Who Will be the 2025 Agency of the Year?

One of the agencies featured in a Rough Notes cover story during 2025 will be named Agency of the Year. The winner will be selected based on votes from previous Rough Notes cover agents.

The nominees for this year’s award are described on the following pages. The winning agency will be announced in the February 2026 issue of Rough Notes.

The principals of the winning firm will be presented with the award at a dinner held in their honor this spring.

February Vermost Insurance Agency

When Darren Vermost’s father’s largest client at his Illinois-based

agency moved its operations to Florida, a game of musical chairs began. His father followed them, purchasing an agency in Florida in 1998. Darren’s brother was queued to be the successor, but an opportunity for his family found him leaving the agency, which led to Darren, who was hesitant to join the agency in the first place, taking the reins and ultimately purchasing the firm in 2006.

In addition to running the agency and producing both commercial and personal lines business, Darren developed an expertise in the probate bond field, and business there grew to such an extent that the agency spun it off in 2023 to a subsidiary called Probate Bond Pros; in fact, he is known as “The Bond Guy.”

“Most of our bonds are issued in under 20 minutes,” Darren, agency president, says proudly.

Agency revenues total $2.1 million, with a 60/40 commercial/personal split if you include the subsidiary’s bond business, or 40/60 without that.

A large portion of its business comes from referrals. “We have a referral program that includes monthly prizes and a grand prize at the end of the year,” Mary Rivera, office manager, explains. “Whenever a new client joins, we ask how they heard about us. If a customer referred them to us, we’ll contact them and let them know they’ll be entered in the monthly drawing.

“We also tie the referral program to our charitable giving,” she continues. “We make a gift to charity in the name of the people who provided referrals. We also give people paid time off to do charity work.”

March Hotchkiss Insurance

Founded fifty years ago by Doug Hotchkiss, Hotchkiss Insurance is now

one of the largest privately held agencies in the state of Texas, employing more than 200 people in five offices.

Doug’s sons Ken (COO), Mike (CEO) and Greg (CFO) joined the agency in 1995, 1999 and 2004 respectively, and assumed their current roles when Doug stepped down in 2015. “Working with family isn’t always easy, but it can be a rare blessing if done right,” Mike says. “Knowing this, we brought in a consultant to guide us through this critical leadership transition.”

This led to the creation of 36 “Fundamentals” known as the Hotchkiss Way. “To help inculcate these fundamentals into each employee’s life, we decided to focus on one per week, going through the list of 36 and then starting over,” Mike notes.

Via a weekly email describing a Fundamental, this effort to invest in the agency’s people and develop a culture of caring has paid dividends; in the last 10 years, revenues have tripled. “This is the result of a culture that focuses on developing our people, aligning our values and work ethic, and giving them a runway to grow,” Mike says.

To help with that growth, the agency’s learning department—Hotchkiss Learning—“not only [offers] instruction on the fundamentals of insurance, but it also helps each person attain industry designations that will help them go as high as they want,” Ken says.

To commemorate its 50th anniversary, the agency committed to doing 50 charitable activities throughout the year. “We want to celebrate this milestone by being particularly mindful of and intentional about serving others,” Mike says.

April CoverLink Insurance

When CoverLink Insurance (formerly Hill & Hamilton) of Bellefontaine, Ohio, came into being in 1920, it may have instinctively operated on The Four C’s, the principle that is now its official guiding light: “our carriers, our clients, our communities and our colleagues,” says Matt Simon, agency president.

Matt joined his father, Tom, who was the third owner of the firm, in 2006. Matt reminisces: “Dad was getting a little burned out … and was looking for someone else who could eventually take over the operations. He decided to give me a shot and see how I worked out.”

Matt says, “It turned out that Dad and I really complemented each other. Dad was a great salesman and I’m more of an operations guy.” That inclination allowed Matt to slowly take over operations and begin to make plans for the future.

“Yes, Dad’s still here and showing no signs of retiring. He can now focus on the part of the business that he loves, and I can do the same,” Matt observes.

That future includes the careful acquisition of five compatible agencies, which still operate under their own names. However, Matt says, “we realized that we needed an umbrella under which each of the offices could operate in order to grow exponentially” (now a 17.5% year-over-year growth rate).

That umbrella is identified by the company’s new name, CoverLink, “to reflect our ability to link our clients and prospects with the right blend of coverage, price and service,” Matt explains.

May EAB Insurance Group

Doris “Dee” Zampella’s parents Ed and Eleanor “Ellie” Boniakowski started EA Boniakowski Insurance Services (now EAB Insurance Group) in 1950, after recognizing the need for reputable insurance products for particularly the immigrant population from Eastern Europe in the New Jersey area.

Dee, who serves as chief everything officer, came on board while still in high school and learned about the industry. As an agency leader, she has focused on having the firm develop full risk management capabilities, an effort that led to moving from principally focusing on personal lines to one where commercial lines represents more than 65% of the agency’s revenue.

To help with this endeavor, Dee searched for an advisor and met Scott Addis of Beyond Insurance Global Network and initiated the firm’s four-step risk management process as well as its quantifiable risk assessment tools.

In 2017, Dee’s daughter, Jacquelyn “Jackie” Zampella, joined the agency, and started to systematize the team’s marking efforts with a new website and an online newsletter that boasts an 83% open rate.

“We built this stronger online presence that helped to increase referrals significantly,” says Jackie, risk architect and vice president of new business. “We instituted a campaign [in 2024] to encourage staff by offering an extra day of PTO for every 10 Google reviews. The result was an increase in 5-star reviews by 120.”

The agency supports some 25 charities that help the community, leading to more than 80% of its business coming from referrals. “We still have a lot of walk-in business. People know us and see that we’re an integral part of the community,” Dee says proudly.

June Breezy Seguros Insurance

At a 2017 discussion of issues that affect the burgeoning Framingham, Massachusetts, Brazilian-American community, insurance emerged as an important concern and ironically led to the creation of a new insurance agency whose purpose was twofold: to educate its clientele, as well as the carriers it represents.

The need was there, but language barriers, plus a lack of knowledge of the intricacies of the insurance industry, were stymying potential clients. Because of those limitations, the insurance industry itself didn’t consider the community to be marketable.

In response, Rodolpho Sanz Jr. and Tiago Prado founded BRZ Insurance. Monica Adwani, CEO and partner of what is now Breezy Seguros Insurance, says that “90% of our staff is trilingual (Portuguese, Spanish and English), so we can explain to each of our clients … what they need to know about the auto, home and commercial insurance requirements in Massachusetts and why it’s important to have the correct coverage … .”

The firm grew rapidly. “In personal lines only, the agency was writing between $1 million and $2 million in premium every month,” Monica says. It was time to expand into commercial, which now makes up 57% of the agency’s revenue.

It was also time to change the agency’s name, which had caused some to think it represented only the Brazilian community when its goal is to serve the entire Latino community. Thus, Breezy Seguros [both Spanish and Portuguese for insurance] came into being “built on the BRZ … that had … a reputation for integrity and fair dealing.”

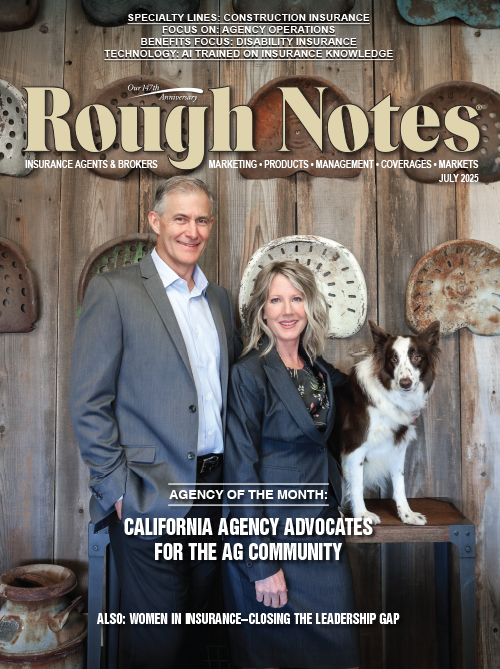

July Heritage Insurance Agency

Two letters—A and G—appear in a different color in Heritage Insurance Agency’s logo. And that tells the whole story of the Chico, California, firm’s beginnings and goals.

It’s all about agriculture, says agency principal Steve Mora. Agriculture has been the thrust of his life from growing up on a ranch in central California, through getting a degree in agriculture, then moving into risk management and agribusiness and the acquisition of his insurance license.

Later, he and his wife, farmgirl Kelly, partnered with an agency owner to create a five-year plan to take over his business.

“We’re really just a couple of displaced farm kids,” Steve quips. That background, plus their complementary talents have caused the aptly renamed Heritage Insurance to grow and thrive, their goal being “protecting the heritage of the land, property and people we insure.”

Steve is the technical person, while Kelly employs her communications degree to market and create community relations.

Steve points out, “A big part of our advantage is that we truly understand the market that we serve; we speak their language. But to maintain this advantage, we have to continually push ourselves to stay educated about the changing marketplace.” That includes his obtaining the AFIS (Agribusiness and Farm Insurance Specialist) designation, along with encouraging team members to do the same.

And, Steve adds, “Our agency is not producer-centric and there is no hierarchy.”

Since 2014, Heritage’s growth has been outstanding, with revenues increasing over six times to more than $3.5 million.

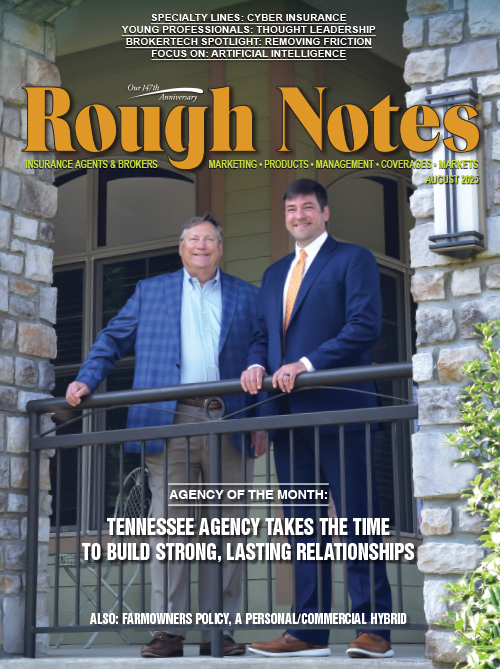

August Powell & Meadows Insurance Agency

Serving the Carthage, Tennessee, area since 1894, Powell & Meadows Insurance Agency has seen its share of owners over the years. Phillip Piper joined in 1986 and purchased the agency from Frank Powell when he retired in 1998.

Prior to Phillip’s arrival, the agency was primarily focused on personal lines, “writing about $2.3 million in premium out of the one office in Carthage,” Phillip recalls.

The agency closed 2024 with more than $65 million in premium—with 68% from commercial lines, 9% from life/health, and 23% personal lines. It now operates out of five offices, all in small Tennessee towns.

Phillip’s son, Chip, joined the agency in 2009 and became a vice president in 2017. “Because we are based in small communities, we must excel at writing and servicing personal lines and small commercial business efficiently,” Chip, who is now an agency partner, says. “Essentially, we are a generalist with two important niches that have helped fuel our growth: utilities and contractors.”

At his previous agency, Phillip gained experience and knowledge in the natural gas community. “I took that knowledge and approached a local natural gas utility to convince them that we had a risk management program that would cater to their specific needs,” he says.

Phillip wrote that account in 1987 and still services it today.

“What followed was a kind of chain effect, where more gas utilities heard about us and we started to write many additional accounts,” Phillip adds.

As that niche expanded, sights were turned to electric cooperatives, followed by water utilities. “We started to focus on specialization well before ‘specialization’ became a buzzword in the industry,” Phillip says.

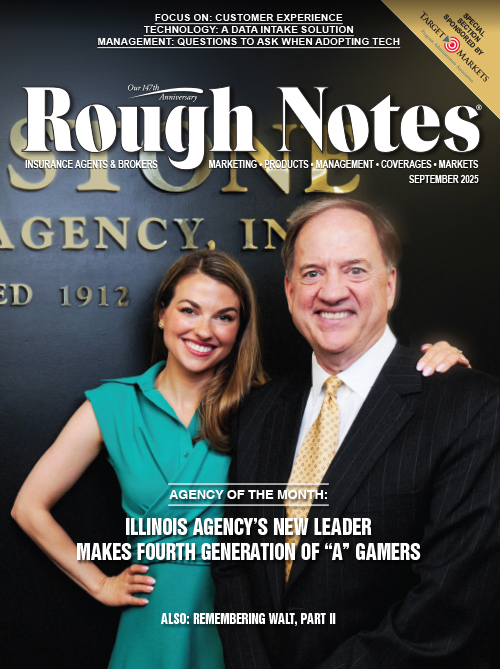

September Hill & Stone Insurance Agency

It’s fitting that Natalie Stone leads an agency founded by a woman, her

great-grandmother Esther Stone, who started the business in 1912. “Esther’s hard work ethic seems to have permeated all four generations,” says George Stone, Natalie’s father and agency principal, who joined the agency in 1979.

“We’ve all brought our ‘A’ game to the agency, each in our own way,” says, George, who recently turned the reins of the Lake Bluff, Illinois, agency over to his daughter because she was, as he says, outperforming him.

When George joined the agency, it was “primarily a personal lines and BOP-type shop,” he recalls, “but I saw an opportunity to become an agency that provided outstanding risk management services in order to reach bigger commercial clients and more affluent personal lines customers, both of which required strong risk mitigation services.”

“We pride ourselves on being completely transparent with our clients about what coverages we are providing and why so that they learn to trust us and provide us with the same transparency in return,” Natalie adds.

The agency developed expertise in the high-net-worth marketplace and garnered success. “We’ve achieved that by hiring brilliant people with high emotional intelligence who want to learn and teaching them insurance,” Natalie points out.

“Our growth comes organically,” she continues. “That’s our hallmark. We’ve reached the point now that we are growing at record pace in both premium volume and number of clients.”

The agency pays for its team members’ continuing education and is a regular contributor to fire departments, libraries, the arts, veterans’ organizations, the Chamber of Commerce and many other entities in the communities in which it resides.

October Rollo Insurance Group

It all comes down to two things, say Jason Rollo, the founder and CEO of Rollo Insurance Group in College Station, Texas, and Jackson, his son and agency president.

First, Jason unabashedly states that “God, family, and country serve as the underpinning for [our] life and business,” adding, “Our integrity is not for sale.”

Second, the Rollo agency thinks and acts locally while aggressively expanding. What does that mean? “When we acquire an agency or open an office, we make certain that there’s a proper fit and that it is staffed by people who share our values,” Jackson says.

“Everywhere we have a location, we believe that our [local] reputation is on the line,” he adds.

And, according to Chief Strategist and Talent Officer Keith Lane, the source of those principles can be found in the way that the agency is structured. “This is an agency that is not run by capital,” he says.

“Being family owned and operated is a strategic advantage,” Keith adds. “All our offices have a unity of purpose, to live out the Golden Rule and act the right way in everything we do,” both in the office and their volunteer structures.

With more than 65 offices to manage, the agency relies on the unity of its unique 12 Rollo Rules that serve as a guiding light for the basic mode of operation of all of its entities.

“People—the right people—that is our niche,” Jackson says. Adds Jason, “God is good. You should be too.”

November Merrill Insurance

When Brett Merrill and his father, Kent, agreed that Brett would purchase Merrill Insurance in Eustis, Florida, neither realized that a life-threatening event would color the meaning of perpetuation.

Kent’s first suggestion was “you’ve got to get younger.”

“I knew he didn’t mean me personally,” says Brett. “He was looking for me to build a management team from young people who could learn from our veterans.

“By the time we entered 2025, we had a management team with an average age of 34,” Brett continues. “[Almost] every one of them came from recommendations from clients and friends.”

Brett jumped right in, building on already instituted, forward-looking changes such as adding a claims advocate and in-house loss control. “We were entering our 100th year ready to achieve our goal of reaching $15 million in revenue,” he notes.

As one of his “perpetuation” actions, Brett began a personal estate-planning procedure.

Then it all hit the proverbial fan. Brett found himself dealing with an unexpected cancer diagnosis and the need for aggressive treatment.

That’s where the young and old leadership team jumped into action, operating smoothly with both clients and carriers as if nothing were wrong. “They really showed that they all were part of a legacy of caring, that they saw their job as protecting our clients and our company partners,” Brett recalls.

In a few months, Brett was declared cancer free and now, looking forward, the team plans to add more outside producers in order to expand further into Florida.

Driven by faith, Merrill Insurance has faced the unknown and has “perpetuated” in ways that could not be foreseen.

December Trailstone Insurance Group

When Mark Rodgers founded his agency in 2013, he didn’t envision a large agency, but rather a great mom-and-pop operation. However, after a conversation with an industry colleague, Mark realized that “if Trailstone stayed small, we could be left behind,” he says.

By the end of 2018, Colorado-based Trailstone had nearly $1 million in revenue and a small team of seven; today, the agency has 67 team members operating across seven states, generating more than $8 million in revenue.

Expansion began strategically with help from carrier partner Safeco. “We’ve always been intentional about where and how we grow,” Mark explains.

The agency also became a RamseyTrusted Provider in 2014, which gave them “a solid foundation of leads,” says Sales Director Ken Abel.

Trailstone has created a robust digital marketing engine, leveraging social media, YouTube, and educational content. Under the direction of Director of Marketing Marquece Cunningham, the agency built an in-house studio to produce professional, informative video content.

“We generate over 200 leads a month through YouTube and social media, and we’re just getting started,” Marquece says.

As the agency evolves, it continues to invest in technology. Its Instant Estimate Tool lets website visitors receive a real-time price estimate in seconds, and the use of digital avatars of employees in messages has seen the number of appointments booked online increase.

To keep the team motivated, the agency uses SalesScreen, a gamification platform that rewards achievements in both sales and wellness.

The agency’s transformation illustrates the value of embracing technology, which also led to Trailstone being named Safeco/Liberty Mutual Agent for the Future Outstanding Large Agency for 2024.