Coverholders and Risk Takers

COOKING UP PROFITABLE LONDON RELATIONSHIPS

Recipe for coverholder success calls for key ingredients and appetite awareness

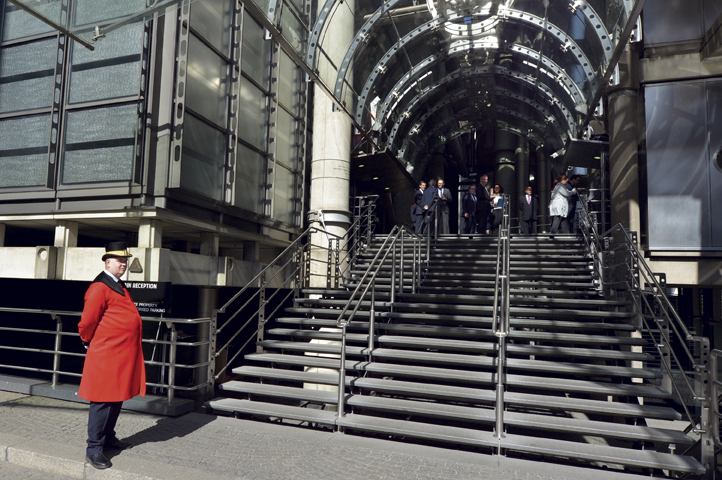

Have you ever watched one of those cooking shows on TV? It’s always amazing to see how a talented person can take a batch of otherwise bland ingredients and turn them into a culinary masterpiece. This same phenomenon can also take place in the insurance world. A skilled agent can take the seemingly innocuous components from his or her existing business and turn them into a profitable program relationship with the world’s oldest and most respected market—Lloyd’s of London.

Before outlining this “recipe for success,” a little review of one of our earlier articles is in order. We previously talked about the unique nomenclature used by our friends across the pond. Agents possessing delegated underwriting authorities from Lloyd’s are referred to as coverholders. In this capacity, they act on the insurer’s behalf: evaluating risks, collecting premiums, issuing policies, and (potentially) adjudicating losses.

A skilled agent can take the seemingly innocuous components from his or her existing business and turn them into a profitable program relationship with the world’s oldest and most respected market—Lloyd’s.

There are currently over 1,000 active coverholders domestically. Interestingly enough, the business that these entities generate accounts for less than one-fourth of the total U.S.-based premium Lloyd’s writes each year. This little factoid serves to illustrate both the diversity of London’s risk appetites and the level of opportunity available for agencies interested in working with the market.

Step 1: Gather the ingredients

Many of the elements needed are right in your back yard—you just need to know where to look. Let’s start with a little “data mining.” Analyze your historical production results to tease out trends like:

- Homogeneity of risk characteristics. Is there a common thread of demographic variables—annual revenues, business segment, geographic location, etc.—within your portfolio?

- Distribution channels. What is your most successful submission source? Do your applicants share areas of affinity, like belonging to the same business organizations or associations?

- Coverage wordings. What policy provisions resonate most strongly with your target audience? With a little creativity, you may find the proper mix of coverage features that will help differentiate your offering from others in the marketplace.

- Underwriting results. What is the experience of your book like? Are there any common “themes” to the losses? Perhaps there is a way to improve results through the use of modified coverage wording or sub-limits.

This is a great start, but we need more to spice things up. Pull together information about your agency’s internal workflows and procedures. Do you use automated management systems to record submissions, monitor outstanding quotes, solicit renewals, etc.? What types of internal controls are in place? Document things like performance standards, quality assurance processes, and complaint-handling practices.

Finally, let’s focus on you. There is a personal element to any business dealing. Insurers need to be confident in the capabilities of their partner agents before ceding any underwriting authorities to them. This is especially important in a long-distance relationship, like the ones the London market participants have with their U.S.-based coverholders.

You are an expert in your particular business niche. Invest the time to put together a comprehensive resume detailing your experience, professional accomplishments, industry designations, etc. Use this document to demonstrate how effective a partner you can be.

Step 2: Mix it all together

Next, organize all of the ingredients you’ve gathered into a cohesive program proposal suitable for submission to the London market. Your “magnum opus” should include the following components:

- Overview of the prospect universe. Talk about the preferred risk characteristics of this target audience. How many of them are there? Are there any points of aggregation (associations, organizations, regulatory/oversight agencies, etc.) that you can access to improve your reach? What is the level of competition in the marketplace?

- Marketing strategies. Demonstrate your expertise by articulating how you intend to solicit business. Provide mock-ups of promotional materials if possible.

- Model policy wording and underwriting guidelines. No one knows the potential exposures and coverage “hot buttons” of this niche market better than you. Outline the product features and pricing structure needed to make the program successful.

- Administrative strategies. Explain how you envision handling incoming submissions. Tout the inter-nal controls and workflows that have been implemented within the agency. Now would also be a good time to talk about any systems enhancements you plan on incorporating to make processing more efficient.

- Estimate production growth over the next five years. Also include forecasts regarding claim activities.

There’s an old saying that “too many cooks spoil the broth.” But when it comes to writing your program proposal, take all the help you can get. If there are deficiencies in your submission, seek out assistance from industry experts to get them resolved. The CHART Exchange has a network of specialists from a diverse array of disciplines to help agencies in this regard. Services offered through our vendor partners include actuarial, claims administration, marketing, systems, legal, and more.

It will be necessary to work through a broker when making a program sub-mission to Lloyd’s. As your “advocate” in London, these firms will help fine-tune your proposal, identify syndicates withthe most compatible risk appetites, negotiate contract terms and conditions, and walk you through the coverholder application process.

Step 3: Let it bake

There is an application process associated with securing delegated underwriting authorities. The first step to becoming a coverholder is to find a syndicate willing to endorse you. Your London broker will work with you to find the best partner.

Once your sponsor has been found, the agency will be required to go through a comprehensive vetting process. Lloyd’s is justifiably protective of the reputation it possesses within the industry; be pre-pared for its due diligence to be very thorough. In reviewing the application, the market will pay particular attention to such areas as the suitability/experience of the agency, financial standing, and licensure required to operate within the target jurisdictions.

The most important piece of advice we can give during this process: be patient. It may take a little while longer than expected to be approved … but it will be worth the wait.

Step 4: Enjoy the taste of success!

Congratulations—you are now align-ed with the most respected insurance market in the world today. Implement your program business plan and watch your agency g/row as a result.

The author

Francis J. “Frank” Huver is senior vice president and chief financial officer of Wilmington, Delaware-based Rockwood Programs, a Lloyd’s coverholder for more than 15 years, and a CHART Exchange early adopter.

Coverholders and Risk Takers is a periodic column written by principals or “early adopters” of the CHART Exchange (chart-exchange.com). Its core purpose is to expand the U.S./London marketplace through the identification and pursuit of new business opportunities. The organization offers tools to help agents seeking to establish a relationship with Lloyd’s, as well as coverholders looking to grow their business. Direct inquiries can be sent to info@chart-exchange.com