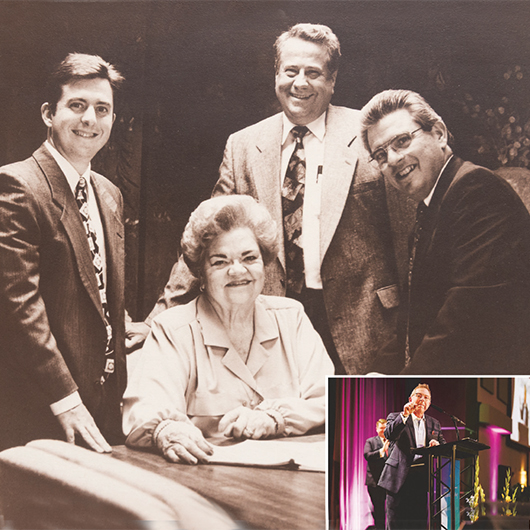

Founder Richard Ollis with his three sons,

who all joined the agency. From left: Fletcher,

Alfred, Richard and Lawrence Ollis

Ollis/Akers/Arney Insurance &

Business Advisors continues to grow

By Lori Widmer

Thanks to smart business decisions and a focus on employees and customers, Ollis/Akers/Arney Insurance & Business Advisors has grown and continues to serve its clients and community. Over the past 140 years, the company has expanded from one office offering real estate, home loans, and insurance to three locations serving clients in more than 30 states. And it all started with family.

In 1885, Richard, Alfred, and Charles Ollis founded the business on Commercial Street in Springfield, Missouri. Two brothers passed fairly early in the life of the business, but Richard’s family line continued his legacy through his three sons, Fletcher, Alfred and Lawrence—with the fourth generation and his namesake leading the company today.

Lawrence unexpectedly died in 1955. His brother and business partner, Alfred, believed that family continuity was crucial, so he asked Lawrence’s wife, Hester, to join the business. “It was almost hard for me to believe she made that transition the way she did,” says Ron Ollis, third generation and retired president.

Because the company leadership often took turns heading the organization, including the president’s role, it wasn’t long before Hester transitioned to president in the mid-1970s. With an education in business from Draughon’s Business College but no on-the-job experience, Hester “went into it and was very strong,” says Ron. “She was like a sponge. She talked to a lot of businesspeople and asked for their advice. And relatively quickly she became very knowledgeable in insurance and handled several fairly large accounts.”

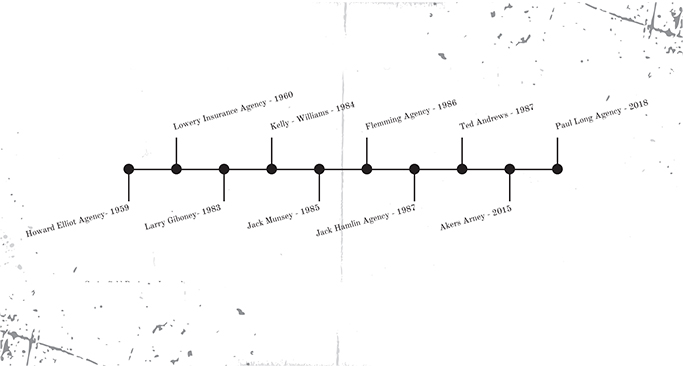

Middle: A timeline shows the agency’s ten acquisitions since 1959

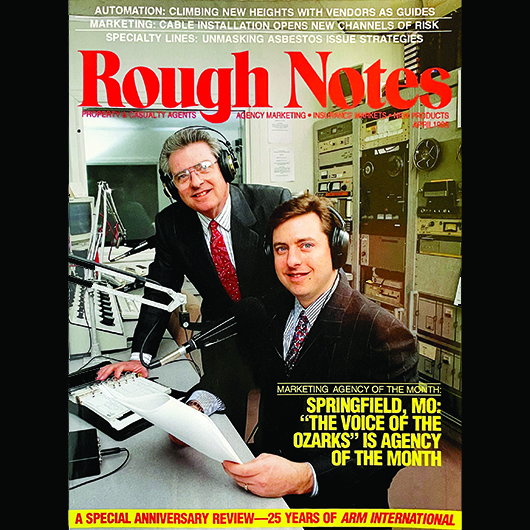

Bottom: As Ollis & Company, the agency was the Rough Notes Marketing Agency of the Month in April 1995.

In 1979, the organization moved to its current location on East Sunshine Street. That’s also when the company “became strictly an insurance agency because the others [real estate, home loans, notaries] were fairly minor parts of the business,” says Ron. By 1983, Ron was heading up operations alongside his cousin Larry, taking over the duties that Hester was performing. Larry’s brother Joe was serving as an agent.

Throughout the years, the organization was growing. From 1959 through 2018, Ollis/Akers/Arney acquired ten agencies. These strategic acquisitions allowed the business to grow to three offices located in southwest Missouri—Springfield, Branson, and Bolivar. The acquisitions included Akers & Arney located in Branson, Missouri, and The Paul Long Agency located in Bolivar.

Edd Akers, David Arney, both retired now, led the Branson agency for several decades. John Akers still heads up the benefits effort as vice president of Benefits and is instrumental in advising and guiding financial aspects for the agency. Paul Long is the vice president of Business and Association Development and serves alongside both Richard and John on the executive management team.

“[Hester] was like a sponge. She talked to a lot of businesspeople and asked for their advice. And relatively quickly she became very knowledgeable in insurance … .”

—Ron Ollis

Third Generation and Retired President

(insert) Richard Ollis receives the 2024 Springfieldian Award.

“[Moving to employee

ownership] … was a

difficult decision to make, as some family members at the time felt we were giving the business away … . While we were giving away a piece of the pie, we had a bigger piece that we were keeping.”

—Richard Ollis

Chief Executive Officer

Edd Akers, David Arney, both retired now, led the Branson agency for several decades. John Akers still heads up the benefits effort as vice president of Benefits and is instrumental in advising and guiding financial aspects for the agency. Paul Long is the vice president of Business and Association Development and serves alongside both Richard and John on the executive management team.

Through Richard Ollis’s leadership, the agency transitioned again in 2008 from a traditional, transactional insurance agency to a consultative firm. Today, Ollis/Akers/Arney offers numerous lines of business, including commercial risk programs, group health benefits, private client services, and Medicare and senior programs, as well as a business consulting division.

The organization “recognized how challenging it is for business leaders to stay informed in all areas of human resources,” says Richard Ollis, the current CEO. “Since that time, our trusted consultants have offered expertise, knowledge and human resources solutions to maximize our client’s return and minimize business risk so clients can focus on their core business.”

Most notably, 1982 saw the beginning of employee ownership of the organization. Ron heard a guest speaker at an annual meeting held for the Missouri Association of Insurance Agents (MAIA). The speaker was presenting the idea of agency perpetuation, and it was Ron’s first exposure to the benefits of an employee stock ownership plan (ESOP).

“Employee-ownership intrigued me at that meeting,” Ron says. So, a few years later when he was serving as president of the state insurance association, he had the association invite the speaker to give a presentation focusing on ESOPs.

From that meeting, Ron says he was “very, very interested in trying to install that in our operation. I must say it was a difficult decision to make as some family members at the time felt we were giving the business away, which were genuine concerns. I didn’t feel that way. While we were giving away a piece of the pie, we had a bigger piece that we were keeping.” He felt it was the best, if not the only, way the company could grow beyond a family-only business.

Richard Ollis celebrates winning

the Springfieldian Award with his wife,

Teresa, and their daughters, Kelsey and Sabrina

Best Places to Work in the region, an award facilitated by Best Companies Group and Biz 417.

From that meeting, Ron says he was “very, very interested in trying to install that in our operation. I must say it was a difficult decision to make as some family members at the time felt we were giving the business away, which were genuine concerns. I didn’t feel that way. While we were giving away a piece of the pie, we had a bigger piece that we were keeping.” He felt it was the best, if not the only, way the company could grow beyond a family-only business.

It was a move that is paying off for both employer and employees, not to mention clients of the organization. Since 2017, the organization has garnered regional and national accolades for their performance, culture, and innovation. Some of the awards include:

- Best Practices Agency by Independent Insurance Agents & Brokers of America (2019 – 2025)

- Top Insurance Employer by Insurance Business America (2019 – 2025)

- Outstanding CSR of the Year for the State of Missouri by Missouri Association of Insurance Agents (2017, 2019 – 2024)

- Best Places to Work by Best Companies Group (#1 for the past three years 2023, 2024, 2025)

With every change and shift to include new business, Ollis/Akers/Arney has managed to improve business outcomes and increase their focus on doing right by their clients. Instrumental in the organization’s growth has been that client focus. “The transition to a consultative firm for our clients has been transformative for our entire agency,” Richard says.

“Establishing a proactive approach that includes proprietary risk assessments, documented progress and results communications, and benchmarking, we have been able to focus on clients that value a true, trusted partnership,” he adds.

Richard also attributes specializing in business segments such as public entity, manufacturing, healthcare, banking and construction for such growth. Likewise, the role of technology has played a key role in the success of the organization.

Utilizing electronic recordkeeping, automated form creation and fillable fields, educational and emerging trend articles, training platforms, and financial systems are all employed to ensure the highest level of service for their clients. “Using technology to deliver safety, wellness and HR resources has enabled us to better serve our clients,” he notes.

Staying relevant for 140 years is challenging, yet Ollis/Akers/Arney has managed to bridge over a century with smart choices and innovative thinking, but also with a focus on what they do best. “Empowering our incredible team to focus on our core competencies, building trust and customer focus, they strive every day to deliver on our mission of protecting tomorrow today,” says Richard. “Staying abreast of emerging trends in not only our industry, but specialized niche markets have proven invaluable in being a top resource for our clients.”

The author

Lori Widmer is a Philadelphia-based writer and editor who specializes in insurance and risk management.