AGENT VOICES 2021

Agency professionals look forward to a return to normal, but caution carriers on claims

By Kevin Jenné, IPC

Much has been made of the post-pandemic world that awaits us. It’s a time of returning to the office, visiting clients in person again, and maybe even permanent adoption of some of the digital tools that made remote working easier.

In our annual survey of independent agents, Channel Harvest Research expected to hear some strong opinions from independent agents on these topics—and we did. But we were somewhat surprised by the persistence of more traditional themes.

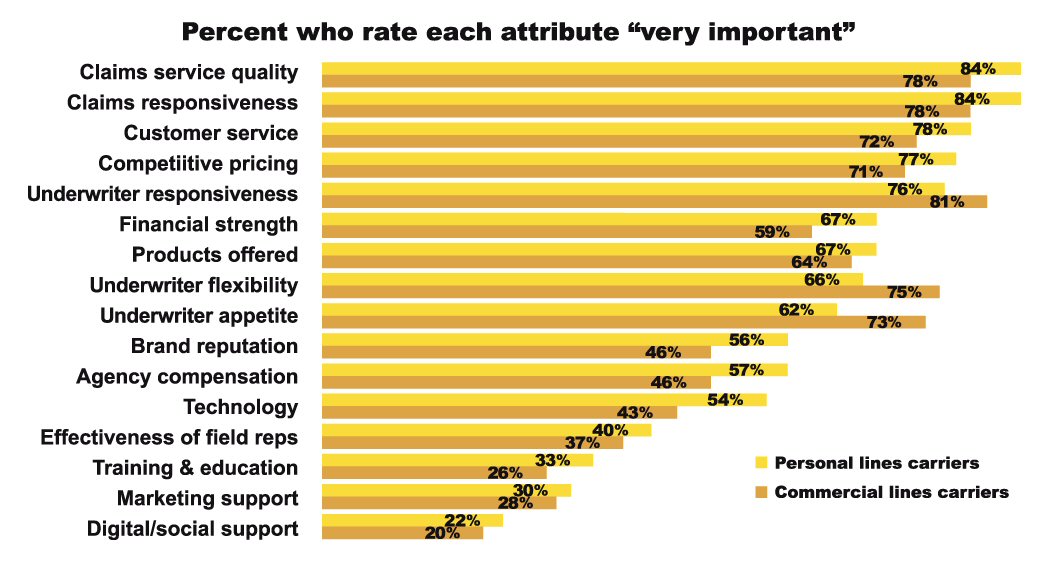

Carriers are pretty familiar with what’s important to agents. Competitive pricing, compensation and ease of doing business rank high, of course, but delivering a great claims experience nearly always rises to the top of the list.

In this year’s survey, Agent Voices2021: Unexpected Challenges, claims service quality and claims responsiveness rank number one and number two in importance for agents when they think of their personal lines carriers, and number two and number three when they refer to commercial lines, behind only underwriting responsiveness.

Nearly 2,000 independent agents responded to the survey, which was developed in collaboration with a number of carriers.

Trusted partnerships

When considering how best to equip agents for success, carriers often focus on point-of-sale factors like pricing and ease of doing business. But agents also consider long-term factors when choosing where to place a customer—like reliable, caring claims service. In our 15 years of surveying agents, they’ve continually reminded us they aren’t just trying to place a policy; they want a customer for life, and that means being able to trust a carrier partner to keep the insurance promise.

In general, agents see business setbacks resulting from COVID-19 as temporary. While circumstances were dire at the time, operations are improving with the pandemic in the rear-view mirror.

Many agents prefer not to get involved with claims unless they have to, but too often that happens when the carrier doesn’t keep the policyholder well informed. A carrier that keeps both the agent and policyholder informed on claims makes for happy agents who will entrust that carrier more with their future business.

Why are we asking agents these questions in the first place? Channel Harvest surveys reveal that agents have an informed perspective of carrier operations. While they may not be on the inside, what they see from the outside is often quite telling. Take for example this comment by an agency claims professional in California regarding claims service: “Please pay attention to the caseloads placed on your adjusters. Many have too many claims to properly handle and too much is slipping through the cracks.”

While carriers might see a near-term expense benefit of reducing claims-handling staff and increasing their caseloads, the cost of eroded trust in lost agent production may take longer to surface, and much longer to recover. Instead, this is where a carrier might want to consider investing in some process automation to lighten the load on claims handlers, especially for a high volume of very similar claims.

Smarter use of talent

It’s a recognized fact that insurance is suffering a talent drain, as experienced, seasoned claims adjusters retire and the supply of younger talent isn’t equal to the demand. So, this plea from an agent in Michigan takes on more urgency: “Please don’t underestimate how much good underwriters (UW) and claims personnel affect your business/retention.”

In addition to recognizing the contributions of good UW and claims personnel, it’s incumbent on carriers to anticipate their retirements by embracing machine learning, for example, to reduce routine workloads on adjusters, enabling them to focus attention on more complex issues. The National Alliance and some carriers are using virtual reality to augment training for newer staff, exposing them to a wider variety of scenarios more quickly than they would see on the job.

Nothing works like positive reinforcement, and we heard it loud and clear again this year, as in this observation from an agency principal in Georgia: “Your claim service is amazing. I get feedback all the time about how responsive and helpful the adjusters are. That’s a result of good company training and culture.” Carriers should take positive comments to heart and view them as encouragement to keep going, to keep improving.

Positive reinforcement also helps to reconfirm where future investment in people and processes is warranted.

COVID effect

In general, agents see business setbacks resulting from COVID-19 as temporary. While circumstances were dire at the time, operations are improving with the pandemic in the rear-view mirror.

Respondents generally anticipate a big recovery post-COVID, as nearly three-fourths (73%) expect increases in revenue in 2021. As expected, agency revenue took a hit, with 59% reporting increased revenue in 2020, compared with 70% in 2019 and 22% reporting decreased revenue in 2020 compared with 12% a year earlier.

The same was true for policies in force: About half reported an increase versus 60% in 2019, while 23% decreased versus 13% in 2019.

Many agencies still have employees working remotely, and it’s unclear if that will remain the case. A little over half (54%) reported having at least some working remotely when the survey was conducted in the first half of the year, with 14% of respondents telling us all of their staff is still remote. Most (82%) have had employees working remotely at some point during the pandemic, while 18% have been able to keep everyone in the office throughout.

Return to meetings

Most agents are again meeting with customers (74%) and prospects (70%) face-to-face, which is key for building relationships. But a much smaller percentage is back to meeting in person with carrier representatives (52%) or vendors (46%), which is per-haps due to those companies’ policies rather than the agents’ choice. Some agents were quite vocal, in fact, urging their carrier reps to get back in the field for face-to-face meetings. An account manager from Colorado was very clear on this point: “Stop locking up their employees in their homes and send them out into the field for that in-person contact. Field reps can still do their jobs and protect themselves at the same time.”

There was a lot of speculation during the pandemic about the extent to which agencies would adopt digital processes to overcome the challenges of a geographically distributed workforce. According to our findings, this was less of a factor than expected. Only a few agencies started using digital tools to deal with the effects of the pandemic. The exception was videoconferencing such as Zoom, which one-third (35%) started using because of the pandemic, while 43% were already using video-conferencing before then.

About one in eight (12%) started using e-signatures with their clients because of the pandemic, while 75% were already doing so. About one-third (32%) were using internal tools like Microsoft Teams with their employees before the pandemic, and another 14% started doing so to help their staff communicate.

The author

Kevin Jenné, IPC, is research director at Channel Harvest and previously was director of agent and consumer research at one of the leading omni-channel property and casualty carriers. He can be reached at kevin@Aartrijk.com. For more information on the Channel Harvest survey of independent agents, visit www.channelharvest.com.