Coverholders and Risk Takers

By Frank Huver

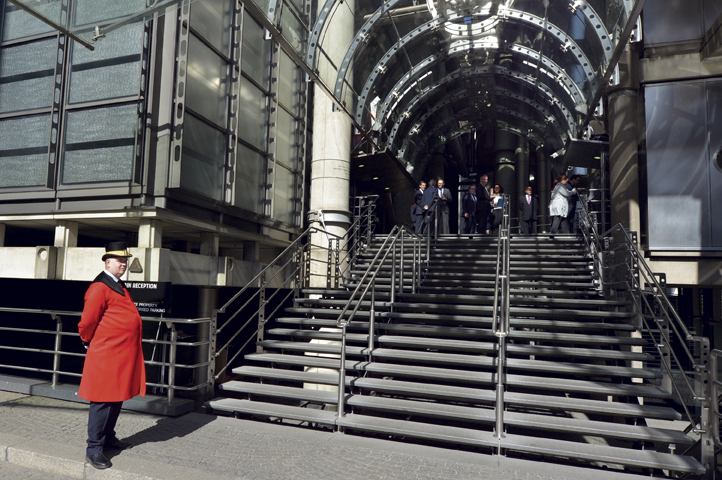

BUILDING A PROGRAM FOR THE LONDON MARKET

Like making sausage, developing a new insurance program takes time, skill, and patience

Have you ever contemplated the amount of effort it takes to make sausage? Here’s what you need:

- A variety of ingredients (meats, spices, herbs)

- Specialized equipment (mixers, grinders, stuffer)

- An investment of time, as the process takes a lot longer than you may have anticipated. This is especially true if you’re trying the recipe for the first time.

- The task can be quite messy.

Once you’ve completed all that hard work, you are rewarded with a creation that is very good—although maybe not good for you.

If you’re like me, you can immediately see the similarities between sausage making and developing and launching a new insurance program. For those who fail to see the parallels, let’s go over the bullet points one by one.

Variety is the spice of life

Launching a new insurance program requires a number of elements. First, it’s important to consider is the characteristics of the target niche. Can you identify any common themes within the demographic variables? Relevant factors include line of business, geographic location, annual revenue, assets, and shared risk exposures.

The issue of shared risk exposures requires elaboration. Your prospective program audience may be more cognizant of the importance of certain policy provisions than others. This could be the result of legal requirements, such as mandated minimum liability limits, or common business hazards. Use this information to your advantage. Including unique coverages may differentiate your offering from others in the marketplace.

The program proposal document provides the perfect forum for demonstrating how effective a partner you can be.

Most agents already have aggregated a portfolio of accounts before taking the next steps toward program development. Underwriting files contain a significant amount of information. Conduct a little data mining to unearth important business trends. A review of historical loss results can provide useful insights into the future performance of the book. Further analysis may even identify recurring loss “themes.” Results may be further improved by making modifications to coverage language or attaching sub-limits to certain risk exposures.

Your data files also may point out ways to communicate effectively with prospective clients. Does the target niche have any shared areas of affinity, such as membership in the same business organizations or associations? Do they subscribe to any particular magazines or trade journals? Is the use of social media prevalent within the group?

When considering new program proposals, markets will evaluate the agency’s internal workflows and procedures to determine whether they are adequate. Your submission should devote considerable space to these factors. Do you use an automated management system to record submissions, monitor outstanding quotes, solicit renewals, and perform other functions? What kinds of internal controls are in place? Document performance standards, quality assurance processes, and complaint handling practices.

The final ingredient in the mix is you. All business dealings involve a personal element. Insurers need to be confident in the capabilities of their partner agents before ceding underwriting authorities to them. This is especially important in long-distance relationships like those that the London market has with its associates in the United States.

You are an expert in your particular business niche. Invest the time to put together a comprehensive résumé that details your experience, professional accomplishments, industry designations, and so on. The program proposal document provides the perfect forum for demonstrating how effective a partner you can be.

Tools to get the job done

Let’s lean on the culinary analogy just a little bit longer. Many of us have heard the old saying that “too many cooks spoil the broth.” While this may be true in the kitchen, it certainly does not apply in insurance. When it comes to developing a compelling business strategy, seek all the help that is available.

You can consult professionals in the field to augment the expertise you already possess in your specific target niche. Use these resources to identify and address any deficiencies or gaps in your submission. Finding the necessary help is easy. For example, the CHART Exchange maintains a network of specialists from a diverse array of disciplines to help agencies in this regard. Services offered through our vendor partners include actuarial, claims administration, marketing, systems, legal, and more.

Domestic entities that are seeking to launch a new program through London must obtain additional assistance. To secure Delegated Underwriting Authorities from this market (achieving Coverholder status), an agency must find a sponsoring broker and a managing agent who are willing to support the application. A managing agent is a company set up to manage one or more Lloyd’s syndicates on behalf of the members. These firms are responsible for employing staff, overseeing results, and supervising day-to-day operations.

The broker also plays a key role in the placement of a program through Lloyd’s. This entity becomes the main point of contact for an agency that is interested in securing underwriting authorities from London. Among the tasks they perform are identifying the syndicates with risk appetites compatible with the market being targeted, shepherding the agent through the appointment process (sometimes referred to as tribunalization), and negotiating the terms of the binder agreement. Once again, the CHART Exchange has dedicated brokerage resources available to assist.

The length of time it takes to go from program submission to launch depends on a host of factors. They include the complexity of the product(s), the intricacies of the market’s appointment process, and the completeness of the proposal itself. As a general rule, you should expect the process to take longer than you may originally have anticipated.

During our time working with the London markets, we have met a fair share of specialist clients who have expressed concerns over the length of time it takes to secure Delegated Underwriting Authorities from Lloyd’s. While they understand the need for due diligence, they may become frustrated over the delays in getting a potentially great new program idea to the implementation stage.

CHART can provide a solution to this problem via an incubation initiative. With this facility, we can team the new client with a firm that already possesses the necessary underwriting authorities, state licenses, and back office administrative capabilities to transact business on behalf of one or more Lloyd’s syndicates. Agreements made between the two parties prior to launch govern such issues as contract duration, duty segregation, revenue sharing, and expiration ownership. This solution inures to everyone’s benefit.

Patience is a virtue

Now we’re at the stage where things might get a little messy. You’ve gone through the exercise of developing a complete and compelling program submission. Specialists from various disciplines have provided actuarial analysis, legal opinions, marketing strategies, and other forms of support. The prospective carrier partner has finished thoroughly dissecting your agency’s financial history, internal workflows, and business experience. You’re home free, right?

Wrong. You begin to receive a series of communications from the insurer that appear to question every aspect of your hard work. The proposed rate structure is inadequate. The target niche is not well defined. The policy form does not appropriately address all of the exposures.

Relax. This is only a matter of the market doing its due diligence. If your experience in the insurance industry hasn’t already taught you the importance of developing thick skin, now is the time to learn that lesson. Your knowledge is not what’s being tested; rather it is your conviction—and your ability to clearly articulate the attributes of the program as presented.

Maintain your composure throughout this process. Rely on the expertise you possess in your target niche to effectively counter any objections made by the market. At the same time, keep your mind open to new ideas or strategies you hadn’t considered before. A little patience goes a long way.

As a result of all that hard work, you’ll be able to enjoy the fruits of your labor. The new insurance program ultimately will serve to enhance the value of your agency, provide important coverage to your clients, and potentially open up new revenue streams through cross-sell opportunities and/or the development of complementary product lines.

The author

Coverholders and Risk Takers is a periodic column written by principals or “early adopters” of the CHART Exchange (www.chart-exchange.com). The group’s core mission is to facilitate more U.S./London commerce via personal interaction, education, and technology. Francis J. “Frank” Huver is senior vice president and chief financial officer of Claymont, Delaware-based Rockwood Programs, a Lloyd’s Coverholder for more than 15 years and a CHART Exchange early adopter.