought: “We’re aware that anything a church spends with us reduces what is available to the ministry to its primary mission to further the Kingdom,” he says, continuing, “We are very cognizant of the need to use the money from tithing and contributions as efficiently as possible.”

In terms of benefits, he says, “[I] find that there is a willingness and a desire to offer benefits to church employees, but there is not always the financial wherewithal to do so. When we sit down with a ministry that wants to start or replace an existing program, our goal is to come in under their budget, while at the same time providing coverage that is at least as good as what they currently have.”

The vagaries of the pandemic didn’t stall ChurchWest’s ministries; they simply enhanced them. The result: increased internet offerings to share information, and virtual conferences for clients and prospects.

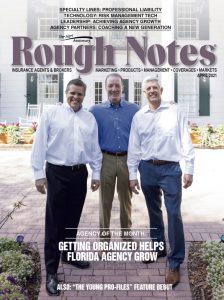

April

Atlas Insurance

Founded in 1953, primarily as a personal lines agency, this firm looked to build its commercial book following Hurricane Andrew in 1992. President Rob Brown brought Vice Presidents Darren Howard, CPCU, and Tommy Kochis, CIC, CRM, on board, and the agency began to see rapid growth by the year 2000.

Founded in 1953, primarily as a personal lines agency, this firm looked to build its commercial book following Hurricane Andrew in 1992. President Rob Brown brought Vice Presidents Darren Howard, CPCU, and Tommy Kochis, CIC, CRM, on board, and the agency began to see rapid growth by the year 2000.

“We knew we needed to get organized. We just didn’t know how,” Brown recalls.

The three heard a consultant speak at a seminar put on by a carrier partner. While the speaker’s ideas seemed too far-fetched at first, about a year after the seminar, with the agency still lacking organization, things started to click.

Agency leaders signed on with the consultant and revamped the agency along his model. In working with the consultant, it became clear to management that the agency’s producers needed to specialize so they could become experts in a particular field and really stand out from the competition.

“We were all generalists,” Brown adds. “As new producers came on board, we encouraged them to specialize. We did the same thing with account executives. Thus, we were creating a service team that could provide unrivaled service expertise in specific niches.” These niches include condo associations, construction and bonding, and nonprofits.

Thanks to the consultant’s emphasis on looking at where revenue came from, “We are now 80% commercial,” Kochis says. “That has been accomplished in large part by our focus on specialization and on bringing in producers and account managers who implement that focus.” Atlas Insurance has experienced organic growth of 14% a year, with 98% retention over the last three years.

May

Great Park Insurance

Daniel Seong’s insurance agency started in his bedroom as a one-man shop. Daniel would get up at 3 a.m. to run quotes and email them out; from 8 a.m. to 5 p.m. he worked on his insurance operation, letting friends and acquaintances know he was in the business.

Daniel Seong’s insurance agency started in his bedroom as a one-man shop. Daniel would get up at 3 a.m. to run quotes and email them out; from 8 a.m. to 5 p.m. he worked on his insurance operation, letting friends and acquaintances know he was in the business.

“At first, I felt a little lost, but I had the support of my wife and children,” he explains. “My wife has everything to do with my success.”

His goal from the start: to run a preferred agency, where clients are properly protected. That means minimum auto liability limits of 100/300 and lots of umbrellas. The agency relies on social media to educate clients—turning them into protectors of the agency loss ratio while improving their own risk profiles. Daniel also stresses the importance of carrier relationships. “Without their support, I’d be out of business.”

He adds, “Consistency … has been the key to my success. I’m not the smartest agent with all the answers, but I’m always there. Clients know they can count on me. And I instill that same commitment to consistent service to all my people.”

The result: a highly successful agency with a top ranking on Yelp, which helps attract new business and new employees. Great Park Insurance complements its solid personal lines position with a growing commercial base and takes a niche approach to various businesses and ethnic communities.

“Everything is about the client,” observes Risk Manager Scott Kim. “It starts out by learning about them, developing a relationship, really caring. You can see this in the way Daniel approaches the business and us. It rubs off and makes for a great working environment.”

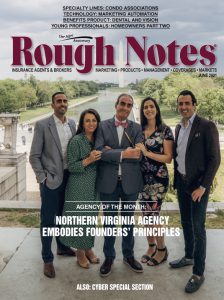

June

Sahouri Insurance

Fuad M. Sahouri would tell his children stories about his childhood in Palestine where he would use a cardboard box to create a sign for his imaginary business, Sahouri, Inc. “He always had an entrepreneurial bent, even when he was 10 years old,” says son Michael, CEO of Sahouri Insurance. “And he also had a much more grown-up desire, to have a business where he could serve people.”

Insurance was the perfect business for Fuad, so he and his wife, Mary, opened an agency in 1970, quickly carving out an international diplomacy niche. Fuad learned that people in embassies really didn’t understand the American system of insurance and often were grossly underinsured—and overpaying. Today, the firm is a leading provider of insurance coverages for embassies and consulates nationwide and many of the agency’s clients from the ‘70s are still with the firm.

About 10 years ago, agency leadership saw the need to diversify. “[O]ur region was quickly becoming a GovCon [government contractor], tech and financial hub,” Michael explains, “and we needed to evolve to meet the growing market.” The firm is looking to expand its geographic reach as part of its goal of helping missions around the world.

Amid growth, the founding principles remain. Director of Sales Allen Hudson, CIC, CRM, who came on board 10 years ago to head up what’s now a significant real estate division for the firm, observes, “The traditional big egos that you often run into in this business are not part of [the Sahouri’s] makeup, and they have no interest in selling just to achieve growth. They really are in the insurance business to help others.”

August

Harbor Brenn Insurance Agencies

In 1972, Bill Brower left law school to start his own insurance agency, a line of work that he came to love. According to Bill, he brought that love home, where daughter Ashley acquired the same love—working at “nearly every position” in the agency. Now president and owner, Ashley operates under a philosophy that reflects the Conscious Capitalism system. According to Ashley, “An organization elevates all of the entities that are impacted by its business. Those entities encompass six stakeholders: employees, clients, owners, communities, suppliers, and the environment as a whole, that need to be considered in every decision.

In 1972, Bill Brower left law school to start his own insurance agency, a line of work that he came to love. According to Bill, he brought that love home, where daughter Ashley acquired the same love—working at “nearly every position” in the agency. Now president and owner, Ashley operates under a philosophy that reflects the Conscious Capitalism system. According to Ashley, “An organization elevates all of the entities that are impacted by its business. Those entities encompass six stakeholders: employees, clients, owners, communities, suppliers, and the environment as a whole, that need to be considered in every decision.

She cites an example: “Going paperless is not done just because it makes things easier for us, but also because it is better for the environment and it provides quicker access to information to the benefit of employees, clients and our suppliers, the insurance companies.”

Because the area caters to a seasonal population, prospects need protection for their seasonal homes; and because their experience with Harbor Brenn has been a pleasant one, it often becomes the clients’ primary agent.

There is great contentment in the employee population of the agency too. Much of this is based on trust. Says Sales Agent Jenny Brower, “So much of our ability to serve our community and have meaningful relationships with our clients stems from the freedom that Ashley has given all of us.”

“We don’t track personal time,” says Ashley. “We have no limits on volunteer hours. We pay for education because that is a vital part of building a more knowledgeable team that can better serve all of our stakeholders.”

September

Commercial Insurance Associates (C.I.A.)

Thirty years of an in-and-out friendship eventually resulted in two friends, along with four others, forming Commercial Insurance Associates (C.I.A.) in Brentwood, Tennessee. The two friends, Donald S. Denbo, president and CEO, and Johnny Thompson, COO, are the only founders still at the agency.

Thirty years of an in-and-out friendship eventually resulted in two friends, along with four others, forming Commercial Insurance Associates (C.I.A.) in Brentwood, Tennessee. The two friends, Donald S. Denbo, president and CEO, and Johnny Thompson, COO, are the only founders still at the agency.

Managing Partner Bob Wagoner emphasizes the philosophy on which C.I.A. is based: “The firm is structured to provide professional support for the producers by rewarding not just the producers but the support team as well, with the ultimate goal being to provide the best risk management program for each of our commercial clients.”

Managing Partner Will Denbo adds: “Our producers tend to have a vertical focus so that they and their support team can become experts in a particular field. … When we meet with a prospect, we don’t look at their current coverage and base our submission on what they already have. Instead we get to know them by talking with them about their business and visiting their plants or offices to see what they need. The result is that we often find areas where they are uninsured or underinsured, as well as areas where they have coverage that they don’t need.”

C.I.A. is not reluctant to write small accounts, the thinking being that all businesses start out small. Recognizing their potential can help them grow.

Don says, “[We] created a self-fulfilling growth cycle as we used income from growth to fuel more growth,” partly through judicious hiring, training in “our own brand of customer–first service,” and the opening of new offices where needed. During the first half of this year, revenue growth year-to-year was 54%.

October

TRICOR

Turnover is rare at TRICOR Insurance in Lancaster, Wisconsin, one of the 100 largest agencies in the country—with 15 partners and 205 full-time employees—“because we allow our people to put their family first,” says David Fritz, CIC, CPCU, president and CEO.

Turnover is rare at TRICOR Insurance in Lancaster, Wisconsin, one of the 100 largest agencies in the country—with 15 partners and 205 full-time employees—“because we allow our people to put their family first,” says David Fritz, CIC, CPCU, president and CEO.

Two months into his employment, Jeff Paro, CPA, chief financial officer, lost his mother. “I needed and was given time off, but what was really incredible was that Dave came to the funeral to support me,” he recalls.

TRICOR Insurance operates 26 offices in small communities throughout Wisconsin and northeastern Iowa. “The agency is unique in that it does not have a base in a large community,” says Bart Straka, CIC, CPCU, executive vice president and chief revenue officer. “We live in a different world from most large agencies, since we’re spread out over Wisconsin and northeastern Iowa, serving small communities and rural areas.

“We have strong relationships with local, regional and national carriers that we strive to maintain by providing them with the kind of business that fits their marketing appetite,” Fritz adds.

In 2020, the agency engaged well-known consultants to help with growth strategies. “[Their] ideas meshed very well with our focus on providing strong risk management services to clients and they helped us better zero in on clients and prospects who value our attention to risk management,” Fritz says. Straka adds that much of the agency’s new business comes from referrals from current clients.

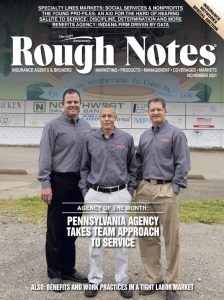

November

Rossbacher Insurance Group

Agency Founder Richard Rossbacher’s goal was to offer each customer a meaningful personal experience. Today, the goal is embodied in the agency’s tagline: “P.S.—Personal Service since 1928.” Agency Partner Brad Allen, CIC, CRM, says this promise to clients also applies to the Rossbacher team, both veteran members and new hires.

Agency Founder Richard Rossbacher’s goal was to offer each customer a meaningful personal experience. Today, the goal is embodied in the agency’s tagline: “P.S.—Personal Service since 1928.” Agency Partner Brad Allen, CIC, CRM, says this promise to clients also applies to the Rossbacher team, both veteran members and new hires.

“When I drew up my strategic plan in 1999,” Brad recalls, “it focused on … bringing in great team members through a careful recruitment process and establishing scalable processes and procedures that guarantee consistency for each client, regardless of which team members speak to that client.”

Previously an Erie Insurance district sales manager, Brad learns from others—in the business and outside of it. “I have really good customers who have shared their business acumen with me,” he explains. “I’ve spent my life learning and have tried to bring people on board who share that passion.”

Teamwork and trust are two components of agency success. For example, hiring decisions are vetted by top management and team leaders. As a result, team leaders are more vested in long-term team member development and get actively involved in the mentoring process.

Carrier engagement is another example. A centralized support group staffed by agency CICs interacts with underwriters. “Underwriters will deal with the same team member on each account,” says Partner J.T. Colwell, “allowing for strong personal relationships to develop.” Underwriters know submissions reflect carrier marketing appetites. The support group also helps uphold agency best practices and minimizes E&O risk.

Community involvement plays a big role at the agency. “All of us are blessed,” Brad says. “We owe it to the communities that have supported us to reciprocate.”

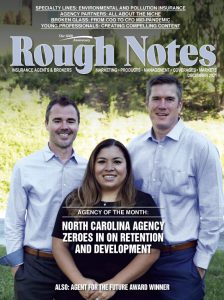

December

Alliance Insurance Services

In the days of price quoting, Alliance Insurance Services in Winston- Salem, North Carolina, emphasizes an alternative “branding” by treating customers and employees as an extended family.

In the days of price quoting, Alliance Insurance Services in Winston- Salem, North Carolina, emphasizes an alternative “branding” by treating customers and employees as an extended family.

In 2004, Christopher Cook decided to open his full-service insurance agency in order to protect clients in all phases of their lives. As the agency’s first and still-current employee (two other first hires are still there) Cecilia Cruz, director of personal lines, puts it, “We’re not just offering an insurance policy; we’re providing a promise to make each client whole after a catastrophe,” continuing, “Sometimes, we’re even just counselors for our clients to bounce ideas off of.”

According to Christopher, because “our goal has always been to provide complete protection to our clients,” Alliance moved from a primary focus on personal lines, including life insurance, to writing BOPs and later entering the health insurance area. Three staff “experts” now concentrate in that entire field, including long-term care and Medicare. Health insurance now represents around 23% of revenue.

The majority of growth has been organic, according to Christopher. “Roughly 17% of our more than $3 million in revenue today is from … acquisitions—smaller shops we brought in and leveraged to fuel continual growth.” The “family” now includes more than 7,500 people, and three branch offices located in Walnut Cove, Pilot Mountain, and Mount Airy.

Agency WIGS (Wildly Important Goals)? Growth—one recent year boasted growth of 34%. Retention—discovering why “family members” leave. Training and benefits—a pathway to success for employees. Increase current charitable giving of 10% of profits through volunteerism.