The Heritage Insurance Agency team

This Chico, California, agency loves

and protects the people who grow and raise our food

“[W]e truly understand the market that we serve; we speak their language.

But to maintain this advantage, we have to continually push

ourselves to stay educated about the changing marketplace. …

[W]e encourage all of our team members to obtain the AFIS designation.”

—Steve Mora, CIC, CRM, AFIS

Principal

By Dennis H. Pillsbury

Photography by Melanie Maganias

“We’re really just a couple of displaced farm kids,” quips Heritage Insurance Agency principal Steve Mora, CIC, CRM, AFIS. “We both loved the rural lifestyle and needed to find a way to not just live that lifestyle, but to do our best to assure the future of those people who work on and own the ranches and farms that produce our food.” The other person in that plural pronoun is Kelly Mora, who is Steve’s partner at the agency and at home.

Steve grew up on a ranch on the central coast of California and fondly remembers hauling hay, irrigating pasture, and building fences. So, it came as little surprise that he graduated with a degree in agriculture from California Polytechnic State University, San Luis Obispo. Soon after graduation, he married his high-school sweetheart, Kelly.

Then, he started looking for a way to use his technically oriented talents in a manner that would help the agriculture community. He went to work for a local California Farm Bureau county office. While working there, he found an opportunity to work with farmers and agribusinesses in the field of risk management and insurance.

Steve was able to support the members of the community that he loved by providing them with concrete advice about the best ways to protect their assets and assure the future of the agricultural community. In 1998, he obtained his insurance license and continued to work for an agency located in the Glenn County Farm Bureau office until 2009, when he met his “symbiotic match,” Fran Wagner, who was an independent agency owner looking to retire.

Fran valued what he observed as Steve’s emphasis on putting relationships ahead of transactions. Steve had a knack for building a family of clients where he became the trusted advisor who was tasked with thinking about insurance and deciding how best to effectively transfer risk. This effectively allows his clients to concentrate on their business instead of their insurance policies.

“We’re really just a couple of displaced farm kids.”

—Steve Mora

Steve and Kelly (“who came along as free labor,” Steve notes with a grin) began a five-year plan that would result in them taking over ownership of Fran’s agency in 2014.

At that time, there were five employees generating revenue of approximately $600,000. In short order, Kelly and Steve began the process of further developing their team, and it turned out the two of them made a perfect leadership duo. The pair brought complementary talents to the table: Steve served as the technical guy and Kelly offered the creative leadership needed to introduce what was essentially a new agency, as they changed the name to Heritage Insurance.

The new name included one quite visible tip-of-the-hat to Fran Wagner, whose eponymously named agency had the AG in his name displayed in a different color, as Heritage followed suit. And they continued the tradition of the predecessor agency of showing respect and genuine concern for the well-being of others, starting with each team member. They reflected this same feeling in their dealings with clients, as well as their insurance company partners.

It worked

Unfortunately, the success of the team building and of the extended family was tested almost as soon as the new agency opened its doors, when Steve was struck down by a life-threatening illness that saw him living in the ICU for several weeks and with Kelly spending much of her time there, providing moral support.

And they came through. The Heritage Insurance team not only continued to provide excellent service to current clients but they actually helped the agency grow. The same was true for the extended family of clients; they were there every step of the way, lending support to Steve and Kelly and showing a respect and caring for the staff members who were working so hard for them.

“I like to think that I always trusted our team,” Steve says. “But this was really an eye-opener for me. They went above and beyond as they covered for our absence.”

“My epiphany was in the value that the community and clients saw in us,” Kelly adds. “I even received a personal letter from a client telling me how important Steve is to their operation. They really cared about Steve.

“And, of course, he cared about them,” she notes. “He even had his laptop in his hospital bed and was trying to maintain a level of service that is difficult even when you’re healthy.

“One result of this outpouring from our clients was the decision to create our first client communication, to let them know what was going on,” Kelly continues. Kelly has a degree in communications from California State University, Chico, that she uses to support the agency’s marketing and community relations.

She spent much of her time developing the Heritage brand built on rural values and continuous improvement of the client experience. “We had prided ourselves on being transparent,” Kelly explains, “and this really showed our clients how willing we were to share everything with them.

“I’ll admit,” she continues, “at first, I hadn’t been sure that insurance was the field for me. After seeing what a caring family Steve and our team had created, I found myself wondering how I could think about working in any other business.”

Staying ahead of the curve

“A big part of our advantage is that we truly understand the market that we serve; we speak their language,” Steve says. “But to maintain this advantage, we have to continually push ourselves to stay educated about the changing marketplace.

“I’ll admit, at first, I hadn’t been sure that insurance was the field for me. After seeing what a caring family Steve and our team had created, I found myself wondering how I could think about working in any other business.”

—Kelly Mora

Principal

Above: The Heritage Insurance executive team. From left: Mandy Jensen, CISR, CLCS, Director of Operations and Finance; Steve Mora, CIC, CRM, AFIS, Principal; Kelly Mora, Principal; Kimball Shirley, CIC, Director of Sales; Lisa Bentz, SPHR, Director of HR and Consulting Services.

Below: When team members celebrate their five-year anniversary at the agency, they are gifted with a painted portrait of them as their “alter ego.” From left: Mandy Jensen; Juan Garcia, PLCS, AFIS, Insurance Advisor; Dan Furtado, REBC, Health, Life and Benefits Advisor; Kimball Shirley.

“I was one of the first people to get the AFIS (Agribusiness and Farm Insurance Specialist) designation from IRMI,” he recalls, “and we encourage all of our team members to obtain the AFIS designation. More than half of them have already achieved that.

“I’ve even studied and understand the commodities market,” he adds, noting how important that market can be for farmers and ranchers. “I also read as many agriculture publications as insurance publications, and we belong to all the major ag associations and attend their conferences.

Left: Office Administrator Jaime Koehler

Below: Client Ben Bertagna (left), who bought his prized truck when he was 13 years old, which he used for selling nuts when he was younger, operates a farm and orchard in the area. Heritage Insurance serves his businesses as well as several businesses started by his children.

“Our (customer) approach is the same regardless of the type of business involved. We offer a proven track record of excellent service and respect for our clients and their needs. Our agency is not producer-centric but rather is service-centric and there is no hierarchy.”

—Steve Mora

“I’ve even studied and understand the commodities market,” he adds, noting how important that market can be for farmers and ranchers. “I also read as many agriculture publications as insurance publications, and we belong to all the major ag associations and attend their conferences.

“We’re members of various farm bureaus, attend county fairs, and support 4-H,” Steve notes. “Agriculture is in our DNA.”

Kelly is involved with many of the philanthropic organizations that support the agricultural community, including the California Women for Agriculture, Dairyville Orchard Festival, California Nut Festival, and Glenn County Fair Heritage Foundation.

She is a proud alumna of the California Agricultural Leadership program and was recognized for her contributions to agriculture and her local community by receiving the Common Threads North Award from that group.

Outstanding growth

The agency has enjoyed outstanding growth, both in its key market and in other commercial and personal lines arenas. Since 2014, revenues have grown more than six times, reaching more than $3.5 million with about half coming from agricultural business and the other half from other businesses.

“Our approach is the same, regardless of the type of business involved,” Steve points out. “We offer a proven track record of excellent service and respect for our clients and their needs. Our agency is not producer-centric but rather is service-centric and there is no hierarchy.”

Kelly adds, “We allow each person to perform using their unique skill set. It is up to us in leadership to find out just what those are, and how they can best serve our goals as well as the goals for each employee. Our principal responsibility is to enrich their life.

“To make certain that we are doing that,” she explains, “we meet regularly, both formally and informally. We eat lunch together, have potlucks and afternoon happy hours, and just talk.

“We conduct a Labor Day survey to see how everyone feels about work,” Kelly continues. “And we have regular employee performance reviews every six months that our people actually love. We know that because we proposed changing to an annual schedule, and that was vetoed by everyone.

“These reviews are basically an open discussion where both the employee and the reviewer assess each other to determine what’s working and where there is room for improvement,” she explains, “and then we act on those findings.

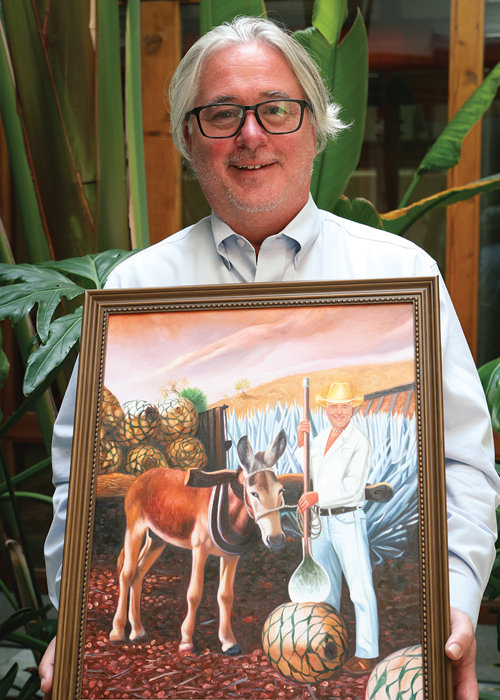

“We recognize employees who’ve been with us for five years with a hand-painted portrait, and a vacation that we pay for,” Kelly adds.

Future focus

“Right now, we are looking at what we need to do to prepare for reaching the next growth plateau,” Steve explains. “We’ve expanded our management team to five members after realizing that, while we were scaling up our service and sales people, we had forgotten to reflect that with an associated growth in leadership.”

Kelly concludes by pointing out how indebted they are to others. “We owe so much to our peers, where we have shamelessly stolen ideas that they graciously share with us.

“We’ve also benefited from the consulting of Kelly Donahue-Piro of Agency Performance Partners, who has provided us with help in many areas of agency management and communication,” she explains.

Rough Notes is pleased to recognize Heritage Insurance Agency as our Agency of the Month. They have shown resilience in dealing with the unexpected and view tough times as opportunity. Steve even mentioned that the current hard market, while difficult, is an opening for independent agents because “we have diverse markets that can help those that are most severely affected. I recently wrote a six-figure BOR account just by helping out.”

The author

Dennis Pillsbury is a Virginia-based freelance insurance writer.