Specialty Lines

CHART takes regional approach in 2019

Coverholders and Risk Takers By Frank Huver CHART takes regional approach in 2019 Organization offers local events for agents to...

FOCUS ON BOATING: CALM BLUE OCEAN OR THE PERFECT STORM?

Specialty Lines Markets FOCUS ON BOATING: CALM BLUE OCEAN OR THE PERFECT STORM? Despite expected growth, claims severity increases as...

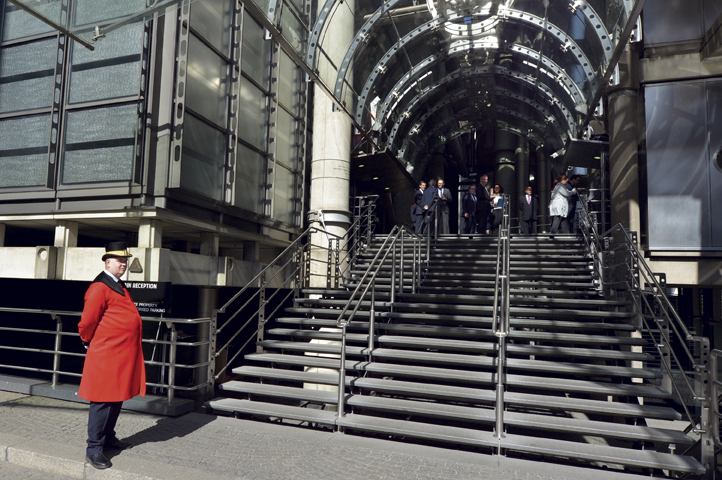

D&O INSURANCE

D&O INSURANCE Is the market really starting to harden? By Joseph S. Harrington, CPCU Today’s agents, brokers, and underwriters have...

FOCUS ON THE CONSTRUCTION INDUSTRY

SPECIALTY LINES MARKETS FOCUS ON THE CONSTRUCTION INDUSTRY Construction insurance sector keeps pace with the general market By Lori Widmer...

SURETY BONDING

SURETY BONDING Business is great, so how do we get people to join? By Joseph S. Harrington, CPCU What’s the...