Members of The Dunn Group executive team. From

left: Bryant Dunn, Chief Operating Officer; Josh Palmer,

President of Swan Morss; and Hank Dunn, President.

Formed during the Great Depression,

agency embodies founder’s values

around family, ethics and charity

By Christopher Cook

Celebrating a nonagintennial—that’s a ninety-year anniversary for the non-Latin speaking folks—is a rare experience. That’s what The Dunn Group, Towanda, Pennsylvania, is doing right now.

It all started when Henry E. Dunn graduated from Penn State with an electrical engineering degree but couldn’t find a job due to the Depression. “My dad started Dunn Insurance Agency in 1933, renting one room from the Masonic Order located across the street from where one of our offices is now,” says Chairman of the Board Henry C. Dunn.

Henry E. would go on to volunteer to serve during World War II, where he received a Purple Heart and Bronze Star for his actions fighting with General Patton’s Third Army Corps in the Battle of the Bulge.

Henry E. would go on to volunteer to serve during World War II, where he received a Purple Heart and Bronze Star for his actions fighting with General Patton’s Third Army Corps in the Battle of the Bulge.

He brought his leadership skills back to the agency after serving in WWII. “My dad passed away in 1969 at the age of 58; I was 19 and a sophomore in college when he died, so I never got to work with him,” Henry says. “I’ve always tried to hold up to his standards, which were all about family, business ethics and charitable values.

“When he died, our family attorney appropriately advised my mother to sell the agency, since the main producer had passed away and the agency was built on his reputation. I asked my mother to not sell it and allow Gerald Corbet and myself to purchase the agency. The family attorney pulled me off to the side and said, ‘You know you’re going to fail.’ That resonated with me my whole career.”

Henry graduated from Bethel College in 1972 and returned to the agency. In the mid-70s, one of the agency’s biggest lines was personal auto. The insurance carriers cut that commission by 25%; at the time, this was a large part of the agency’s volume. To help replace lost income, Henry decided to become a real estate broker. Today, the real estate side of the business, which operates in four of the agency’s locations, is run by Henry’s wife, Sarah.

“One of the benefits to the real estate side is that the Realtors will refer homebuyers to the agency for home and auto insurance,” Henry says.

In 1993, Henry’s son Hank, now holding the title of president, joined the agency. In 2007, Henry’s youngest son Bryant, now serving as chief operating officer, joined.

Looking to expand into New York, in 2016, Henry Dunn Insurance acquired Swan Morss (which is celebrating its 170th anniversary) and created The Dunn Group.

“Dan O’ Connell, one of our now-retired former partners, was looking for a transition plan, and Hank, Henry and Bryant were looking for a growth opportunity outside of Pennsylvania; the timing was ideal,” says Josh Palmer, president of Swan Morss.

“I had met with Rich Swan and Dan before we bought their agency; we were all similar regarding family values,” Henry adds. “They brought additional strengths where we weren’t as strong.”

“I’m like the middle child between the older and younger brother,” Josh adds with a laugh. “I think more than anything the natural fit was our commitment to our teams and being family oriented.” (More on that later.)

The Dunn Group currently operates in seven locations across Pennsylvania and New York.

Operations, education and tech

To develop strong relationships with clients, especially those in commercial lines, the agency takes a risk management approach. “We look to identify current and future challenges our business clients may face,” Bryant explains, “and once we identify that, we discuss solutions with their team to better improve their operations and risk profile.

“This approach has helped us grow quite extensively in the commercial lines department; we’re up 18-plus percent year over year.”

The Dunn Group also offers client seminars, discussing topics like OSHA, driving safety and cyber insurance. Many team members have seats on the safety committees of commercial clients.

On an agency development level, “we’re visionaries and use vision boards,” Hank says. “We ask our employees what their vision of the company is, and what ideas they might have. There are no crazy ideas here. If they’re willing to take ownership, we’ll put it on the vision board.

“We have visions for the year, and they’re placed on everyone’s desktop, so everybody’s involved. Even though we’re challenged with multiple branches, it loops everybody together.”

One employee idea driven from this process led to the creation of the agency’s education center, Dunn U. “It’s an onboarding process, where we educate clients on technology we provide or extended services (HR, benefits, risk management and more) we offer,” Josh says. “It’s very unique to us.”

Along with the education center, The Dunn Group is passionate about team member learning. “We push all the different designations and pay for all continuing education because insurance is intangible,” Henry says. “You can’t see it; it’s in your knowledge and your capabilities. We’re big on that.”

To stay current on the latest workload and efficiencies trends, along with client needs and expectations, the agency focuses on technology. “The future is constantly changing, and we want to evolve with it,” says Hank. “Technology has expanded our reach to 26 states.”

The agency’s benefits management system has helped expand its growing division. “It gives our clients the ability to do electronic online enrollment easier and they can be more transparent with their benefits plans,” Hank says. “We have videos on the portals that explain benefits options to our clients’ employees so that their HR isn’t tied up with several phone calls.”

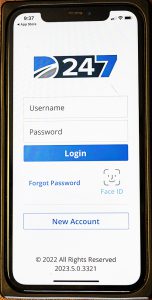

Providing clients with instant access to their policy information, the agency’s Dunn 24/7 app is also available.

Providing clients with instant access to their policy information, the agency’s Dunn 24/7 app is also available.

“Right now, it’s available to our personal lines clients,” Josh says. “For example, if they have their phone and get in an accident on the highway, they can pull up their policies and insurance card.”

“Right now, I’m investigating A.I.,” Bryant says. “We’re always looking to stay ahead and be one of the more innovative agencies out there through our processes and the technology we have implemented.”

Products and partnerships

Considered to be generalists, The Dunn Group offers a wide range of products from personal and commercial lines, financial services, real estate services and employee benefits.

“Benefits is a fast-growing area for us; we offer captive products, self-insured administration, ICHRAs, executive benefits, voluntary, individual products and more,” Hank says. “Our team works with our clients’ needs even outside of insurance, so the model is always changing or we’re taking on special projects. Becoming a true partner in the relationship, along with a willingness to change, is key.”

“We push all the different designations and

pay for all continuing education because

insurance is intangible. You can’t see it; it’s in your knowledge and your capabilities.

We’re big on that.”

—Henry C. Dunn

Chairman of the Board

The Dunn Group

The agency also focuses on some niche areas.

“Our primary niche is the landscaping industry; we write over 100 landscapers up and down the east coast between Maine and Florida,” Bryant says.

The Dunn Group hosts seminars for landscape clients and hosts speakers from the Snow & Ice Management Association (SIMA).

“A lot of our landscapers push snow in the wintertime, so we wrap around them during all seasons,” Bryant says. “We discuss driver safety training, OSHA, legislation that’s passed. We sit on these clients’ safety committees and attend their annual and semi-annual meetings.”

The Dunn Group also has specialties in manufacturing and Bitcoin mining insurance.

The development and growth of the agency can also be seen in its partnerships. “When I started in the industry 17 years ago, I met Scott Addis at a Chubb event in Philadelphia,” Bryant says. “Hank, Dad and I stayed connected with Scott over the years; when he developed the Beyond Insurance Global Network (BIGN), he approached us to see if we’d be interested in joining, which we did in 2019.

“BIGN has semi-annual meetings throughout the United States, where we come together as industry experts and share ideas to help each other cultivate innovative ways to help clients. The great thing about this group is that we’re all risk advisors, so we all take the same approach as far as how we want to help our clients.”

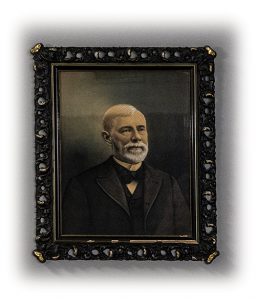

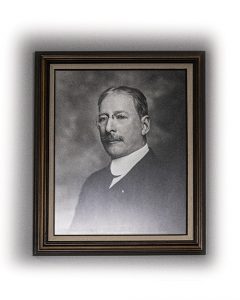

Celebrating 170 years of service, Swan Morss honors its founder and his family in its Corning, New York, office. Charles Swan (left) founded the agency in 1853. His sons, Charles Jr. (center) and Fred (right), joined the agency in the late 1800s.

In the late 1990s, Swan Morss became part of a local cluster of agencies that “work together to share resources, ideas and thoughts,” Josh says. “The group gives us a larger breadth to support our clients.

“Dan O’Connell had the idea and did much of the heavy lifting. Bryant and I have been fortunate to continue that leadership role.”

“Collectively, there’s 50 million-plus premium dollars in the group; that grabs the attention of our carrier partners,” Hank says. “We meet monthly via Zoom, and then annually in person.”

In 2019, the cluster expanded from seven to 14 agencies across New York and Pennsylvania.

Culture and community

The third generation of Dunns—and Josh—stay focused on operating the agency based on its founder’s principles. “Our management style is very family based and we’re willing to listen,” Hank says. “Our employees are part of our family and we’re willing to bend on their various needs that they may need to attend to.”

“I’m like the middle child between the

older and younger brother. I think more than anything the

natural fit was our commitment to our teams and being

family oriented.”

—Josh Palmer

President

Swan Morss, part of The Dunn

Group

“Josh and I still do all the interviews; from the get-go we make it apparent that this is a family company,” Byrant adds. “I still remember interviewing one person who said that she couldn’t attend her son’s graduation because she didn’t have any more PTO, and I just couldn’t fathom that.”

As a way for team members to share their opinions, “we put groups together for meetings; they’re like sounding boards,” says Hank. “They can vocalize concerns they have and changes they’d like to see. There’s always an executive team member at those meetings.”

Another group formed is the agency’s team-member-run WTF—or What the Fun—committee. “They come up with fun monthly events to keep things moving and shaking and enjoyable in the offices,” Bryant says. “We have a lot of fun throughout the year, which I believe helps the overall culture within offices.”

A meeting a few years ago led to implementing Jeans Friday, where team members wear jeans at the end of the week for the price of a dollar. Each year, a vote determines which community charity receives the collection.

Speaking of giving to community, “What don’t we support? I personally sit on 11 nonprofit boards,” Hank says.

“We encourage our team to get on a committee, get involved, and give their time,” adds Josh, “We don’t make them use PTO for board meetings.”

Team members spend significant time supporting schools, nonprofits, hospitals, community groups, and youth sports.

“We ask our employees what their vision of the company is,

and what ideas they might have. There are no crazy ideas

here. If they’re willing to take ownership, we’ll put it on the vision board.”

—Hank Dunn

President

The Dunn Group

My dad was very charitable, and I’m a strong believer in charity work; I still sit on six boards,” Henry says. “My philosophy with my kids is that it’s good to sit on boards, but you better be doing something for them to make them better.”

The agency also holds an annual golf event. “We pick up the tab for that day and give the money to a charity. We invite insureds, to thank them for doing business with us but also to encourage them to mingle and do business with each other,” Henry adds.

“Our pillars have always been our clients, our colleagues and our community,” Bryant says. “A consultant recently looked at [our giving records] and said we gave 80% more than a typical agency our size. We’re proud of that.

“We wouldn’t be here 90 or 170 years without the time and energy our past and present team members have put in; 100% of the credit is given to them, because they’ve been pivotal to our growth.”

—Bryant Dunn

Chief Operating Officer

The Dunn Group

Rough Notes is proud to recognize The Dunn Group as our Agency of the Month. Its family-oriented culture, its longevity—as it celebrates milestone anniversaries this year—and its dedication to clients and the communities it serves stand out in the industry.