Texas-based young pro shows that

second-generation leaders are more than the owners’ offspring

By Christopher W. Cook

In the insurance industry, certain dedicated young professionals stand out among their peers and are members of an elite squad of individuals. These are their stories. “Dun dun.”

Last summer, this writer’s son turned three years old. He can be a handful at times, or a “threenager” as we sometimes refer to him as. For whatever reason, maybe due to being distracted by all his shenanigans at home, my introduction to these articles disappeared and was last seen in the May 2023 issue. I only recently realized it had been gone.

Well, it’s back. Until I forget again. With all the running around and having to remember doctors’ appointment times and making sure the collapsible toddler toilet seat is packed in the travel bag, sometimes being a family guy is hard, but it’s what Jackson Rollo, president of Rollo Insurance Group in College Station, Texas, lives for.

While his family has a background in the industry—his dad started the agency in 2000—insurance was not in the original life plan for Rollo, a trend often seen in some multi-generational insurance families.

“My grandpa has been in the business for 50-plus years, my dad’s been in it for 25 years at this point. It’s a family business, but in all reality, I never really grew up wanting to be in insurance,” Jackson says. “Like most kids, you don’t really understand what [insurance] is. My plan was always to become an attorney.”

Rollo graduated magna cum laude from Texas A&M in 2019—a year early—earning a Bachelor of Arts degree in English. “With law school being the original plan, I had my eyes on Stanford and becoming a contract lawyer, so [the English degree] fit. I treated it like a business degree.

s.

“[T]he fastest way to learn this business is by asking questions.

In my opinion, you have to have practical experience

before the classroom knowledge make sense.”

—Jackson Rollo

President

Rollo Insurance Group

“Instead of spending all my time reading the books and focusing on the more philosophical points, I wanted to spend time with my professors and learn who they were as people. Most of my [papers] were me selling to them their thoughts on the book in a rhetorical format,” Rollo says.

With a year break before starting law school, Rollo decided to sell insurance and make some money at his parents’ agency.

“During that time is when I learned more about the industry that my family’s been in—more about the agency and the relationships that are the foundation of this industry,” Rollo says. “I just became enamored with how beautiful of an industry it is. Relationships are the most important thing and I just fell in love with it.”

Rollo then debated between “going to law school and racking up some debt” or seeing where the insurance industry would take him; obviously, he chose the latter.

“I started in the business as a producer for about eight months,” he says. “At that time, our agency was going through a change and needed a director of sales. I don’t know what it was, the gift of gab or something, but I took home all our top producer awards for our agency having produced for just eight months (half of this time was as an intern), and so I was able to take over as director of sales in 2019.”

Rollo took over his current role as president of the agency from his father in 2022; his father still serves as the CEO.

Educating himself and others

Rollo, who earned his CIC designation in 2022, is a believer in the importance of continuing education and designations, but he finds that real-life experience is equally if not more important.

“Before working on any designation, the fastest way to learn this business is by asking questions,” Rollo says. “In my opinion, you have to have practical experience before the classroom knowledge make sense.

“The CIC program through The National Alliance was good and gives you a basis for the product you’re selling. The course I enjoyed the most was the carrier operations one. I thought it was fascinating.”

This is mainly because, as president, Rollo no longer sells but fills his schedule with leadership duties, including the management of the agency’s carrier partnerships.

“I’m a big relationship guy,” Jackson notes. “It was awesome to learn how carriers are put together, how they make their money, and what makes them tick. And in our hard market right now, the better a partner you are to your carriers, the more important your agency is to them.”

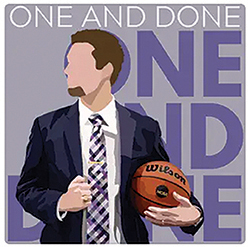

Rollo also educates young people about the insurance industry and the white-collar business world by hosting a podcast that he started in 2021 called One and Done. The show is “geared toward helping college students find their perfect career path,” he says.

“I’m a big basketball guy and the theme of the podcast is that someone going to college to play basketball would want to do so for one year and then he would want to go to the NBA. In similar fashion, if you were to go straight from college into a career that you are going to be in for the rest of your life, you’re going to be more successful than somebody who picks it up at 30. You’ll be even more successful if you intern at a business when you’re 20. You learn the lingo and the industry-specific habits and details of that industry that can set you apart.

“That’s the concept of the podcast: to open [students’] eyes at a younger age to industries like insurance to encourage them to gain experience earlier in their life. That way, they can go ‘one and done’ from college into their professional career.”

Involvement and advice

Creating a volunteer program at his agency, Rollo keeps busy supporting the community. “We’re a ‘God, Family, Country’ agency,” he says. “Our superpower is that we [support] local in every area in which we have an office. I’m a big community guy.”

Some of the charities that Rollo Insurance has historically been involved with and supports are: The Brazos Valley Food Bank, The Museum of the American G.I., and The Down Syndrome Association of the Brazos Valley; they also contribute to a toy drive run by the Texas National Guard that not only donates during the holiday season, but also to kids in local hospitals throughout the year.

With his hard-work ethic in the community and at the office, Jackson is appreciative of his parents for passing on their commitment to excellence.

“My mom and my dad, the owners and founders of the agency, are the epitome of what it looks like to be a hard-working couple who risked a lot in their life to build what they have built,” Jackson says. “They just have so much wisdom as it relates to running an agency and dealing with people and building relationships; they’re a big impact on my life.

“They’re also the model example of what you would expect from people who are Christians. Faith is a big deal to us. Seeing how they live their lives, and that they don’t compromise who they are for anything, is amazing.”

For new industry professionals starting out their careers, Rollo, who teaches courses from time to time at Mays Business, the business school at Texas A&M, offers three pieces of advice.

“Ask questions. I love it when you’re new to something because you have fresh eyes; you have zero perspective of what’s going on,” he says. “Ask the question ‘why?’ I used to ask why a lot when I started. [My co-workers] would bring up a problem, and I didn’t even understand why it was a problem much less how I could help fix it.

“The second thing is that you have to outwork everybody else. When I was an intern, I’d get to the office around 9 a.m. and I’d leave around 6 p.m. But then I’d go back to the office around 10 p.m. and I’d work until 2 a.m. preparing every night for the accounts that I was going to meet with and sell to that next day.

“I wanted to outwork everybody because, to me, it was the only way I could prove that I wasn’t just the son of the owner. Second-generation business owners have a certain stigma and I not only want to avoid that, but I want to blow that idea out of the mind of anyone I work with.

“The last thing is to find a mentor,” Rollo continues. “Find somebody who’s smarter than you are and learn from them. I’m 26; I don’t know one tenth of what I need to know about the insurance industry. The more that I understand, the better I can be as a person.

“It’s a cycle. You ask questions and outwork everyone to build better solutions. You fix problems; you don’t create them. And then you learn more from people who are older and more experienced. Then you do it again.”

When he’s not doing “insurance” stuff, Jackson can be found spending time with his “wonderful” wife and young daughter. “I’ve been married for four-and-a-half years. We have an 18-month-old daughter and we’re expecting our second (a little boy) in late spring,” he says.

“I’m a big family guy. I leave the office most days by 5 o’clock. I put the hours in; I usually work over 70 hours a week, but I go home at five because that’s my QFT (Quality Family Time). After my daughter goes to bed around 7 p.m. or 8 p.m. I’ll pull my laptop out and work again.”

Rollo is also a big sports guy, supporting the Kansas City Chiefs, Texas Rangers and any sport of Texas A&M.

“We have a lot of friends; we’re involved with our church (The BCS Church of Christ). Getting to see my daughter grow and develop and watch sports together, it’s a big deal,” he conclude