Coverholders and Risk Takers

By Frank Huver

GOOD THINGS COME TO THOSE WHO WAIT

Securing underwriting authorities requires a healthy mix of diligence and patience

Like most parents, I was tasked with teaching my children about the concept of patience. This was not an easy thing to do, as they were growing up in an era of instant gratification. More often than not, I’d have to resort to repeating one of my father’s favorite maxims: “Good things come to those who wait.”

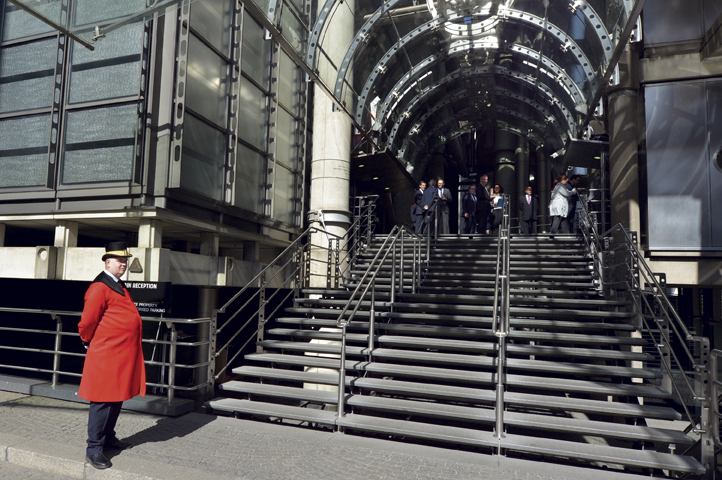

We can see the same impatience phenomenon at work in our own industry today. Lloyd’s of London possesses a well-earned reputation for innovation and expertise. As a result, it is often sought as the partner of choice for agencies that are seeking to launch a new program. Unfortunately, acquiring the appropriate underwriting authorities from the market requires undergoing a somewhat arduous due diligence process.

Anticipate receipt of a steady stream of communications from the syndicates that appear to question every aspect of the hard work done to date.

The length of time required to complete these steps often becomes a source of frustration for an agency that is eager to launch a product offering. The best counsel we can offer to these perturbed producers is: “Have patience; a little short-term forbearance can pay significant benefits over the long haul.”

Just what is involved in securing delegated underwriting authorities from the London market (sometimes referred to as achieving Coverholder status)? Let’s go through the process. Suffice it to say you’re going to need some help.

The first order of business is for the agency to find a sponsoring broker and a managing agent who are willing to support the initial application. A managing agent is a company set up to manage one or more syndicates on behalf of the members. These firms are responsible for employing staff, overseeing results, and supervising day-to-day operations.

A London broker also plays a key role throughout the appointment process, which is also called tribunalization. This broker is sanctioned by the Committee at Lloyd’s to serve as the domestic agency’s advocate in London. Among the tasks it performs are identifying the syndicates whose risk appetites are compatible with the market being targeted, shepherding the agent through tribunalization, and negotiating the terms of the binder agreement. A directory of approved brokers can be found on the Lloyd’s website. The CHART Exchange also possesses this capability as part of its portfolio of services available to clients.

The next step is to provide Lloyd’s enough information to determine whether an agency is eligible for coverholder status. Expect to provide the following data:

Company information. In addition to the entity’s name and address, applicants will be asked to identify any affiliated branch offices through which policies and other insurance documents will be issued.

Underwriting and claims roles. What level of authority is being sought (prior submit, full underwriting, and so on)? Will the prospective coverholder also be handling claims? Entities that assume both responsibilities will be asked to articulate how duties will be segregated between the underwriting and claims departments.

Business strategies. This section allows the applicant to demonstrate the depth of its expertise in the target niche. Key areas of focus include an overview of risk characteristics, marketing strategies, rating methodology, and anticipated premium and loss results.

Ownership and key staff. Describe the qualifications of the individuals who will be involved in the administration of the prospective program. Include details of their insurance experience, their educational backgrounds, and their professional designations.

Financial information. Financial statements reflect a firm’s stability and management practices. At a minimum, be prepared to provide income statements and balance sheets that have been audited or reviewed by a qualified professional.

Systems and controls. Lloyd’s will need to verify that processes and procedures are in place to ensure that compliance with minimally acceptable service levels can be achieved. Areas that will receive particular attention include turnaround times, risk evaluation protocols, and the quality of output documents. The market also will seek assurances that appropriate in-house policies are in place to protect against bribery, sanctions, money laundering, and other financial crimes.

Licenses. All applicants must be able to demonstrate that they are authorized to transact insurance in all states in which they plan to do business. Because the vast majority of Lloyd’s policies are written on a nonadmitted basis, proof of surplus lines licensure also will be required.

Completing the application process puts us at the stage where things might become especially frustrating. Let’s quickly review the effort expended thus far. The agent has developed a complete and compelling program submission. Specialists from various disciplines have provided actuarial analysis, legal opinions, marketing strategies, and other forms of support. Lloyd’s has finished thoroughly dissecting your agency’s financial history, internal workflows, and business experience. Mission accomplished, right?

Wrong. Anticipate receipt of a steady stream of communications from the syndicates (risk takers) that appear to question every aspect of the hard work done to date. The proposed rate structure is inadequate. The target niche is not well defined. The policy form does not appropriately address all of the exposures.

Our advice at this juncture can be distilled down to one word: Relax. This is only a matter of the market doing its due diligence. If your agency’s experience hasn’t already taught you the importance of developing a thick skin, this is the time to learn the lesson. Look at this as a unique opportunity—a chance to demonstrate the depth of your expertise to effectively counter any objections made by the market. At the same time, remember that our friends from across the pond know a thing or two about insurance as well; keep an open mind to new ideas or strategies. A little patience goes a long way.

A number of agencies we’ve encountered are eager to launch a new program while still going through the due diligence process. After all, they already possess the business strategies, technical expertise, and distribution channels that are needed to get started. That’s why CHART developed an incubator initiative. A client partners with an existing coverholder to help expedite entry into the marketplace.

Of course, compatibility is the key. CHART’s Glenn Clark explains it this way: “We operate on a basic philosophy that compatibility, or chemistry, between the prospective client and mentoring agency is of paramount importance. From my experience, it is extremely rare to have any kind of partnership succeed unless it is established with complete candor and openness. The alignment of interests between the prospective client and mentoring agency becomes apparent fairly early in the process.”

The CHART team assesses both the business opportunity and level of support the mentoring coverholder is being asked to provide. Is the expected distribution to be local, regional, or national in scope (licensing and compliance)? Does the prospective client have the administrative capacity needed to handle the anticipated workload?

The CHART Exchange can serve as a resource for helping specialist agencies launch new programs or products in the U.S./London marketplace. We believe that CHART’s client-centric approach puts us in a position to advocate for business submissions seeking placement through Lloyd’s. We have a number of tools at our disposal, including brokerage capabilities, and an extensive vendor network representing various disciplines. For more information, visit the CHART Exchange website or submit questions to info@chart-exchange.com.

The author

Coverholders and Risk Takers is a periodic column written by principals or “early adopters” of the CHART Exchange (www.chart-exchange.com). The group’s core mission is to facilitate more U.S./London commerce via personal interaction, education, and technology. Francis J. “Frank” Huver is senior vice president and chief financial officer of Claymont, Delaware-based Rockwood Programs, a Lloyd’s coverholder for more than 15 years and a CHART Exchange early adopter.