Natalie Stone takes the helm at Illinois

agency founded by her great grandmother

“Our team learns from one another constantly, enabling us to craft

tailored risk mitigation strategies for each client. Everyone here

knows our clients and deeply understands the sophisticated exposures they face.”

—Natalie Stone

President

By Dennis H. Pillsbury

It seems fitting that Natalie Stone, another hard-working woman, has become the president of an agency founded by a woman in 1912. Esther Stone, a widowed mother, started Hill & Stone Insurance Agency in Lake Bluff, Illinois, at a time when women could not vote and were not always the first choice for appointments by insurance companies to write their business.

What Esther did offer was a willingness to work harder than her male competitors and to learn harder as well. She became a student of insurance and the financial markets so that she could provide top notch protection to the growing number of residents and businesses along the North Shore of Chicago that chose her agency to handle their insurance needs.

Her success certainly proved wrong any predictions of those who believed Hill & Stone was doomed from the start, simply because it was founded on an unlucky date—April 15, 1912—the same day the Titanic sank. (And for those thinking of Tax Day, income taxes didn’t exist yet; they began in 1913 after the passage of the Sixteenth Amendment.)

Generations of leadership

Esther passed her focus on hard work and knowledge to the next generations. Her grandson, George S. Stone, CLU, remembers Esther teaching him how to read the stock tables when he was 10. “Through her, I first learned how to work hard,” he adds. “Her only son, my dad, also learned that lesson well.

“He took over the agency from Esther and helped it continue to grow,” George notes. “And during World War II, he was a decorated code breaker and met Mom, a code breaker from England, at the Pentagon.”

In 1979, George joined the agency after graduating from Dartmouth College with multiple job offers until his dad, who was president at that time, added one more. George responded with a “yes” and joined an agency that then had fewer than 400 clients. “Today, we have many thousands,” he says.

“We always look to exceed expectations, especially with claims. We want to earn referrals by the high standard of service we provide that focuses on the client being first.”

—George Stone

Principal

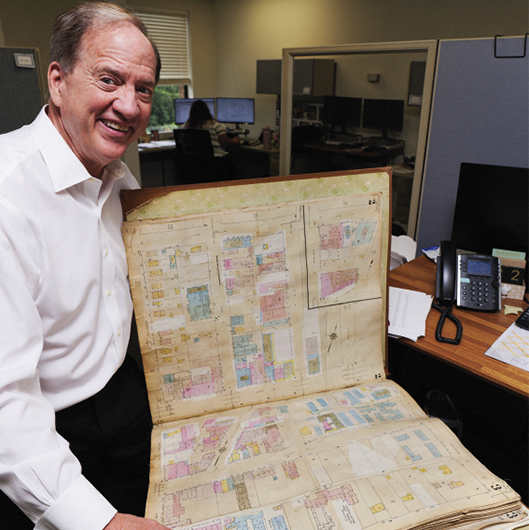

Left: George shows the Sanborn Map Company’s plat of northern Lake County, Illinois buildings from the 1920s, with details on each building’s fire code.

Right: Tracing its roots to the Lake Bluff Camp Meeting Association, Lake Bluff was a late 19th century vacation destination for the then-emerging middle class.

George, who is the former president and current principal, recently turned the presidency over to Natalie Stone, MBA, CIC, MLIS (Management Liability Insurance Specialist) because she is “outperforming” him and “I’ve been a sales machine and she leaves me in the dust.”

When George joined the agency, he was looking forward to working with and learning from his dad and also looking forward to an opportunity to further his education. But that lasted only a short time because his dad became terminally ill the next year. “I passed up an opportunity to go to business school in order to focus on the agency,” George explains.

“We hire smart people and train them to be black belts in insurance.”

—Natalie Stone

Left: A crib for her youngest daughter is by Natalie’s desk at all times.

“At the time, we were primarily a personal lines and BOP-type shop,” he recalls, “but I saw an opportunity to become an agency that provided outstanding risk management services in order to reach bigger commercial clients and more affluent personal lines customers, both of which required strong risk mitigation services.”

Growth drivers

Natalie continues, “Our growth comes organically. That’s our hallmark. We’ve reached the point now that we are growing at record pace in both premium volume and number of clients.”

George adds: “We are known coast to coast, especially in the high-net-worth insurance marketplace, where we have developed an expertise that is second to none.”

“We’ve achieved that by hiring brilliant people with high emotional intelligence who want to learn and teaching them insurance,” Natalie points out.

The agency has seen enormous success by hiring talented individuals completely outside of the insurance industry. Natalie illustrates that these individuals include a memoir author, a teacher with an ME degree, another who took AP classes in physics, and one of their longest-term staff members who was valedictorian at her high school. “We hire smart people and train them to be black belts in insurance,” she says.

“I also think that we’ve been very fortunate generation to generation as a family business,” George adds. “There’s been no let down. Esther’s hard work ethic seems to have permeated all four generations. We’ve all brought our ‘A’ game to the agency, each in our own way.”

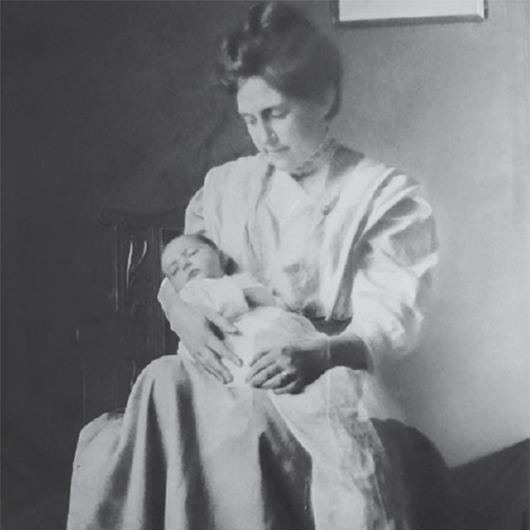

Left: Agency founder Esther Stone, holding her son George—Natalie’s grandfather—who ultimately would become the agency’s second-generation owner.

Different path

Natalie didn’t begin her career at the agency. After graduating from Lafayette College, she joined Citigroup, where she was elected co-chair of the Citi Women’s Network of New York, representing over 2,000 members. Wanting to deepen her education in a program that combined analytical rigor with an entrepreneurial focus, Natalie left Citigroup to pursue her MBA at the University of Chicago Booth School of Business.

“There’s been no let down. Esther’s hard work ethic seems to have permeated all four generations. We’ve all brought our ‘A’ game to the agency.”

—George Stone

Between Citigroup and Booth, she spent a few unexpected months working at Hill & Stone. It was during this time that she discovered her true passion: the unique opportunity to work alongside her dad and eventually take over the family business. “I quickly learned that this was where I belonged,” she says. “I loved having the ability to make decisions that would help the agency grow and loved working closely with our clients.”

Natalie went on to complete her MBA at Booth, where she earned financial grants to support entrepreneurial initiatives. After graduation, she returned to Hill & Stone full time.

Market mastery

In addition to running the agency, Natalie leads by example, focusing her risk management expertise on “asset preservation for the affluent client, as well as working with businesses that require strong professional liability protection,” with her efforts bringing in clients from those areas at an exponential rate.

“Our growth is driven by a deep understanding of the affluent and high-net-worth insurance market. We offer innovative products from top-tier insurers who specialize in this space, paired with personalized, concierge-level service from our team,” she says proudly.

“This business is about wealth preservation, not just protecting the physical damage to homes, vehicles, and buildings. I enjoy working closely with families to help them understand and craft this fundamental risk management piece to their financial plan.”

She emphasizes that a key driver of their success is the agency’s commitment to in-person collaboration, which sets them apart in an increasingly remote work environment. “Having a single office location is a strategic advantage—it fosters the cohesion and daily collaboration necessary to deliver seamless, white-glove service on complex risks,” Natalie says.

Team approach

“Our team learns from one another constantly, enabling us to craft tailored risk mitigation strategies for each client,” Natalie adds. “Everyone here knows our clients and deeply understands the sophisticated exposures they face. We take ownership of managing those risks, allowing our clients to focus on their demanding, fast-paced lives with confidence and peace of mind.

“But that does not mean that we just sit here at this location. We spend a lot of time visiting with clients in person or remotely; they know we are always willing to see them whenever they need us.

“We’re also proud that our concierge service doesn’t just occur when we sit down with the client and present the plan, but when a claim happens as well,” Natalie adds. “We don’t just file claims. We advocate for our clients aggressively and make certain that all claims are reported within one hour.”

Expectations and trust

To which George adds, “We always look to exceed expectations, especially with claims. We want to earn referrals by the high standard of service we provide that focuses on the client being first.”

Natalie concludes by commenting on the agency’s commitment to building trust. “We pride ourselves on being completely transparent with our clients about what coverages we are providing and why so that they learn to trust us and provide us with the same transparency in return.

“That is the only way that we can make certain that we are providing customized coverage for our clients through various life changes—especially when considering coverage for family offices,” she adds. “And our staff is trained and eager to handle the job. I can honestly say that each one of our people has the equivalent of an MBA in insurance protection.”

Education, reputation and more

Not surprisingly, the agency has great belief in continuing education. “We pay for it,” George points out. “Our people must be continually learning so that they can speak intelligently with our professional partners on both the client and company side.

“We have established deep relationships with professional services firms that need a trusted partner on the insurance side, especially when it comes to liability protection,” he adds. “They have to view us as partners who are there to help them grow and prosper. And they do.

“I’m very proud that we have clients that have been with us for several decades and regularly refer us to friends and business colleagues.”

The agency is a regular contributor to the community in which it resides, supporting fire departments, parades (the agency’s float took first place at one of the Lake Bluff parades), libraries, the arts, veterans organizations, the Chamber of Commerce and many others.

George is a Paul Harris Fellow and has chaired numerous national producer advisory councils for the major insurance companies which Hill & Stone represents.

Rough Notes is proud to recognize Hill & Stone as our Agency of the Month. Esther would be proud and astounded by what it has become.

The author

Dennis Pillsbury is a Virginia-based freelance insurance writer.