A promising option for

A promising option for

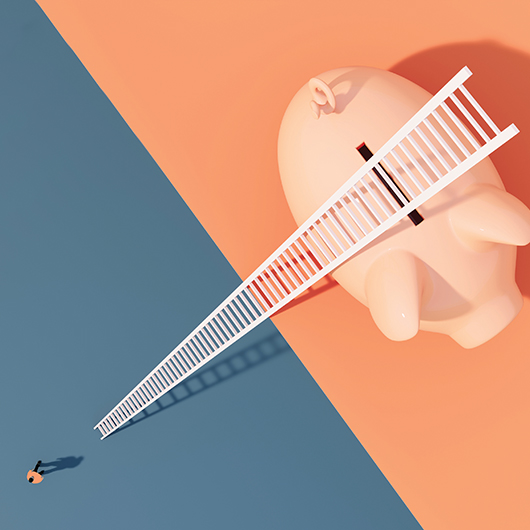

creating retirement readiness

“Most Americans who eventually will retire are extremely interested in some kind

of retirement income that is protected or guaranteed for life.”

—David Blanchett

Portfolio Manager and Head, Retirement Income Research

PGIM

By Thomas A. McCoy, CLU

Despite introducing significant improvements to defined contribution (DC) plans that are helping workers boost their retirement savings, most plan sponsors are still a way off from delivering a benefit that workers and retirees say they want: the security of a guaranteed lifetime income. Insurers continue to search for the right strategy to build a guaranteed income product at scale.

“It’s not easy,” says David Blanchett, portfolio manager and head of retirement income research at PGIM, the global investment management business of Prudential Financial. Blanchett has been researching potential lifetime income solutions for more than a decade.

“I’m excited about the attention being devoted in the industry to lifetime income. There is just a lot to figure out,” Blanchett told a recent EBRI retirement seminar audience.

In developing a DC plan guaranteed income product, “Too often we focus on economic efficiency—some kind of a Monte Carlo projection overlaid with mortality projections. In reality, there are behavioral considerations and the product landscape to consider,” he said.

“Workers are looking for a way to figure out ‘how do I take this big pot of savings and create income from it.’ But if you ask people what they want in lifetime income, they want everything.

“Everything,” he said, includes “income growth, flexibility, inflation protection and liquidity. When you put all these together, it reshuffles the question of what products are best to consider for a DC plan.

“What’s evident from almost every survey is that most Americans who eventually will retire are extremely interested in some kind of retirement income that is protected or guaranteed for life,” Blanchett said.

An EBRI-sponsored survey in 2024 showed that 83% of retirement plan participants were either very interested or somewhat interested in options for providing guaranteed lifetime income at retirement.

When survey participants were asked about specific options, the solution scoring the highest was a product with a default option in the plan that would allocate a portion of savings to the guaranteed lifetime income feature. At retirement, the participant could decide to use the feature.

Under a second option, at retirement, plan participants would be directed to a platform/exchange to help them buy an income-producing solution they like—some guaranteed and some not guaranteed.

A third option would not provide a guarantee, but the participant would receive management of their portfolio with advice on a target withdrawal rate. The second and third options ranked four or five percentage points below the default option for accumulating an income guarantee during the working years.

“Workers’ retirement solution preferences will vary, depending on demographic differences such as age and retirement balances,” Blanchett pointed out. “What’s clear is that people want help from a professional fiduciary on all these complex financial decisions.

“Advisors can help people do a lot more than pick good funds and build an efficient portfolio,” he continued. “Increasingly, the role of advisors is holistic, to help them get both to and through retirement.

“The good news is that (based on EBRI’s study) about 40% of Americans (including workers and retirees) have an advisor; the bad news is that 60% don’t. But a lot of those who don’t, especially those still working, eventually plan to work with one.”

As part of its 2025 Enduring Retirement Model Study, MetLife research found that 35% of the 225 DC plan sponsors surveyed currently have a guaranteed lifetime income option—an increase from 17% in 2019.

Among those without a guaranteed retirement income option, the study found that 68% plan to offer that option at some point in the future—about half (47%) said within two to five years.

The study also found that 78% of plan sponsors think that when a guaranteed lifetime income solution is offered in a DC plan, the choice to elect the guaranteed income should be made voluntarily by the participant; 19% were in favor of a default to the guaranteed income.

Just over half (53%) of the plan sponsors surveyed said they “definitely or probably” should consider “repositioning their DC plans as retirement income programs.”

When asked what are the most important choices they could provide to help protect retirement savings, 80% of the plan sponsors named solutions that would guarantee an income for life, 76% selected “off-boarding” or retirement education and tools, and 72% named a capital preservation or stable value fund option.

The Milken Institute, a non-partisan think tank, as part of its Lifetime Financial Security Program, recently analyzed the market for guaranteed income in DC plans, where they are now, and how to broaden their appeal.

The Milken report stated, “Offering in-plan lifetime income options within a retirement plan’s investment lineup is an important, innovative industry development that needs to be offered more frequently.”

“Research shows that by having the guaranteed income stream, retirees feel freer to spend from it than they would from an account consisting only of their savings.”

—Cheryl Evans

Director, Lifetime Financial Security, MI Finance

Milken Institute

Cheryl Evans, director of lifetime financial security, MI Finance, of Milken Institute, speaking at the EBRI seminar, noted that plan participants like having the longevity protection of the guaranteed income stream while (in most plans) maintaining access to some of their accumulated nest egg funds.

“Research shows that by having the guaranteed income stream, retirees feel freer to spend from it than they would from an account consisting only of their savings,” she said.

As for ways to entice more plan sponsors to offer the product, the Milken report suggests, “Plan sponsors want more information to share with participants/employees, including straightforward explanations of the solutions, transparent fee structures and a better understanding of the solutions themselves.”

It also suggests the need for these products to become a separate “asset class” as a means for plan sponsors to better analyze them, in particular to distinguish them from retail annuities.

It further notes that although the SECURE 2.0 Act of 2022 provided some safe harbor liability protection to DC plan sponsors setting up a guaranteed income solution, “the current language needs further clarification to address plan sponsors’ concerns fully.”

Defined contribution retirement plans have made significant progress in helping workers build their account balances. Among the biggest contributors have been employer contribution matches, auto enrollment and escalation, and emphasis on target date funds.

A guaranteed lifetime income product within the plan could be the next significant enhancement for many employers. “Defined contribution plans continue to improve to help participants get not just to, but through retirement,” Blanchett said.

The author

Thomas A. McCoy, CLU, is an Indiana-based freelance insurance writer.