Two agency principals share U.S. Army experiences and

insights on veterans joining the insurance industry

By Christopher W. Cook

As in previous May issues of Rough Notes, to sync with the Memorial Day holiday, we’re sharing the stories of two veterans and their insights on why the insurance industry is a good fit for military personnel starting their next career chapters.

Staff Sergeant Butler

Bill Butler, CIC, CISR, CWCA, president of Butler & Associates, Apple Valley, Minnesota, enlisted in the Minnesota Army National Guard in October 1993 while a junior in high school. “I spent a little over four years serving with the 1st 194th Mechanized Infantry Unit doing training deployments to Norway and Greece,” he recalls. “Wanting more out of my military career, as I was serving with many first Gulf War veterans, I decided to transfer to the active-duty Army in the spring of 1998.”

Butler would spend the next three years at Fort Campbell (Kentucky), serving with various Units. “I started my active Army service as an Infantryman with C Company 2/502nd as a Specialist in an infantry line unit and volunteered for the scout platoon where I would spend the next year as a Scout and Scout Sniper in the Headquarters and Headquarters Company (HHC) 2/502nd,” he says. “While in the scout platoon, I attended and graduated from Air Assault School and 5th Special Forces Group Sniper School during the fall of 1998 and spring of 1999.

“In the fall of 1999, I earned my Expert Infantryman’s Badge and then went on to attend U.S. Army Ranger School where I earned my Ranger Tab in January 2000 with class 02-00 and then graduated from Airborne School in April 2000. My last year at Fort Campbell (Kentucky) was spent with the 101st Airborne Div Pathfinder Company as an Army Pathfinder.”

It was during this time, in September 2000, that Butler had his accident.

“My girlfriend (now wife) back in Minnesota and I talked on the phone the afternoon of that night jump,” Butler recalls. “She ended the call saying, ‘Be careful; I have a bad feeling about tonight.’”

That evening, a newly assigned Chaplain to the group was doing her first training of any sort and had come to the drop zone to observe the night jump. Butler, who was running as the team sergeant, and one other Pathfinder both suffered leg and foot injuries on the landing.

The Chaplain accompanied Butler and the other Pathfinder to the hospital. While waiting his turn to be examined, Butler was asked by the Chaplain if there was anyone whom she could call for him. He told her to call his girlfriend and tell her that he had gotten hurt but was okay, and that he’d call her in the morning.

However, the Chaplain left half a dozen generic messages like: “My name is XXXX with the 101st Aviation Brigade, I’ll call back later.”

“My girlfriend returned home from an evening out to all these voicemails with little to no details; she thought I had died on the jump,” Butler says. “We laugh about it today, but that day it wasn’t too funny. I wound up proposing to her while home on convalescence leave for the broken leg.”

Over the next nine months, Butler rehabbed his leg and, ultimately, decided after three years with the 101st Airborne Division Air Assault to move back to Minnesota. “After leaving the Active Army, I spent the next three years as a Recruiter for the Minnesota Army National Guard in St. Paul. This was the start of my sales career,” he says.

Butler would spend the next three years (2001-2004) as a recruiter, followed by two more years with the Minnesota Army National Guard, doing pre-deployment training to Minnesota National Guard units being deployed to Iraq and Afghanistan.

“After almost 13 years, I ended my military career in 2006 as a Staff Sergeant to fully pursue my insurance career,” says Butler, who started in insurance in 2004 by joining the agency founded by his parents two years prior.

“Insurance is a rewarding career where a veteran of any branch of service can go from defending their country to protecting their clients.”

—Bill Butler, CIC, CISR, CWCA

President

Butler & Associates

System on a familiarization range at 5th Special Forces

Group Sniper School during his Special Operations

Target Interdiction Course (SOTIC).

“They started the agency as a second career a little later in life, as my military career was winding down, so the timing worked out for all of us,” he says. “We made lots of mistakes in those early years, and we all learned the insurance industry together.”

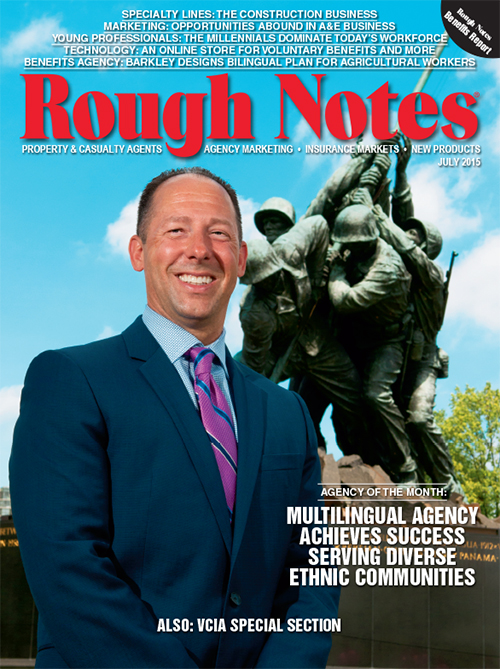

In 2017, Butler became president of the agency—the July 2019 Rough Notes Agency of the Month—leading it through the retirement of his parents and launching its niche commercial insurance division.

“The military is all about risk management. It didn’t matter whether I was a team leader in charge of three, a platoon leader in charge of 30, or a commander in charge of a couple hundred men, we would have to run different scenarios and we would lay out all the risks.”

—Bob Klinger, LUTCF, CPIA

President and CEO

Klinger Insurance Group

Captain Klinger

Bob Klinger, LUTCF, CPIA, president and CEO of Klinger Insurance Group, Germantown, Maryland, enlisted in the U.S. Army right after high school as an 11B Infantryman. He completed his basic training and advanced individual training at Fort Benning (Georgia).

A proud Army “Mustang,” officers who start their military career as an enlisted service member, Klinger would rise through the various ranks of E-1 Private, E-2 Private Second Class, E-3 Private First Class, E-4 Specialist, and E-4 Corporal. “When I was at Fort Benning, a lot of my instructors would tease me because I was Corporal Klinger,” he jokes. (Corporal Maxwell Klinger was the name of the character on the T.V. show M.A.S.H. who tried to get discharged by crossdressing).

After ranking as an E-5 Sargent, Klinger would join the Cadet Reserve Officers’ Training Corps (ROTC) at PennWest Edinboro, where he began studying criminal justice. The father of a girlfriend of his, who worked as an underwriter at Erie Insurance, tried to get Klinger interested in the insurance industry. While he laughed it off, the following summer he ended up taking an internship with Mass Mutual.

Klinger would continue to sell life insurance part-time while advancing in his military training, attending Airborne School and Air Assault School during the summers. Klinger jokes that while at Airborne School at Fort Benning, he’d sell life insurance policies to fellow cadets, who were also jumping out of planes.

In 1989, Klinger was selected to lead 11 other cadets to compete in the USMA (United States Military Academy) Sandhurst Competition, which pitted OCS (Officer Candidate School), ROTC, and West Point cadets in a competition of various military skills. Klinger’s team won first place.

Considered officer material by his superiors, Klinger would go on to attend Officer Candidate School (OCS) at Fort Benning as a 0-1 Second Lieutenant, followed by the ranks of 0-2 First Lieutenant and then 0-3 Captain.

After receiving his degree in criminal justice, with a minor in psychology, Klinger started working for Mass Mutual full-time, where he became the top rookie agent in New York in his first year.

In 1992, Klinger took a job through a connection with Erie Insurance at a P-C agency in Gaithersburg, Maryland, that was looking to expand into life insurance. At this time, he got licensed in property/casualty. However, not favoring the way business was done, he left the agency and started his own, Klinger & Associates—the July 2015 Rough Notes Agency of the Month—from scratch in 1993, focusing on life/health and commercial lines.

While starting his own insurance agency, this was not the end of Klinger’s military career, which had him stationed at Fort Leavenworth (Kansas), Fort Bliss (Texas), Fort Campbell (Kentucky), Fort Pickett (Virginia), and AP Hill (Virginia). Klinger would also serve overseas in Frankfurt, Germany, with some time in Hohenfels, Germany.

After rotations at Fort Polk (Louisiana), Fort Irwin (California) and Arman, Jordan, Klinger saw time in combat in Kosovo, Tikrit, Iraq (the hometown of Saddam Hussein) and Ramadi, Iraq.

During his tours in Iraq, Klinger’s team saw plenty of action. “In my first tour, I was in charge of 195 guys, which included sniper, demolition, and engineering teams, and we would conduct raids at night. Whenever there was intel on bad guys or there was action being engaged, we were there,” Klinger says.

Aside from performing raids, another duty of his team was providing protection for individuals with “V.I.P.” status. “When Donald Rumsfeld or the president came to Kuwait and Iraq to speak, we would provide the security. Even though the Secret Service would come, we were in the background running things. We did checkpoints, and roadblocks. At one point, I had Oliver North and Geraldo Rivera following me, reporting on my unit.”

At the end of his final tour, Klinger’s troop was involved with the first Iraqi election on January 30, 2005, protecting citizens while they voted and taking care of ongoing threats to voting sites. It ended up being a successful election, but emotional events followed for Klinger, including discovering on election day that a family of five that had given him intel about an attack a few days prior had all been beheaded.

“I still live with it today because if they hadn’t come to me with that information, they’d still be alive,” he says.

The day after the election, intel was received and a major raid was to take place in Al-Imam, a village in Northern Tikrit. In the early morning hours of February 1, 2005, Klinger’s team walked into an ambush. “They started blowing up the buildings, and that’s when I lost some guys and that’s when I seriously got hurt,” Klinger says.

The flying debris left Klinger with traumatic brain damage, amongst other injuries. He was flown to Landstuhl, Germany, to receive immediate surgery, before being relocated to receive further evaluations at Fort Bliss in Texas. Klinger’s final year and a half in the military was spent at Walter Reed Army Hospital’s trauma unit, getting his memory back, and having additional procedures on his back and legs.

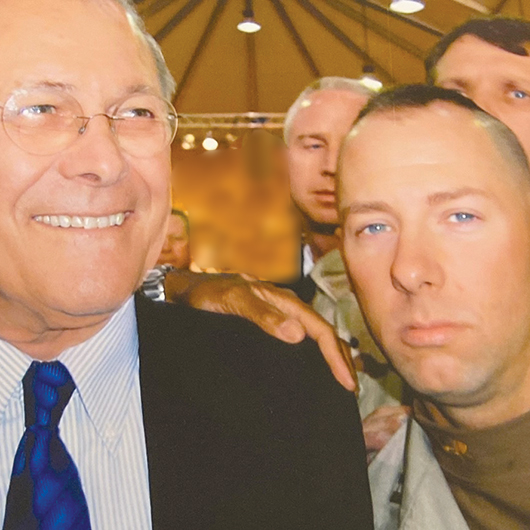

“I was about 18-and-a-half years into my career in the Army,” he recalls. “President Bush came to visit some of us on the seventh floor; he was with General Peter Pace, who was head of the Joint Chiefs of Staff, and he gave me my Purple Heart.

“They wanted to make sure my career made it to 20 years, so they assigned me a position at the Pentagon, but I didn’t go to work there because I was going through my medical rehab. I eventually retired from the military after 20 years, six months, 17 days and 33 seconds.”

A career for veterans

Both veterans believe that their experiences in the Army prepared them for their insurance careers and that the industry provides a great opportunity for those with a military background.

“Having not attended college, my military career was my higher education and taught me leadership, teamwork and how to persevere in the face of great adversity,” Butler says. “Right now, there is great adversity in the insurance industry, but I often fall back on my military experience to overcome what we are all facing, leading my team on a day-to-day basis.

“In the Army, I learned how to persevere, to lead and be a member of a team, and I learned that I am capable of so much more than I think I can do. I also learned to volunteer, like I did to become a Scout, Airborne Ranger, and Pathfinder. To this day, volunteering has opened doors in my insurance career that might otherwise be closed.

“Insurance is a rewarding career where a veteran of any branch of service can go from defending their country to protecting their clients. There is a great sense of service above self being an insurance professional,” Butler says.

“The military is all about risk management. It didn’t matter whether I was a team leader in charge of three, a platoon leader in charge of 30, or commander in charge of a couple hundred men, we would have to run different scenarios and we would lay out all the risks,” Klinger says. “It was our job as leaders to see how we can mitigate those risks, how we can put in precautions to save lives, whether ours or civilians.

“In the Army, we did more before 8 a.m. than most people do in a day. We learned attention to detail—where you stepped, how you walked, what you did, knowing where everything was in your fellow soldiers’ pockets. Teamwork was everything. You had to rely on and trust the guys on your right and left, because if you had to go to sleep for a half hour, those guys had to stay awake to make sure someone didn’t kill us and vice versa.

“We also learned to understand different cultures,” Klinger continues. “America is a melting pot, and for every culture you have to understand the way they think and their values. During the first Gulf War, we did not understand the culture in Iraq. We were offending all the Iraqis because we wanted to shake their hands and we didn’t realize that they don’t shake hands in Iraq; they put their hand over the heart and say ‘Assalaamu Alaikum.’”

Other traits Klinger developed in the military included time management, being in the zone, leadership and team building, multi-tasking, effective communication, integrity, self-sufficiency, strategic planning, giving peer evaluations and adaptability in the face of adversity.

“I look to hire veterans; they know how to be on time and dress for success. They’re trainable and teachable, and they’re willing to adapt, and they adapt a lot quicker because they’ve been through a lot more. The fundamentals were taught in the military, which is parallel to our industry,” Klinger concludes.