Amid challenges, administrators strive to

innovate, adapt, and find new ways to

meet evolving client and partner needs

By Elisabeth Boone, CPCU

Data show that 2022 was a banner year for program administrators. According to the Target Markets Program Administrators Association (TMPAA) State of Program Business Study 2023, the market grew 47% from $53.8 billion in 2020 to $79 billion in 2022. Since 2010 when the TMPAA inaugurated the market study, premiums increased by 352%.

“There’s a great deal of alternative capital available,

but that may be starting to shift now. Looking over

our shoulder, I believe this was a driver

of increased growth in the program sector.”

—Chris Pesce

National Programs Practice Leader

One80 Intermediaries

The TMPAA State of Program Business Study is a biennial survey that documents the size of the program business arena and tracks trends that shape the market. The study, which was conducted in tandem with Zywave, reflects the views of 155 program administrators that represent 1,062 programs, 51 insurers that represent 1,521 programs, and 21 service providers.

The report notes that program business had encountered a “multitude of challenges” that led to a slowdown in the growth of premiums administered and a decline in renewal rates in 2020. Amid these challenges, administrators strove to innovate, adapt, and find new ways to meet the evolving needs of their clients and partners. As a result, program business has regained its growth momentum in 2022, according to the study’s executive summary.

Program business continued to grow more quickly than the overall commercial insurance market. While the size of program business rose 47% between 2020 and 2022, the growth in direct premiums earned for commercial property/casualty lines was only 21.3% over the same period.

Despite active consolidation in the program space, the estimated number of program administrators in the United States increased from 1,000 in 2020 to 1,100 in 2022 as new entrants joined the space.

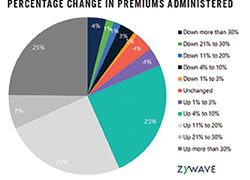

The percentage of administrators that reported increases in premiums rose significantly, from 72% in 2020 to 86% in 2022. Average revenue increased from $13.3 million in 2020 to $13.8 million in 2022. Thirty-one percent of administrators posted renewal rates of over 90%.

Larger administrators reported the greatest proportion of premium increases, posted the highest proportion of revenue increases, registered the highest profit margins, and introduced more programs than smaller administrators, which reported higher renewal rates.

The lines of business with the highest share of respondents that reported increasing premiums were automobile (96%); excess/umbrella (92%); property (92%); liability (91%), and professional liability (90%). The percentage of respondents that reported increases was unchanged for excess/umbrella. The percentage of administrators that reported increases in rates declined for several lines: financial and political risk (-43%); employment practices liability (-18%); cyber (-9%); fidelity, surety, and crime (-8%); medical malpractice (-7%); management liability (-5%), and automobile (-2%).

While the percentage of administrators that reported increases for workers compensation increased in 2022, it stood out because rate decreases far outweighed increases (72% vs. 28%).

Some 40% of respondents reported that they manage over $75 million in program premiums, up from just 18% in 2018. Fifty-nine percent of program administrators manage between one and three programs, compared with 28% in 2014. Average premium per program showed that the sweet spot was shared by program administrators that reported premium of $10 million to under $20 million at 38% and $20 million to under $50 million at 32%. Responses of program administrators that reported premium of less than $5 million and those that reported premium of $5 million to under $10 million were split evenly, with each segment coming in at 14%. Just 2% of premium in the $50 million to under $100 million was reported.

Forty-three percent of program administrators reported profit margins of more than 25% in 2022, up from 41% in 2020 and 31% in 2018. The average renewal rate was relatively stable in 2022 at 83.7%, compared with 83% in 2020 and 84.5% in 2018. Thirty-one respondents reported renewal rates of over 90% for 2022.

Some 83% of administrators plan to introduce new programs in the next two years, while 96% of carriers plan to add new programs in the next three years. Also, 96% of carriers anticipate increasing the amount of premium written in the next three years.

Growth insight

“Property values are up. Payroll values are up. Sales are

up. It’s been a growing economy the last couple of years, so

those factors right there have a multiplicative effect.”

—David Jordan

Chairman

Steamboat Group

In the report’s discussion of findings, Target Markets Program Administrators Association board members addressed factors that contributed to the acceleration of growth in 2022.

“I would have to think it was driven primarily by the hard market,” said Chris Pesce, National Programs Practice Leader at One80 Intermediaries. “The MGAs have experienced tremendous organic growth over the past couple of years. For the most part, for those not killed by COVID, they got the opposite.”

Chairman of Steamboat Group David Jordan said, “It’s the sum of all the rate increases compounded by exposure increases. Property values are up. Payroll values are up. Sales are up. It’s been a growing economy the last couple of years, so those factors right there have a multiplicative effect.

“You’ve got standard carriers that continue to back away from tougher classes,” he added, “and a lot of program administrators specialize in nonstandard coverages and classes of business, so that has driven growth, and as you overlay that on top with acquisition activity, it’s like a triple whammy of growth.”

According to Pesce, “Also, all these fronting companies that have come in, that’s a relatively new phenomenon. There’s a great deal of alternative capital available, but that may be starting to shift now. Looking over our shoulder, I believe this was a driver of increased growth in the program sector.”

“You continue to have a shift of talented underwriters from insurance companies to delegated authority. I think that’s a third factor driving it,” shared John Colis, president and CEO of Euclid Insurance Services.

“You continue to have a shift of talented

underwriters from insurance companies to

delegated authority. I think that’s a third

factor driving [program business growth].”

—John Colis

President and CEO

Euclid Insurance Services

Traditional carriers preferred

Administrators showed mixed enthusiasm for the use of nontraditional carriers, with 75% still preferring traditional carriers over nontraditional options like fronting and hybrid fronting. Some 71% of administrators did not move any programs from a traditional carrier to other options.

The percentage of carriers that expressed plans to acquire administrators fell significantly from 20% in 2020 to 2% in 2022, while the percentage of carriers that said a hard “no” to acquiring administrators increased markedly from 46% in 2020 to 73% in 2022.

Administrators, carriers, and service providers have a generally positive outlook for the program space. Administrators and carriers tend to agree on what they see as strengths, weaknesses, opportunities, and threats in program business.

With respect to emerging risks in program business, both administrators and carriers cited artificial intelligence. Among the other emerging risks mentioned by administrators were self-driving automobiles, drones, cannabis, and climate change. Carriers cited parametric coverage, specie/art, pandemic coverage, and sexual abuse and molestation (SAM) coverage.

The percentage of administrators that reported

increases in premiums rose significantly, from 72% in 2020 to 86% in 2022.

Carriers that specialize in program business are growing in size and number of programs they handle. In 2016, just 5% of carriers reported having more than 40 programs, compared with 17% today. Asked whether they anticipated increasing or decreasing premium written in the next three years, fully 96% of responding carriers saw premium increasing vs. just 4% that said they didn’t know.

What were the reasons that carriers dropped programs in the past two years? Poor performance was cited by over 65% of respondents, while 12% mentioned a corporate decision to exit a line of business and just over 3% said it was because of a decision to reduce the percentage of money in program business.

Some 83% of administrators plan to introduce new programs

in the next two years, while 96% of carriers plan to add new programs in the next three years.

More data

The study also explored several other benchmarking areas that have a significant impact on program business, including program administrator and carrier practices and views about data analytics and machine learning, M&A, cyber coverage, IT, and post-pandemic work arrangements.

Other survey findings included a focus on the hot topic of 2023 amid the fallout from the Vesttoo collateral scandal and other counterparty security and capacity-related missteps in the MGA and fronting space last year.

The study commented on the rise of fronting carriers in recent years, citing Conning data that showed they accounted for $12 billion in premium written by MGAs last year, up 38% over 2021—such that around 15% of total MGA premium is now supported by fronting companies.

And respondents suggested that level of growth could meet headwinds in the future.

“There will be a culling of fronting and hybrid carriers coming in the next five years,” said one survey respondent. “There has been an incredible influx of capacity, and many have been aggressively adding new programs in some very difficult lines of business.”

But another added: “I’m not sure how the hybrid fronts will fare over the next five years, but I’m certain the program business model will continue to flourish.”

Another respondent suggested that challenges that face the sector are like growing pains: “The business is growing up and doing so rather quickly. If it is exploding with growth and potential, it’ll be interesting to see what it looks like when it further matures. How will its growth impact services provided, the size of the programs administered, and many other aspects? That’s something to look forward to.”

The report found little differences between program administrator and carrier views on the impact of the hardening market on pricing, capacity, reinsurance availability, and terms and conditions. It also reported that program administrator and carrier respondents reported rate increases across most lines of business, but saw moderation as increases slowed, in line with reports from the broader commercial P-C sector.

Program administrators and carriers reported increased use

of data analytics and machine learning, with the greatest

use in underwriting, followed by claims, administration, and loss control.

The program world is set to gather in May in Tampa at the association’s 2024 Mid-Year Meeting (May 13-15), looking to further innovate, adapt, and find new ways to meet the evolving needs of clients and partners.

For more information:

Target Markets Program

Administrators Association

www.targetmkts.com

The author

Elisabeth Boone, CPCU, is a freelance journalist based in St. Louis, Missouri.