Finding innovative ways to redefine

your team and staff for tomorrow

By Carey Wallace

There is no question about it; people are the most valuable asset inside an independent insurance agency. It is the people who create the culture and the experience that is felt by your clients. Their expertise, empathy, and ability to connect may be the single biggest factor that determines whether a client stays or leaves an agency.

They are also the biggest expense inside an agency, which makes perfect sense. The average agency dedicates over half of its revenue to payroll and benefits for its staff.

With this kind of investment, it is not hard to imagine why many agencies are redefining and looking for ways to restructure their teams. The goal is to allow their staff to focus on the high-impact parts of their roles and minimize the time and energy focused on the low-impact tasks that can be redirected, automated, or eliminated. This will ultimately create more capacity across the entire team and help to better scale the agency.

Traditional team

For years, scaling an agency followed a familiar pattern: One person gets licensed, obtains the necessary insurance, and gets to work. They may start off with basic email, and office software to keep track of their clients, and that one person completes all of the tasks needed to sell insurance and service their clients.

At some point, the work that it takes to sell and service expands beyond what one person can manage, and the first hire is made. If the owner is a strong salesperson, they will hire a service person to help them; if the owner loves service they may choose to hire a new salesperson to join the team. Some choose to add technology such as an agency management system or CRM system to manage the workflow and processes.

The core roles of sales, service and operations begin to emerge, and this is where many independent insurance agencies first begin to choose their path towards scale. Based on profitability and production performance, they begin to add team members when the work to service clients grows beyond what the current staff can manage.

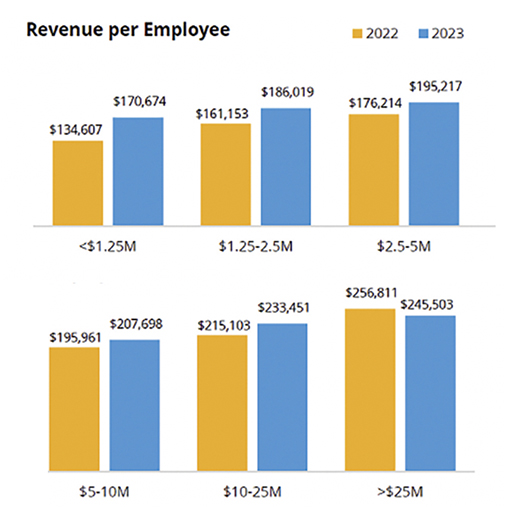

The chart on page 36 is a part of the published industry metrics included in the Best Practices Report from The Big “I” and Reagan Consulting that help owners determine when new hires are needed.

This approach of adding employees based on volume has worked for years. But recently, the game has changed. Finding and retaining great talent continues to be the number one concern for agencies. The expected number of people across all roles at or nearing retirement age—otherwise known as the Silver Tsunami—is impacting our industry, as well as is the widespread embracing of remote workers that was created by COVID and sustained by many agencies. As a result, the human resources game has become more competitive than ever before.

In addition, many carriers have expanded their expectations and increased the workload that agencies are responsible for in both the sales and service process. These combined factors have created the perfect storm requiring agencies to rethink their team structure and innovate. Some agencies are blowing up these metrics by redefining the tasks that each role on their team is responsible for, utilizing virtual assistants, outsourcing work, eliminating duplicative administrative work by leveraging technology and robotic process automation all in an effort to maximize capacity and profitability inside the agency.

This approach of adding employees based on

volume has worked for years. But recently, the game has changed.

Reallocating work

Not all work is created equal, and not all tasks that are performed in the traditional roles of producer, account manager and client service representative need to be done by highly trained and licensed staff.

Many agencies have identified the administrative work that is embedded in these roles, such as creating a new client file, downloading daily carrier reports, reconciling downloads, data entry into both the management systems and CRM system, issuing certificates of insurance, and many other daily tasks as areas that can potentially be reallocated to a newly created role within the agency.

Virtual assistants. Many agencies are now using virtual assistants in these newly created roles to complete the reallocated tasks. This reallocation of work not only creates capacity for the existing employees, but it also provides the opportunity to standardize these processes across the agency, which can lead to cleaner data and better decision-making. This strategy provides an alternative approach to answering the current staffing challenges, while also increasing productivity across the agency.

Since employing virtual assistants is far less expensive than hiring a U.S. employee, this strategy will increase the profitability of an agency if it is deployed and executed well.

(P)retirees. Another alternative for some agencies is engaging employees from Work At Home Vintage Experts (WAHVE) to help solve their staffing challenges. As many licensed agents and other agency professionals near the end of their career and wish to work part-time, they can work through this program to share their knowledge with agencies who seek experienced staff.

These employees bring a deep understanding of the industry that can be utilized to train new employees or fill an immediate talent gap when a key employee is lost. The cost of such an employee is considerably higher than a virtual assistant, but the effect on the team can be incredibly impactful.

Outsourcing. Core administrative functions inside an agency such as human resources, accounting, payroll and information technology often are the responsibility of the owner. These are prime areas to be outsourced, as the agency owner is the most expensive resource inside the agency. Making sure they are focused on the areas where they can make the biggest impact is imperative to both growth and scale.

As an agency grows, it becomes increasingly difficult for the owner to wear all of these hats. They may look to fill some of these responsibilities by utilizing fractional roles such as a fractional CFO, fractional sales manager or CRO, or a fractional CMO. These roles are being used by agency owners who may not have a strong skillset in a particular area and wish to obtain this talent without paying full price for a full-time employee.

In addition, using fractional roles can provide the agency owner with a broader perspective than hiring a person in the role who does not have the benefit of experiencing many different agency structures and approaches.

Technology. Another approach to redefining the team is to leverage technology that can eliminate, automate and/or streamline some of the traditional work that may have been identified as an area to reallocate. This can be accomplished by staying current with the current technology utilized by the agency. At the same time, keep an eye on new solutions that may integrate with your current tech stack.

This approach of adding employees based on volume has worked for years. But recently, the game has changed.

Consider using consultants or firms that can help you identify, evaluate, select, and implement the solutions that fit your agency’s specific needs. or contact Carey at Carey@agency-focus.com.

This is an area that can be both time-consuming and expensive if not executed well. By engaging experts that hold a more comprehensive understanding and purview, an agency owner can minimize the potential investment risks and maximize the impact of adopting innovative technology solutions.

Don’t delay

The teams of today and tomorrow are changing as fast as our environment is changing. Client and carrier expectations are not expected to reduce as time moves on. If anything, they will continue to increase.

We all expect to have information readily available and accessible when we want it, and that expectation will continue to grow. Agencies that wish to continue to compete and grow must continue to change and evolve, as well.

Redefining the roles and expectations of their teams and creating a work environment that is poised and ready to serve the clients of today and tomorrow can be achieved only with focus and innovation.

The author

Over the past 16 years, Carey Wallace has worked with hundreds of independent insurance agencies helping them understand their agency’s value and turn that knowledge into an actionable plan for their future. She prides herself on taking the time to understand the agency’s unique situation and helping them build the future they envision for themselves. She is a Certified Exit Planning Advisor (CEPA) and provides a variety of business consulting services including valuation, perpetuation planning services, acquisition support, financial and compensation analysis, and fractional CFO services through the company she founded, Agency Focus, LLC. To learn more, please visit www.agency-focus.com