Managing private passenger cost

Managing private passenger cost

increases without boosting exposure to loss

Advising insureds about how to reduce their exposures

can help make coverage more affordable for them and

help reduce carrier’s loss costs—a win-win during uncertain times.

By Lisa A. Gardner, Ph.D., CPCU, AIC, AIDA, API

Anyone shopping for private passenger auto insurance during the past three years has likely seen their premiums go up, many significantly. This is true even for the safest drivers with no accidents or violations.

Higher premiums mean less money to spend on other household budget items and can leave consumers feeling pinched. For some, it means saving money by choosing higher deductibles, lower limits, reducing the number of miles driven, or dropping optional coverage altogether. Some will reduce the number of insureds under a policy by, for example, asking young adult drivers to buy their own personal auto insurance.

Making these choices can be hard, often leaving the insured with more exposure to loss.

By how much did private passenger auto insurance premiums increase? Information from the Bureau of Labor Statistics (BLS) motor vehicle insurance index helps answer this question. This index reflects inflation for bodily injury liability, property damage liability, medical payments, uninsured motorist, collision, comprehensive, and personal injury protection coverages. It includes premium amounts for vehicles commonly eligible for private passenger vehicle insurance (e.g., automobiles, SUVs, trucks, vans) and excludes vehicles mainly used for businesses, farming, and ranching.

The index provides one important way to measure private passenger auto insurance inflation.

The BLS reports inflation rates using a year-on-year (e.g., December 2021 to December 2022) approach, which captures growth in prices over time. According to the BLS statistics, inflation grew by 14.2%, 20.3%, and another 11.3% from December 2021-22, 2022-23, and 2023-24, respectively. Motor vehicle insurance inflation was so high that, compared to other sources of inflation included in the Consumer Price Index (CPI), it ranked sixth, first and second over the same periods.

These rankings and rates give insights into what happened yearly. The effects of inflation over longer periods of time deserve some attention, too. The cumulative rate for motor vehicle insurance inflation from December 2021-2024 exceeded 52%, a remarkable increase unheard of in decades. If an insured’s premium increased to keep up with motor vehicle insurance inflation during this time, they saw an increase of 52 cents on the dollar.

Why was motor vehicle insurance inflation so high? While the reasons may never be fully understood, elements of the BLS’ Consumer Price Index provide some explanations:

- The CPI measures overall inflation rates for the U.S. economy.

- The index includes more than 30 categories, some of which directly relate to auto insurance premiums: hospital and related services, medical care, new vehicles, physicians’ services, prescription drugs, and used vehicles.

- Increases in other items included in the CPI like energy and transportation expenses affect the costs of doing business, too, which affects premiums.

The inflationary effects of these items raise auto insurance rates and premiums over time. Private passenger auto insurance contracts typically last six or 12 months, with premiums set at the outset, so any adjustments to premiums usually happen at renewal or if the insured changes carriers. Insurance carriers file personal auto rates with state insurance regulators; usage of these rates may require approval, which takes time.

Actuaries do not use a single year’s data in setting private passenger auto rates, so periods of low inflation may still be reflected in rates used, say, one or two years later when inflation is much higher.

These reasons help explain why increases in healthcare and vehicle costs, as well as overall inflation, as measured by the CPI, have a delayed effect on motor vehicle insurance inflation.

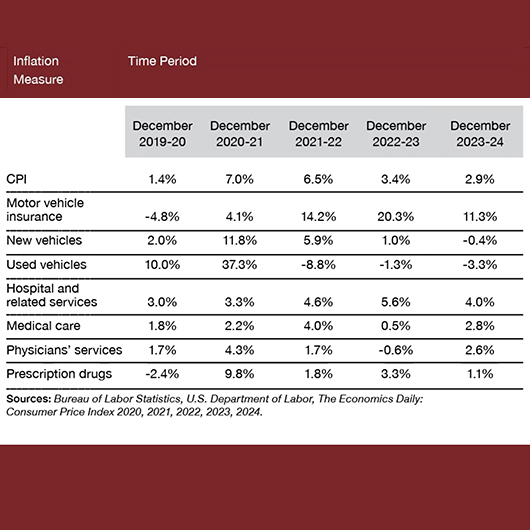

The table below shows inflation rates for the CPI, motor vehicle insurance, hospital and related services, medical care, new vehicles, physicians’ services, prescription drugs, and used vehicles from December 2019-20 through December 2023-24.

The overall inflation rate as measured by the CPI, as well as inflation rates for new vehicles, used vehicles, physicians’ services, and prescription drugs, all peaked in 2020-21, and medical care inflation peaked a year later. In comparison, motor vehicle insurance inflation was relatively low during 2020-21, more than tripled the following year, and increased further in 2022-23, as some of the peaks from the previous two years impacted premiums.

While hospital and related services inflation also likely affected premiums, peak rates occurred in 2022-23 and as a result may not be fully reflected in motor vehicle insurance values shown above.

Will motor vehicle insurance inflation rates continue to decline? Since the end of 2024, CPI and motor vehicle insurance inflation rates fell through March 2025—good news for insurance consumers. How long will these falling rates continue? It depends on many factors, like whether tariffs continue being implemented that adversely affect the auto and healthcare sectors, as well as the economy more broadly.

Shortages of computer chips used in motor vehicles can also increase motor vehicle insurance inflation. Labor shortages in healthcare and automotive repair will fuel inflation, if they occur. If auto theft rates climb, expect premiums to follow. More generous jury verdicts in private passenger auto suits will also cause premiums to rise, as well as natural catastrophes that may damage or destroy thousands of vehicles.

These factors seem beyond the control of nearly all insureds. But there are some actions that advisors can recommend to insureds to help counter motor vehicle insurance inflation.

Encourage your insureds to regularly maintain their motor vehicles. Drivers who keep lights functioning, turn signals operable, brakes in good working order, and tires in good shape and adequately pressurized will lower their chance of getting into an accident.

Remind your insureds of the benefits of embracing safe driving habits. Drivers who avoid distracted driving, drive within posted speed limits, wear seatbelts, participate in a safe driving course, drive sober, and adopt other safe driving habits reduce the chance that they are in an accident, and its likely loss severity, too.

Good vehicle maintenance and driving habits protect the insured, their passengers, and others on the road, including nearby pedestrians.

Where affordability remains a challenge, some brokers and agents encourage insureds to revisit their coverage needs, including deductibles, limits, and the benefits and costs of optional coverage. However, reducing coverage can leave the insured further exposed to loss.

Other ways to help insureds manage auto insurance costs include reminding them to get an auto insurance quote before they decide to trade vehicles or add a vehicle to their household. Insureds who have factored in the effect of buying or trading a motor vehicle on their auto insurance costs are better equipped to make a choice that they can afford.

Finally, ask the insured whether they can significantly reduce their auto usage by using mass transportation, walking, or bicycling more. Not only should this help reduce their costs but also should encourage healthier habits by the insured.

Keeping auto insurance premiums affordable when inflation increases can be a challenge. While inflation rates have fallen, there is no guarantee that they will remain low. Advising insureds about how to reduce their exposures can help make coverage more affordable for them and help reduce carrier’s loss costs—a win-win during uncertain times.

The author

Dr. Lisa Gardner is the associate director, Content and Research, at the Risk & Insurance Education Alliance. Her experience includes more than three decades as a professor in higher education where she taught courses about risk management and insurance, statistics, and finance, and provided programmatic leadership.