Coverholders and Risk Takers

By Frank Huver

DIVIDED BY A COMMON LANGUAGE

Five steps for getting your new program or product in front of the London market

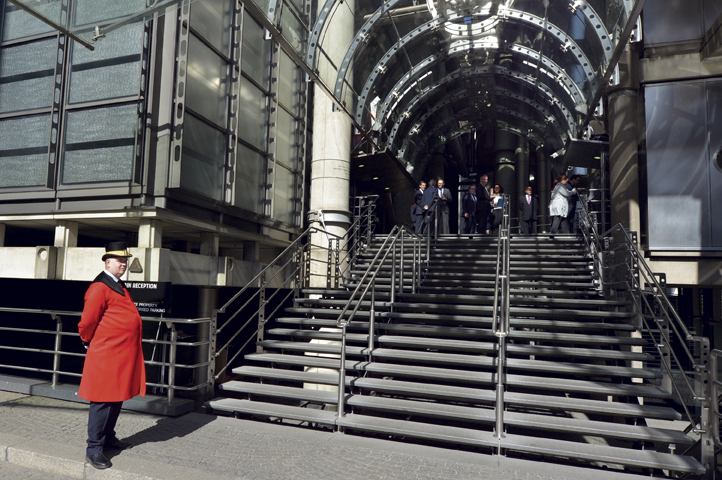

For many U.S.-based agencies, the London market is something of a paradox. Lloyd’s is the oldest, most recognized insurance brand in the world. It has a well-earned reputation for being both innovative and savvy evaluators of risk. These qualities alone make it a preferred underwriting partner for any new program or product.

Despite these positive attributes, a number of domestic producers are still reluctant to pursue a business relationship with London. The reason: There is a perception that securing the necessary appointments and underwriting authorities is a difficult and time-consuming task. Unfamiliar terminologies and nomenclature used by Lloyd’s personnel confuse things even further.

This perception reminds us of a quote frequently (and as it turns out, mistakenly) attributed to George Bernard Shaw: “England and America are two countries divided by a common language.” We can vouch for the accuracy of this statement.

[T]here is a perception that securing … appointments and underwriting authorities is a difficult and time-consuming task. Unfamiliar terminologies and nomenclature … confuse things even further.

Fortunately, the time spent working at both Rockwood Programs and CHART 2.0 allows me to serve in the role of translator. As a veteran practitioner within the program administration space, Rockwood can “speak the language” of domestic insurance agents. Our 16 years of experience acting as a coverholder (firm with delegated underwriting authorities from Lloyd’s) uniquely positions us to succinctly communicate with the syndicates from London.

So exactly how does a U.S.-based agency specialist get their new program or product idea in front of the London market? We’ve broken the process down into five steps:

Step 1—Quantify the opportunity. Companies interested in launching a new offering usually have a compelling story to tell. The business idea can be the result of years of experience providing coverage to a particular segment, recognition of an underserved niche, or identification of a new risk exposure. It is critical that this story be communicated in such a way that it’s understood by a prospective risk taker.

Any new program submission should address a number of key topics. What does the proposed policy intend to cover? What are the homogeneous risk characteristics of the target audience … and what is the size of the prospect universe? How does your planned business model differ from the competition? What are the forecasts for future premium and loss development?

All this information needs to be positioned in an organized manner. A great template to follow is the program questionnaire used by CHART. This document provides a standardized format through which the various components of the new business concept can be articulated. Part of the questionnaire protocols call for the exchange of nondisclosure agreements at the outset to protect data confidentiality and the client’s intellectual property.

Step 2—Assess the input. Once all the information has been compiled, it is a worthwhile exercise to look at the result in an objective, unbiased manner. It may even be prudent to secure feedback from experts in such diverse disciplines as:

- Review policy language, applications, claims handling processes and procedures, etc.

- Market analysis. Review the competitive landscape, including the coverage forms, rates, and promotional methodologies used by the other “players” in the targeted space.

- Marketing plans. Seek guidance on the development of innovative strategies for promoting the new program.

- Portfolio review. Do you have an existing block of business that will be transitioned into the new program? Consider the possibility of having an extensive analysis of loss results, risk demographics, and other relevant factors performed.

CHART 2.0 maintains a network of knowledgeable vendors capable of lending their expertise to the development of a new program proposal. Regardless of who is providing the feedback, agencies must be prepared to accept the fact that it is not always possible to implement every new program or product concept.

Step 3—Identify potential partners. This is euphemistically referred to as the “matchmaking” phase of the process. One of the more unique characteristics of the London market is its diverse array of underwriting philosophies. The effort here is to identify which syndicates possess the risk appetites that most closely align with the coverage needs of the proposed program.

While Lloyd’s is an excellent market choice, it is not the only one available. To increase the likelihood of approval, other options should be considered as well. If the chances of successful placement appear more favorable closer to home, plan on submitting the program proposal to one or several domestic carriers with compatible appetites. If circumstances warrant, it may even be prudent to consider nontraditional alternative risk transfer mechanisms, such as Risk Retention Groups, captives, etc.

Step 4—Finalize the submission. Once all the required information has been compiled, it is time to initiate the task of arranging the data into a program submission structure acceptable to the selected market.

Our experience with CHART 2.0 is especially relevant here. First of all, we strive to make the placement process a collaborative effort; the program package will not be submitted to any prospective carrier partner without the prior approval of the client.

Next, the CHART team will liaise with the market in order to respond to additional information requests, facilitate dialogue related to changes in coverage or rate, etc., in a timely manner. Finally, we hold all parties—both the markets and the submitting agency—accountable to any commitments they make regarding turnaround times and approval deadlines.

Step 5—Solve for the issue of administration. Most program proposals seek delegated underwriting authorities from the markets so the processing of business can be handled in-house.

Getting appointed as a coverholder (the London equivalent of a domestic program administrator) takes some time. An agency must first find a sponsoring broker and managing agent willing to support the application. Once this is complete, Lloyd’s will then take steps to validate the agency. This entails a thorough analysis of the firm’s financials, business experience, back-office capabilities, etc.

During our time working with the London markets, CHART 2.0 has encountered its fair share of specialist clients who have expressed concerns over the length of time it takes to secure delegated underwriting authorities from Lloyd’s. While they understand the need for due diligence, there is a frustration over the delays in getting a potentially great new program idea to the implementation stage.

We can provide a solution to this problem via an incubation initiative. Under this facility, we can team the new client with a firm already possessing the necessary underwriting authorities, state licenses, back-office administrative capabilities, etc., to transact business on behalf of Lloyd’s. Agreements made between the two parties prior to launch govern such issues as contract duration, duty segregation, revenue sharing, and expiration ownership. This solution inures to everyone’s benefit.

CHART has been an advocate for the U.S./London marketplace for nearly five years. The recent 2.0 “reboot” resulted in a shift away from a collegial association model in favor of a more client-centric approach. Our involvement with the customer does not end with the successful placement of a new program or product. The team will continually work with the agency to evaluate business results, modify marketing strategies, identify potential coverage enhancement opportunities, and monitor claims activity.

For more information about CHART and its capabilities, we invite you to view our website (www.chart-exchange.com). Questions and inquiries can be submitted to info@chart-exchange.com.

The author

Coverholders and Risk Takers is a periodic column written by principals or “early adopters” of the CHART Exchange (chart-exchange.com). The group’s core mission is to facilitate more U.S./London commerce via personal interaction, education, andtechnology. Francis J. “Frank” Huver issenior vice president and chief financial officer at Claymont, Delaware-based Rockwood Programs, a Lloyd’s Cover-holder for more than 15 years and a CHART Exchange early adopter.