Coverholders and Risk Takers

By Frank Huver

CHART takes regional approach in 2019

Organization offers local events for agents to learn about London opportunities

Aesop was a well-known figure in ancient Greece. Each of the stories he told was crafted to offer a life lesson at its conclusion. One such fable is titled “The Lion and the Mouse.” In it, the King of the Beasts decides to release a mouse it had caught. The tiny creature repaid this clemency by helping to free the lion after it had been ensnared by hunters. The moral of the story: “Good things come in small packages.”

Individuals who participated in CHART’s inaugural regional meeting in Dallas on February 25 experienced firsthand just how accurate that statement can be. CHART was established in 2015 to serve as an advocate for domestic wholesale and specialty insurance agencies interested in establishing a business relationship with the world’s oldest and most recognized insurance brand, Lloyd’s of London. The group’s goal always has been to facilitate the flow of new domestic program business to the London marketplace.

“We appreciate CHART’s commitment to educating the U.S. market about Lloyd’s and the opportunities available …”

—Enya He

Regional Director

South Central

U.S. Lloyd’s

In the beginning, CHART followed a meeting template used by many other groups in the insurance industry: Events were held in elegant venues, complete with cocktail receptions, well-known speakers, and vendor exhibitions. The meetings were multi-day affairs, and attendees had to pay a registration fee to take part.

Feedback received from agency participants who attended such CHART events suggested some flaws in this approach. The expansive, almost party-like atmosphere was thought to be entertaining but not always conducive to transacting business. A number of agency principals were reluctant to spend a significant amount of time outside the office. And it should come as no surprise that these business owners also expressed concern over paying any kind of attendance fee.

CHART leaders took all of this input to heart—even taking the extraordinary step of suspending the planned 2018 meeting to allow time to develop and implement a go-forward strategy to more fully address the needs of all involved. The outgrowth of that was plans for a series of regional CHART events, which reflected a new approach.

The meetings would be limited to one full day, and a number of peripheral features—keynote addresses, organized vendor activities, and the like—would be eliminated. The London-centric agenda would cover a number of relevant topics while also allotting ample time for networking and private meetings to discuss new business opportunities. Also, no charge would be assessed to participate.

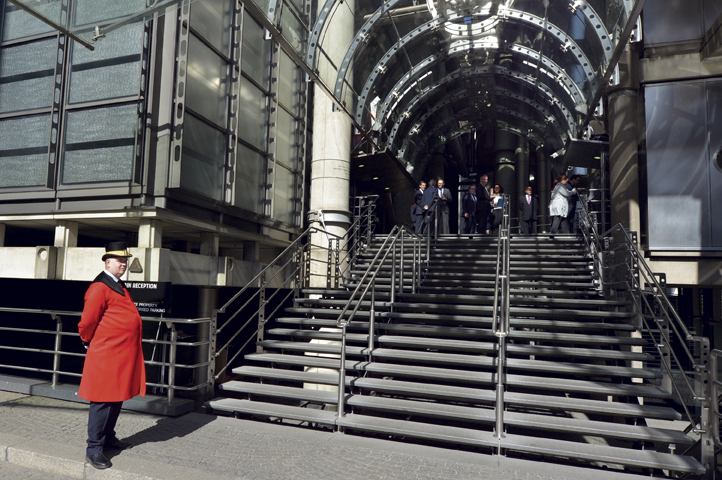

The inaugural regional meeting was held in the Dallas office of Wilson Elser, CHART’s first vendor partner and arguably its most committed supporter. This prestigious law firm has over 800 attorneys operating in 37 strategically located offices across the United States, with another in London. The firm’s reputation, expertise, and international footprint make it uniquely positioned to assist agencies that are looking to operate within the coverholder market niche.

The session began with remarks by Glenn Clark, chairman of Rockwood Programs and CHART’s “Earliest Adopter.” His comments were followed by a discussion led by Enya He, regional director, South Central, for U.S. Lloyd’s. The topic of her presentation was “Lloyd’s Navigating Forward.”

In her talk, He provided informative background on the market, as well as business structure, global premium production, financial ratings, and portfolio diversity. She also presented a frank assessment of the challenges facing Lloyd’s today and strategies that will be employed to address them.

A key segment of the presentation was He’s description of the market’s U.S. footprint. She articulated a number of statistics and facts, including:

- Some 44% of Lloyd’s global premium comes from the United States ($17.2 billion in 2017)

- Lloyd’s is the leading excess-surplus lines market and third largest non-U.S. reinsurer

- The facility is eligible to write surplus lines in all jurisdictions

- Underwriters at Lloyd’s are licensed insurers in Illinois, Kentucky, and the U.S. Virgin Islands

The next topic addressed was cyber liability. This discussion was led by Amanda Harvey, a partner in Wilson Elser. Her presentation underscored both the obvious (systems inaccessibility) and subtle (lost revenue, decreased productivity, reputational damage, etc.) impacts that a data breach can have on a firm. Attendees learned about the role of the federal Office for Civil Rights in these situations, especially when protected health information has been compromised. Harvey also addressed issues related to compliance and notification procedures that must be followed in the event of a data breach.

Steven Ahern, regional director at London-based Iris Insurance Brokers, presented an overview of the steps a specialist agency in the U.S. must follow to secure Delegated Underwriting Authorities from London. The journey begins with the firm securing the sponsorship of a broker and managing agent willing to support it, he explained. A significant amount of due diligence takes place during the application phase, he added, noting that Lloyd’s will pay particular attention to the applicant’s experience level, financial stability, licensing, back-office capabilities and business plan. It may take from several months to more than a year to complete the process.

Ahern’s presentation provided a natural segue to a discussion of CHART’s Incubation initiative. Many agencies that are seeking to bring a new program to market are frustrated by the length of time required to secure the appropriate authorities. Clark offered CHART’s Incubation initiative as a potential solution.

Through this facility, CHART can team a new client with a firm that already possesses the necessary authorities, state licenses, and back-office administrative capabilities to transact business on a national scale. Agreements made between the two parties prior to launch govern such issues as contract duration, duty segregation, revenue sharing, and expiration ownership.

Discussions of business solutions available through the organization continued with a presentation about CHART Markets. This facility was described as a shopping mall for coverages underwritten through the London market. CHART provides a Web-based platform—a virtual counterpart to a brick-and-mortar shopping facility. Visitors have access to an easy-to-use directory where they can conduct product searches, get assistance on the placement of unique or one-off risks, and learn more about the services offered by CHART’s network of vendor partners.

Individual agencies that are seeking to distribute products through CHART Markets can build their own customized storefront. These dedicated pages offer product information, submission instructions, and descriptions of preferred risk characteristics.

Mark Rattner, chief underwriter at Jacksonville, Florida-based Fortegra, provided insights into distributing a Lloyd’s-underwritten product using admitted paper. This can be accomplished using a hybrid fronting model available through his firm. The solution benefits the London market as well, given that Fortegra typically assumes risk (up to 20%) on these transactions.

Valeri Williams, a partner in Wilson Elser, tackled another hot topic, leading a discussion of employment practices in the “#MeToo” era. The presentation reviewed issues related to sexual harassment and retaliation claims, bookended by two seminal events—the Anita Hill testimony from the early 1990s and the more recent media focus on Harvey Weinstein. Statistics cited in these discussions underscored the potentially devastating impact an employment practices claim can have on a firm. Williams also addressed current and pending legislation related to this topic.

The meeting concluded with an overview by Glenn Clark of “CHART 2.0.” The new vision has the organization moving away from its original collegial association structure to one that is more business-centric. Resources now are in place for CHART to provide “cradle to grave” service for any specialist agency that is interested in securing a business relationship with London.

As noted earlier, ample time was allotted during the meeting for networking and private discussions related to new business opportunities. The Dallas event surfaced no less than five potential programs for London.

Presenters and participants praised CHART’s new meeting format and content.

“We appreciate CHART’s commitment to educating the U.S. market about Lloyd’s and the opportunities available for developing lasting relationships and risk transfer solutions that enable our distribution partners to grow and prosper,” said Lloyd’s’ He.

“Going into 2019, the Lloyd’s market is well positioned, financially and geographically, to continue delivering our unique value proposition to coverholders across the U.S. and around the world,” she added. “The regional conference in Dallas successfully delivered this message.”

Charlie Fontenelle, founder of F&G Insurance, a Metairie, Louisiana-based retail agency, said, “It was a great meeting, and I came away with so much more knowledge about [CHART] and what you have to offer. We look forward to working with you guys to improve marketing results and hopefully one day get our coverholder status.”

Noted professor and author Vernor Vinge once observed that “even the largest avalanche is triggered by small things.” The inaugural CHART regional meeting was small in comparison to other industry events, but it will generate outsized results for our specialist agency clients, the London market, and our valued vendor partners.

The author

Coverholders and Risk Takers is a column written periodically by principals or “early adopters” of the CHART Exchange (www.chart-exchange.com).The group’s core mission is to facilitate more U.S./London commerce via personal interaction, education, and technology. Francis J. “Frank” Huveris senior vice president and chief financial officer of Claymont, Delaware-based Rockwood Programs, a Lloyd’s coverholder for more than 15 years and a CHART Exchange early adopter.