Beyond Insurance

By F. Scott Addis, CPCU, CRA, CBWA, TRA

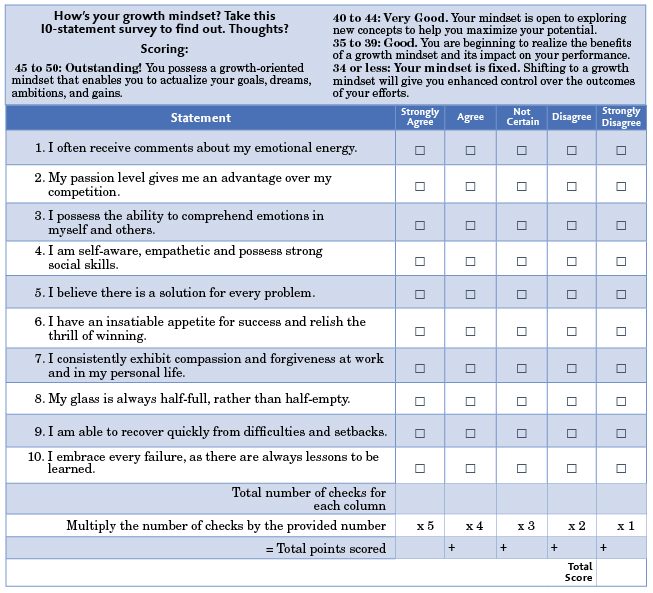

GROWTH MINDSET INDEX … A GAUGE WITH FIVE DISTINGUISHING QUALITIES

Will your methods, beliefs and attitudes help you reach your ultimate potential?

The research and first-hand experience of Beyond Insurance evidences that there are both internal and external forces that prevent individuals from realizing their ultimate potential. External forces—industry perception, commoditization, and the addiction to the insurance bid—are equally as powerful as internal forces, which include one’s skill set, attitudes, and overall mindset.

So what is a mindset? It is those assumptions, methods, beliefs, and attitudes someone holds that affect their approach to life. Mindset is so powerful that it orients the way we think, act, feel, and handle situations.

What makes it possible for people who might seem otherwise ordinary to achieve great things? The answer is passion.

Developed by Beyond Insurance, the Growth Mindset Index™ (GMI) serves as a personal gauge of assumptions, methods, beliefs, and attitudes as they relate to five distinguishing qualities:

- Passion

- Emotional Intelligence

- Drive

- Gratitude

- Resilience

Passion

Passion in business means loving what you do; it stimulates your mind, motivates your efforts, andincites energy and excitement about your work. Thinkof passion as the thermostat that measures the intensity of your emotions. The fuel for passion is your purpose, cause, and belief in your unique abilities.

Were you aware that more than 50% of all CEOs of Fortune 500 companies had a “C” or “C-” average in college? Nearly 75% of all U.S. presidents were in the bottom half of their classes. What makes it possiblefor people who might seem otherwise ordinary to achieve great things? The answer is passion.

To gain a better understanding of your level of passion for your work at this point in time, ask yourself:

- How long has it been since I was so excited about a work-related system, strategy, or tool that I could not sleep?

- Do I find myself getting excited when I share my value proposition and unique business model?

- Is my energy contagious?

Emotional Intelligence

The second distinguishing quality of a growth-minded individual is emotional intelligence (EI)—the ability to comprehend the emotions of yourself and others. For risk consultants, the capacity to recognize certain feelings—and use this knowledge to motivate, inspire, and manage—has a direct correlation with success in the business of insurance and risk management. Emotional intelligence has two primary components:

- Understanding and managing your emotions

- Understanding and promoting positive relationships with others

Success in business requires more than intelligence. You must be able to develop long-term relationships founded on mutual trust in addition to your technical knowledge. You will reap the benefits of EI when you focus on developing the following five competencies:

- Self-awareness—knowing your emotions

- Self-regulation—managing your emotions

- Motivation—motivating yourself

- Empathy—recognizing and honoring the emotions of others

- Social skills—managing relationships and building trust

Drive

Drive is a common denominator of high-performing people, and this is especially true for successful risk consultants. When all else fails, it is people’s inherent drive—to succeed, to accomplish a goal, to make a difference, to win—that keeps them going in the face of adversity. Drive is so important and powerful that it often pushes less-talented individuals to achieve more than those who were born with higher skill sets but lack a burning desire to succeed.

Risk consultants who exhibit high-drive tendencies are motivated by the need to achieve outstanding results and are willing to do virtually anything to get there. They are ambitious, disciplined, and hyper-focused on advancement, with an inherent motivation that enables them to relentlessly pursue excellence and success in everything they do.

Finally, a truly optimistic individual knows that focusing on the light at the end of the tunnel is the key to overcoming any challenge. Individuals with high levels of optimism have three key advantages over their pessimistic peers:

- They expect to win

- They believe that all problems can be solved

- They frame rejection with appropriate perspective

Gratitude

Gratitude is simply taking the time to reflect on all the positive things in your life and cultivate an appreciation for what you have. Research confirms that gratitude is the single most powerful way to increase overall happiness, as it is applicable to so many aspects of our lives: careers, relationships, and mental and physical health.

High-performing risk consultants recognize that practicing gratitude creates positive engagement and improved outcomes with prospects, clients, colleagues, carriers and community. An attitude of gratitude is a skill that can be learned and developed to the point that it becomes a habit.

Here are a few simple ways to practice gratitude:

- Three good things. Each and everyday, identify three things that went welland replay them in your mind or write them down in a Gratitude Journal.

- Positive people. Make an effort to surround yourself with others who demonstrate gratitude and a positive outlook.

- Remove obstacles. Remove the specific obstacle(s) from your mind so you may visualize all the good things in your life.

- Thank you notes. This ritual will positively impact your own life and spread the attitude of gratitude to others as well.

Resilience

In today’s hyper-competitive world, you must be willing to put yourself out there—even in the face of rejection. Resilience is measured by how quickly individuals recover after rejection or defeat. How well do you handle rejection? Learning how to process and move past the aftermath of rejection—to get back in the saddle after falling off the horse—is an essential survival skill in the business of insurance and risk management.

Research shows that “Rejection Sensitivity,” a condition in which rejected individuals experience severe psychological distress, is on the rise. It is rejection sensitivity that makes us cautious and, in some cases unwilling to take risks.

If you are on the high end of the rejection sensitivity scale, you may feel anxious or fearful about putting yourself out there. As a result, you will rarely move beyond your comfort zone—and your career may pay a steep price. Tell-tale signs include ineffective referral networks, call reluctance, and random prospect research and qualification strategies.

By cultivating personal resilience, you can learn how to avoid rejection sensitivity and achieve the career of your dreams. Master the art of resilience using these five steps:

- Don’t take it personally. Often the other person is not rejecting you. Rather they are rejecting the product, service, solution or offering to which you are attached.

- Know when to cut your losses. When you face rejection, you will be wise to decide how much time, energy and effort you will put into the project.

- Rely on your support system. When your ego is bruised, it is important to receive encouragement, guidance and counsel from those who care most about you.

- Maintain your focus. Focus on what you can control. Do not dwell on uncontrollable forces.

- Keep a positive attitude. With every “no” you receive you are that much closer to the next “yes.”

What will you achieve from a growth mindset supported by these five distinguishing qualities? Your ultimate potential!

The author

Scott Addis is CEO of Beyond Insurance and an industry leader. His agency was recognized by Rough Notes magazine as a Marketing Agency of the Month, he was a Philadelphia finalist for Inc. magazine’s “Entrepreneur of the Year” award, and was selected as one of the “25 Most Innovative Agents in America.”

Beyond Insurance is a consulting firm that offers leadership training, cultural transformation, and talent and tactical development for enlightened professionals who are looking to take their organization to the next level. Since 2007, the proven and repeatable processes of Beyond Insurance have transformed agencies as measured by enhanced organic growth, productivity, profitability, and value in the marketplace. To learn more about Beyond Insurance, contact Scott at saddis@beyondinsurance.com.