Coverholders and Risk Takers

THE OBSTACLE OF ESCALATING BUSINESS COSTS

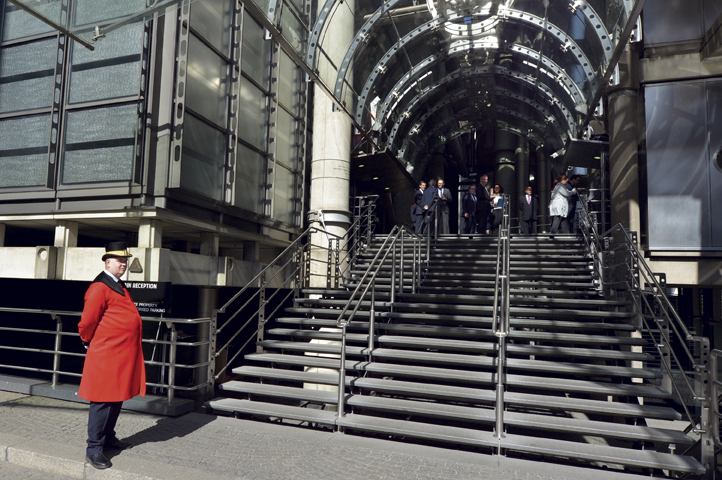

Lloyd’s of London is taking steps to embrace a more modern and efficient processing model

Lloyd’s of London is the oldest and most recognized insurance brand in the world. Over the course of its 332-year history, the market has established a reputation for being both innovative and flexible. To retain this position, Lloyd’s is always on the lookout for ways to be more accessible and efficient.

Our industry’s current environment offers the London market another opportunity to demonstrate just how adaptable it can be. Make no mistake—this is perhaps one of the more tumultuous times the insurance world has experienced in quite a while. Customers are becoming more technologically proficient, demanding answers to their business-related inquiries in near real time. New and emerging market growth is becoming more predominant. Markets also are bracing for the potential earnings decline and capital deterioration resulting from the spate of hurricanes, earthquakes, and other natural disasters that have occurred recently.

[L]loyd’s is always on the lookout for ways to be more accessible and efficient.

These issues are daunting enough. Unfortunately, Lloyd’s has several additional obstacles to overcome. These include rising acquisition and administrative costs, technology, prevailing misconceptions about the London market, and the perceived difficulties in securing access. We’ll touch on each of these topics over the next several months.

What’s the problem?

An excerpt from the 2017 Lloyd’s Annual Report provides the most succinct explanation why rising business expenses concern the market:

There has been a slowdown in the rate at which expenses have been increasing relative to growth in premium, resulting in a small improvement in the expense ratio. However, the Lloyd’s market expenses continue to be higher, as a proportion of net earned premium, than those of our competitor group, particularly in relation to acquisition costs, reflecting Lloyd’s more extensive distribution chain. This will continue to be an area of focus in 2018 with plans to realize some of the benefits of the London Market Target Operating Model (LM TOM) and pilot initiatives to make it cheaper and easier to write business at Lloyd’s.

The “extensive distribution chain” mentioned above refers to the numerous mouths that must be fed in order to bring a risk to London. For instance, the acquisition allowance for a U.S.-domiciled account must be significant enough to compensate a program administrator (also known as a Coverholder), wholesaler, and retail agent. The market also is responsible for paying commissions to a London broker, who serves as a licensed intermediary between the Coverholder and Lloyd’s.

The cost of acquiring risks is only part of the equation. London also must grapple with internal expenses associated with processing transactions. Some of this is unavoidable; it is all part of the complexities associated with accepting business from all corners of the world. Still, some activities can be streamlined to make the process more efficient.

Addressing the issue

The LM TOM initiative referenced in the annual report is an ambitious project designed to deliver central services and provide the benefits of straight-through processing for all market participants. At its core are two simple principles:

- One-touch data capture: This reduces the risk of error inherent in having several different parties re-enter the same information multiple times. Implementation of the strategic model will allow data to be entered once or translated into a common global standard, allowing information retrieval by all applicable parties. This will result in more efficient processing and remove barriers to international access to the London market.

- Enhanced shared-data services: Many non-competitive tasks would be more efficient and consistent if delivered at one central location, rather than being repeated by each broker and Syndicate participating on the same risk. Removing the responsibility of performing redundant tasks allows these entities to concentrate their focus on areas that differentiate their business.

Fifteen different projects exist within the LM TOM initiative. Probably one of the most impactful that currently is underway—at least from the U.S. market perspective—goes under the acronym of DA SATS (Delegated Authority Submission, Access and Transformation Solution). This specific task seeks to resolve the problems that occur when Coverholders, brokers and markets all have differing systems to support their businesses. The lack of seamless integration increases operating costs.

Once DA SATS is complete, reporting for Coverholders will be much easier. A common set of risk, premium and claim data requirements will result in increased efficiency for all involved. This standardized dataset will be uploaded to a dashboard capable of automating the generation of reports and statistics. The availability of this information in a flexible format offers London the additional benefit of meeting management and regulatory reporting requirements at the appropriate level of detail.

CHART positioned to assist

The CHART Exchange was established in 2015; its core purpose is to expand the U.S./London marketplace through the identification and pursuit of new business opportunities. Initiatives the group plans to launch this year offer both Coverholders and Syndicates the opportunity to reduce overall acquisition costs while simultaneously expanding market reach. The new facilities include:

- CHART MGA. A number of Syndicates have insurance offerings that were developed for the domestic U.S. market. Their advantages of an excellent coverage form, automated underwriting, London expertise, etc. are somewhat mitigated by an inability to fully execute efficiently in the United States. It is both time-consuming and expensive to find the right wholesaler partners willing to fully invest in a new product launch. It requires surplus lines licenses to “perfect” a Lloyd’s-underwritten sale in almost every state. CHART MGA solves this issue for syndicates who wish to have a dedicated entity to help them bring innovative new products to market.

- CHART Markets is an online shopping mall dedicated to the promotion of London-centric insurance products. Much like its “brick-and-mortar” counterparts, the facility provides participating members with virtual storefronts from which their various product and service offerings can be promoted. Marketing campaigns targeting retail insurance agencies will be implemented in an effort to drive traffic to this unique Internet platform. We will utilize media advertisement, direct response mail, broadcast email, and other methods to raise awareness.

The author

Coverholders and Risk Takers is a periodic column written by principals or “Early Adopters” of the CHART Exchange (www.chart-exchange.com). The group’s core mission is to facilitate more U.S./London commerce via personal interaction, education, and technology. Glenn W. Clark, CPCU, is owner and president of Rockwood Programs and the “Earliest Adopter” of the CHART Exchange. Email him at Glenn.Clark@rockwoodinsurance.com.