Two long-time agency veterans share their wisdom

“Old-timer” … “golden ager” … “senior citizen” … these and other appellations are frequently used to describe people who have attained a certain age. In our youth-obsessed society, little credence is given to the deep experience and hard-won wisdom accumulated over a lifetime of work and family, triumph and heartbreak, challenges met and obstacles overcome.

In this article we’ll meet two veterans of the independent agency business whose long careers encompass all those elements and more.

This year Beverly Yochmann, CIC, celebrates her 50th anniversary as a key person at Sprague & Killeen, Inc., in the Hudson Valley town of Ellenville, New York. Yochmann began her career with the Allen D. Potter Agency, which later merged to become the Carlsen Agency. With encouragement from her boss at Potter, she attended the Hartford School of Insurance and discovered what would become a lifelong passion for the insurance industry.

—Beverly Yochmann, CIC

Sprague & Killeen, Inc.

At the Hartford school, Yochmann was one of two women in her class and is pleased to report that she was treated as a professional and an equal by her male fellow students. For that matter, she says, she never experienced discrimination in any phase of her career. “I never acted as if I expected to be discriminated against, and I wasn’t,” she declares.

In 1968, Jack Killeen and Donald Sprague purchased the Carlsen Agency and invited Yochmann to become part of their team. Her insurance knowledge and strong work ethic quickly made her indispensable to the agency, where she is regarded as an excellent role model and valued for her wit and charm. From 1972 to 1994 she served as office manager, after which she took partial retirement and assisted with financial operations, a position she continues to hold today. Yochmann received the CIC designation in 1988, and at about that time she was elected president of what was then the Ulster County Insurance Agents Association.

Asked to name what she sees as the biggest change in the insurance business during her career, Yochmann is quick with a one-word reply: “Computers.” Before the advent of computers, she says, “We had to look up rates manually and make our own calculations.” Another cumbersome function was reconciling accounts receivable. “We got our first computer in 1969 through Travelers. I didn’t know anything about computers, so I took a course at the community college. Some years later, we purchased an AMS system.”

What advice would Yochmann offer a young person who is considering a career in the independent agency business? She suggests following in her footsteps with respect to education. “Ask to attend an insurance school or to enroll in CPCU or CIC studies,” she counsels. “I asked my boss for that opportunity, and he didn’t hesitate to give it to me.”

Yochmann believes that the independent agency arena presents attractive opportunities for young people. “They go to the GEICOs and the Progressives, and then they move to an independent agency,” she observes. “They realize that we can offer our clients a choice instead of placing all their business with a carrier that may not meet their needs.”

She adds that being part of an independent firm allows employees to help clients in a way that direct writers can’t. “When it comes to choosing the right insurance, people want to feel that they’re talking to a friend,” she says. “It makes me feel good to help people out and make sure they have insurance that meets their needs.”

Asked about plans for her ultimate retirement, Yochmann says she’s not there yet. “I drive between 150 and 200 miles a week, and I don’t just drive to the post office and the doctor,” she says with a laugh.

“I think it’s important for us to take care of ourselves,” she adds. “I go to the gym three times a week, and I work with a personal trainer twice a month. My health is excellent, and I can leg press 300 pounds.”

Slowing down? Taking it easy? Not a chance, says this bright, energetic 67-year agency veteran. “I’ve had wonderful years in our industry, and I expect to keep on having them,” she says.

Seven decades of service

Living to the age of 70 is an impressive accomplishment. But how about looking back on a career that spans 70 years, all with the same agency?

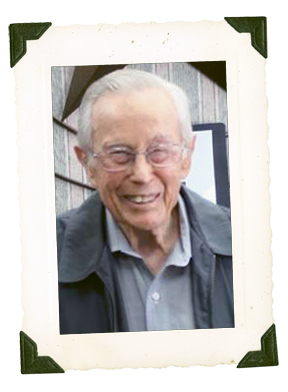

In February of last year Ray Duncan, a principal of what today is known as DFB Insurance Group, retired after 70 years with the agency he operated with his brother in Texas. The agency had been established after the end of World War II.

Today, at age 93, Duncan is sharp and engaging as he looks back on his long career.

“My father was a young lawyer in Pampa (Texas). He had three children, and to supplement his income he obtained a license and opened a little agency in 1917,” Duncan recalls. “He wrote insurance for his family and friends and continued to do so into the 1940s. My brother and I went to the University of Texas, and when the United States entered the war in December 1941, he served in Europe and I was sent to the South Pacific as a supply officer on a Navy destroyer. We fought in all the battles that took place in the Philippines.”

—Ray Duncan

Retired Principal

DFB Insurance Group, LLC

When the war ended, Duncan returned to the University of Texas to complete his degree, and his brother decided to forgo college, get married and start a business. “He went back to Pampa and wasn’t sure what he wanted to do, so our father said, ‘Why don’t you take over this little insurance business and see what you can do with it?’ I got my degree in business administration, and in 1947 I joined my brother as a partner when we formed the Duncan Insurance Agency.

“We started from scratch,” Duncan says. “People today would marvel at how we managed to put groceries on the table. We had a little upstairs office and shared a secretary with a friend. I think she cost us $90 a month, and our rent was $40 a month. I kept the books, and in a good month we wrote about $15,000 to $20,000 in premium. Back then the companies paid a 25% commission, but that didn’t amount to much, because our premium volume was so low.”

Over time, the brothers grew their agency and expanded into all lines of personal and commercial insurance. They moved their office to a location at street level, which Duncan notes was an improvement “even if our office was next to a bar. Occasionally a customer would come out of the bar, weave through the parking meters, and end up in our office,” he says with a chuckle.

The agency saw its business increase after passage of the state financial responsibility law that required drivers to purchase minimum limits of liability insurance. “In addition to liability, we wrote physical damage coverage, and that gave us a big boost.”

Older readers may remember the polio epidemic that swept the country in the 1950s. “We had a company that wrote a $10 polio policy with a $10,000 benefit, and we had people lined up outside our office waiting to buy those policies,” Duncan remembers. “We wrote a lot of them.”

The Duncan agency also grew through acquisitions. “Over the years we bought several of our smaller competitors,” Duncan says. “We bought an agency that gave us access to First Federal Savings and Loan in Amarillo, and we made home loans and wrote the insurance on the houses. We bought another agency that handled mobile homes and one that specialized in personal lines.

“In the 1980s we acquired an agency that had a contract with Mid-Continent Casualty, which wrote oilfield insurance. Almost immediately we wrote $3 million worth of oilfield contractors. From there we started our oil and gas service contractor business, and we also wrote all the other lines for those clients,” Duncan says.

In 1975, Duncan’s brother’s son-in-law joined the agency, and in 1977 Duncan’s son came on board. “We were glad to have these young men with us, because we were getting tired out,” he says. “My son got involved with the oil business, and he had people from all over the Panhandle calling him to buy service contractor insurance. He was our lead producer for many years.”

In 1992, Duncan’s daughter joined the agency, and, as Duncan observes, “We got to be a pretty sizable family business. In 1995, we met Bill Bridges of the Pampa Insurance Agency and Lee and Mike Fraser with the Fraser Agency. We decided we were tired of fighting each other for business, so we formed Duncan, Fraser & Bridges. Bill has built the agency through some major acquisitions, and it’s now part of Insurica, which ranks among the 50 largest insurance brokers in the country.”

Looking back on his seven decades as an independent agent, Duncan says, “I stayed in the insurance business because I liked it. Several years ago, I shortened my work hours to help care for my wife, Hilda, who had become wheelchair bound. I’d work from 9:00 to 3:00 or 4:00 and then come home and take care of things around the house, so I was able to keep my customers and stay involved in the agency. Then one day I fell and broke my leg, and that put an end to my insurance career.”

On a sad note, Hilda Duncan passed away in March. Ray Duncan’s son and daughter both retired from the agency before he did. “I decided I’d better retire before my grandchildren did,” he says with a laugh.

Back in the 1940s when Duncan and his brother were taking over their father’s small agency, he offered his sons some advice. “‘If you want to succeed, you have to be honest,’ he told us. “‘If you can save a customer some money, do it, even if it costs you in commissions.’ We always abided by that principle, and it served us well all through the years.”

By Elisabeth Boone, CPCU