Apple Valley Insurance team members at an urban park situated

along the Woonasquatucket River in downtown Providence, Rhode Island.

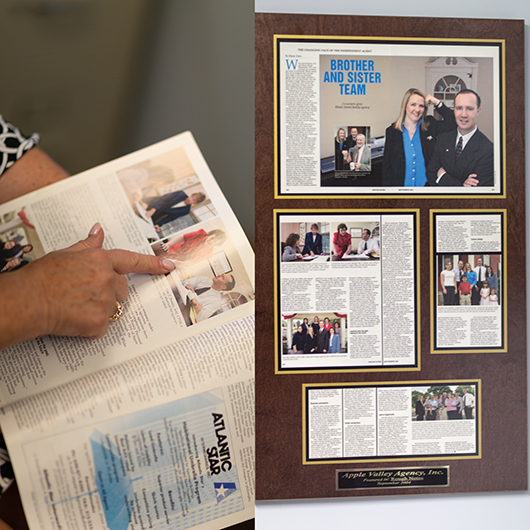

Sister-brother team heads up Rhode Island

agency that sees every change as an opportunity

By Dennis H. Pillsbury

Photography by Jeremie Barlow

When Donald A. Brush started the Donald A. Brush Agency, Greenville, Rhode Island, in 1962, he probably didn’t realize he was starting a business that would become a home for two of his children, working in “an industry that we love,” says his son David Brush, CIC, who today is co-owner of the agency along with his sister Nancy Mendizabal, CIC. “We feel blessed that our dad took this path.”

Nancy and David joined the agency, now known as Apple Valley Insurance, in 1990 and 1991, respectively. And they “continued to work alongside our dad for almost 15 years before purchasing the agency in 2004,” Nancy says.

“It turned out to be a perfect partnership,” she continues. “David and I complement each other so well. We have different strengths but very important commonalities including a similar risk tolerance; we are both willing to try new things and delight in the successes, while learning from the failures. We both have a recognition that the only way to find out if something works is to try it and then evaluate its effect quickly so we can incorporate it or get rid of it.”

“Another important value that Nancy and I share,” David adds, “is our love of learning. We are learners and teachers for life. That is one of our core values. And that is an important part of why we changed our way of bringing new people into the agency.

“We used to focus on a person’s skills when making a hiring decision,” he explains. “Now, all decisions are based on how well the individual fits with our core values and culture. The result of this change has been dramatic. We now have the best team in our 60-year history.”

Positive energy

“That team exudes positive energy,” Nancy adds proudly. “Everyone on the team is positive and they each love what they do. They want to help people and that comes across in their interactions with clients and our insurance company partners.

“It also really helps that every member of our team has ultimate decision-making power when dealing with one of their clients, including the decision on which company to use to provide coverage, which coverages are needed, and so on.”

Continuing with that theme, David points out that every client is assigned to a team member as their principal contact at the agency. “Our clients really like the fact that they have a dedicated person that they can talk to about anything, but we also make it clear that our other team members all are able to help if their dedicated team member is unavailable for some reason.”

Nancy adds that “we’ve also worked with our company partners to roll out service centers as a value-added service. They still have that dedicated contact, but the service center will be there as back-up if needed or wanted. We’re still working with our companies on the best way to implement this in an integrated manner.”

Change as opportunity

I suspect we all could agree that one of the biggest changes in recent history was the COVID pandemic and, not surprisingly, Apple Valley showed its positivity amidst a daunting negative event. “We decided to look at this as an opportunity to find ways to get stronger and better, and to help our clients get through this emergency without having to worry about their financial protection. We wanted to help as much as possible,” David says.

“When COVID hit,” Nancy continues, “five agency employees went home with laptops—and haven’t come back since. Now we have 11 people working remotely, and that number will grow. We learned how to hire remotely, and we even successfully completed two acquisitions during COVID.”

The results speak for themselves. From January 2019 to December 2023, the agency tripled in size. “In addition,” Nancy reports, “we increased the time and energy spent on team training, onboarding, and new hire selection.” They also added three new employees during COVID, as well as completing the aforementioned acquisitions.

Remote not impersonal

Building and maintaining a remote team is not much different from building an in-person team. It still takes a lot of communication and transparency. “We share everything,” Nancy says. “We have a Monday morning meeting that’s mainly a Q&A session and a Tuesday team meeting. These meetings focus on problems or opportunities, as well as sharing information about things like changes in a company’s appetite or new coverages or changes in coverage.”

The meetings also provide a platform for people to ask other team members for help if they’re faced with a problem they haven’t seen before.

“Then, twice a week,” Nancy continues, “we have shoot-the-breeze meetings, where we get to know each other, find out what’s happening in a team member’s life that they’re willing to share. We don’t talk work. This also is a time where we get a chance to enhance our relationship with company representatives. They occasionally are invited to join in these discussions so they can get to know the people they’ve been dealing with.

“We also meet one-on-one with each team member monthly to find out where we can help them and to see if the agency is living up to their expectations,” Nancy adds. “The monthly meetings are all about our role in empowering our people.

“We try to find each person’s strengths so we can build on them and create even greater job satisfaction. At the same time, we can uncover areas where we can help them realize their goals.”

David points out that “Nancy is good at finding and building on people’s strengths. So, I tend to step back during those discussions. However, I have the ability to handle hairy situations and can take over in situations where a team member is feeling overwhelmed. This is just one example of the way that Nancy and I work so well as a team.

“We’re comfortable passing off certain functions to the other person. I rely on Nancy’s strengths and she relies on mine. Even more important, however, is the fact that having a reliable partner takes away little bits of worry. It’s great to not have to be concerned about what would happen if one of us is not around,” David continues.

Other perspectives

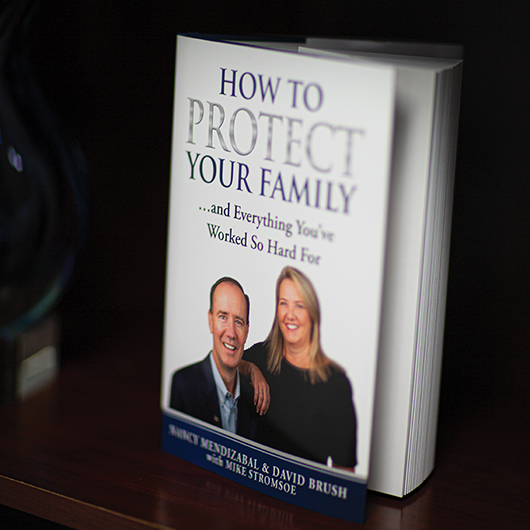

“It also allows us to travel outside of Rhode Island and participate in association meetings (Nancy was president of Independent Insurance Agents of Rhode Island in 2007 and has been a board member for more than 15 years), meet with company partners and other agents, and also get involved with coaching groups, like the Sitkins Group and Mike Stromsoe’s Unstoppable Profit Producer,” David adds. “Each one of these relationships presents us with possible opportunities for change that might help the agency grow or provide better ways we can serve our employees and our clients.

“Equally important,” he says, “is the fact that every time I leave Rhode Island, I find myself working on the business rather than in the business. It provides me with an opportunity to get a birds-eye view of the agency.”

Nancy points out that “one of the key ideas came from working with Goldman Sachs 10,000 Small Businesses in 2016-2017, where they helped us look differently at the growth path offered by acquisitions. This completely changed our perspective on leveraging debt.”

Nancy concludes by pointing to the future. “For the first half of 2024, we worked on internal efficiency, team talent allocation, retention and rounding. We are transitioning our focus to growth in the second half of 2024 and then make another acquisition in 2025.

“[W]e are learners and teachers for life. That is one of our core values. … We used to focus on a person’s skills when making a hiring decision. Now, all decisions are based on how well the individual fits with our core values and culture. The result of this change has been dramatic.”

—David Brush, CIC

Agency Principal

“David and I complement each other so well. We have different strengths but very important

commonalities including a similar risk tolerance; we are both willing to try new things and delight in the successes, while learning from the failures.”

—Nancy Mendizabal, CIC

Agency Principal

“Our goal is to end 2027 at $15 million in premium,” she explains. “We will continue to invest in and empower our team; we see this as the leading indicator of our success and our greatest asset.”

As of March, the agency had more than $11.5 million in total premium, with 82% coming from personal lines. The 18% represented by commercial lines is primarily written as back fill for personal lines clients who have small businesses. Their retention rate is in the low to mid 90s, thanks to the fact that the ratio of policies to clients is close to 2-to-1. It was affected slightly by the two acquisitions but is improving thanks to a cross-selling effort.

David adds, “I would be remiss if I didn’t mention the importance of the personal touch. Even though, as a remote agency, we rely on technology, that doesn’t mean we ignore the personal touch. When a client has a special event, Chery Upshall, account manager and person in charge of cards, will send a handwritten card to that individual.

“We also use e-cards to thank company people who provide excellent service or have helped out one of our team members.”

He concludes: “This is a great industry that offers tremendous opportunity for young people, and we’ve been pleased to help some of them enter and enjoy this opportunity.”

Rough Notes is proud to recognize Apple Valley Insurance for its strong adherence to honesty and accountability while embracing change and showing once again how resilient the independent agency system is.

The author

Dennis Pillsbury is a Virginia-based freelance insurance writer.