Coverholders and Risk Takers

By Glenn W. Clark, CPCU

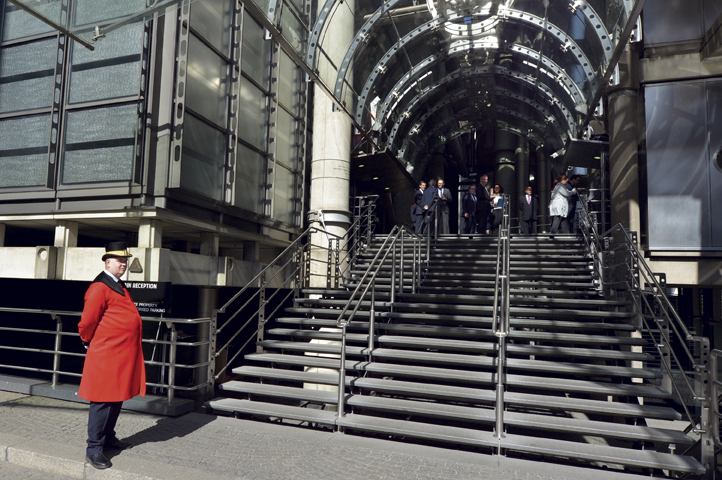

PATHWAY TO THE LONDON MARKET

U.S. producers can call on the expertise of a veteran program manager

“First they ignore you, then they laugh at you, then they fight you, then you win.” —Mahatma Gandhi

Everyone has had a new product or business idea, and some have them every day. What separates the ones who “get it done” from the thousands of others who do not cross the finish line? Divine providence, luck, timing, financial backing, and connections all combine to have an impact on the success or failure of a new concept.

From personal experience gained from launching new programs, I know you are going to meet many kinds of people on your journey. Beware of some of these individuals, as their involvement will actually impede your progress. They can be broken down into five distinct segments:

- Naysayers. We also categorize this group under the name “With Friends Like These.” You can depend onthem to quickly criticize the merits of any new idea, while conveniently overlooking the innovative approaches you’ve articulated. You definitely need thick skin when reviewing their feedback.

- Smoke Blowers. Another faction offers empty input, but at least it doesn’t damage your ego too much. Their feedback is not actionable as it lacks any constructive criticism. While it is nice to receive their praise, the true finisher will quickly realize it is all smoke being blown.

- Consultants. Members of this group certainly do not adhere to the axiom that money can’t buy friends. They are more than willing to champion your new product or program idea … for a price. More often than not, these individuals will charge you for their “expert” help and you are often left with the bill and no completion.

- Cheerleaders. While it’s great to have them on your side to motivate the crowd, you need true athletes on the field when the game gets tough.

- Fence Sitters. This faction is arguably the worst of the lot. Benjamin Franklin was probably thinking of them when he said: “A false friend and shadow attend only when the sun shines.” Fence sitters appear to back you but offer no tangible support when it is needed most. Of course, they will engage with you after success is attained.

Fortunately for business specialists, resources are available in the marketplace to assist them in the implementation of a new product/program idea. We built CHART 2.0 to be such a resource, designing our operating model to deliver optimal benefit to those who turn to us for assistance in placing business with the London market.

Everyone has had a new product or business idea, and some have them every day.

The natural inclination for most entrepreneurs who read about CHART’s strategic philosophy is to think: “That all sounds well and good, but what’s in it for me and my business?” Let’s take some time to do a deeper dive into the value proposition for specialist agencies seeking to establish a relationship with the London marketplace.

- We are going to make you work. To paraphrase another famous quote attributed to Benjamin Franklin: “CHART helps those who help them-selves.” There are no better advocates for an agency’s area of specialization than those who actually do the work. Clients must invest the time and effort to clearly articulate information such as the product(s) being sought, the unique demographics of the target audience, the competitive scene in the marketplace, and so on. CHART has developed a program questionnaire to help structure this process. Once this data is available, our team can get to work to find the markets with the most compatible risk appetites.

- CHART is with you all the way. Lloyd’s of London is the world’s oldest and most recognized insurance brand. This reputation can be intimidating to U.S.-based producers—especially those who are entering the program space for the first time. Our team has significant experience in the London market. We will guide you through every step of the process—from initial submission through final approvals. CHART has recently secured internal brokerage capabilities within London. This means we now have the wherewithal to support clients through all phases of the program business life cycle. Our team can collaborate on the development of submissions, secure necessary delegated underwriting authorities (tribunalization), handle placements, and facilitate new growth via product expansion, cross-sell opportunities, and so on.

- All communications will be honest and unfiltered. Earlier we warned about the dangers posed by “smoke blowers.” It is not always possible to implement every new program or product concept. This could be attributable to a host of factors, including level of competition, rate adequacy, or current regulatory environment. The CHART team will always be respectful toward our clients and their ideas, but we also will be honest. If the proposal has deficiencies that cannot be overcome, we will clearly explain the issues and share feedback from the markets.

- Meeting the need for instant gratification. A lengthy due diligence process must be undertaken before delegated underwriting authorities from London can be secured. Agencies that are looking to expedite the launch of new programs into the marketplace can avail themselves to CHART’s incubation initiative. Under this arrangement, clients can be teamed with a firm that already possesses the necessary authorities, state licenses, back-office administrative capabilities, and so on to transact business on a national scale. Agreements made between the two parties prior to launch govern such issues as contract duration, duty segregation, revenue sharing, and expiration ownership. This strategy inures to everyone’s benefit.

- It’s good to have friends. CHART has a network of vendor partners with expertise in a variety of disciplines. We can tap into this network to help clients address issues related to actuarial analysis, claims administration, systems development, marketing, legal support, and more.

“I have not failed. I’ve just found 10,000 ways that won’t work.”

—Thomas Edison

What do you do with all the naysayers, smoke blowers, faux consultants, cheerleaders, and fence sitters once you’ve crossed the finish line and delivered on your new idea or product? Forgive them. They will be your second wave of potential buyers who will help grow your program.

For more information about CHART and its capabilities, we invite you to view our website (www.chart-exchange.com). Questions can also be submitted to us via e-mail; send your inquiry to info@chart-exchange.com.

The author

Coverholders and Risk Takers is a periodic column written by principals or “Early Adopters” of the CHART Exchange (www.chart-exchange.com). The group’s core mission is to facilitate more U.S./London commerce via personal interaction, education, and technology. Glenn W. Clark, CPCU, is owner and president of Rockwood Programs and the “Earliest Adopter” of the CHART Exchange. Email him at Glenn.Clark@rockwoodinsurance.com.