Dig a Little Deeper

By Linda Ferguson, CPCU

ORDINANCE OR LAW COVERAGE

An important endorsement is changed to close a key gap

The Court Decisions column of Rough Notes magazine and Court Cases in the PF&M Analysis, a publication of The Rough Notes Company, are popular with our readers. One reason is that the courtroom is where the promises made in an insurance contract become real. All insurance professionals can develop “what if” scenarios, but until those scenarios are tested with an actual loss and a court decision, they remain mere mental exercises. In this column, the editors of PF&M are going to dig a little deeper into a court case to identify a coverage problem and then provide possible solutions.

ISO has developed a solution for this significant gap.

The case No Boundaries, Ltd., v. Pacific Indemnity Company from the Washington Appellate Court brings up an important but often overlooked aspect of the ISO CP 04 05–Ordinance or Law endorsement.

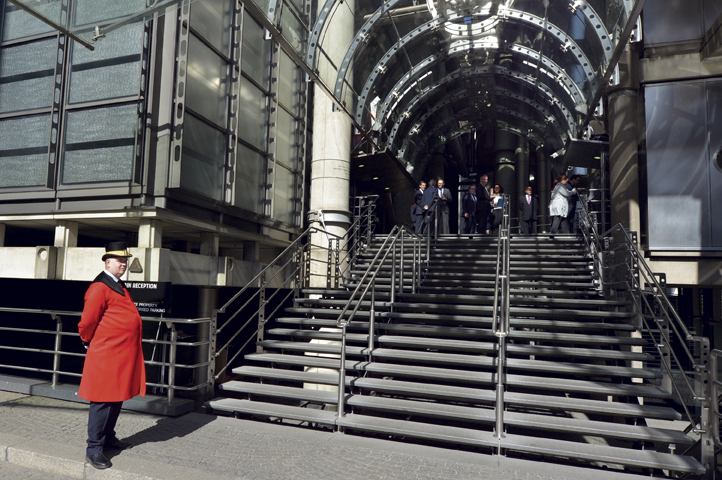

In 2005, a portion of the wooden flooring in a corner of the basement of the Metropole Building in Seattle, which was owned by No Boundaries Ltd., collapsed as a result of moisture damage and wood decay. No Boundaries submitted a claim to its insurer, Pacific Indemnity Company. In 2007, before No Boundaries had repaired the damage in the basement, a fire damaged the three ground floors of the Metropole, which was a 100-year-old historic building. No Boundaries submitted a claim for the damage to Pacific Indemnity. The insurer paid No Boundaries about $4,750,000 for the fire damage and over $750,000 for the earlier damage in the basement.

The particular ordinance or law coverage at issue in this court decision was a non-ISO extension of a replacement cost valuation. It is fairly similar to the ISO CP 04 05 with one important exception: It didn’t establish exactly which ordinances or laws would apply. The replacement cost wording stated that the value of the loss was determined as of the time of the loss but didn’t mention when those covered ordinances or laws had to have been put into effect.

An unusual situation occurred in Seattle when the more stringent regulations that were in place at the time of the loss had been revoked by the time No Boundaries started construction. No Boundaries argued that Pacific Indemnity should pay the expenses that No Boundaries incurred to meet the stricter regulations, even though by the time of the rebuilding it was not required to do so. The appellate court agreed.

The CP 04 05 is much more precise than the non-ISO wording above because it states that coverage applies only to ordinances or laws that are in effect at the time of the loss. This means that if the date of loss is September 1, 2019, only the cost to bring the building up to the minimum standards of ordinances or laws that are in effect on that date will be covered. While this specific wording would have been to the benefit of No Boundaries, for many insureds it is a problem.

As an example, let’s consider Jerry, who owns a three-story apartment building in Small Town. Big Town is growing and is attempting to annex Small Town. Once Small Town is annexed, Jerry’s building will be subject to Big Town’s building codes. Due to grandfathering he will be permitted to continue as is but will be unable to build or expand. Jerry’s agent knows of the impending annexation and recommends that Jerry purchase the CP 04 05 so that if a loss should occur, he would be covered for the ordinance or law expenses that he would incur to rebuild based on the new codes.

Timing is everything. A windstorm comes through the area, and Jerry’s building is badly damaged. Before a settlement has been reached with the insurance company, the annexation process has been completed. When Jerry is finally ready to start rebuilding, he attempts to get the needed permits and is informed that he must demolish the undamaged part of his building and rebuild the current frame of the building with fire-resistive construction. He notifies his carrier about the added expenses and expects the terms of the CP 04 05 to apply. Jerry is extremely disappointed when he is informed that none of those expenses will be covered because those ordinances or laws did not exist at the time of the loss.

Another gap filled

The column doesn’t end on this cautionary note, because ISO has developed a solution for this significant gap. A revised CP 04 05 was filed in many states in September 2017. The key change to the endorsement is the introduction of a new option called the “Post-loss Ordinance or Law Option.”

If the new option is selected in the schedule, the highlighted wording is added:

The Coverage(s) provided by this endorsement applies with respect to an ordinance or law that regulates the demolition, construction or repair of buildings, or establishes zoning or land use requirements at the described premises, subject to the following:

The requirements of the ordinance or law are in force at the time of loss; or the ordinance or law is promulgated or revised after the loss but prior to commencement of reconstruction or repair and provided that such ordinance or law requires compliance as a condition precedent to obtaining a building permit or certificate of occupancy.

This means that the coverage provided by the CP 04 05 applies even if the laws or ordinances that affect the insured’s ability to obtain a building permit or certificate of occupancy are changed the day before building construction or repair starts.

This wording would have been helpful to Jerry in our example and will be for many others because ordinances and laws are constantly being changed and annexation of smaller communities is becoming more common. Because the word “or” is used in this wording, it also would be helpful in a case similar to the cited court case. If the option was selected and the named insured demanded coverage to meet the regulations of the prior ordinance, that flexibility would remain.

Note: Please refer to the December 2018 Rough Notes Mind the Gap column by Marc McNulty in which he explained the significant coverage gap created by the Ordinance or Law Exclusion that is part of all ISO property forms. He described the CP 04 05–Ordinance or Law Coverage endorsement and recommended that it be offered to all clients.

The author

Linda D. Ferguson, CPCU, is senior vice president of Technical and Educational Products at The Rough Notes Company, Inc., and has over 45 years of experience in the insurance industry.