Keeping a small town feel in a big city

We all remember those mentors who helped us decide on a direction in life—a teacher, a boss, a coworker, a spouse. Well, for Brook Mahoney, it was “a great professor at the University of Iowa who lured me into this business.” And so it was that Brook graduated with a BA in Insurance and Marketing and began a career in the insurance business. Since then he has achieved several industry designations, including CPCU, ARM and CIC.

In 1982, Brook moved from Iowa to Denver, Colorado, where he started working for a national broker. “Coming from a small town, relationships were very important to me. But the emphasis at the broker was on profit and production. That didn’t fit with the way that I wanted to do business.”

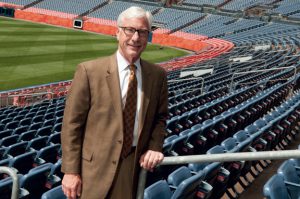

So, in 1985, Brook left the broker to start his own agency, Greenwood Village-based Cherry Creek Insurance Group, in Denver’s Tech Center, a business and economic trading hub. Not surprisingly, a principal focus of the new agency was to bring small-town service, built on strong relationships with clients, to the Denver area and beyond. Today, the agency has clients in all 50 states and eight countries and does business as CCIG, because that name “travels better outside of our territory,” reports President and Chief Operating Officer T. Scott Kennedy, CIC, CRM.

—Brook Mahoney

The competitive advantage

“Our culture is our competitive advantage,” Scott maintains. “We have focused on making CCIG a place that clients and employees enjoy. Our growth has made it imperative that we work to maintain this feeling across the entire spectrum of our employees. Today, we have about 85 employees and, since we are adding about 15 to 18 more every year, this can be a challenge.”

Brook adds, “We have a person on staff who is responsible for employee interaction, engaging employees across the operation. We host community activities to support charities, hold recreational events, get together for parties, and so on. Everyone gets to know everyone. And the numbers point to the fact that it’s working, along with the fact that people tell us they like coming to work here. We track our employee retention, just like we do our client retention, and I’m very pleased to report that they are both in the high 90s.

“What also really helps is our team approach to client service,” Brook continues. “While the producer who brought in the business remains the lead on the account, he or she is backed up by a team that helped with that account from the very beginning.”

“It’s not uncommon for four or five people to be present at the point of sale,” Scott notes. “In addition to the producer—we call ours Insurance Advisors—the team could include people from client service and claims, or anyone who would be involved in making certain that the particular client receives the best risk management advice possible.

“We present our approach as a pyramid, with the client at the top, and our people providing service to them,” he adds. “If there’s a claim, they have a claims advocate who reports to them. If they need a safety program, they have a safety professional from our agency who reports to them. And of course, no matter what the concern, they have an insurance advisor who works to provide them with whatever help they need in managing and mitigating risk.

“Our management team at the agency is at the bottom of that pyramid,” Scott points out. “That really resonates with the buyer.”

It works

Meetings with potential clients are focused on the services CCIG provides to help them manage their long-term cost of risk. “We win a lot of business by showing the prospect what we can do to improve the performance of their overall insurance program,” Brook points out. “We can demonstrate where they are uncovered and where they are paying too much for insurance by doing a careful review of their current coverage. We show them how our safety professionals can help them create a safer workplace where there will be fewer accidents, with a goal of reaching an accident-free workplace.”

“At the same time,” Scott adds, “because we include our claims advocates as part of the team, we can show them what happens when we handle claims for them. We have some of the best claims advocates in the business. They know the carriers and what they expect, because they joined us from the carrier ranks. If there’s ever a problem, they can get it resolved quickly and make certain every claim is handled promptly and fairly.”

This approach has led to an impressive growth rate, which has averaged 15% annually for the past 10 years. “That means we double our revenues every five years,” Scott points out. “And I think we can continue that.” Today, revenues total about $13.5 million—80% commercial, 15% personal, with a large part of that involving high-net-worth individuals, and 5% benefits—and the agency is on target to reach $20 million in 2020. The agency’s focus is on middle market commercial, but clients range from publicly traded global companies to local, family-owned businesses.

Of course, in order to sustain growth, the agency needs to attract quality people and plan for increases in personnel, as well as in revenue. The year-over-year growth in personnel over the past three years has been in the double digits.

“We are always on the lookout for sales people,” Scott says. “And if we find someone who has the sales acumen and fits with our culture, we’ll always find room in our budget to bring them on board. We are always looking for high-character individuals who are competitive, educated, and have a history of giving back to the community.”

The hiring process

The agency uses a multiple interview process in various settings. The interview team explains the agency culture in detail, so the candidate understands the importance of servant leadership and working with a team to create success for the entire agency. When a person makes it past the first two interviews, they then must take a personality assessment test. This process has been in place for more than a decade and has resulted in a 70% success rate with onboarding new insurance advisors.

The new advisors generally come from one of three groups:

Those people who are new to insurance, but who demonstrate strong sales skills, are competitive, coachable, and have a history of community service.

Individuals who have three to five years of agency experience, who may have picked the wrong agency, but who have heard of CCIG and its culture and team environment.

Senior producers who know the marketplace and have numerous contacts to launch their organic growth career with CCIG.

Once an advisor is on board, he or she is assigned a mentor and they cooperatively create a business plan. Advisors are trained on products. And the agency also pays for continuing education and sends each new advisor to producer schools. The compensation plan each candidate is offered is highly competitive and rewards aggressive book growth and exceeding sales goals.

—T. Scott Kennedy

Planning for tomorrow

The double-digit growth in personnel means that the agency has to have a plan that recognizes and responds to its growing size. “We brought in an outside consultant to help us focus on transitioning to a larger organization with a more robust middle management, as well as developing replacements for the current leadership,” Brook says. “I am looking into the future for the transitioning to start.

“One of the eye-opening exercises we had to undertake was development of an organization chart for five years from now, when we will have somewhere around 150 people working here, and 10 years from now, when we’ll have more than 300. We realized that we had to redesign our structure as the agency got bigger. Right now, for example, Allen Greenberg is our communications department, but the need for increased internal communication that helps us maintain our culture of servant leadership means that his department could have eight or nine people. Likewise, the need to find ways to involve all employees in fun events could mean that we will need more than one person charged with employee interaction.”

The agency has launched an Emerging Leadership Development Program that will be looking to “identify individuals who can step into middle management roles,” Scott says. “Then we will create a platform to prepare them for those roles. We need them to be cognizant of the fact that we are a risk management firm that has to remain on the cutting edge. We need to look for individuals who can be involved in growing our risk management expertise in the areas of risk control, risk analytics, claims advocacy, and developing tools for our clients—such as a risk management portal, where clients can access robust risk management offerings.”

Giving back

It is hardly surprising that an agency that requires new hires to have a history of community involvement has a strong community service engagement component. The agency has a Community Outreach Committee that makes certain that such involvement includes all employees and that it occurs on a regular basis.

“Our Community Outreach Committee plans events throughout the year to give employees good options to serve, volunteer, and help worthy charitable organizations,” Brook points out. “Examples include organizing food drives, supplying food and services to the homeless, providing support for veterans, and organizing fundraising events for worthwhile causes.”

CCIG exemplifies those traits that make the independent agency system the strongest marketing system in the insurance industry with strong growth based on exceptional client service, as well as community involvement, making the agency an asset to its clients and its community. It has regularly been recognized as a Best Practices Agency by the IIABA, as well as being a top performer with MarshBerry. To these honors, Rough Notes is proud to add Agency of the Month.

By Dennis H. Pillsbury