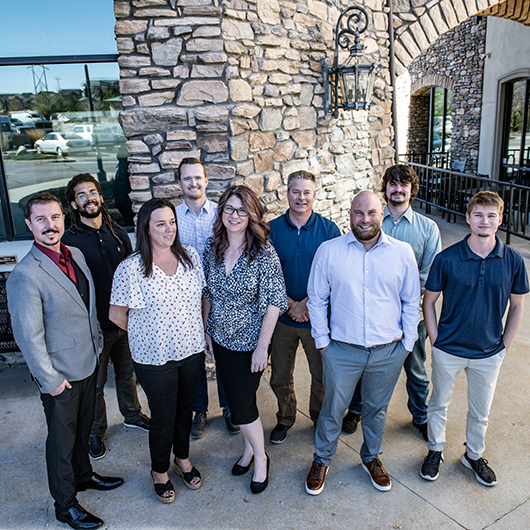

The Trailstone Insurance Group team, including (below) Remi, one of

Mark Rodgers’ two Australian Shepherds who frequent the office.

Intentional approach to growth

transforms mom-and-pop agency

into regional powerhouse in a dozen years

By Dennis H. Pillsbury

Photography by Lynn Donaldson

When Mark Rodgers founded Trailstone Insurance Group in August 2013, his goal wasn’t to create a large agency, it was to build a great mom-and-pop operation. Starting from scratch in Littleton, Colorado, he envisioned a team that delivered personal, high-touch service to every client. But as the industry evolved, so did his vision.

“In 2017, I was talking with Jason Cass, founder of Virtual Intelligence VI, and we both recognized that the independent agency model was at a crossroads,” Mark recalls. “To compete with future players like Amazon and Google, agencies would need scale and technology. I realized that if Trailstone stayed small, we could be left behind.”

With that realization, Mark began positioning the firm for expansion—reinvesting profits into technology and infrastructure that would support long-term growth for a modern agency.

By the end of 2018, Trailstone had nearly $1 million in revenue and a small team of seven. Growth continued steadily, but by 2023, Mark made a pivotal decision to transition from working with independent contractors to hiring in-house producers. “We wanted a team fully committed to our mission and culture,” Mark says. “That meant bringing our producers inside the organization and investing in their long-term success.”

Today, the agency has 67 team members operating across seven states, generating more than $8 million in revenue. Expansion began strategically with help from carrier partner Safeco, which the agency worked with to identify five key markets less prone to catastrophic losses: Utah, Arizona, Idaho, Oregon, and Washington.

“We’ve always been intentional about where and how we grow,” Mark explains. “Technology has enabled us to manage multiple states efficiently while maintaining our service standards.”

Creating a leadership team

As Trailstone grew, Mark focused on building a strong leadership team to sustain the agency’s momentum.

He brought Cynthia LeGolvan on board to lead human resources, a move that marked a major step in bringing HR functions fully in-house. “Cynthia’s leadership helped formalize hiring, onboarding, and employee development processes, ensuring our culture scales alongside our growth,” Mark says.

Also, Mark promoted Ken Abel, one of the agency’s top producers, to sales director. “Ken’s leadership has been instrumental in creating a cohesive team of high-performing producers and in driving innovation in how the agency generates business,” Mark explains.

“It took nearly two years for us to become what’s called a RamseyTrusted Provider back in 2014,” Ken recalls. RamseyTrusted Providers—insurance agencies, real estate firms, tax professionals, and financial planners—go through a thorough vetting process, receive coaching, and are regularly evaluated by financial guru Dave Ramsey’s firm.

“That partnership gave us a solid foundation of leads,” Ken adds. “Over time, we added new channels; organic leads now account for about half our business, with some still coming from Ramsey.”

Trailstone has since built a robust digital marketing engine, leveraging social media, YouTube, and educational content rooted in the “Endless Customer” framework. The framework is a system that helps companies become known, trusted, and recommended in their market. Created by Marcus Sheridan, it’s based on his bestselling book, Endless Customers.

“We’ve always been intentional about where and how we grow. Technology has enabled us to manage multiple states efficiently while maintaining our service standards.”

—Mark Rodgers

President

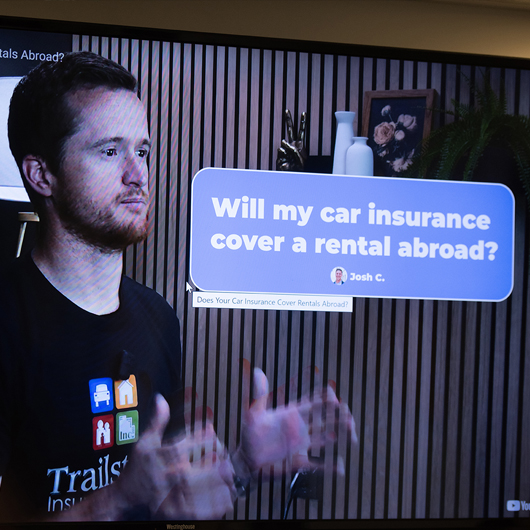

From the agency’s in-house studio,

Personal Lines Account Manager Abi Tilwar (left)

and Insurance Agent Cody Kovash (below left) share

insurance and risk management information

for customers on the agency’s “Insurance Talks” YouTube video series.

“We generate over 200 leads a month through YouTube and social media, and we’re just getting

started. … Every video we produce is designed to educate first and sell second. That’s what builds trust.”

—Marquece Cunningham

Marketing Director

Taking a digital leap

Much of the agency’s marketing evolution has been led by Marquece Cunningham, director of marketing. Under his direction, the agency has built an in-house studio to produce professional, informative video content.

“We generate over 200 leads a month through YouTube and social media, and we’re just getting started,” Marquece says. “Our goal is to hit 1,000 monthly leads across all platforms in the next six months. Every video we produce is designed to educate first and sell second. That’s what builds trust.”

In October 2025, the agency launched its new website built on HubSpot, marking another major milestone in its digital transformation. Marquece collaborated closely with the Impact team, a consulting firm that offers “Endless Customer” coaching and training, to design a site that emphasizes AI-driven trust signals, prioritizing credibility and clarity over traditional SEO tactics.

“The goal is to help visitors immediately feel confident they’re in the right place, guided by a brand they can trust,” he says.

“I’ve built hundreds of websites, but Trailstone’s was the first where SEO truly took a back seat to AI trust signals,” Marquece explains. “It made me rethink everything about how people find and evaluate information online. Instead of chasing rankings, we focused on building credibility by making sure every page, video, and detail reflects who we are and helps customers get real answers they can trust.”

Trailstone’s digital strategy reflects one of its five core values, “Heart of a Teacher,” and its commitment to being the most trusted source for insurance education in every market it serves. The agency describes the value like this: “Our job is to help you understand your options so you can make confident decisions without pressure or confusion.”

Building trust through technology

As the agency continues to evolve, its philosophy around technology remains grounded in one core idea: People want to do business on their own terms. Mark points out that modern consumers expect to explore options, compare pricing, and understand value before ever talking to an agent. Agency leadership saw this shift early and invested in tools to meet customers where they are.

One of the most impactful additions, according to Ken, has been Trailstone’s Instant Estimate Tool, a digital feature that lets visitors receive a real-time price estimate in seconds. “While it’s not a final quote,” Ken explains, “it builds immediate trust by offering transparency. Clients appreciate knowing they can get an idea of what to expect without pressure or commitment.

“It took nearly two years for us to become … a RamseyTrusted Provider … . That partnership gave us a solid foundation of leads. Over time, we added new channels and organic leads now account for about half our business, with some still coming from Ramsey.”

—Ken Abel

Sales Director

“Customers want to engage on their own schedule,” he adds. “Our instant pricing shows we respect their time and trust them to take the next step when they’re ready.”

Trailstone has also leaned heavily into automation that it believes feels personal. For example, the agency now uses digital avatars to engage clients after hours through friendly video messages that invite them to schedule appointments online. “The response has been incredible,” Ken shares. “We see 35% to 40% of viewers click through to schedule, compared to about 10% from standard emails. These small, human-like touches allow us to maintain connection even when the office is closed, demonstrating how technology can still deliver genuine care.”

Social media and video content have become central to that mission, too. Through a growing YouTube presence, the agency aims to educate first and sell second. “The goal isn’t just to advertise, it’s to teach, explain, and empower customers to make smart decisions,” Ken notes. “Every video reinforces the Heart of a Teacher value and aligns with Dave Ramsey’s principle of trust through education.”

“The modern insurance buyer is different from even five years ago,” says Samantha “Sam” Thomas, director of operations. “They are more independent, digitally aware, and value authenticity above all. Clients want to be helped in the way they choose, so we make that choice available. Trailstone recognizes that shift and continues to create experiences that allow customers to research, learn, and interact before they decide to call. This approach has not only increased lead flow but has significantly improved customer satisfaction and retention.

Trailstone’s evolution shows that technology doesn’t replace relationships; it strengthens them. Every system, from HubSpot to automation workflows, is designed to give the client more freedom and the agent more time to focus on meaningful conversations. It’s a model agency leaders say is built on empathy, efficiency, and empowerment, one that proves high-tech can still be high-touch.

Operational excellence and culture

As the agency scaled, maintaining service quality became critical. As operations director, Sam has played a key role in that. For instance, she led initiatives to improve efficiency, retention, and the overall client experience through process and automation, leveraging HubSpot as the agency’s CRM and agency management systems.

“Renewals drive our retention strategy and fuel our top-line growth. … [W]e utilize automation to invite every client to a renewal call and we shop every policy for those who engage.”

—Sam Thomas

Operations Director

“Renewals drive our retention strategy and fuel our top-line growth,” Sam explains. “Not every client can be shopped every year, but we utilize automation to invite every client to a renewal call and we shop every policy for those who engage.”

Mark admits that “our retention was pretty low when Sam joined. But it has improved by 10 points since she came on board.”

The agency also invests heavily in team culture and engagement from celebrating Customer Service Week to maintaining a dog-friendly office that reflects its people-first philosophy and “Treat Others the Way You Want to Be Treated” core value.

Trailstone runs on the Entrepreneurial Operating System (EOS) management framework, holding weekly Level 10 Meetings to review progress toward 90-day goals and address key issues. EOS was developed by entrepeneur and author Gino Wickman to simplify business management by focusing on six key components: vision, people, data, issues, process, and traction. “EOS keeps everyone aligned and focused on what matters most,” Mark says. “We’ve learned to eliminate tangents and stay strategic.”

At a leadership team meeting in the agency’s

conference room are (from left): Executive Assistant

Laine McCord, Sales Director Ken Abel, Director of Operations

Sam Thomas, Agency Founder and President Mark Rodgers, Business Development and HR Manager Cynthia LeGolvan and

Marketing Director Marquece Cunningham.

To keep the team motivated, the agency uses SalesScreen, a gamification platform that rewards achievements in both sales and wellness. Producers earn coins they can spend on rewards not just for hitting metrics, but also for maintaining their core value of “Healthy Balance.”

“We brought in SalesScreen to add gamification to the sales process,” Ken says. “The game might focus on achieving a particular metric, but it also provides rewards for maintaining a healthy lifestyle.”

As for commissions, “There’s no cap on what our producers can earn,” Ken adds. “It’s about creating a performance-driven culture that’s also fun and balanced.”

Looking ahead

While personal lines remain Trailstone’s foundation, the agency is now expanding aggressively into commercial lines with a goal of achieving a 50/50 revenue balance. “We have the technology, systems, and lead flow to support major growth,” Mark says. “Now, we’re looking for the right people to help us scale in the commercial space. The future is about leveraging data, automation, and education to reach more clients while staying true to who we are.”

In just over a decade, Trailstone Insurance Group has evolved from a small, local agency into a tech-forward, multi-state operation built on innovation, education, and heart. Its transformation illustrates the value of embracing technology without losing the human touch. It also led to the agency being named Safeco/Liberty Mutual Agent for the Future Outstanding Large Agency for 2024.

Rough Notes is pleased to recognize Trailstone as its Agency of the Month, a shining example of how independent agencies can combine technology, culture, and purpose to redefine what’s possible in today’s insurance landscape.

The author

Dennis Pillsbury is a Virginia