Do you know where your firm compares to insurance

industry averages for compensation decisions?

By Tommy McDonald

Compensation represents a substantial expense for most insurance agencies and brokerages. Therefore, the approach to compensation has a significant impact on the profitability and value of a firm. However, many firms have very little understanding of how a compensation strategy can help drive revenue and organic growth. Even fewer know what their peers, competitors and top-performing firms are doing. And while a majority of firms aim to improve their value, few are willing to alter compensation structures to achieve it.

Last year was a robust one of hard-market-driven growth for insurance distributors, both in overall organic growth and profit margin. In fact, the past several years have been good for the insurance industry. For many, these top-line metrics may be disguising inefficiencies or opportunities within the firm’s compensation strategy that could drive even more growth, as well as prepare a firm for a softer market and rate environment.

MarshBerry’s 2024 Insurance Agency & Brokerage Compensation Study reveals what top-performing firms are doing to remain competitive. It includes details about brokerages’ structure salaries, commissions, and bonuses and their methodologies for driving maximum revenue and growth. This biennial study, conducted in March 2024, surveyed firms on their 2023 compensation policies, processes, and strategies for roles commonly found across most insurance brokerages, and their expectations for 2024.

Study overview

The 2024 Compensation Study provides brokerages with a better understanding of the landscape of total compensation, benchmarks to measure against, and the trends that have evolved over time.

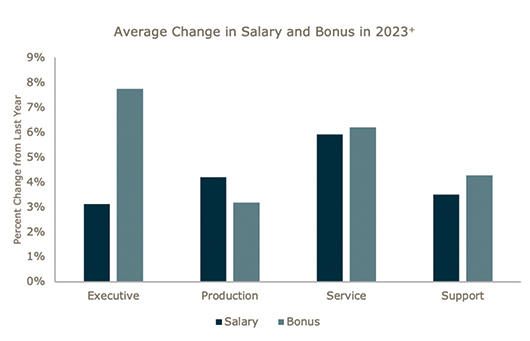

It’s broken out across four employee categories: executive and management, production personnel, service personnel and support personnel. At a high level, wages have increased across the board for all levels of personnel in 2023—for both salary and bonus.

Executive and management roles. This category is defined as executive personnel acting in the capacity of high-level management positions within the firm. This would include positions such as: chairman, chief executive officer (CEO), president, chief operating officer (COO), and chief financial officer (CFO).

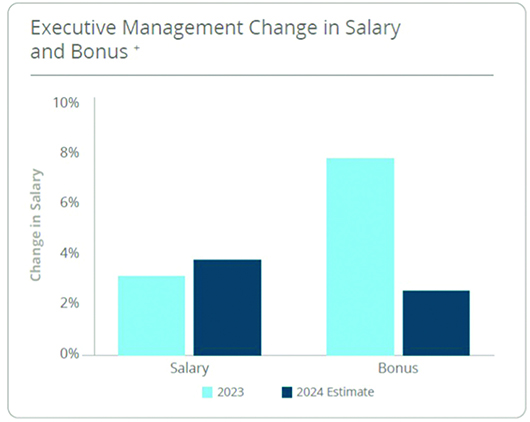

In 2023, executive salaries increased and continue to trend upward. The majority of survey respondents reported that executive salaries were higher in 2023 and were optimistic about further increases in 2024. Keep in mind that executive performance tends to be linked to top-line growth and profit growth, and 2023 saw strong organic growth and profit margin expansion in the insurance brokerage sector. The respondents’ projections for higher executive compensation in 2024 may also reflect expectations for stable, robust levels of growth in the near future for the industry.

Production personnel. These are employees who are responsible for selling insurance. They are the producers of the firm who proactively identify and close opportunities that otherwise would not have existed for the organization.

Producers are segmented into two categories—validated and unvalidated producers—because they are in different stages of their career and tend to be compensated differently. Producers who are validated are usually generating enough business to validate their total compensation (including benefits). Producers who are unvalidated are typically newer employees (less than three years) and are not generating enough business to cover their compensation.

For most firms, producer compensation typically represents a significant amount of compensation expense. As a result, any change in compensation may have a significant impact on profit and value.

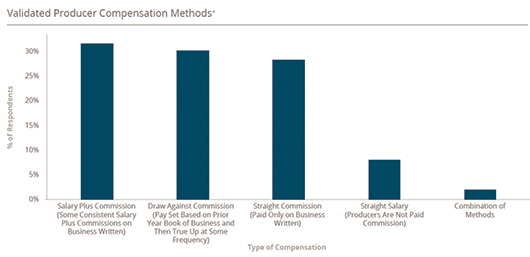

Compensation for validated producers is often tied to commission and linked to their books of business. However, firms use various combinations of compensation methods for these producers, some that also incorporate a salary.

For firms that are paying some type of salary to producers—inclusive of any unvalidated producers—survey results regarding year-over-year increases were mixed. Half of the firms surveyed indicated that they made no changes to salaries in 2023. However, the other half reported increases that averaged 9%—bringing the total overall average salary increases for producers to over 4%.

Service personnel. This category includes a diverse and expanding set of job functions. In the average firm, service employees comprise 59% of total personnel and service payroll makes up 39% of total payroll expense. On average, there are 2.8 service staff to every producer.

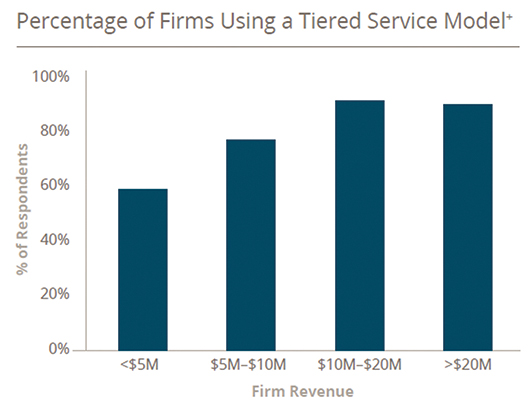

The majority of study respondents report using a tiered service model—meaning they have multiple roles involved in servicing a client. While specific titles amongst different firms can vary, if using a tiered service model, we have segmented service personnel in three main roles: account executives, account managers, and processors. Use of a tiered service model is heavily correlated to company size.

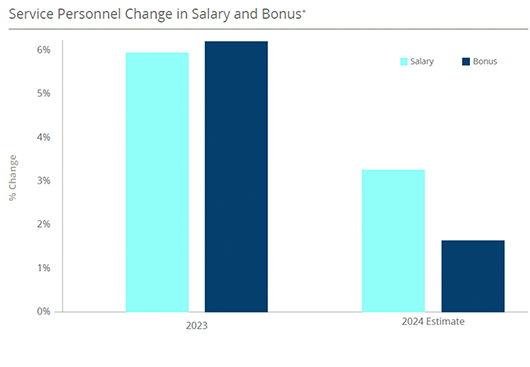

Between the four employee categories, service personnel saw the largest boost in salary in 2023 with 83% of respondents reporting that service personnel salaries were higher in 2023 (compared to 2022), increasing an average of 6%. Additionally, 77% of respondents expect them to increase in 2024.

As firms look for ways to excel in this competitive industry, taking a close look at their

existing compensation approach and finding ways to optimize their strategy

may be the difference between being an average firm and high-performing firm.

Support personnel. These are employees who support the entire organization, rather than a specific department. Support functions include areas like accounting and finance, general office management, human resources, and information technology personnel. Typically, the salaries for these positions are more closely aligned with the local market than they are to a specific industry.

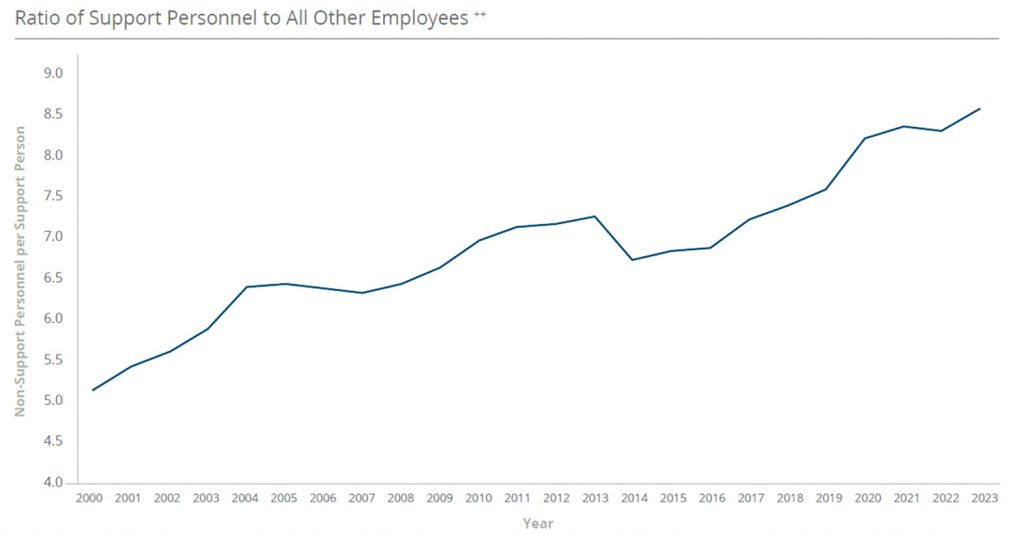

In 2023, the average firm had approximately 8.6 full-time equivalent (FTE) employees for every one FTE of support staff.

Overall, salaries and bonuses for support personnel increased in 2023. For 2024, salaries are projected to increase, while bonuses are projected to remain relatively flat.

Getting started with a compensation strategy

As firms look for ways to excel in this competitive industry, taking a close look at their existing compensation approach and finding ways to optimize their strategy may be the difference between being an average firm and high-firm. Firms can start by asking themselves:

How do high-performing firms use compensation to manage employee performance/underperformance?

Are my validated and unvalidated producers being compensated according to appropriate expectations/performance?

- How do most firms handle commissions below a minimum account threshold?

- What are the average commission rates in top firms? How do they differentiate between new business vs. renewals?

- What are average salaries in insurance brokerages by role? By geography?

- What types of benefits do other firms offer their employees?

- What types of incentives are top-performing firms using to drive growth? To attract talent?

- What factors should influence executive salaries and bonuses?

- What are other firms’ flexible and remote work policies?

The value of a compensation study

MarshBerry’s comprehensive, one-of-a-kind industry report evaluates compensation trends across 35 different roles in an insurance brokerage, provides over 100 charts that illustrate respondent data, and provides detailed insights into the results. It offers insurance brokerages the opportunity to benchmark where their firm sits in the range of industry peers on compensation approaches and can provide reinforcement for their current approach—or reveal areas for change.

As insurance brokerages continue to look for ways to grow their business, whether it be through their product offerings, service capabilities, or technology upgrades, people will always be at the root of everything they do. Having a top-performing organization with top-performing personnel starts with a top-performing compensation strategy. n

For more information:

MarshBerry 2024 Agency &

Brokerage Compensation Study

events.marshberry/.com/24CompStudy

+ MarshBerry 2024 Compensation Study

++ MarshBerry Propriety Financial Management System, Perspectives for High Performance

The author

Tommy McDonald is a director within the financial advisory division at MarshBerry, a global leader in financial advisory and consulting services serving the insurance brokerage and wealth management industries. In his 16-plus year career, Tommy has built extensive knowledge in the insurance distribution space in areas involving merger and acquisition advisory, organic growth best practices, financial management, valuation, perpetuation, and strategic planning. Tommy is a frequent keynote speaker at national conferences, broker association meetings, insurance carrier elite meetings, and executive leadership forums. He has authored over 100 industry articles for leading insurance magazines and MarshBerry’s proprietary publications.