Coverholders and Risk Takers

By Frank Huver

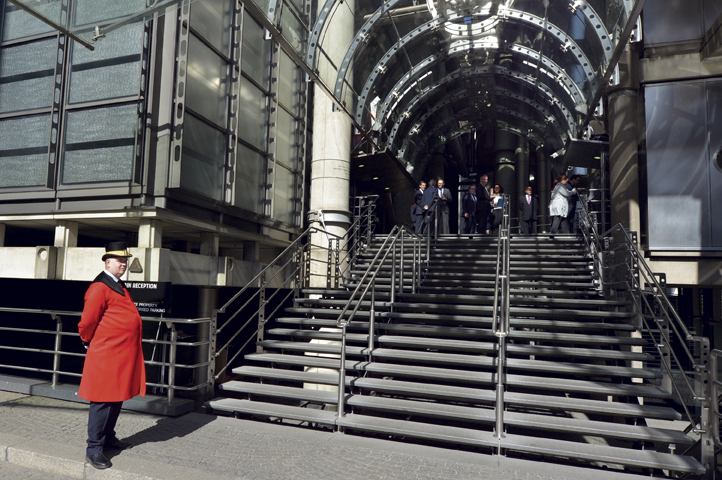

LLOYD’S OF LONDON: CHALLENGES AND SOLUTIONS

The venerable market retools to “build the most advanced insurance marketplace in the world”

Lloyd’s of London is the world’s oldest and most recognized insurance brand. Since beginning in a coffee shop over 330 years ago, it has developed a reputation for being an innovative pioneer in our industry. For example, did you know that Lloyd’s issued the first automobile coverage back in 1904? Given the paucity of information about this fledgling technology, the underwriters had to fall back on their maritime experience. The policy described the vehicle as “a ship navigating on land.” Lloyd’s was similarly in the forefront in writing coverage for other emerging risks such as airplanes and spacecraft.

Recent history has not been particularly kind to this venerable institution, causing a critical reevaluation of its entire business model. The impact of this period of self-imposed introspection has sent ripples across the Atlantic. Some coverholders (domestic agents with delegated underwriting authorities from London) have seen their programs either terminated or subjected to rate increases. Reinsurance also has become more difficult to place. Fortunately, Lloyd’s has taken the decisive actions necessary to reverse these negative trends, putting it on a path to strengthen its preeminent position in the insurance marketplace.

Last September, Lloyd’s reported a first-half pretax profit as a result of both investment gains and the cutback in underperforming business.

We will use this article to (1) examine some of the major issues that resulted in the London market’s need for “recalibration,” (2) review several of the more significant remediation strategies undertaken to improve matters, and (3) offer some common-sense suggestions for domestic agency specialists who are interested in pursuing a business relationship with Lloyd’s.

What happened?

A series of natural disasters resulted in Lloyd’s posting significant losses for two consecutive years. Three major hurricanes in the United States and the Caribbean in 2017 were followed by another set of devastating catastrophes (typhoons in Japan, wildfires in the U.S.) in 2018. The problems were exacerbated by the soft market; competition in the sector made it difficult to secure higher rates despite the losses.

Alex Lloyd-Baker, director of the corporate risk division of Lloyd’s broker CBC UK Ltd., describes what happened next: “As a direct result of unprofitability over the past few years during this ‘soft’ market, Lloyd’s placed significant restrictions on Syndicates in an effort to limit losses and improve results. Without a surplus of capacity, risk takers had to be very selective in the business they chose to underwrite. Consequently, some are finding it more difficult to find a home for fragile or borderline accounts than in years past.”

Lloyd’s issues aren’t limited to the recent string of underwriting losses. While long considered to be highly innovative, it also suffered from having the unfortunate reputation of being—to put it nicely—“technologically challenged.” The market has clung to a number of timeworn, arcane processes that impede efficiency. This deficiency has not gone unnoticed by the upper echelons of the Lloyd’s management team. In an interview with the Financial Times, chief executive officer John Neal observed that “insurance as a sector has got to speed up in a tech-driven world.”

Lloyd’s also has grappled with the increasing cost of doing business. An excerpt from the 2017 Lloyd’s Annual Report provides the most succinct explanation of why the issue of rising business expenses is such a serious concern:

There has been a slowdown in the rate at which expenses have been increasing relative to growth in premium, resulting in a small improvement in the

expense ratio. However, the Lloyd’s market expenses continue to be higher, as a proportion of net earned premium, than those of our competitor groups, particularly in relation to acquisition costs, reflecting Lloyd’s more extensive distribution chain.

The “extensive distribution chain” mentioned above refers to the numerous mouths that must be fed to bring a risk to London. For instance, the acquisition allowance for a U.S.-domiciled account must be significant enough to compensate a program administrator (also known as a coverholder), wholesaler, and retail agent. The market is also responsible for paying commissions to a London broker. This entity serves as a licensed intermediary between the coverholder and Lloyd’s.

Corrective strategies

Last year saw the unveiling of the Future At Lloyd’s project. This initiative aims to “build the most advanced insurance marketplace in the world.” The first iteration—called Blueprint One—outlines six innovations for improving workflow, taking advantage of technology, and becoming more efficient. The initial project phase is scheduled for delivery sometime this year. The six integrated solutions are:

- Complex Risk Platform. An automated mechanism for dealing with more sophisticated submissions. The platform will complement/augment the traditional face-to-face interactions that take place during the quoting, binding, issuance, and renewal of insurance/reinsurance business.

- Lloyd’s Risk Exchange. A system for processing less complex risks more quickly and efficiently.

- Claims Solution. A platform for expediting the claims process.

- Capital Solution. This feature will bring more capital into the marketplace by allowing investors who are not part of a licensed insurance entity to participate.

- Syndicate-In-A-Box. The Blueprint describes this initiative as a way to “bring innovative, accretive, and profitable business into the market for a set period without the need for a physical presence at Lloyd’s.”

- Services Hub. A set of high-value services to support the market’s business. This includes data sharing and access to Lloyd’s inventory of insights and analytics. The information will be available via an online platform.

London’s “recalibration” strategy is not limited to the implementation of operational improvements. As part of the annual business planning exercise that took place in 2018, those syndicates with three consecutive years of losses were required to produce a detailed remediation plan. In addition, all risk takers—regardless of overall performance—were required to submit corrective strategies for the worst-performing 10% of their business. In Lloyd’s nomenclature, this has become known as the “decile 10 review.”

The impact of the mandate was immediate. The review resulted in some syndicates exiting certain classes of business; rate increases were imposed on others. According to S&P Global, around 20% of the entire market was required to submit full remediation plans. This will not be a one-time exercise; the “decile 10 review” will continue to form a part of Lloyd’s annual review process.

The changes appear to be having the desired effect. Last September, Lloyd’s reported a first-half pretax profit as a result of both investment gains and the cutback in underperforming business.

A number of players in the U.S./London marketplace are encouraged by the results. Mark Rattner, executive vice president and chief underwriter at Fortegra, said: “Lloyd’s should no doubt be commended for taking action to address the challenges they have faced and are facing. As a big Lloyd’s supporter I am gratified to see this. That’s not to say we haven’t had to endure some short-term ‘pain.’

“Fortegra places a significant amount of reinsurance business with the London markets. There have been several incidents where the renewal terms received were incompatible with the historical profitability of the business. Regardless, the re-emergence of Lloyd’s is a good sign for the U.S. insurance marketplace over the long haul.”

Advice for U.S. agencies

The London market is definitely open for business. Here are some common-sense approaches domestic agencies should take as they consider starting a business relationship with Lloyd’s:

Develop a comprehensive business plan. The syndicates have finite levels of capacity to dedicate to new programs/products; they are looking to allocate this precious resource to initiatives that will generate the highest levels of underwriting profit. Agencies should be cognizant of this fact when developing their submissions. Remember to touch on the following topics in your proposal:

- Overview of the prospect universe. Talk about the preferred risk characteristics of this target audience. Are there any points of aggregation (associations, organizations, regulatory/oversight agencies, etc.) that you can access to improve your reach? What is the level of competition in the marketplace?

- Marketing strategies. Demonstrate your expertise by articulating how you intend to solicit business. Provide mockups of promotional materials if possible.

- Model policy wording and underwriting guidelines. No one knows the potential exposures and coverage “hot buttons” of this niche market better than you. Outline the product features and pricing structure needed to make the program successful.

- Administrative strategies. Explain how you envision handling incoming submissions. Tout the internal controls and workflows that have been implemented in your agency. Now would also be a good time to talk about any systems enhancements you plan on incorporating to make processing more efficient.

- Projections. Estimate production growth over an extended period of time (three to five years). Don’t forget to provide estimates of loss trending, as well as an explanation of the assumption set used to generate the results.

Be realistic when it comes to commission requirements. As noted earlier, the London market is focusing on the acquisition costs of the business it writes. One strategy to consider is a willingness to “put your money where your mouth is.” Reduce some of the up-front compensation requirements in exchange for the opportunity to share in back-end underwriting profit. Adopting this approach demonstrates your confidence in the success of your business plan and depicts you as a true “partner” in the venture.

Don’t be afraid to ask for help. Everyone’s heard the expression “too many cooks spoil the broth.” But when it comes to writing your program proposal, take all the help you can get. If there are deficiencies in your submission, seek assistance from industry experts to get them resolved. The CHART Exchange has a network of specialists from a diverse array of disciplines to help agencies in this regard. Services offered through our vendor partners include actuarial, claims administration, marketing, systems, legal, and more.

The author

Francis J. “Frank” Huver is senior vice president and chief financial officer at Rockwood Programs, a Lloyd’s Cover-holder for more than 15 years.