AGENCY PARTNERS

ALL ABOUT THE NiCHE

A specialty insurance provider that operates as an MGA? That’s not all that’s different about NSM Insurance Group.

By Lori Widmer

Geof McKernan wants you to know this about his company: “We create niche-specific products. That’s how we build our success.” In fact, when leaders of NSM Insurance Group, a Philadelphia-area specialty insurance provider, are asked what NSM stands for, they now proudly say “Niche Specialty Markets” instead of the founders’ names—Norman, Spencer and McKernan.

Yet, back in 1990 when NSM first opened its doors, niche was not the focus. Started on a handshake between McKernan and his then-partner, Paul Norman, NSM began as a commercial property and casualty insurance brokerage firm.

Even then, though, McKernan recognized the writing on the wall. He began to see areas of specialty that weren’t being addressed by the market and decided that NSM would fill those gaps. By January 1994, NSM’s first specialty program—Staffing Lines, for the staffing industry—was launched. Five years later in 1999, the firm’s AllComp Solutions workers compensation program joined the lineup.

Fast forward another 22 years and NSM Insurance Group has grown to over $1 billion in premium and more than 750 employees across 14 locations in the United States and the UK. The company now boasts 25-plus specialty insurance programs ranging from behavioral health and professional underwriters liability to collector car and pet insurance.

Organic success

Such growth didn’t happen by accident, nor did it occur overnight. From the onset of the business, McKernan had an eye toward specialty programs. “I looked around and said ‘Okay, what do we really want to become?’ And we wanted to become a leader in delivering specialty niche insurance.”

It was a natural next step for McKernan, whose own career prior to NSM tended to focus on writing specialty groups. Having watched his own career grow organically by becoming an expert in a specific line, he realized quickly that specializing could be a lucrative path.

Even amid an economic crisis, McKernan says NSM invested when others were putting their investments on pause. As other companies were laying off staff and cutting back on marketing, NSM pushed on. “We doubled down on our people. We doubled down on our marketing, and our technology. We grew the business.”

And grow it did. In just the last three years, NSM has tripled its business. That’s come in part via the focus on the verticals. “We invest in helping people become experts.” By that, he means each specialty has its own team of dedicated underwriters. The coastal condominium business has its own team of underwriters who write nothing but that line of business. “All the people in our pet insurance division—that’s all they know. Why is that important? Because when we go to a carrier, they see that we are experts in what we do. We go three miles wide and ten miles deep.”

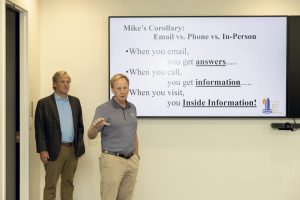

Customers too are noticing, but the first thing they notice is the personal touch. NSM’s retail agents still make house calls and build relationships in person. That kind of service, combined with quick turnarounds on quotes, allowed NSM to enjoy exponential growth at a time when other brokers and MGAs were struggling.

Market upheaval

—Geof McKernan

Founder and Chief Executive Officer

He uses another example: An umbrella policy with a $50 million limit. “One of two things,” he says. “You may not be able to get it today, or you might only get $5 million and that limit might cost you as much as it used to cost you to get $20 million.”

The industry, McKernan says, has seen a lot of losses. Catastrophic storms, wildfires, and nuclear verdicts have created large, record losses. As the market fluctuations continue to swing wildly, NSM holds fast because, as McKernan says, the company has partnered with top insurers with A+ ratings. “We partner with insurance carriers that want to be in the specialty program business and understand that program.”

Building a nimble approach

Perhaps that has buoyed the success of NSM, even as recessions, hard markets and pandemics have stymied many businesses in the last decade or so. In fact, the company pivots quite a lot. Pet insurance, towing, staffing, freelance liability, addiction treatment—the types of specialties NSM takes on is diverse and runs the gamut. “We’re agnostic to the niche of business we get into,” says McKernan. “What we look for in a niche is that the industry itself is stable and growing.”

With pet insurance, he says, they acquired Embrace Pet Insurance in 2019 and have tripled it in size since then. “The pet industry itself, whether you’re selling dog food or pet insurance, is a very stable, fast-growing industry. We want to continue to be a front runner in that business.” That includes claims handling, policy issuing, and what McKernan says is a high-quality product.

Purchasing Embrace, he says, was just one example of NSM’s acquisition strategy. “We look at different niches and industries that we feel will continue to be strong and stable, whether the economy is good or bad.”

Chief Information Officer.

That translated well into one of the company’s more recent acquisitions—Dinghy, which offers insurance for freelancers. “There are always going to be independent contractors,” McKernan says, much like, he adds, there will always be pets, and there will always be a need for towing industry services. “When we look at a business, we look at things that are repeatable—I like to say sustainable, where the industry itself has growth potential and is stable.”

The word “stable” comes up quite a bit when McKernan talks about acquiring new business. Another word he repeats often—gap. Where there exists any gap in coverage, NSM sees that as a need to be filled.

Such was the case when McKernan and team decided to take on the addiction treatment insurance business, which has paved the way for NSM to become what he says is the largest insurer of addiction treatment centers in the United States. When the company took on the specialty 15 years ago, McKernan notes, there was a lot of confusion regarding what the facilities offered or, in some cases, even were. “They didn’t understand what drug and alcohol rehab or what a sober living house was. So we became the forerunners of those insurance coverages.”

The Amazon of insurance

McKernan also wants to be the provider that gives customers what they need when they need it. He gives the example of placing an order on Amazon. “You go online and order it and it’s done. It’s pretty seamless, right?”

—Geof McKernan

“At the end of the day, we want to be the go-to program when buyers or retail agents have an opportunity that fits our box, whether it’s pet insurance, electric car insurance, or social services. They can trust us to provide them with a solution.”

The author

Lori Widmer is a Philadelphia-based writer and editor who specializes in insurance and risk management.