SUCCESS IN THE ROCKY MOUNTAIN REGION

Top 100 agency celebrates attainments in business … and caring

By Barley Dennison

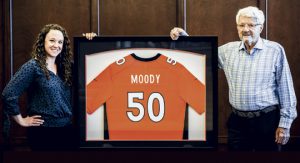

On May first of this year, the Moody Insurance Agency of Denver, Colorado, celebrated 50 years of developing trusted relationships with people and businesses looking to protect themselves against the risk of loss.

The agency was started by Evan Moody in 1972, who today serves as chief executive officer. In its early days, Moody Insurance Agency specialized in surety and commercial insurance for construction companies in the Rocky Mountain region.

Evan’s sons, Brad and Troy, joined the firm in the early 1990s; Brad serves as president and Troy is vice president and chief operating officer. Their mother, Karen, who started the agency alongside Evan, continued to serve as controller until she retired six years ago. Today, the organization generates revenue in excess of $30 million and employs 140 associates in three locations.

“Our dad built a great foundation—creating a strong risk management-focused organization,” Troy explains. “And all we did was follow in his foot-steps. We see ourselves as trusted advisors; our employees work to establish a personal relationship—learning about the client’s business so we can provide them with the best risk management approach to handle any losses.”

“Building relationships, truly under-standing what people need, and being able to provide tools for them to succeed are some of the reasons why we have been so successful,” Brad notes. “We’re very proud that our average retention is better than 97%.”

He points out that strong staff retention also is a characteristic of Moody Insurance Agency. “We have a lot of employees with more than 20 years of service with the organization, and more than 40% of our associates have been employed at the agency for 10 or more years,” he explains, noting that this “assures a level of continuity and consistency in dealing with the more than 5,000 insureds for which we are responsible.”

Adding services

The agency has experienced strong organic growth, thanks in part to its focus on relationships. “Staff consistency and the focus we place on serving customers has allowed us to thrive,” Brad notes, “and this paved the way for us to expand our reach into other areas. In addition to organic growth, we’ve also added revenues through two big acquisitions,” he continues. “We purchased an agency in Grand Junction in 1995, which resulted in our first branch office in that town. And about 12 years ago, we purchased Smallwood Financial, which added some 20 employees and allowed us to round out our product offerings to our commercial lines customers.”

Heather Prier, vice president of employee benefits at Moody, was part of the Smallwood acquisition, which brought new benefits expertise to Moody. Initially skeptical about the acquisition and how it might impact the group of employees that came over from Smallwood, Heather observes, “Twelve years after the acquisition, I look up and see so many of the same faces I started working with over15 years ago. Moody Insurance has been a phenomenal place to work. The people—from the top down—have created an environment that feels like family.”

Evan attributes much of the agency’s success to its people, their expertise, and their market knowledge. “We are in a unique position to help Colorado residents and businesses because we focus on the state and know it very well,” he explains. “By the same token, we also have the size and financial strength to offer a full suite of services beyond just selling insurance.

“We have attracted talented people from insurance carriers, risk management programs at the college level, and from large brokers, as well as agencies that have decided to wind down,” Evan adds. “These strategic hires have allowed us to have an in-house loss control and safety department, a full claims department that includes a claims advocate for clients, and an in-house counsel.

“This array of services lets us compete directly with the big brokers for larger accounts,” he explains. “In fact, we write several businesses in the $500 million to $1 billion revenue range.

“Our hires also represent a diverse group that includes a number who are destined to be the next generation of owners,” Evan points out.

Among the changes Troy has observed over his years in business is the growing number of successful women in every part of the business. “When the agency started, there were very few women in leadership roles at agencies or insurance companies,” he says. “Today, here at Moody Insurance, for instance, we have more women in leadership positions than we do men.

Kim Burkhardt, chief sales officer at Moody Insurance for the past 23 years, says there’s good reason for this. “I am so proud to work for an organization that creates a culture of caring for our employees, our carrier partners and our customers,” she explains. “Every day, we get to help our customers manage their business risk, assist them in creating benefit programs for their employees, and guide them when a catastrophe occurs.”

Niche markets are key

In order to deliver a strong expertise in what are often complex commercial insurance lines of business, “our producers focus on specific niche areas that we have developed over the years,” explains Jim Smallwood, president, employee benefits. “Not surprisingly, construction is one of those niches, since Evan came out of the surety business before opening the agency and starting what has become an important niche for the firm.”

Smallwood notes that, while construction is extremely important to the agency, “we recognize that, like insurance, the construction industry also goes through cycles. Diversification of niches allows us to grow and weather those cycles.”

“We are in a unique position to help Colorado residents and businesses because we focus on the state and know it very well. By the same token, we also have the size and financial strength to offer a full suite of services beyond just selling insurance.”

—Evan Moody

Chief Executive Officer

The agency possesses extensive expertise in oil and gas; real estate; manufacturing; technology; architecture; engineering; charter schools; not-for-profits; and professional services. “We also have clients outside these areas,” Brad says, “and work to immerse ourselves in the industry they represent so we can provide them with targeted risk management programs that best meet their unique needs.”

“Building relationships, truly understanding what people need, and being able to provide tools for them to succeed are some of the reasons why we have been so successful. We’re very proud that our average retention is

better than 97%.”

—Brad Moody

President

Changing without changing

“Technology is very important for us,” says Patty McQuade, chief information officer, “but we use it not as a way to distance ourselves from clients, but rather as a way to make our services to clients even more efficient.

“We always start out with a relation-ship, where we sit down with each client and develop a risk management strategy and set objectives,” she adds. “That information then goes into our technology platform, where we utilize a number of tools to assist in managing each account.

“Because of the speed that technology offers and its ability to process enormous amounts of information, we can monitor each account daily,” notes McQuade, a 30-year agency employee. “This results in better service to each client, and it makes certain that every-thing we do is focused on ways to improve the client’s bottom line through proper risk management and mitigation.”

“We see ourselves as trusted advisors; our employees work to establish a personal relationship—learning about the client’s business so we can provide them with the best risk management approach to handle any losses.”

—Troy Moody

Vice President and Chief Operating Officer

Community focus

This year—the 50th anniversary of Moody Insurance—marks the 20th anniversary of Judi’s House, one of the charities the agency supports. Started by retired NFL quarterback Brian Griese—a 1998 Broncos draft pick who earned a Super Bowl ring in his rookie season as a backup to John Elway—Judi’s House provides counseling for young people who have lost a close relative. The son of Hall of Fame quarterback Bob Griese, Brian lost his mom to cancer when he was 12 years old.

An annual golf tournament Moody sponsors on behalf of Judi’s House has raised $1 million for the charity—helping to support its move to a new location, where it can help even greater numbers of young people dealing with loss.

“Technology is very important for us, but we use it not as a way to distance ourselves from clients, but rather as a way to make our services … even more efficient.”

—Patty McQuade

Chief Information Officer

Over the years, the agency has made community outreach an important aspect of its business. This goes well beyond its involvement with Judi’s House and includes The Children’s Hospital, Flight for Life, Special Olympics and others.

This importance the agency places on community involvement resonates with Milissa Morgan, agency controller, who has been with the firm for 18 years. “I’m extremely proud of Moody’s charitable involvement. Agency leaders are committed to making a difference in many facets of our local community.”

She adds, “Also, I think many employees—myself included—really value the work-life balance that comes with working here. Moody Insurance truly values its people and cares about them as a whole person, not just as an employee. The family has built an incredible organization over the past 50 years, and I appreciate their dedication to ensuring the agency will be around for another 50 years.”

Rough Notes is proud to recognize Moody Insurance Agency as our Agency of the Month. It has shown how an agency can grow to become one of the largest in the country—reaching the top 100 three years ago—and still adhere to old-fashioned values while utilizing new technologies as effective tools for better service.

The author

Barley Dennison is a freelance insurance feature writer.